U.S. - With Little Economic News, Investors Focus on the Virus

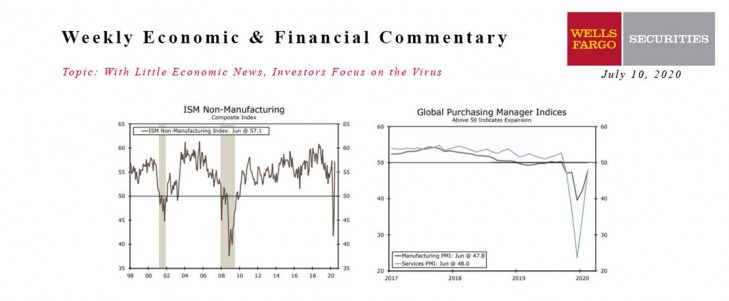

- The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

- Mortgage applications for the purchase of a home rose 5.3% and are now running 33.2% ahead of their year-ago level. Refi-applications are up less, reflecting tighter underwriting.

- Weekly first-time unemployment claims fell slightly more than expected and continuing claims have also come down the past two weeks, but claims for Pandemic Assistance have increased.

- The producer price index (PPI) unexpectedly fell 0.2% in June and core PPI fell 0.3%. Both were expected to rise modestly.

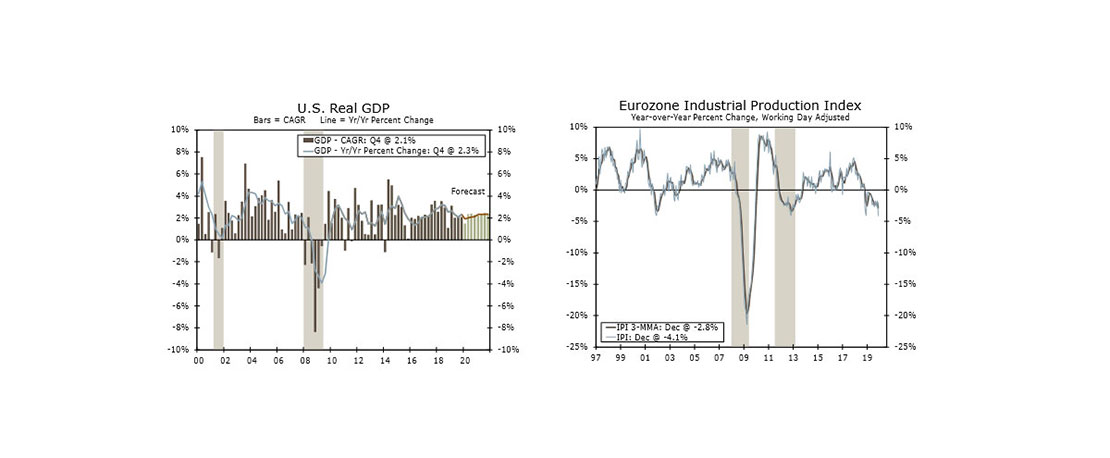

Global - Signs of Life for the Global Economy

- Recent economic figures portray a global economy that is recovering from its 2020 lows. The June global services PMI rose to 48.0, an even sharper jump that the manufacturing PMI. While confidence surveys are still below pre-COVID levels, they have recouped much of their losses.

- The Euro zone reported an out sized gain in May retail sales, an outcome that could see a smaller decline and quicker rebound in GDP than previously expected. Potential fiscal stimulus and improving COVID-19 case numbers are also positive. Next week China’s Q2 GDP will be closely watched with most–but not all–of the Q1 decline expected to be recouped.

This Week's State Of The Economy - What Is Ahead? - 08 November 2019

Wells Fargo Economics & Financial Report / Nov 09, 2019

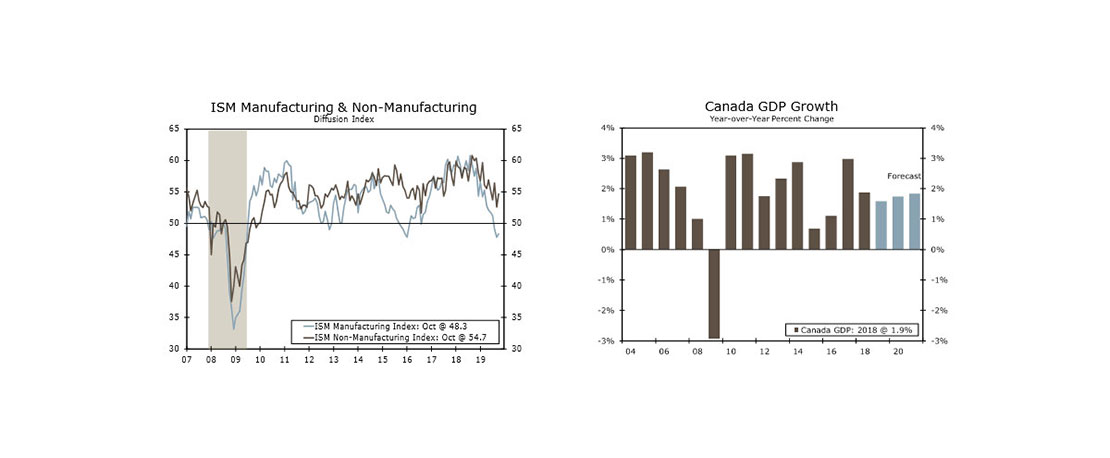

Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

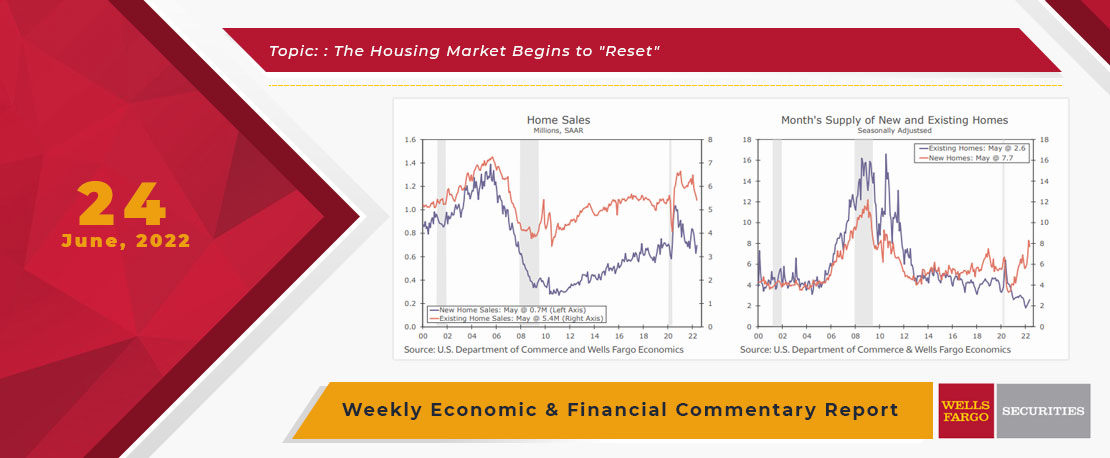

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

This Week's State Of The Economy - What Is Ahead? - 19 May 2023

Wells Fargo Economics & Financial Report / May 23, 2023

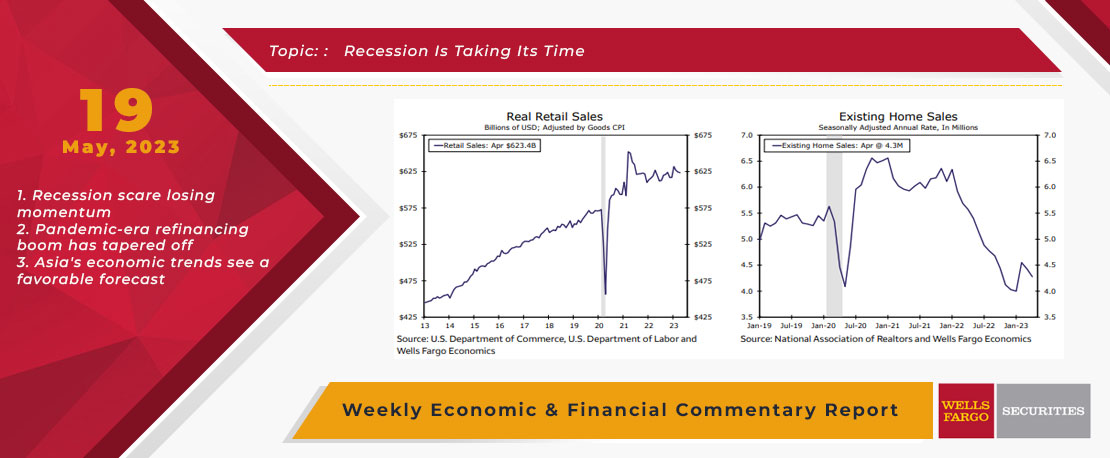

Economic data continue to suggest the U.S. economy is only gradually losing momentum. Consumers continue to spend, and industrial and housing activity are seeing some stabilization.

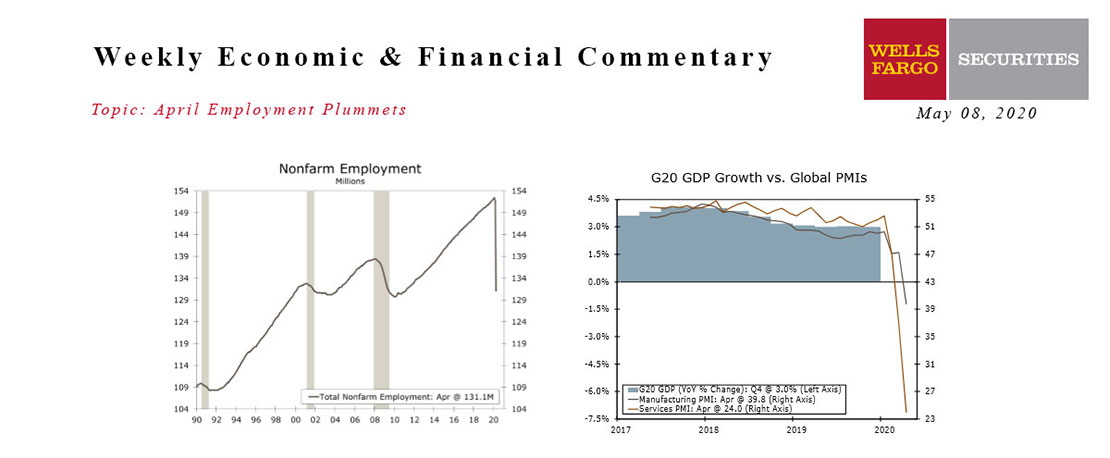

This Week's State Of The Economy - What Is Ahead? - 08 May 2020

Wells Fargo Economics & Financial Report / May 15, 2020

April nonfarm payrolls confirmed what we already knew—the labor market is collapsing. By the survey week of April 12, net employment had fallen by 20,500,000 jobs.

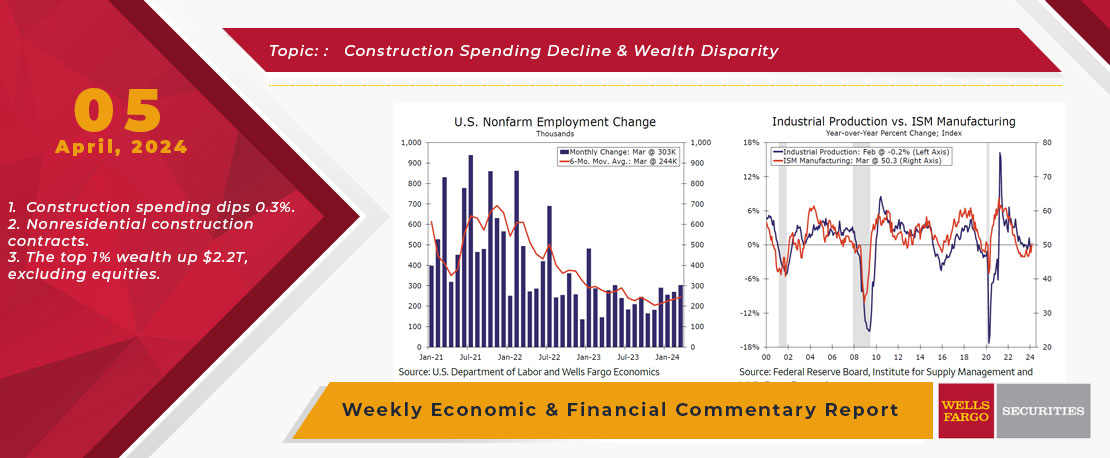

This Week's State Of The Economy - What Is Ahead? - 05 April 2024

Wells Fargo Economics & Financial Report / Apr 09, 2024

Nonfarm payrolls expanded 303K in March, surpassing all estimates submitted to Bloomberg. The continued strength in hiring suggests less urgency for policymakers at the Federal Reserve to lower the target range of the fed funds rate.

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

This Week's State Of The Economy - What Is Ahead? - 11 August 2023

Wells Fargo Economics & Financial Report / Aug 15, 2023

During July, both the headline and core Consumer Price Index (CPI) rose 0.2%. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging, with core CPI running at a 3.1% three-month annualized pace.

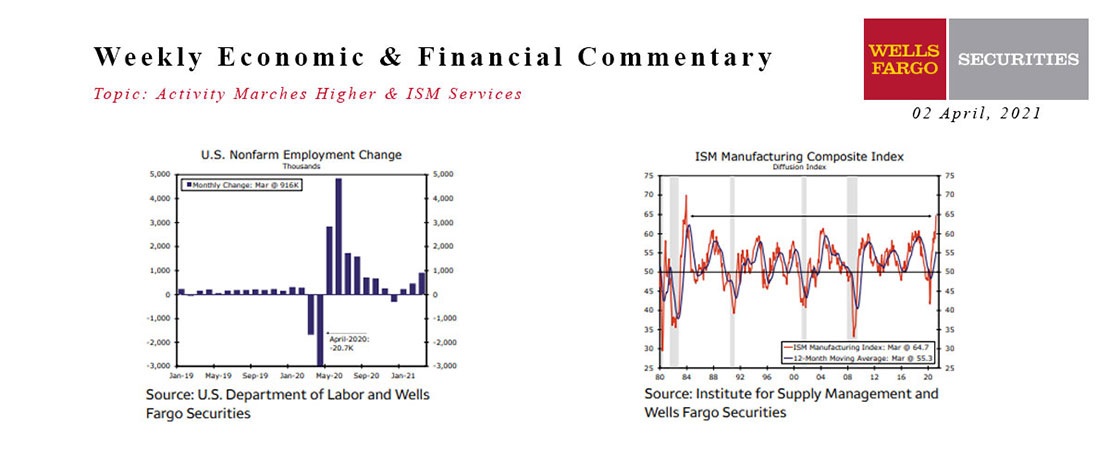

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

This Week's State Of The Economy - What Is Ahead? - 24 May 2024

Wells Fargo Economics & Financial Report / May 29, 2024

Homebuying retreated in April following a leg up in mortgage rates. Meanwhile, durable goods orders surprised to the upside, suggesting the manufacturing industry is on better footing.