U.S. - A Trade War Armistice? Don't Make it a Holiday Yet

- Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

- Due to the lack of concrete details, we are sticking to our assumption that the 15% tariffs on $156 billion of consumer goods imports will go into effect on December 15, but recognize there is some upside potential to growth and rates if a deal is reached.

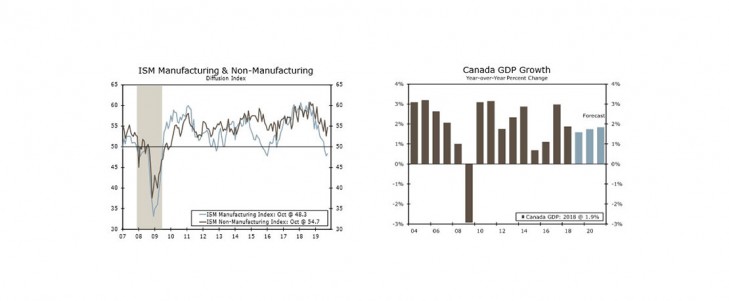

- Regardless, the economy has shown signs of stabilizing. The ISM non-manufacturing survey beat expectations this week by climbing to 54.7 from a three-year low of 52.6 last month.

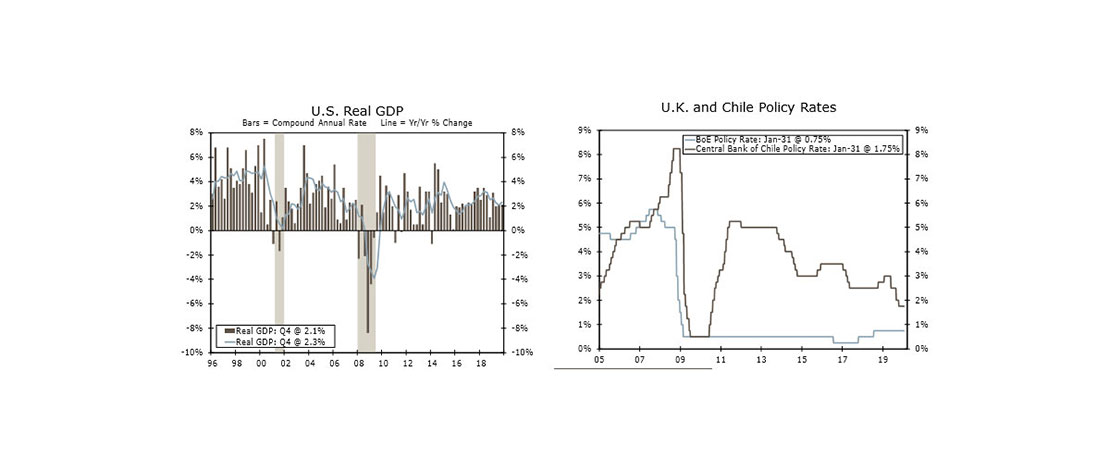

Global Review - Central Banks Still Center Stage This Week

- Central banks were back in focus this week, starting with Australia. The Reserve Bank of Australia kept its official Cash Rate steady at 0.75% and reiterated that it was prepared to ease policy further if needed.

- Elsewhere, the Bank of England opted to keep its Bank Rate at 0.75%, but two BoE members unexpectedly voted to cut interest rates.

- Canada's labor market added fewer jobs than expected in October; however, the unemployment rate remained at a near-record low. Even with the slight drop in October, the Canadian labor market is still performing relatively well.

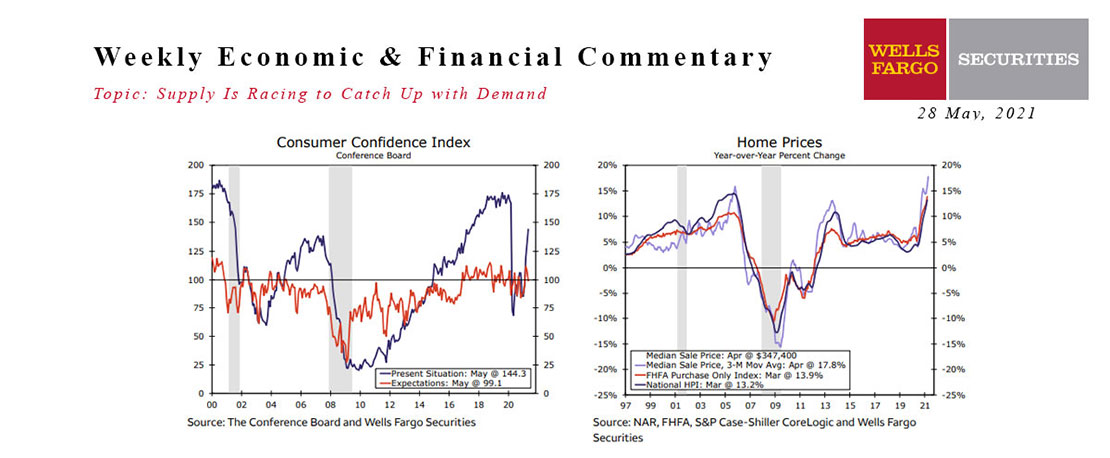

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.

Economic Uncertainty Seems Removed Going Into The New Year 2020

Wells Fargo Economics & Financial Report / Dec 28, 2019

The U.S. economy continues to expand, albeit at a moderate pace. The U.S. Bureau of Economic Analysis reports U.S. gross domestic product (GDP) grew 2.1 percent in Q3/19.

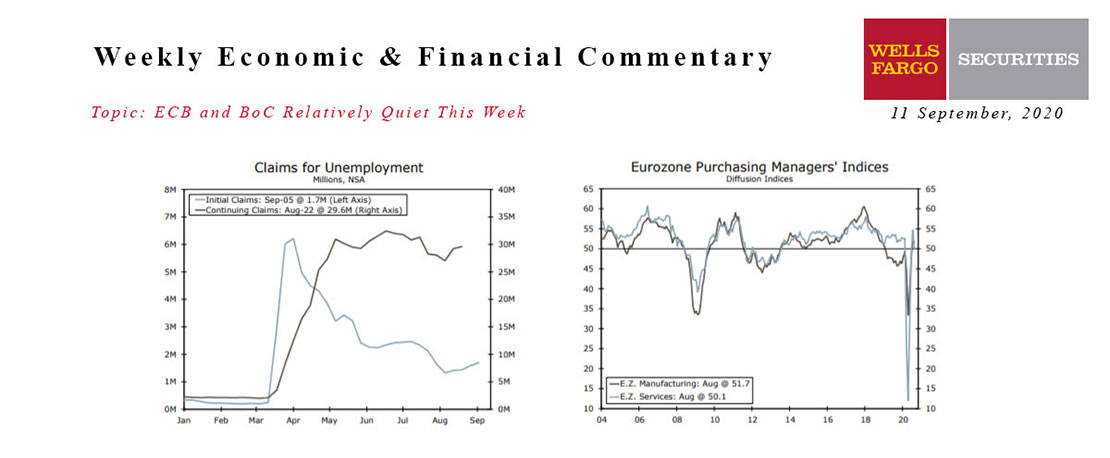

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

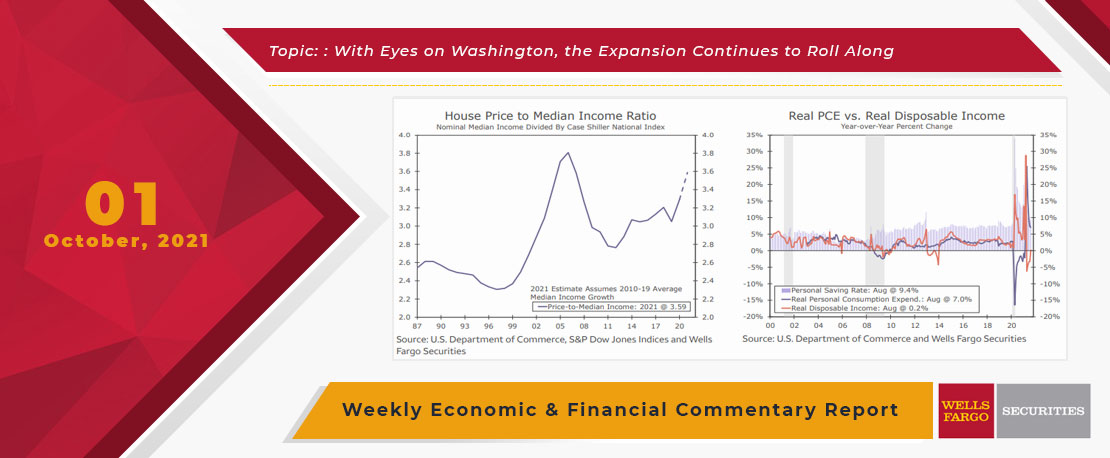

This Week's State Of The Economy - What Is Ahead? - 01 October 2021

Wells Fargo Economics & Financial Report / Oct 10, 2021

Economic data this week indicated that the ongoing expansion still has some momentum despite some familiar headwinds, though this week\'s releases were largely overshadowed by a busy week on Capitol Hill.

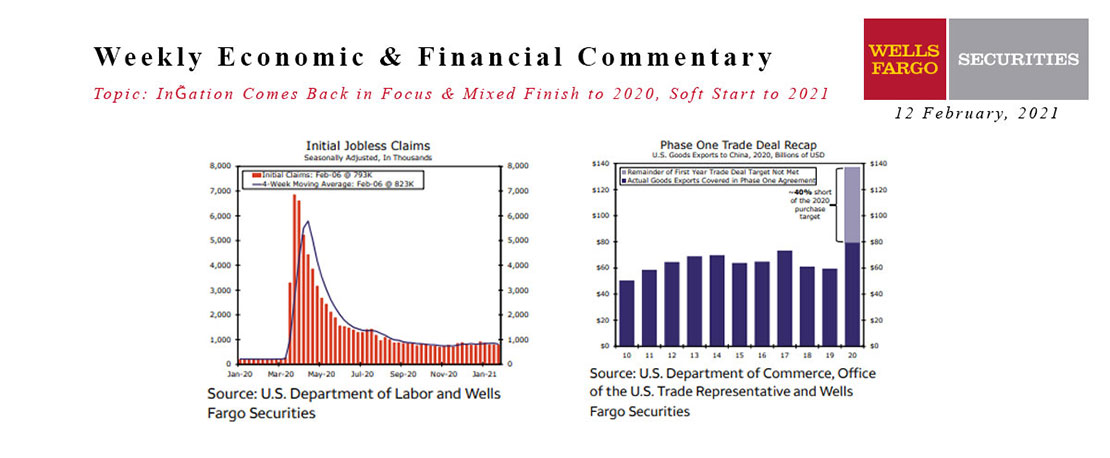

This Week's State Of The Economy - What Is Ahead? - 12 February 2021

Wells Fargo Economics & Financial Report / Feb 19, 2021

Market attention was concentrated on the January consumer price data, as inflation has come back into focus.

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

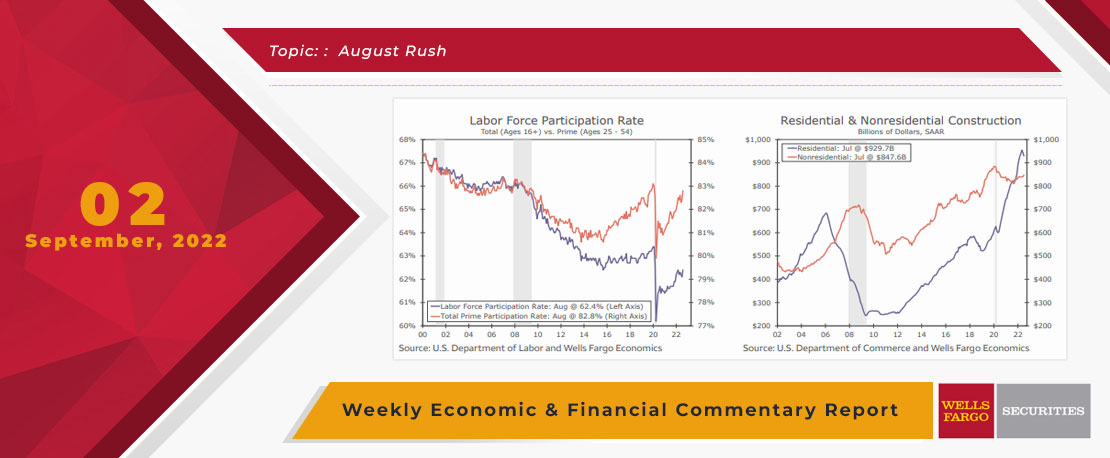

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

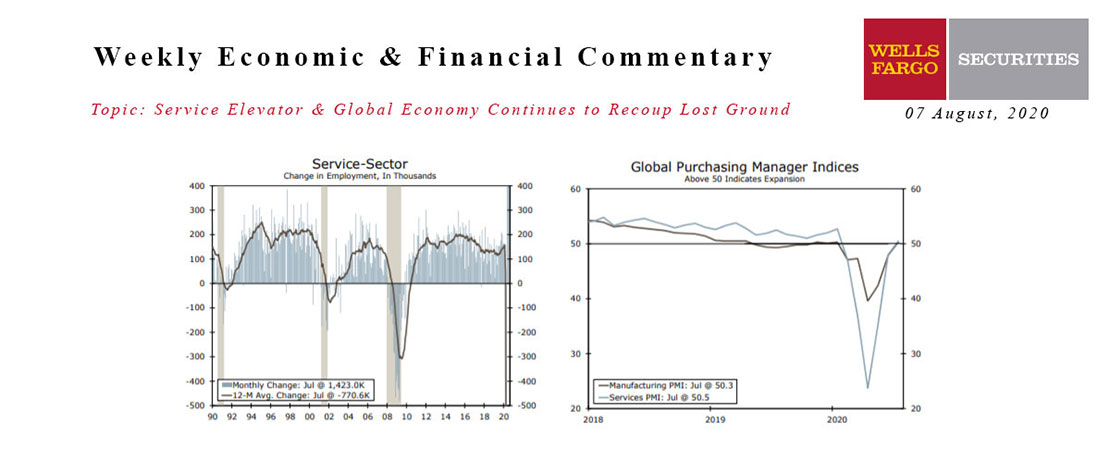

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

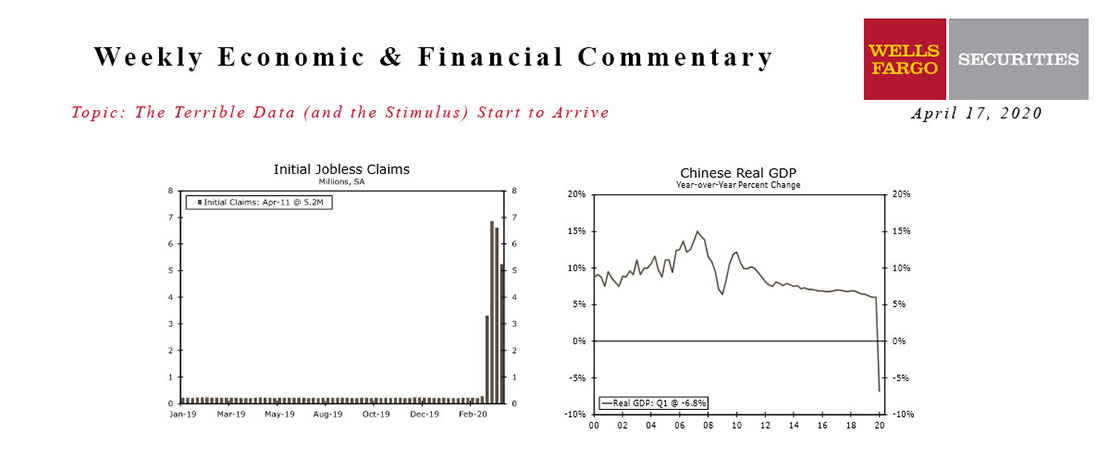

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.