U.S. - The Consumer-Producer Divide on Full Display

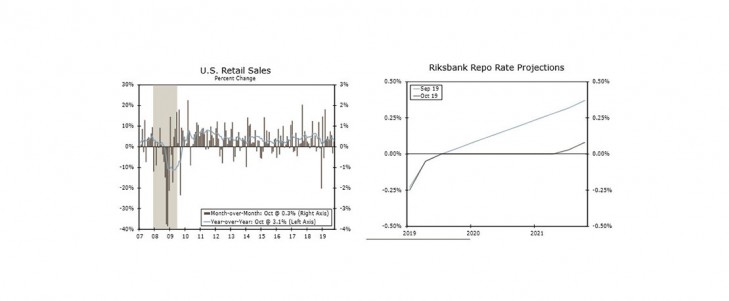

- Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.

- Industrial production in October declined 0.8%. Overall production remains in the doldrums with the energy sector pulling back and continued weakness in manufacturing, even outside the auto sector.

- The CPI advanced 0.4% during October, the strongest gain in eight months. The monthly jump was owed to a surge in gas prices, and core CPI grew a more modest 0.2%.

Global Review - Another Week, Another Central Bank Surprise

- The Reserve Bank of New Zealand caught markets off guard at its meeting this week with its decision to hold its main policy rate steady at 1.00%, saying that monetary policy is stimulatory and that there is no urgency to act further.

- The latest Swedish inflation data added support to the central bank’s plan to raise interest rates to 0%, even though they were slightly below the Riksbank forecast.

- In a split vote at its meeting this week, the Bank of Mexico opted to ease monetary policy, cutting its main policy rate 25 bps to 7.50%, the third such move this year.

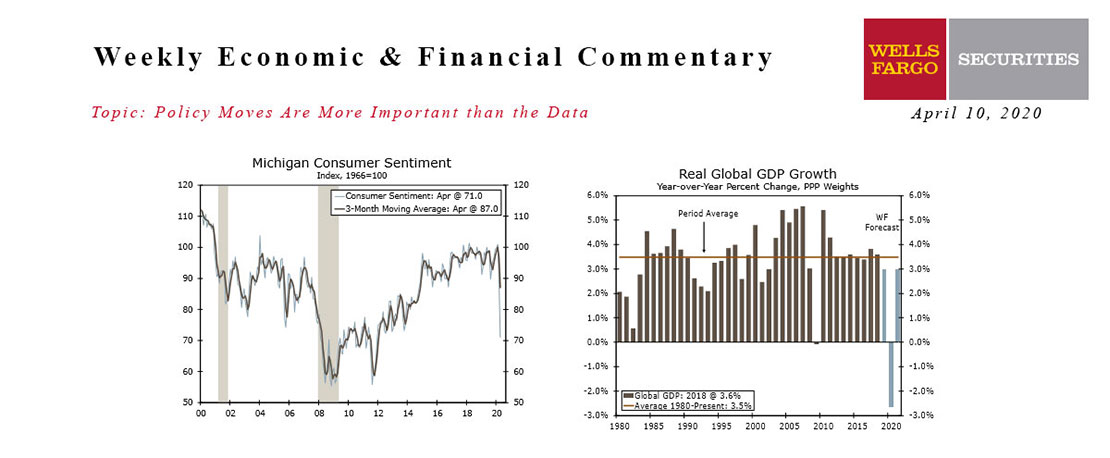

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

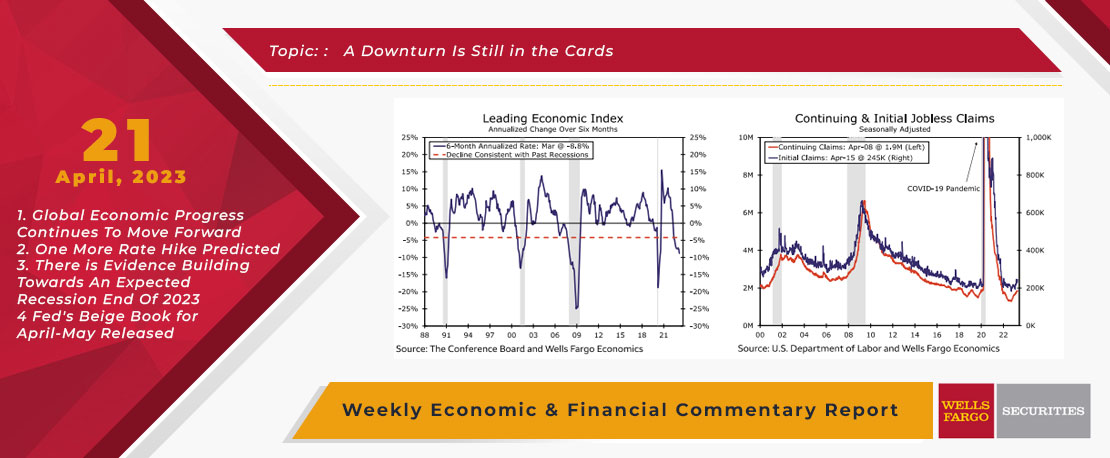

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

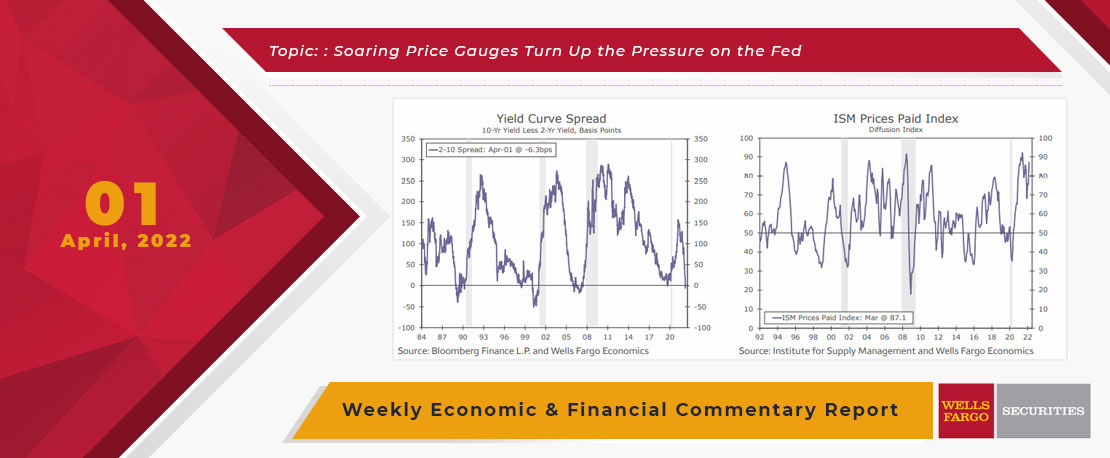

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

This Week's State Of The Economy - What Is Ahead? - 11 August 2023

Wells Fargo Economics & Financial Report / Aug 15, 2023

During July, both the headline and core Consumer Price Index (CPI) rose 0.2%. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging, with core CPI running at a 3.1% three-month annualized pace.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

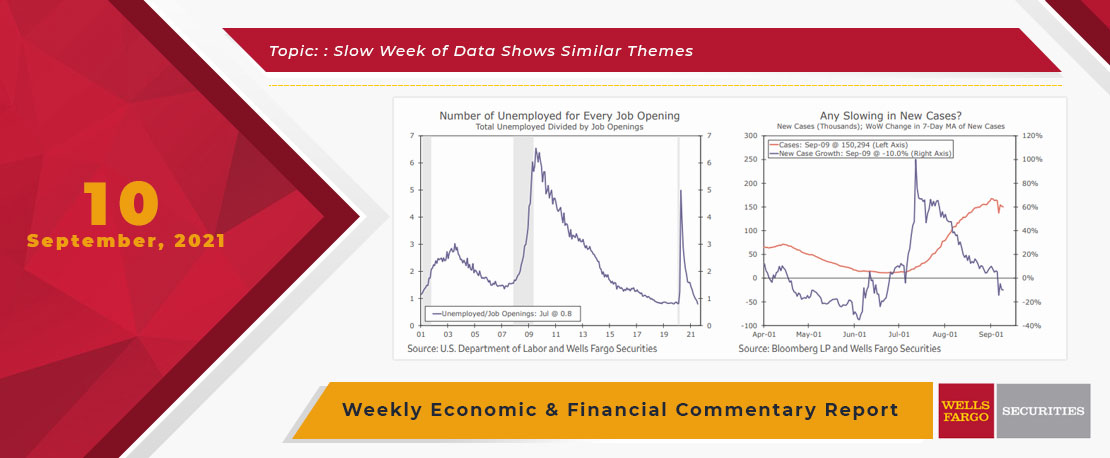

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.

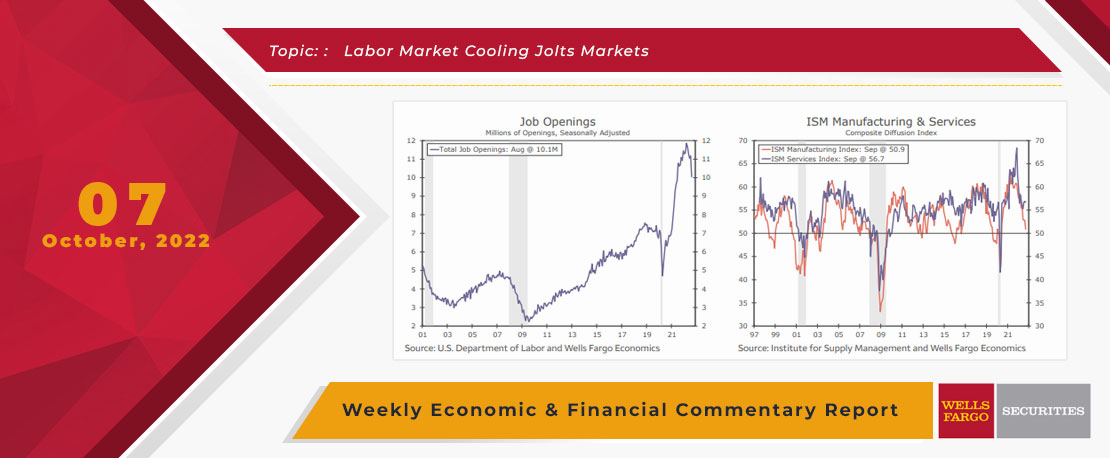

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

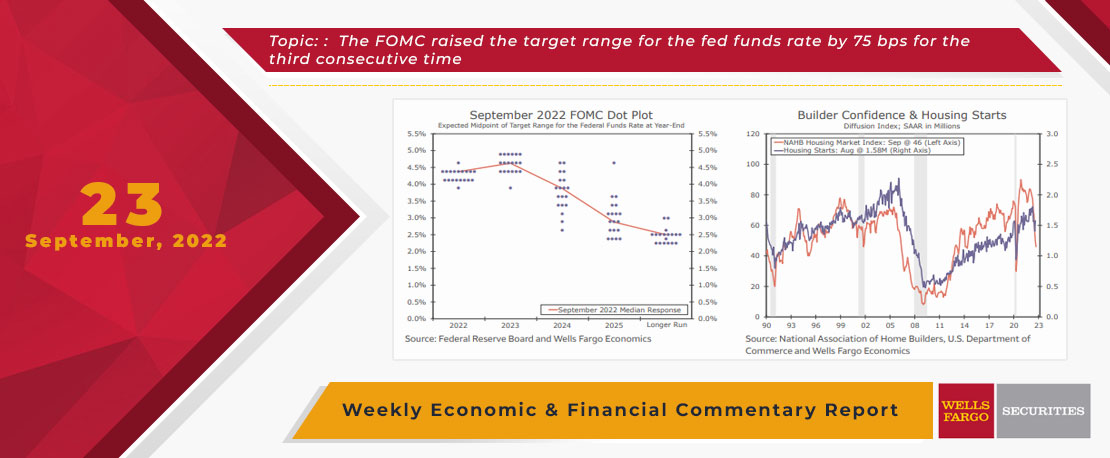

This Week's State Of The Economy - What Is Ahead? - 23 September 2022

Wells Fargo Economics & Financial Report / Sep 27, 2022

The FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage rates.

This Week's State Of The Economy - What Is Ahead? - 24 February 2023

Wells Fargo Economics & Financial Report / Feb 28, 2023

Existing home sales declined 0.7% in January, while new home sales leaped 7.2%. Real personal spending shot higher in January, and solid growth in discretionary spending suggests continued consumer resilience.

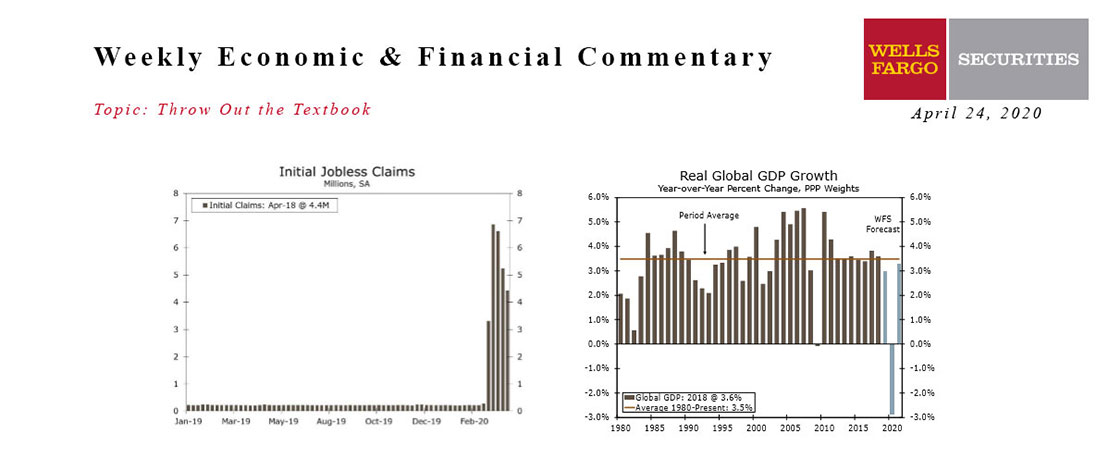

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.