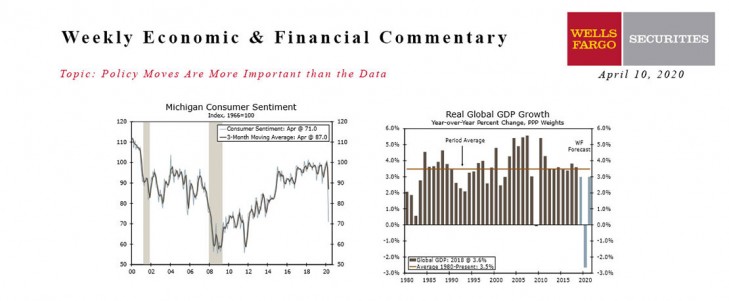

U.S - Policy Moves Are More Important than the Data

- The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

- While hiccups in implementing the Payroll Protection Program have been frustrating, the plan offers significant relief to small businesses that will lessen the severity of the downturn and contribute to a speedier recovery.

- High frequency data, such as jobless claims, consumer confidence and mortgage applications, continue to show an economy under intense pressure. Inflation data are largely old news given the sharp plunge in demand in recent weeks.

Global - Bad Economic News Keeps on Coming

- 2020 is going to be a very tough year for the global economy. In our latest forecast update published earlier this week, we highlighted that every major economy we monitor will suffer a recession, and we revised our GDP forecast down further to project a 2.7% global contraction this year.

- This week’s data gave further clarity on how bad global activity might be. Canada’s March employment fell by one million, and given a large drop in hours worked a sizable Q1 decline looks assured. The U.K. economy was slowing even before the virus hit and the U.K. should also see Q1 GDP fall, while next week’s data focus will be an expected slump in China’s Q1 GDP.

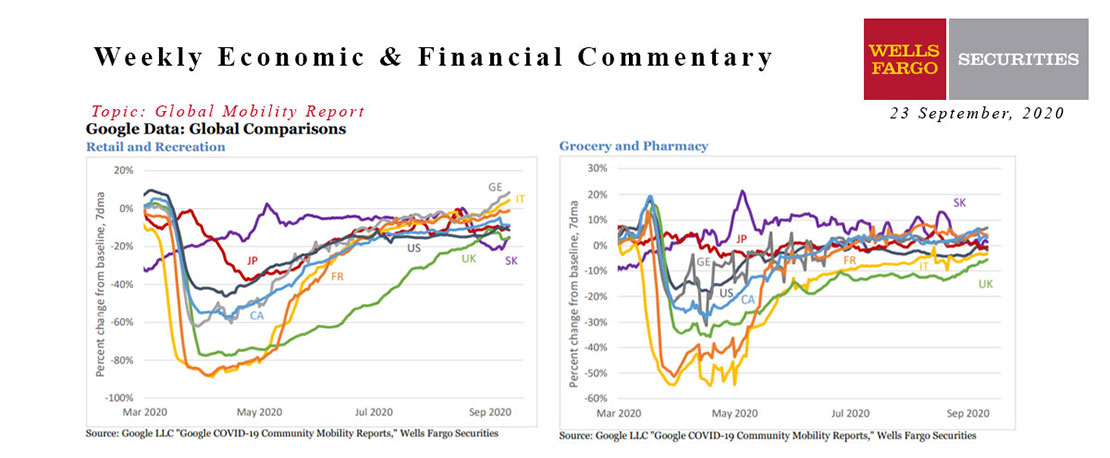

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

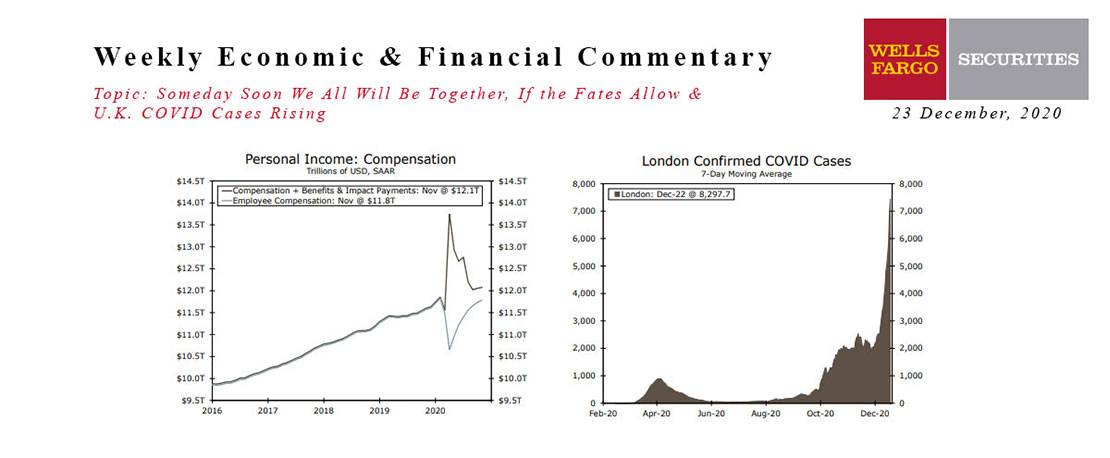

This Week's State Of The Economy - What Is Ahead? - 23 December 2020

Wells Fargo Economics & Financial Report / Dec 26, 2020

Vaccines are here, but they are not yet widely available in a way that can stem the spread of a disease that grows by 200K a day.

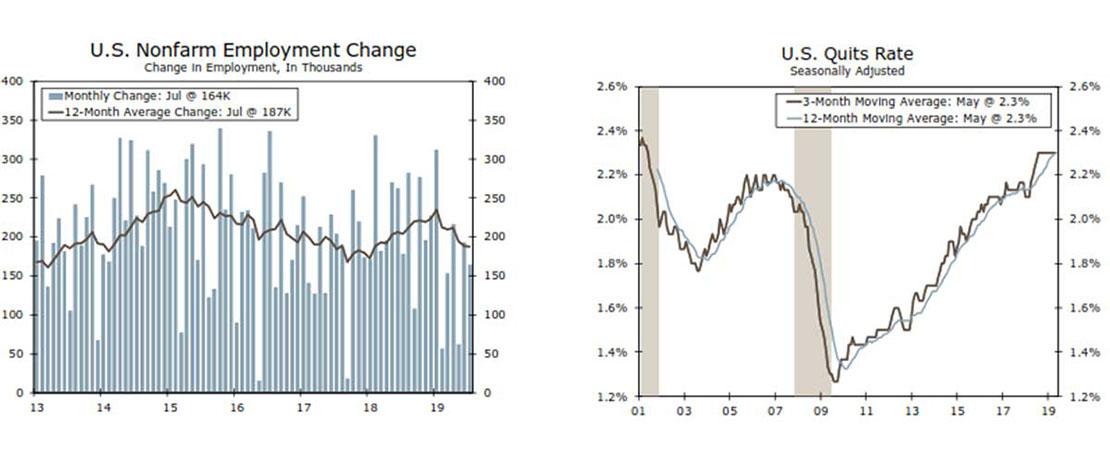

This Week's State Of The Economy - What Is Ahead? - 03 May 2024

Wells Fargo Economics & Financial Report / May 10, 2024

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions.

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

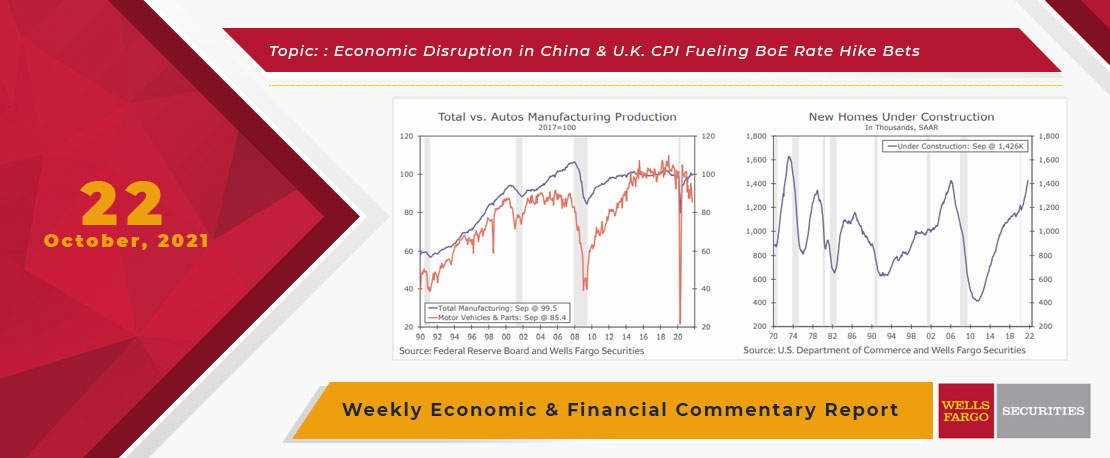

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

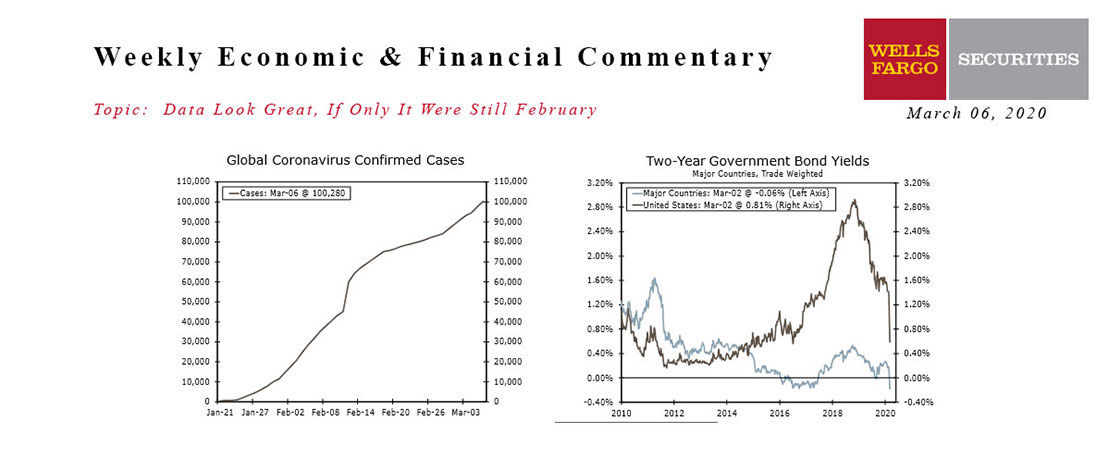

This Week's State Of The Economy - What Is Ahead? - 06 March 2020

Wells Fargo Economics & Financial Report / Mar 07, 2020

An inter-meeting rate cut by the FOMC did little to stem financial market volatility, as the number of confirmed COVID-19 cases continued to climb.

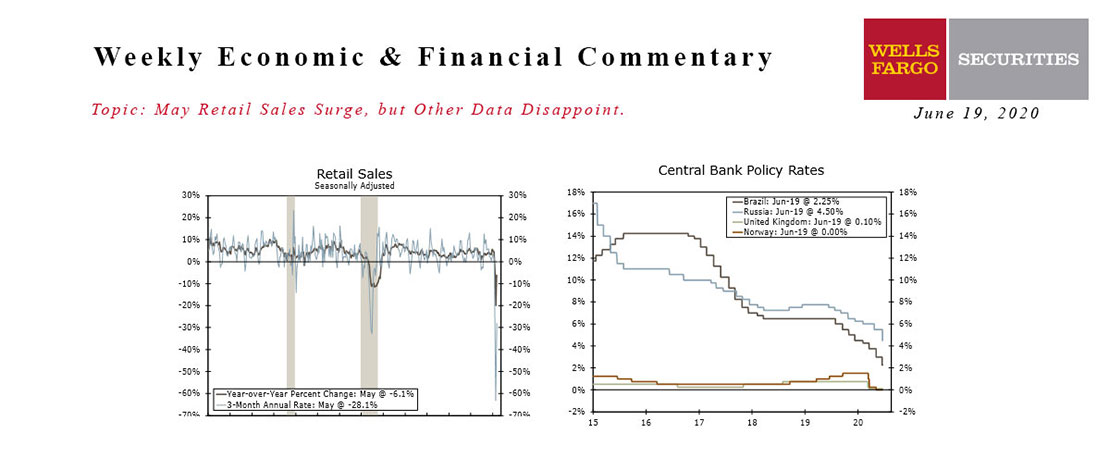

This Week's State Of The Economy - What Is Ahead? - 19 June 2020

Wells Fargo Economics & Financial Report / Jun 22, 2020

Retail sales kicked off the week with a bang, rising 17.7% month-over-month in May. The increase was larger than every single one of the 74 forecast submissions.

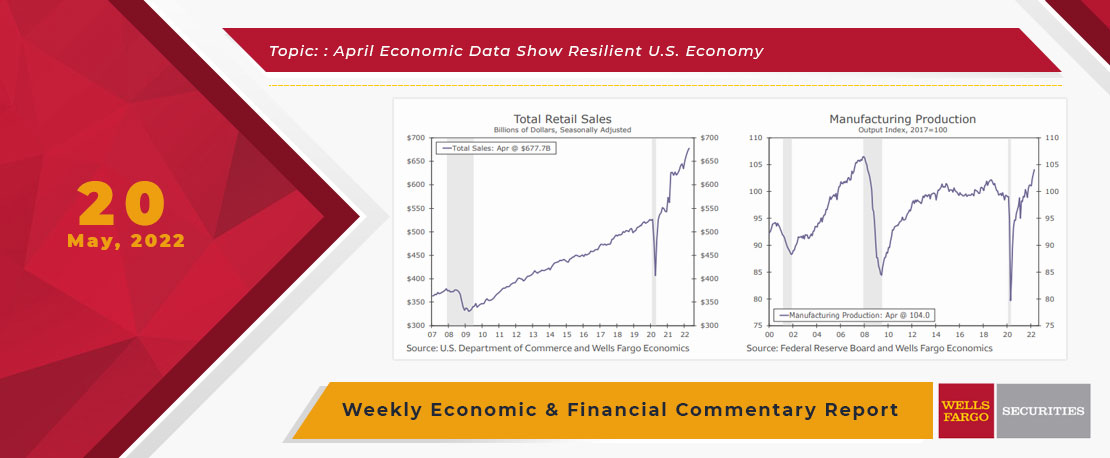

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

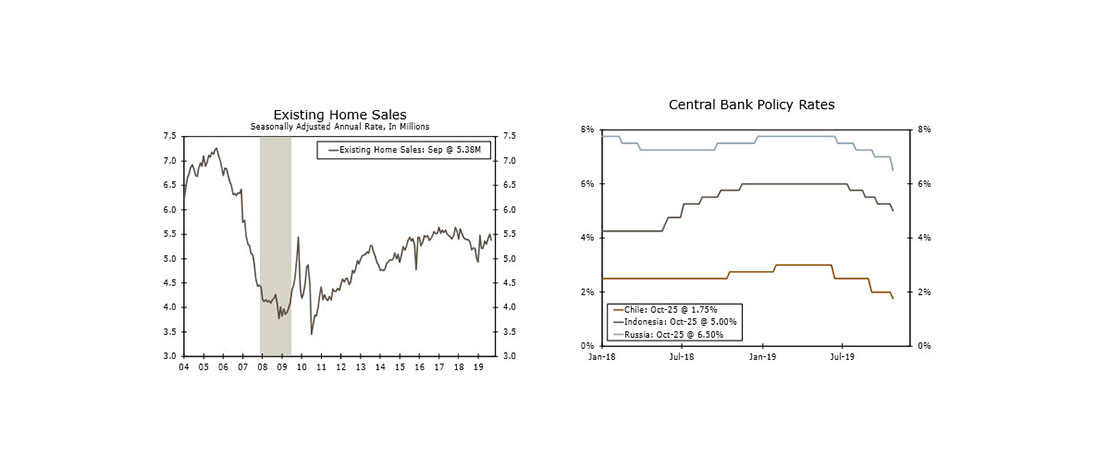

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.