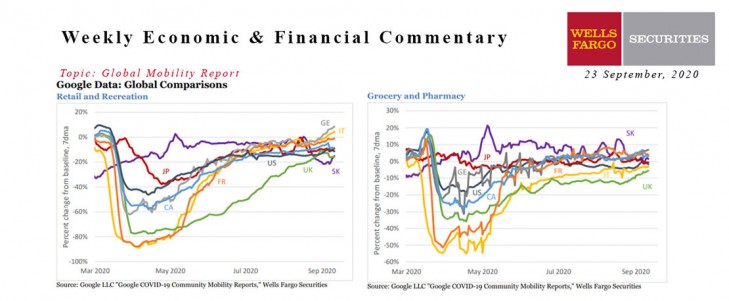

Global Mobility Report

Key takeaways from this week (Google data through September 13, Apple data through September 21)

- European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures. Still, the data are an encouraging sign for Europe’s recovery.

- The U.S. Labor Day boost has faded. Retail and recreation visits have stalled and are turning lower, and Apple data suggest a similar pattern. The slowdown is broadly based across the largest U.S. states.

- Korea is rebounding from the lows, while the United Kingdom languishes. Korea eased some restrictions on activity in Seoul earlier this month after new case growth lessened, which may have helped the turnaround. Still, Korea remains near the bottom of the pack in the all-important retail and recreation category, along with the United Kingdom. U.K. PM Boris Johnson’s announcement this week that more restrictions would be placed on bars, restaurants and other activities should keep U.K. activity restrained.

- Workplace mobility remains subdued across the board. Major European economies have seen some rebound, but it is slowing, and other countries are seeing flat or weakening workplace visits. U.K. workplace activity is likely to slow even further after PM Johnson encouraged more working from home.

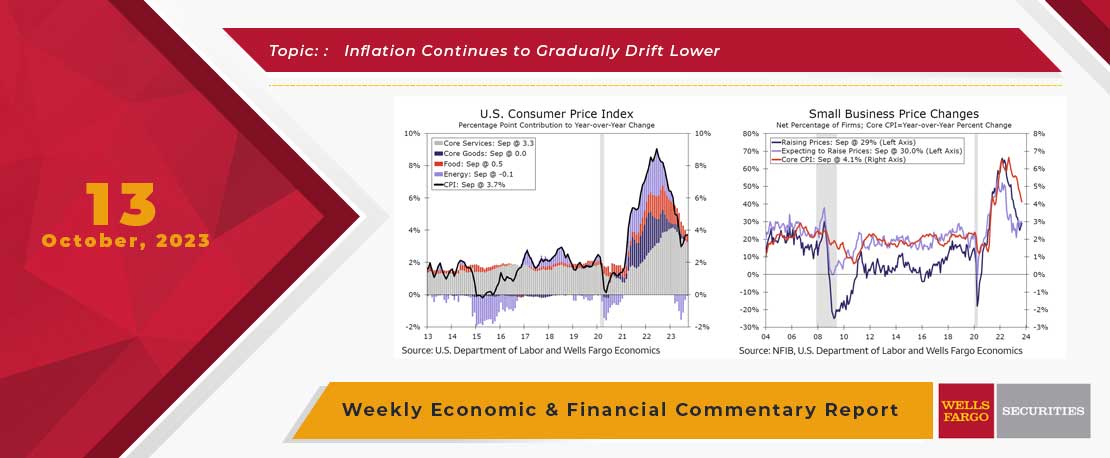

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

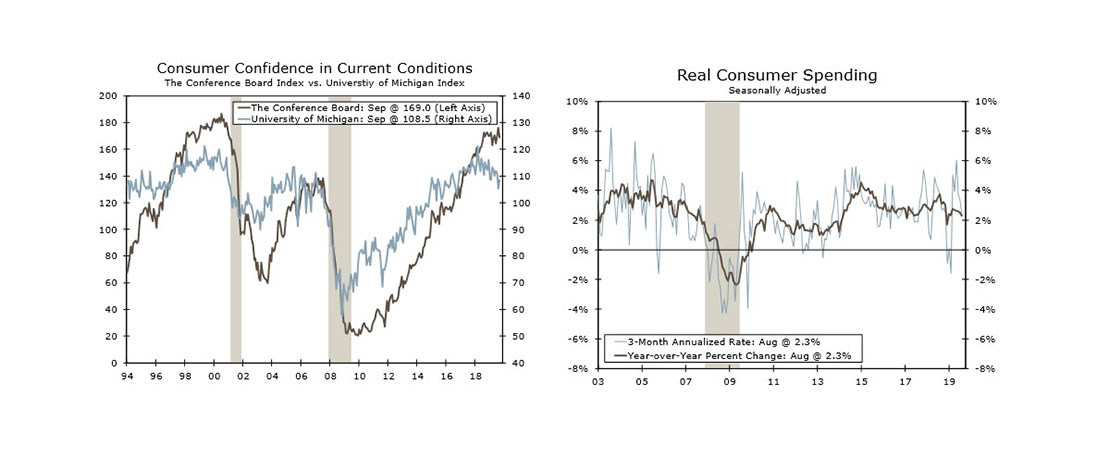

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

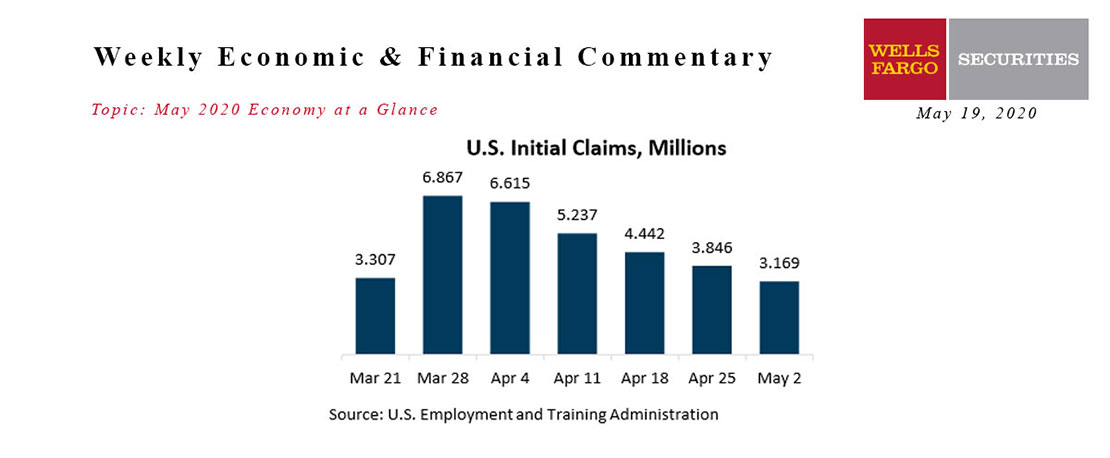

May 2020 Economy at a Glance

Wells Fargo Economics & Financial Report / May 19, 2020

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs.

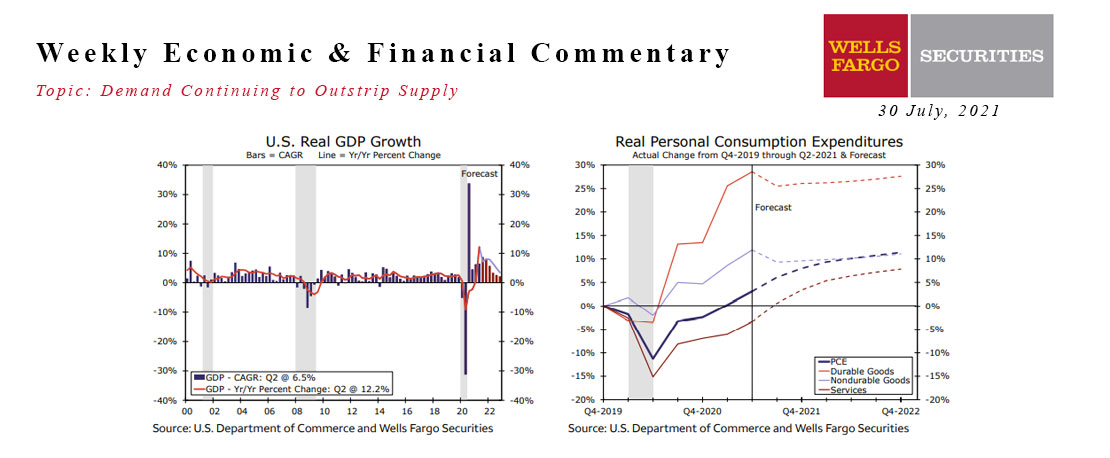

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.

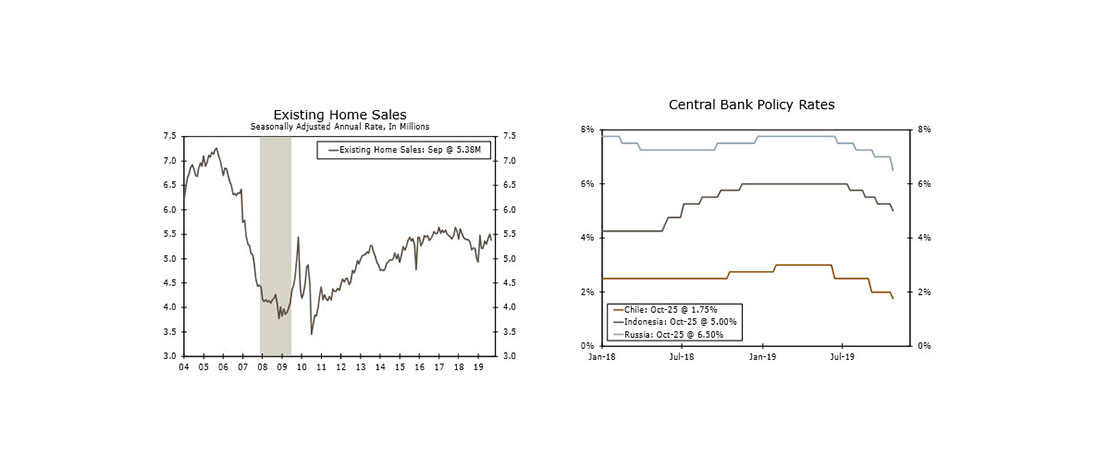

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

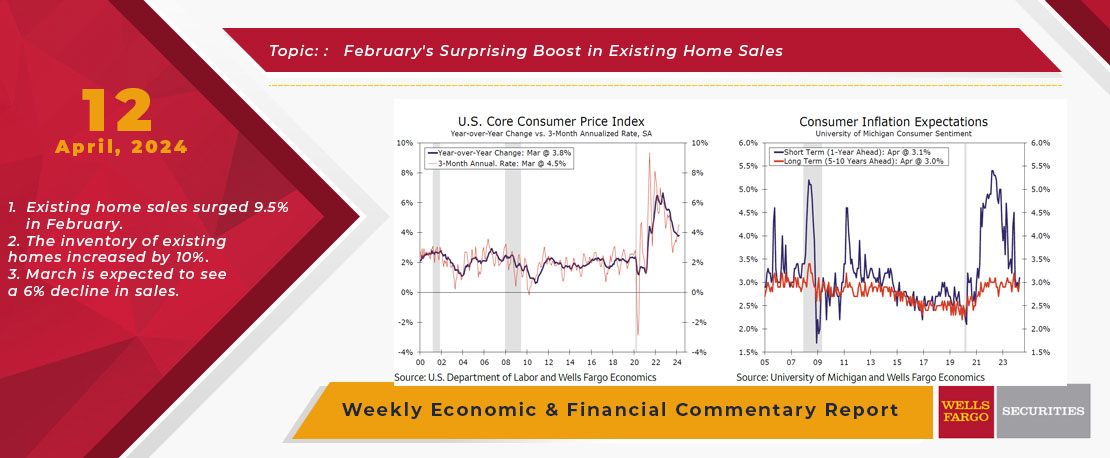

This Week's State Of The Economy - What Is Ahead? - 12 April 2024

Wells Fargo Economics & Financial Report / Apr 18, 2024

The March consumer price data dominated the economic discussion this week and are the latest to support that the timing and degree of Fed easing will be later and smaller than many of us previously expected.

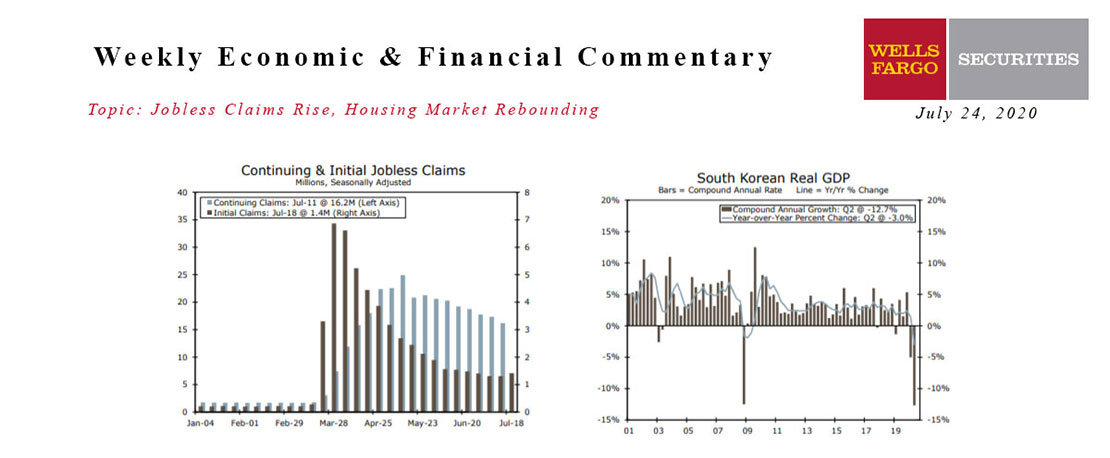

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

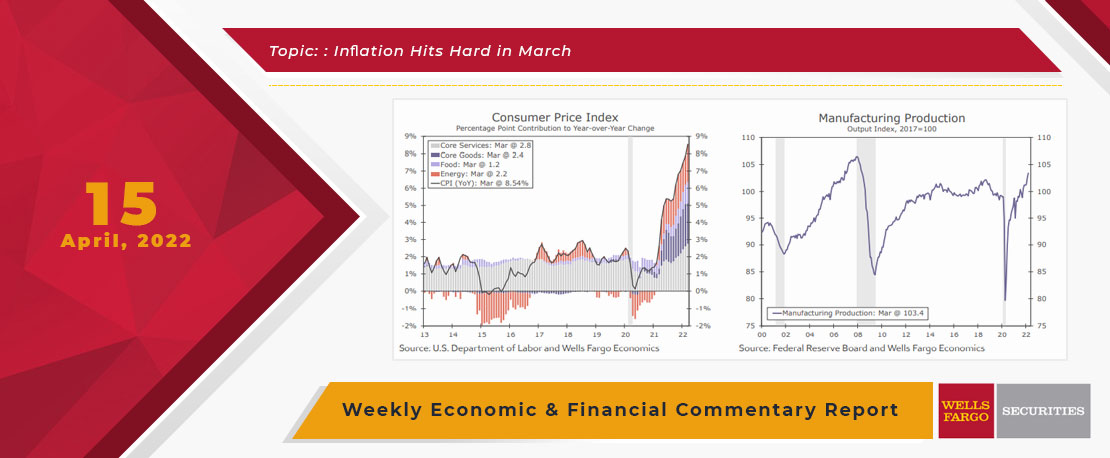

This Week's State Of The Economy - What Is Ahead? - 15 April 2022

Wells Fargo Economics & Financial Report / Apr 18, 2022

What do pollen and the Consumer Price Index (CPI) have in common? Answer; both are hitting new highs. This week’s U.S. economic data was led by the largest month monthly increase in the Consumer Price Index (CPI) since September 2005.