U.S - Politics Takes Center Stage

- The release of the transcript of President Trump's phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week's economic reports and took bond yields modestly lower.

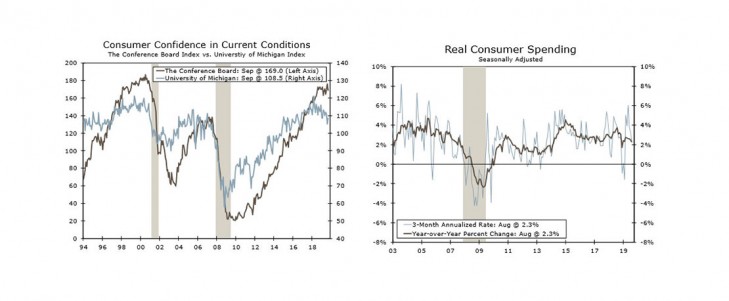

- Consumer confidence came in weaker than expected in September, falling 9.1 points to 125.1. The jobs plentiful series fell back from its cycle high hit the previous month.

- Durable goods orders rose 0.2% in August, but nondefense capital goods orders fell by a like amount and were revised lower for the prior month, indicating that capital spending continues to lose momentum.

Global - Eurozone Economy Continues to Falter

- Preliminary data on economic activity in the Eurozone in September were disappointingly weak, signaling the slowdown there will not subside by the end of the third quarter.

- Data on the country-specific level were not much better. The PMI for manufacturing in Germany declined to 41.4 in September, down from 43.5 in August and a cycle high of 63.3 in December 2017.

- Mexico's central bank continued to ease monetary policy this week, cutting its main policy rate 25 bps, the second such move this year.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

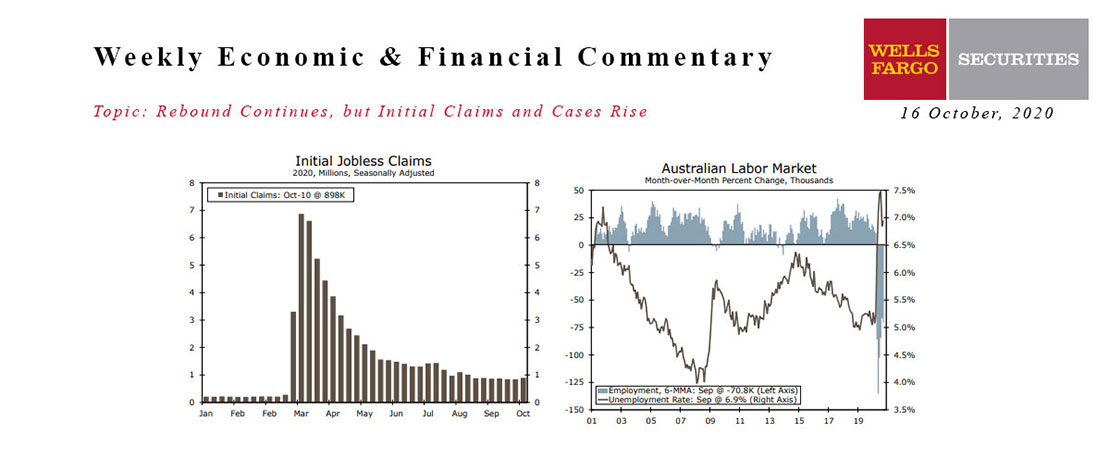

This Week's State Of The Economy - What Is Ahead? - 16 October 2020

Wells Fargo Economics & Financial Report / Oct 20, 2020

Data continue to reflect an economy digging itself out of the lockdown-induced slump.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

This Week's State Of The Economy - What Is Ahead? - 25 February 2022

Wells Fargo Economics & Financial Report / Feb 27, 2022

What a crazy week. It’s hard to worry about something as relatively unimportant as economic trends when one thinks about what folks in Ukraine are enduring, but economies are nonetheless impacted.

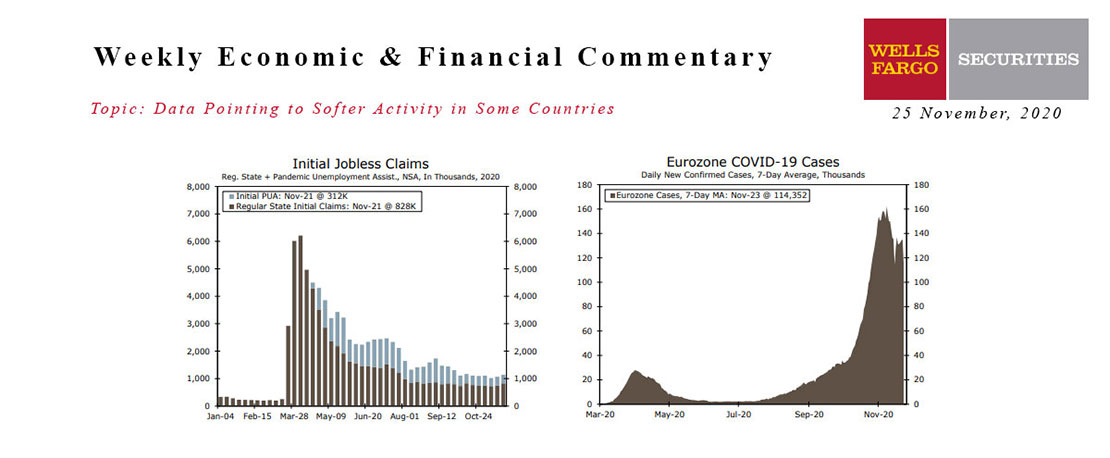

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

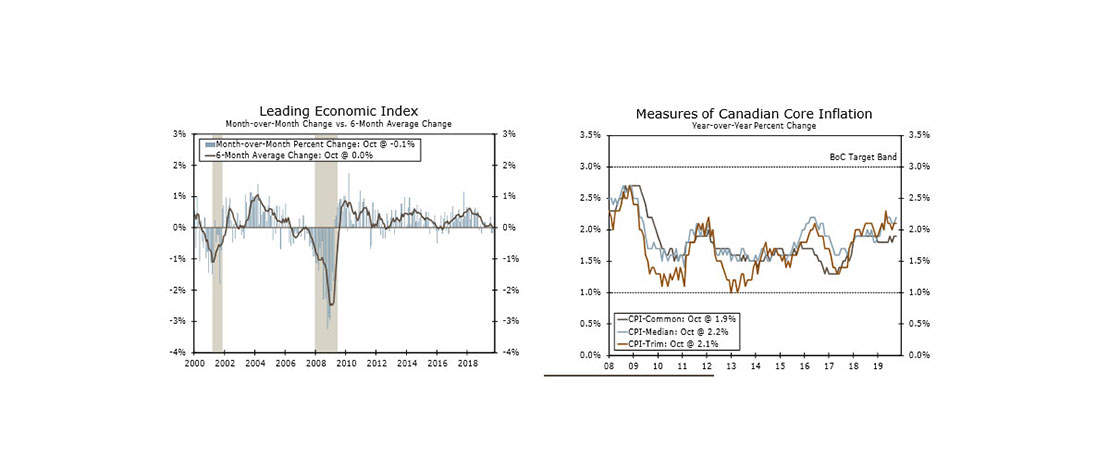

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.

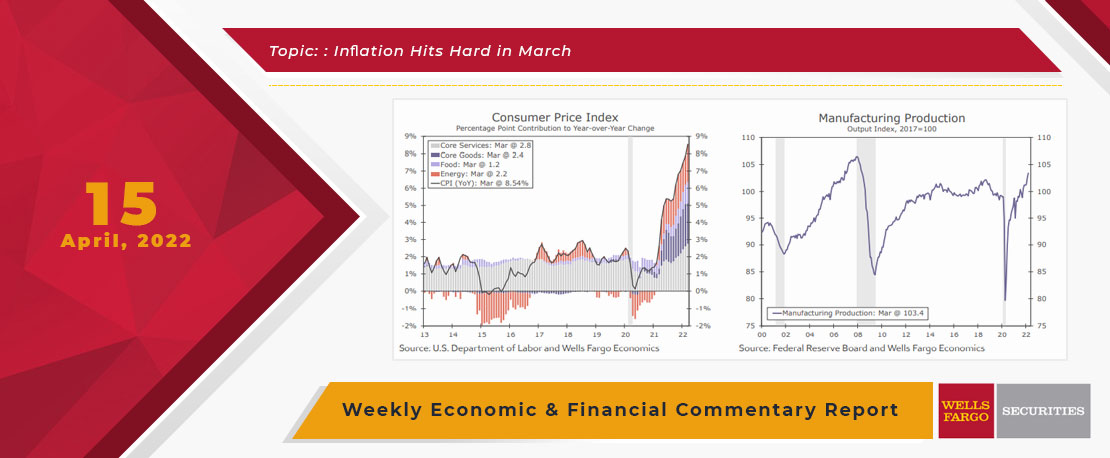

This Week's State Of The Economy - What Is Ahead? - 15 April 2022

Wells Fargo Economics & Financial Report / Apr 18, 2022

What do pollen and the Consumer Price Index (CPI) have in common? Answer; both are hitting new highs. This week’s U.S. economic data was led by the largest month monthly increase in the Consumer Price Index (CPI) since September 2005.

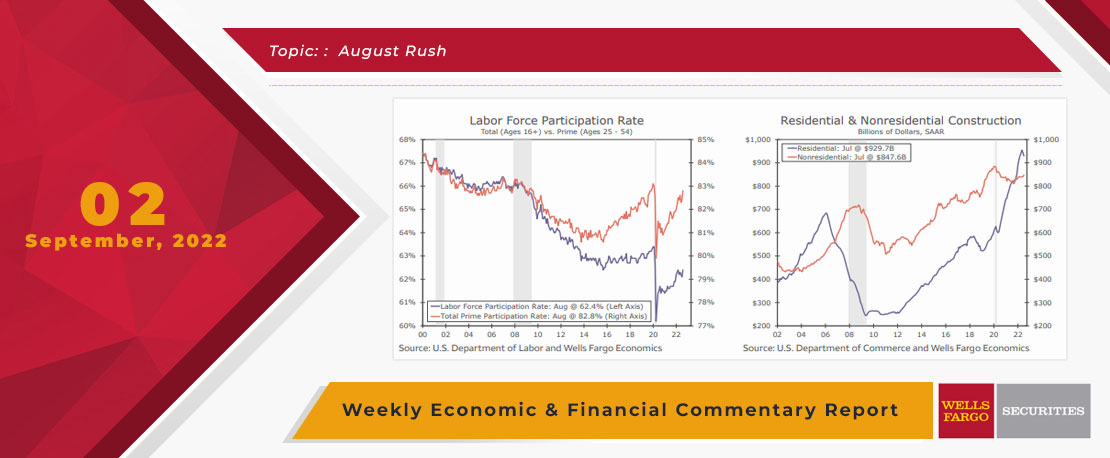

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

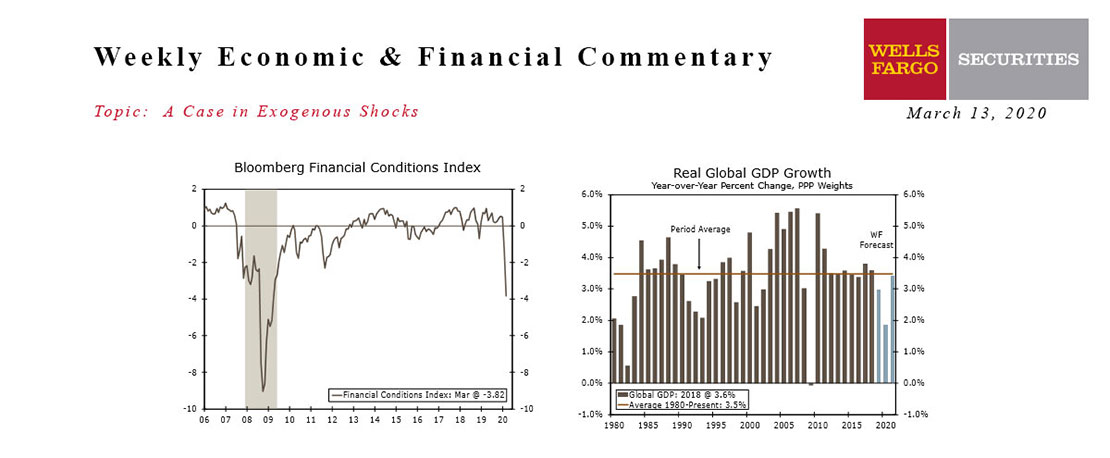

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

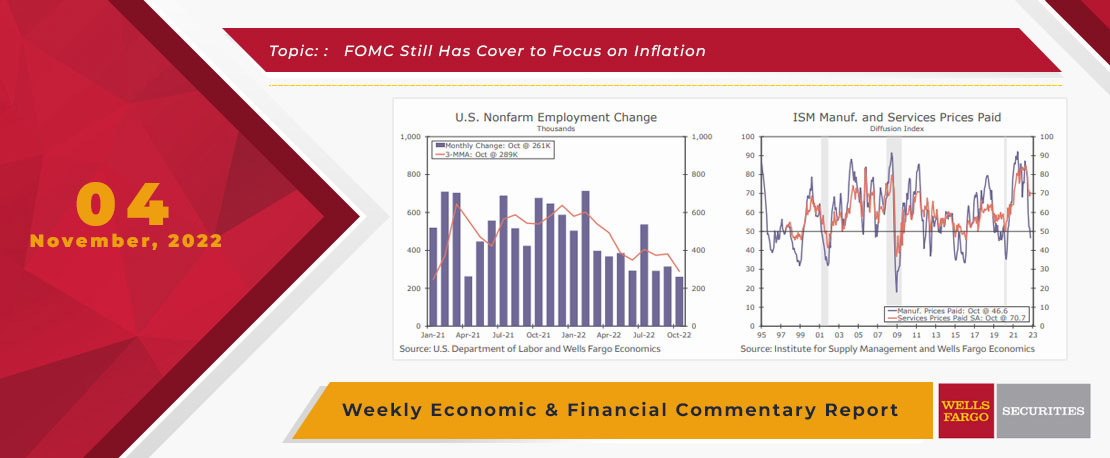

This Week's State Of The Economy - What Is Ahead? - 04 November 2022

Wells Fargo Economics & Financial Report / Nov 07, 2022

Employers continued to add jobs at a steady clip in October, demonstrating the labor market remains tight and the FOMC will continue to tighten policy.