U.S - Fed Cuts Again, But Dissent Rises

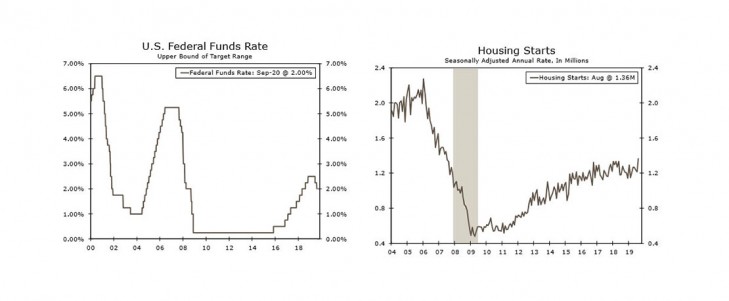

- The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

- The higher pace of home sales and improving builder confidence should feed through to stronger construction later this year, meaning residential investment should finally contribute positively to GDP growth.

- Manufacturing production rebounded in August, but is still down over the past year.

- The surge in oil prices should have fairly limited effect on the U.S. economy, while the spike in repo rates was largely due to technical factors.

Global - Central Banks in the Spotlight

- Central banks were the focus this week, starting with Japan. The Bank of Japan made no major changes to its monetary policy at its September meeting, even as a majority of central banks have shifted to easing monetary policy.

- Elsewhere, the Bank of England unanimously decided to keep policy rates on hold. In addition to holding rates steady, Bank of England policymakers highlighted how uncertainty surrounding Brexit could weigh on inflation expectations.

- Bucking the trend of easier monetary policy, Norway's central bank caught markets off guard this week with its fourth interest rate increase within the last year.

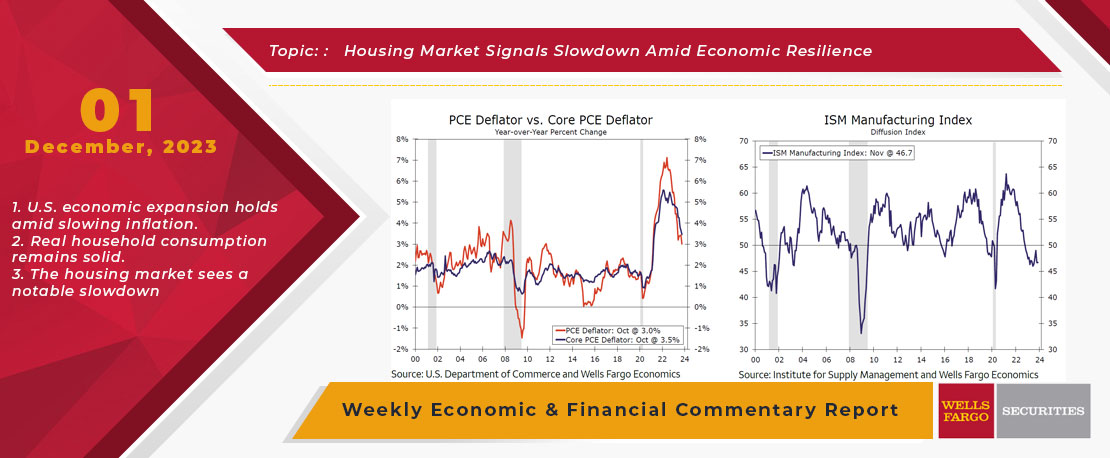

This Week's State Of The Economy - What Is Ahead? - 01 December 2023

Wells Fargo Economics & Financial Report / Dec 05, 2023

U.S. data released this week indicates the economic expansion remains alive even as inflation continues to slow. The year-ago rates of headline and core PCE inflation were the lowest since March 2021 and April 2021, respectively.

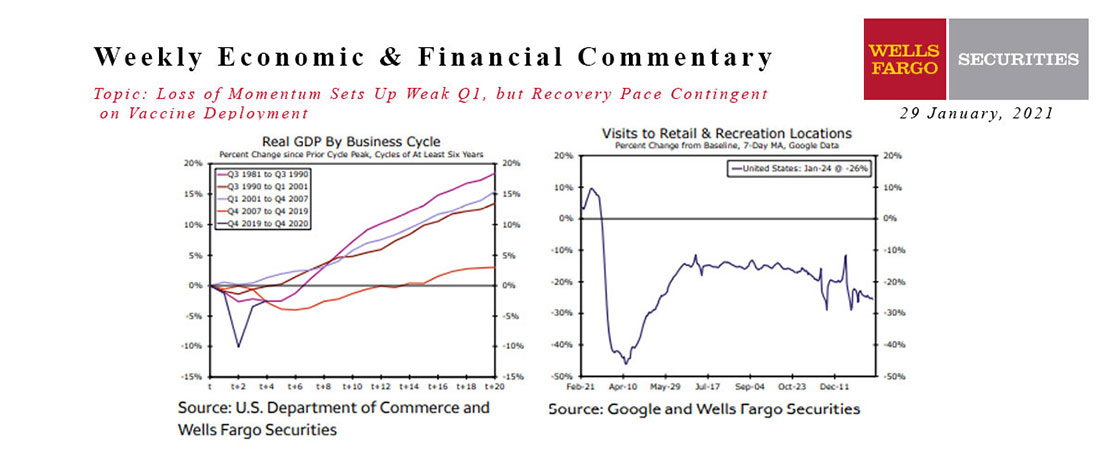

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

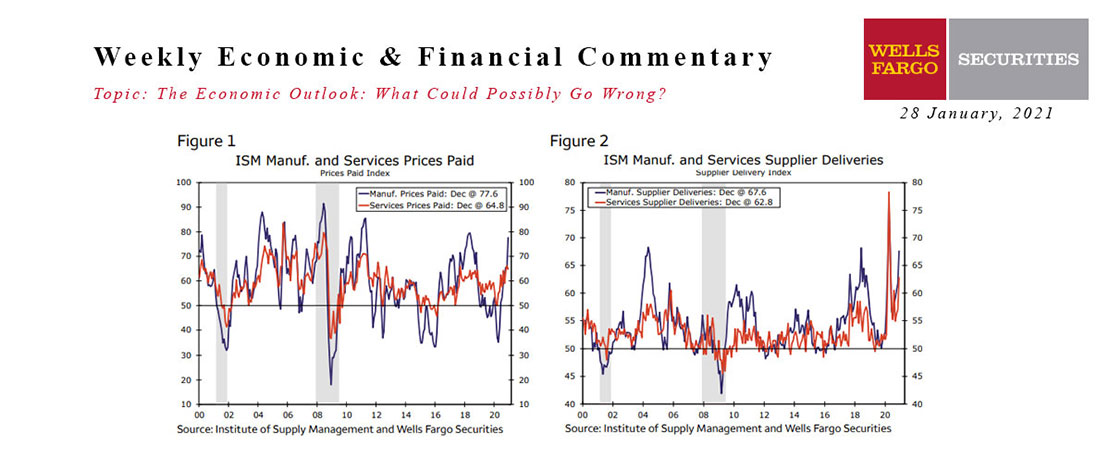

28 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Feb 08, 2021

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years.

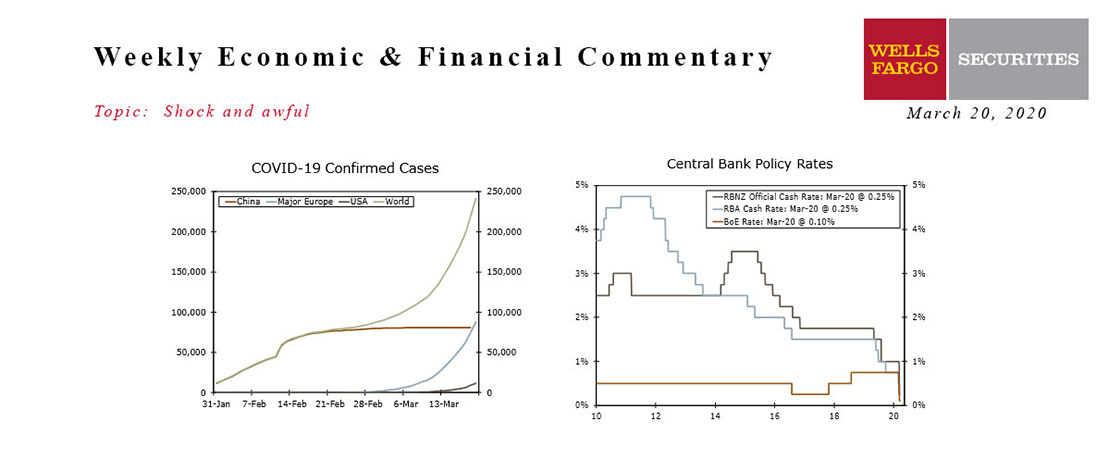

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

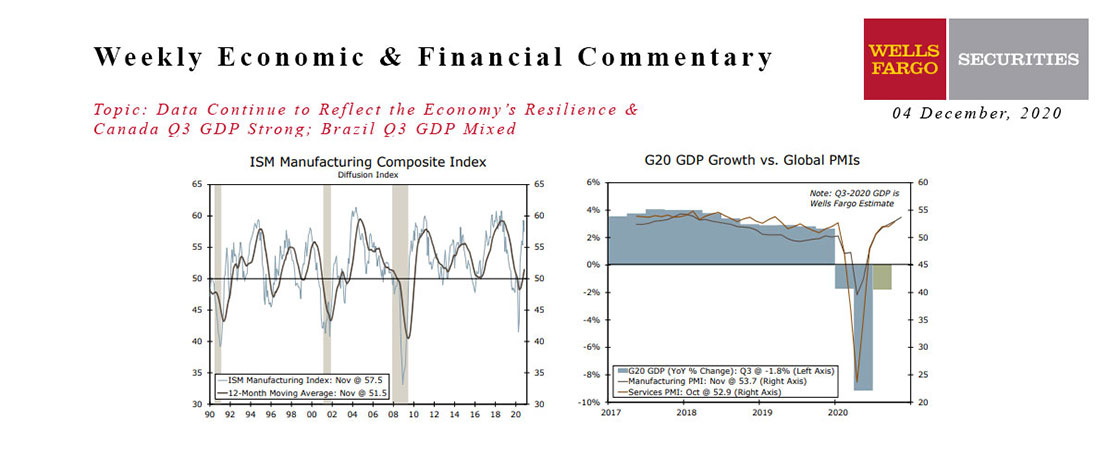

This Week's State Of The Economy - What Is Ahead? - 04 December 2020

Wells Fargo Economics & Financial Report / Dec 09, 2020

Manufacturing held up relatively well in November, despite a larger-than-expected dip in the ISM manufacturing survey. The nonfarm manufacturing survey rose slightly.

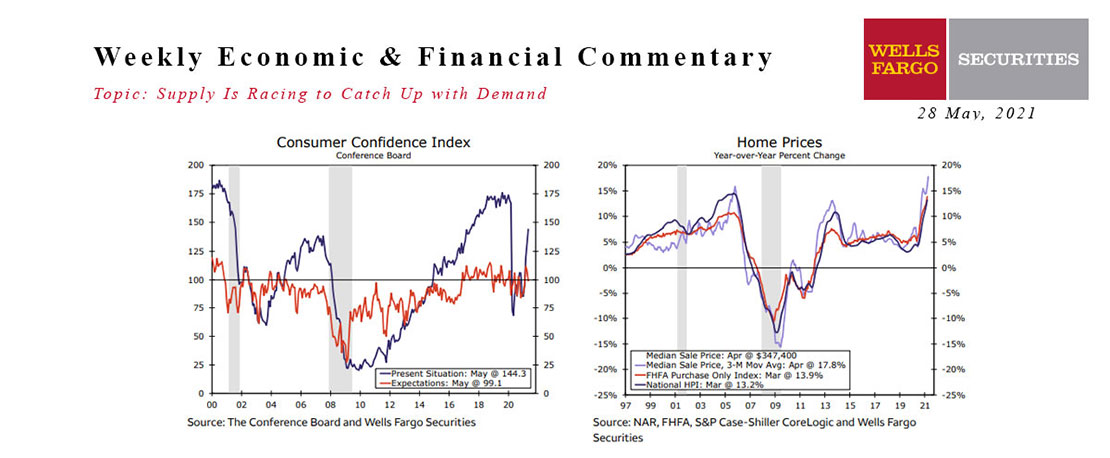

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

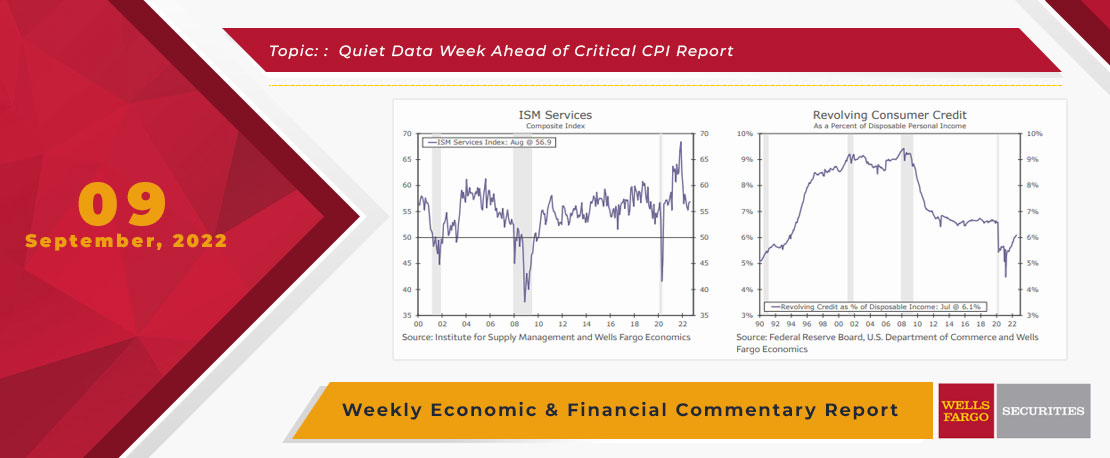

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

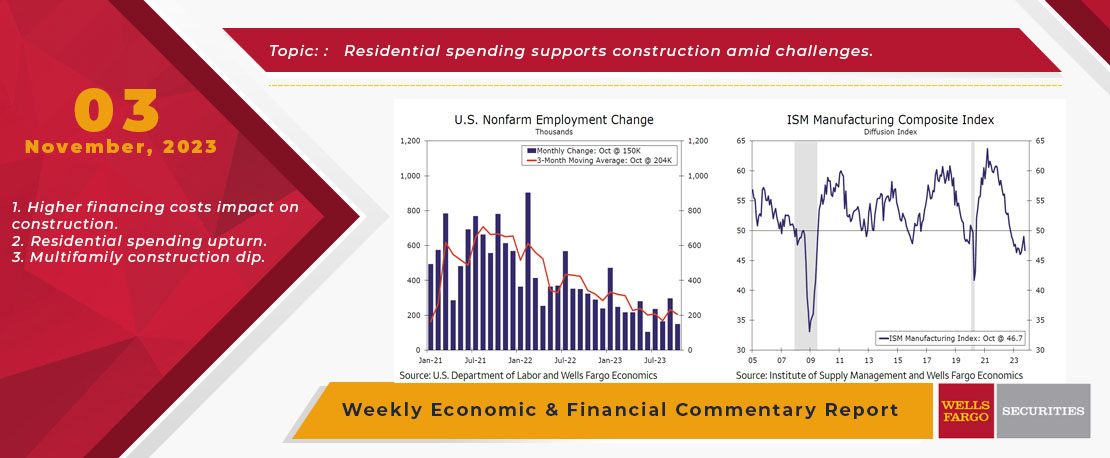

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

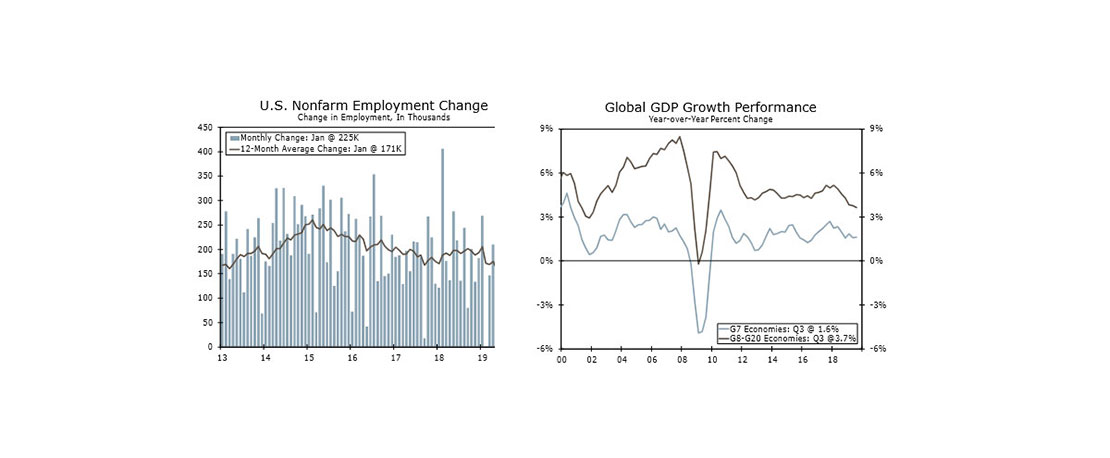

This Week's State Of The Economy - What Is Ahead? - 07 February 2020

Wells Fargo Economics & Financial Report / Feb 08, 2020

U.S. employers added 225K new workers to their payrolls in January, which handily beat expectations. But the factory sector shed jobs for the third time in four months, and net layoffs were reported for finance and retail as well.

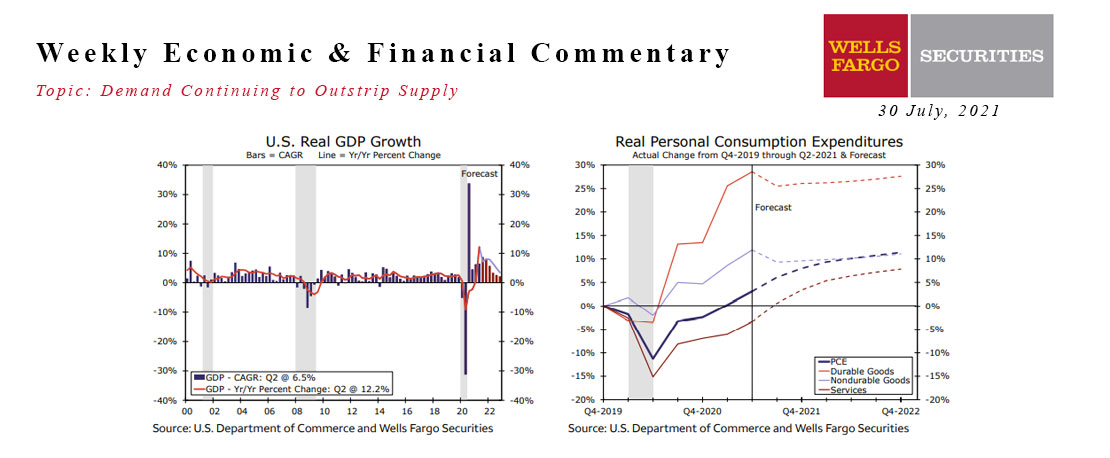

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.