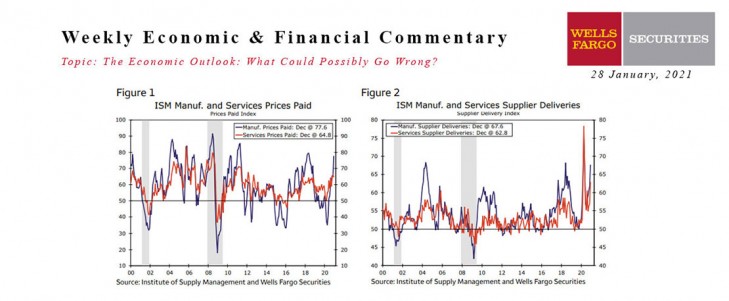

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years. In short, we look for a modest increase in rates of consumer price inflation later this year. Not only do year-over-year comparisons become favorable for higher rates of inflation starting in the spring, but prices of many services could be boosted later this year, at least temporarily, by robust consumer spending when the economy fully reopens.

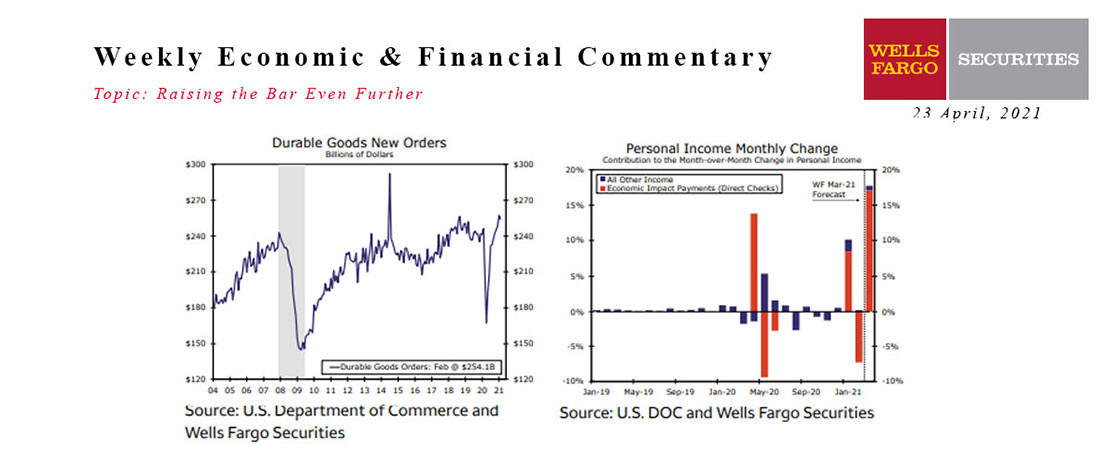

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

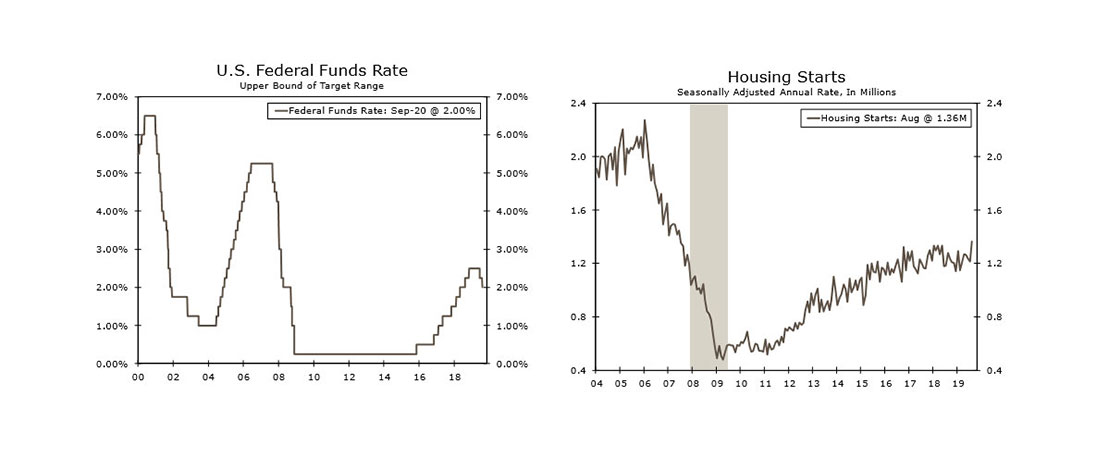

This Week's State Of The Economy - What Is Ahead? - 20 September 2019

Wells Fargo Economics & Financial Report / Sep 21, 2019

The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and muted inflation pressures.

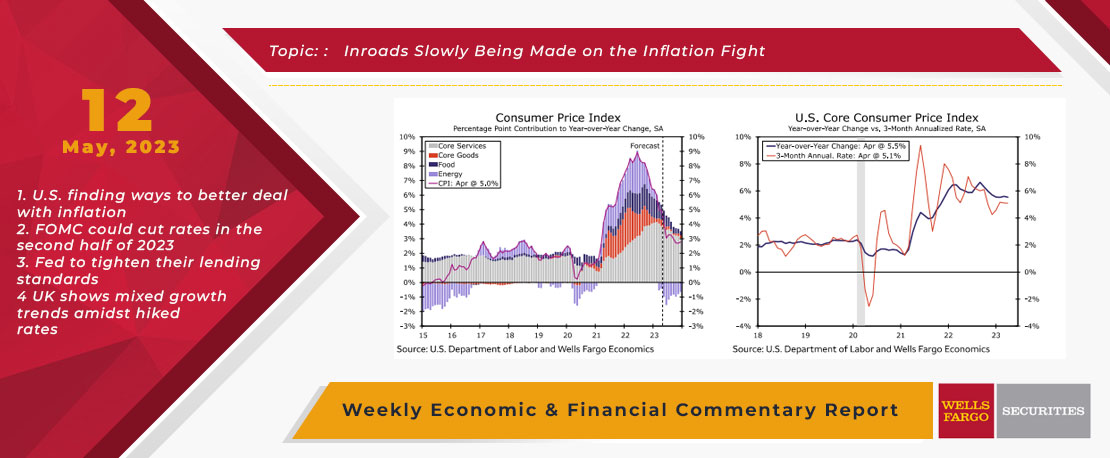

This Week's State Of The Economy - What Is Ahead? - 12 May 2023

Wells Fargo Economics & Financial Report / May 17, 2023

In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead.

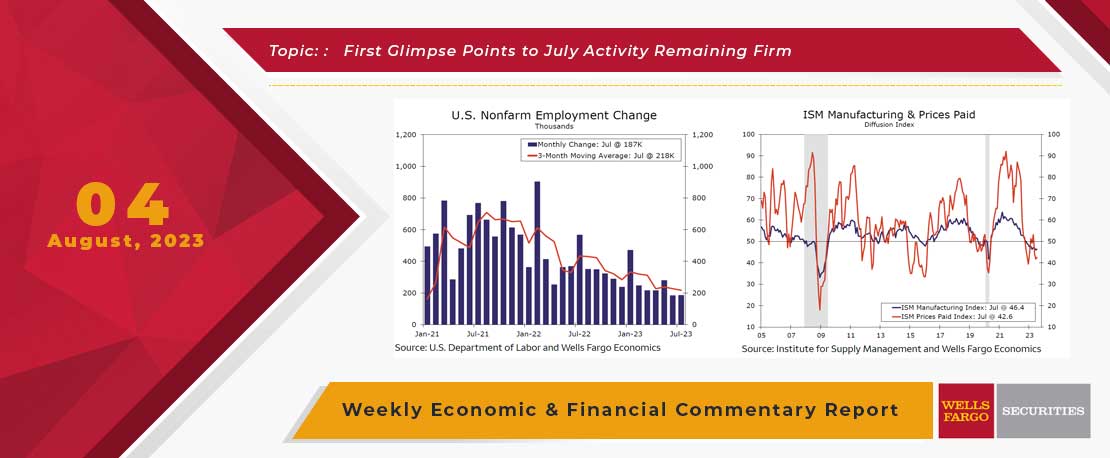

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.

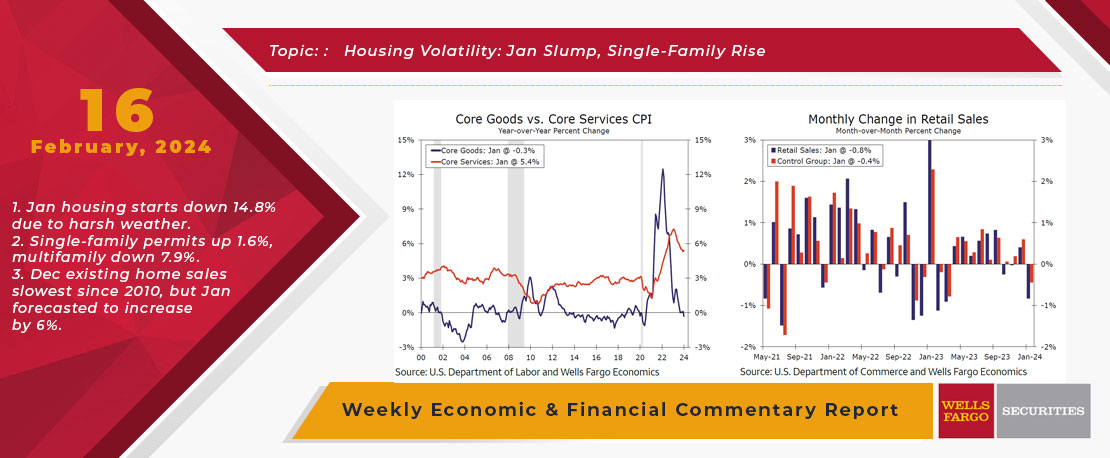

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

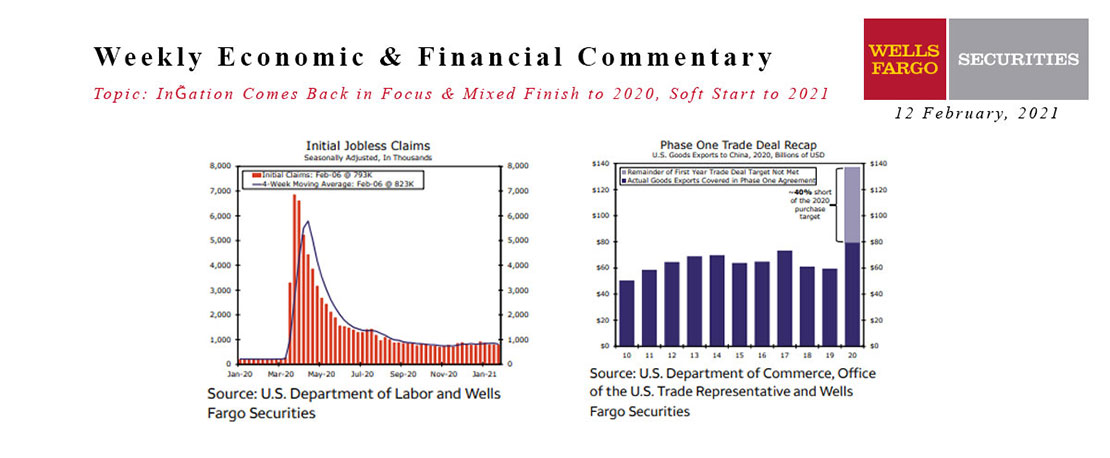

This Week's State Of The Economy - What Is Ahead? - 12 February 2021

Wells Fargo Economics & Financial Report / Feb 19, 2021

Market attention was concentrated on the January consumer price data, as inflation has come back into focus.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

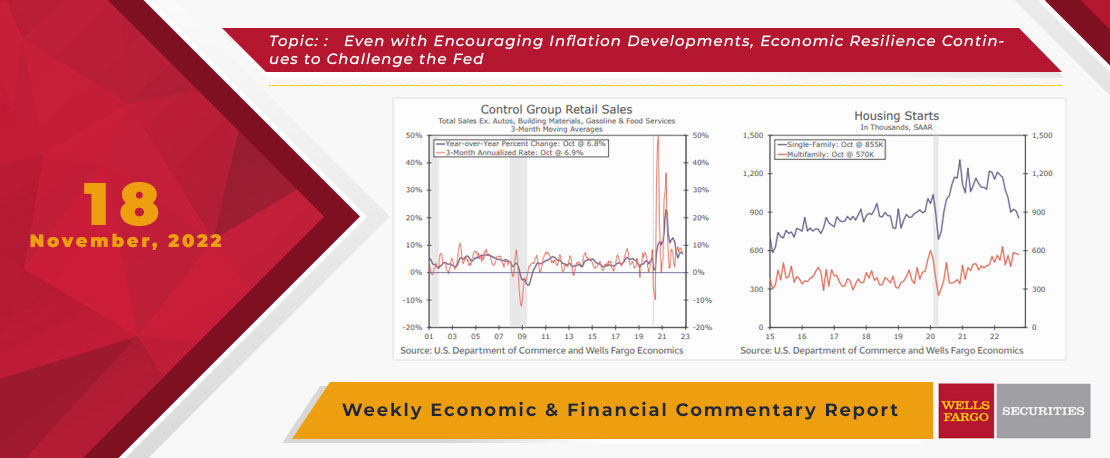

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

This Week's State Of The Economy - What Is Ahead? - 24 February 2023

Wells Fargo Economics & Financial Report / Feb 28, 2023

Existing home sales declined 0.7% in January, while new home sales leaped 7.2%. Real personal spending shot higher in January, and solid growth in discretionary spending suggests continued consumer resilience.