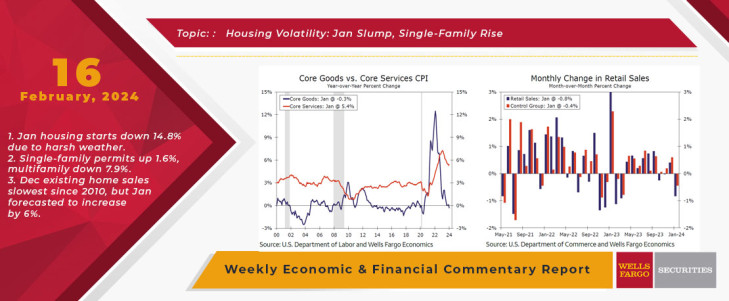

Economic data were stuck in the doldrums this week, highlighted by the latest bump in the road back toward 2% inflation. January CPI data came in hotter than expected, propelled in part by an outsized jump in energy services and food prices. Excluding food and energy, core CPI rose 0.4% in the month, also eclipsing consensus estimates. Peeling back the layers, core goods prices declined over the month alongside a fall in used car prices. Core goods inflation is now largely back to its pre-pandemic pace. By contrast, core services inflation continues to be elevated. Core services prices advanced 0.7% over the month, the largest gain in 16 months. At the center of the monthly gain was a move higher in price growth for owners' equivalent rent, medical care services and travel services, such as airfares and hotels. Despite the hot reading, we believe core services inflation will continue to trend down in the months ahead. Primary shelter prices, which we cover more in-depth in Topic of the Week, have room to decelerate based on leading indicators for this series, and the jump in travel-related prices is unlikely to be sustained.

All of that being said, January’s hot CPI report marked the second month in a row inflation exceeded expectations and is a reminder that despite a trend decline in inflation over the past year, the battle is not yet over. Indeed, the run rate of core CPI inflation has trended upward over the past five months. Since bottoming out at 2.6% in August of last year, the three-month annualized rate of core CPI growth has risen to 4.0% through January. Such developments are not likely to lower the FOMC’s confidence that inflation is completely under control. Our base case is for the FOMC to commence its rate-cutting cycle at its May meeting. However, there remain two more CPI reports between now and the May FOMC meeting, as well as a host of other economic data. If the downward trend in inflation continues to stall, we acknowledge that the first rate cut could slip into the summer.

Retail sales surprised to the downside to start 2024. Overall retail sales slipped 0.8% over the month, the largest drop in 10 months. January spending is typically affected by a post-holiday pullback and colder weather, subjecting it to considerable seasonal adjustment. With those factors in mind, the disappointing report implies that unadjusted sales were even weaker last month. Even when controlling for volatile components such as autos and food services, monthly sales still slumped. Weak spending was broad-based across retailers, implying a general pullback in consumer spending rather than selective cutbacks. One bright spot in the data was a boost to food services & drinking places sales, suggesting service-sector activity held up to start the year. Although eye-catching, January's drop in retail sales likely does not indicate that a sustained pullback in consumption is forthcoming. Households continue to benefit from real income gains, and a sturdy labor market should continue to support consumer spending.

Less sturdy was the manufacturing sector, which continued to fly at stall speed in January. Industrial production ticked down 0.1% over the month as high rates have kept the sector in a holding pattern over the past year. Weakness was concentrated in manufacturing and mining output, which comprise about 90% of the total industrial production index. A jump in utilities production helped offset declines in other categories, but overall industrial activity continues to be constrained by economic uncertainty and higher financing costs crimping capex investment. We look for production to firm up in the second half of 2024 as the Federal Reserve eventually eases monetary policy.

Housing Starts Plunged in January Alongside Harsh Weather

The out-of-consensus start to the year for economic data continued with a startling 14.8% drop in housing starts during January. The drop occurred in both single-family and multifamily starts. Here, the weather appears mostly to blame. During January, wide swaths of the nation experienced cold temperatures, snow, heavy rainfall and flooding, conditions which are hardly conducive to construction. Through the monthly volatility, however, the diverging trend between single-family construction and weakening multifamily development remained in place. Single-family permits rose 1.6% during January, and they have steadily risen over the course of the past year and are now up nearly 36% since reaching a bottom in January 2023. The improvement reflects builders becoming more confident in future sales on account of eroding resale affordability and their ability to boost demand through price discounts, mortgage rate buy-downs and other sales incentives. A solid gain in February's NAHB Housing Market Index indicates that lower mortgage rates recently are further lifting the spirits of home builders. By contrast, a 7.9% decline in multifamily permits is the latest sign that apartment and condo development is moving into a lower gear alongside deteriorating apartment market conditions, largely stemming from the wave of recently delivered projects as well as a robust pipeline of under-construction units.

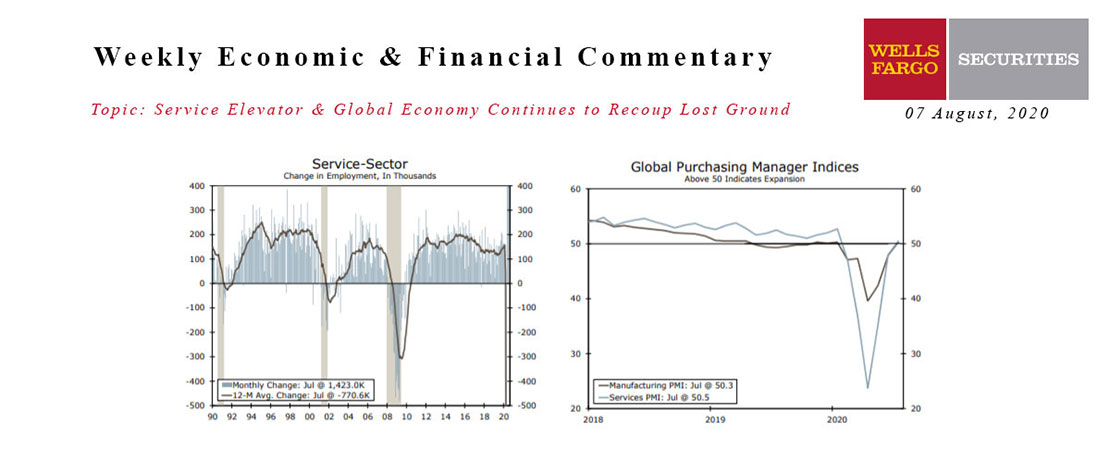

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

This Week's State Of The Economy - What Is Ahead? - 07 June 2024

Wells Fargo Economics & Financial Report / Jun 11, 2024

The U.S. labor market continues to defy expectations. Employers added 272K net new jobs in May, which was stronger than even the most bullish forecaster among 77 submissions to the Bloomberg survey.

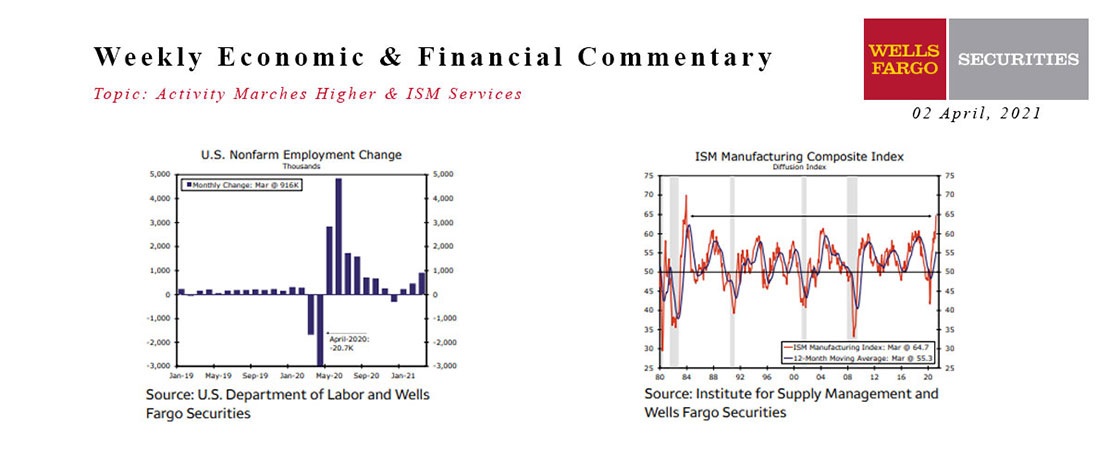

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

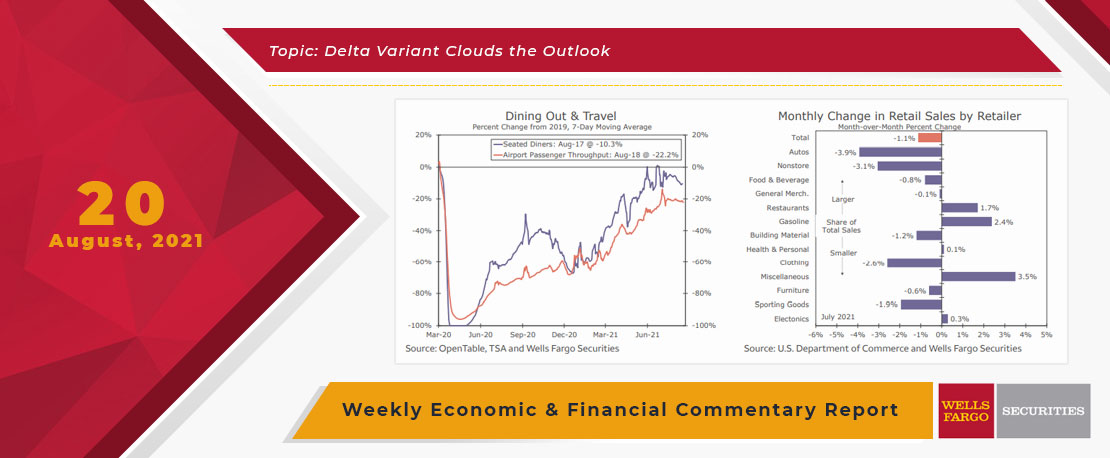

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

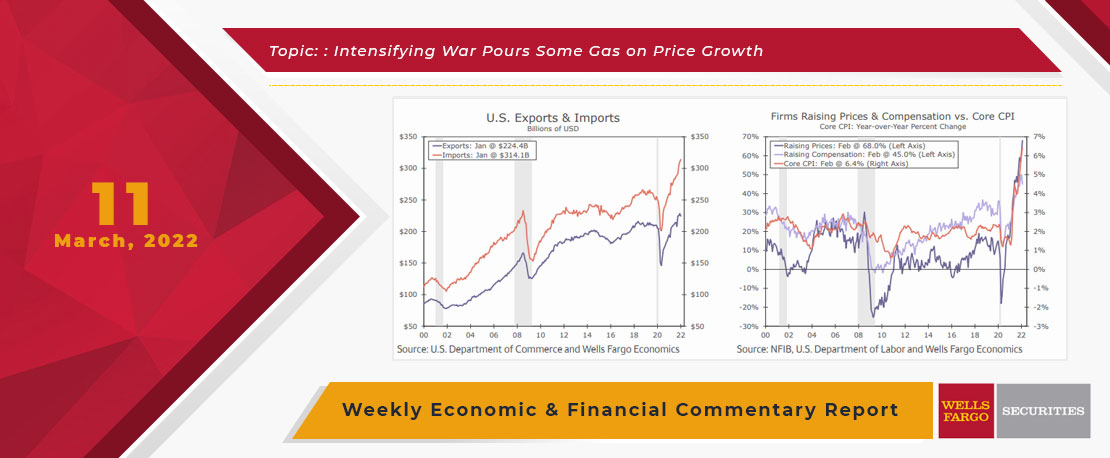

This Week's State Of The Economy - What Is Ahead? - 11 March 2022

Wells Fargo Economics & Financial Report / Mar 16, 2022

Russia\'s invasion of Ukraine continues to consume nearly all media attention and has created a level of volatility that is not yet reflected in the data released this week.

This Week's State Of The Economy - What Is Ahead? - 24 January 2020

Wells Fargo Economics & Financial Report / Jan 25, 2020

Fears of an escalating coronavirus outbreak reached the United States this week, as a Washington state man became the first confirmed domestic case and the international total reached more than 800.

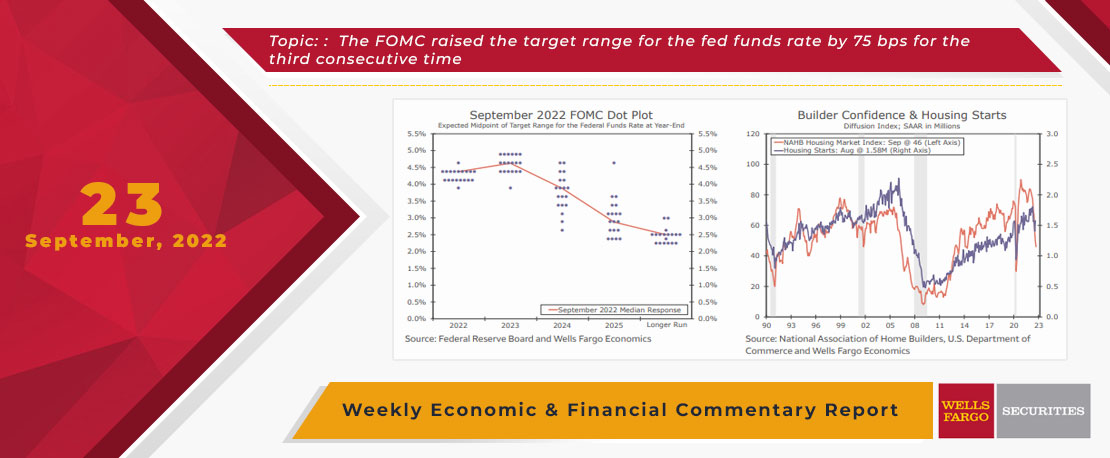

This Week's State Of The Economy - What Is Ahead? - 23 September 2022

Wells Fargo Economics & Financial Report / Sep 27, 2022

The FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage rates.

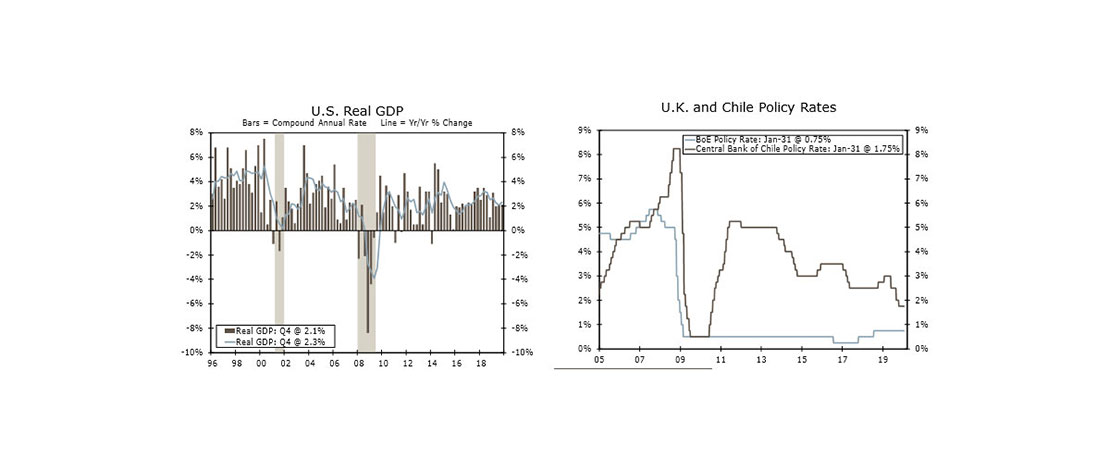

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

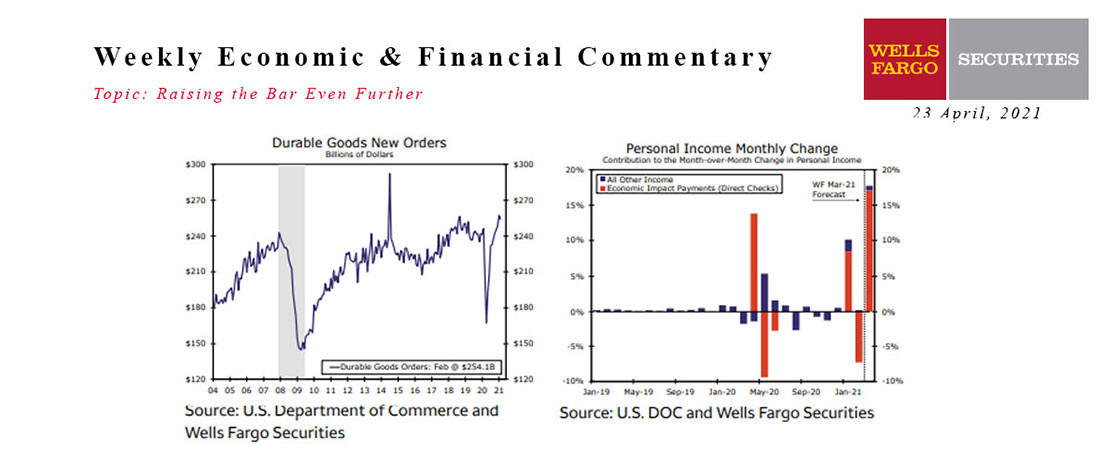

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.