The economic calendar was quiet the past few days, so market participants continued to digest last week's slew of data. Retail sales, manufacturing production and residential construction all came in weaker than expected in January, while consumer and producer price inflation were stronger than expected. The combination of slowing output amid persistently elevated price growth puts the Federal Open Market Committee (FOMC) in a tough position in terms of fine-tuning monetary policy, but some of the softness in activity can be chalked up to seasonality. We suspect the Committee will stand pat at its next meeting in March to allow for more data to come through.

The economic reports released this week were mixed, but they largely leave the narrative unchanged, in our view. The Leading Economic Index (LEI) came in slightly under expectations, falling 0.4% in January. Even though consumer expectations and the new orders component of the ISM manufacturing index jumped at the beginning of the year, sentiment is rebounding from low levels after spending much of 2023 in the doldrums. Average weekly hours in the manufacturing sector nosedived in January and the yield curve remained deeply inverted. As these components are heavily weighted in the index, the monthly outturn was negative. The LEI now stands just two points above its April 2020 low (chart), which underscores the magnitude of its out-of-sync recession signal.

While the LEI continues to gesture toward tough waters ahead, the home resale market finally caught a tailwind. Existing home sales rose 3.1% in January to a 4.0 million-unit annual sales pace. The increase was widely expected as pending home sales and mortgage purchase applications perked up in December amid declining mortgage rates. The sales rebound may prove to be short-lived, however. The average 30-year fixed mortgage rate crept up 30 bps over the past few weeks to 6.9% (chart), as recent inflation data have added credence to a “higher for longer” interest rate environment.

Underpinning the move higher in mortgage rates, the minutes of the FOMC's January meeting were mildly hawkish. The Committee held its benchmark interest rate steady last month and signaled that it would not lower rates “until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” In support of that stance, the minutes revealed that “most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent.”

While we look for the core PCE deflator, the Fed's preferred measure of inflation, to have edged down in January on a year-ago basis—see U.S. Outlook for more detail—the upside surprise in the CPI is not a confidence booster in the campaign to get inflation back down to 2% on a sustainable basis. We currently forecast the first rate cut to take place in May, but the timing of that cut is at risk of slipping further into the summer.

This Week's State Of The Economy - What Is Ahead? - 14 October 2020

Wells Fargo Economics & Financial Report / Oct 14, 2020

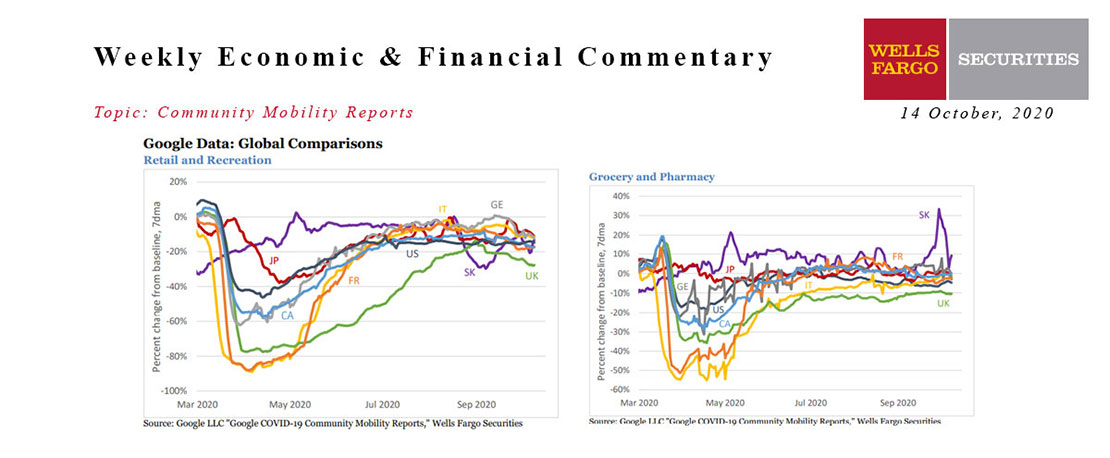

The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline.

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

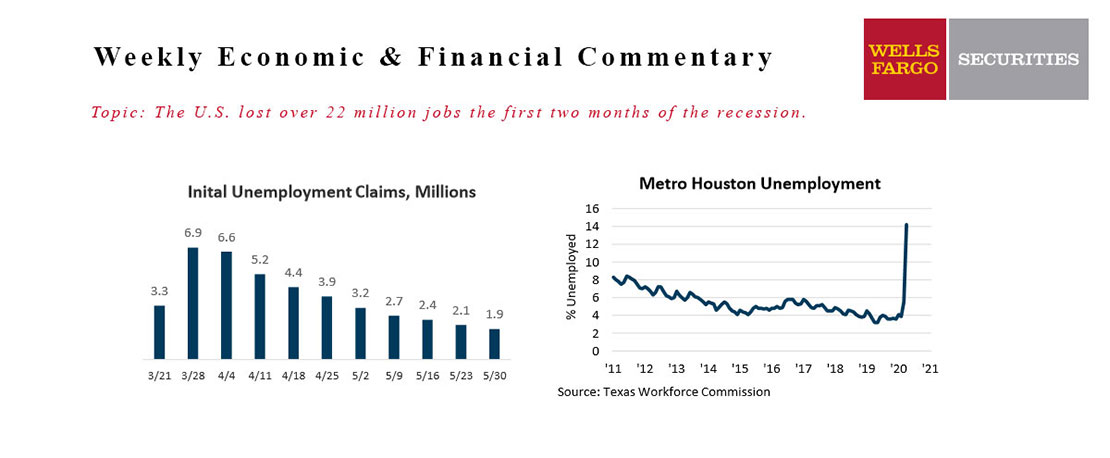

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

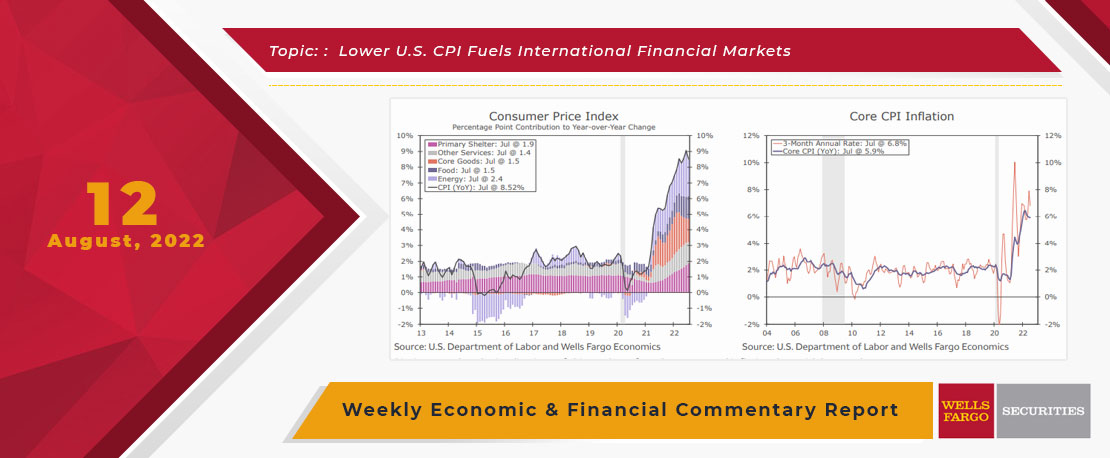

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

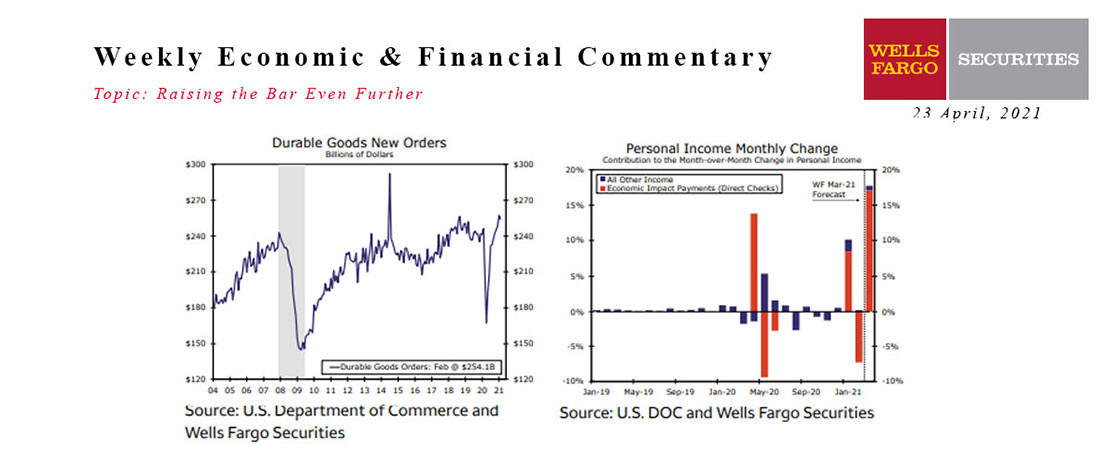

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

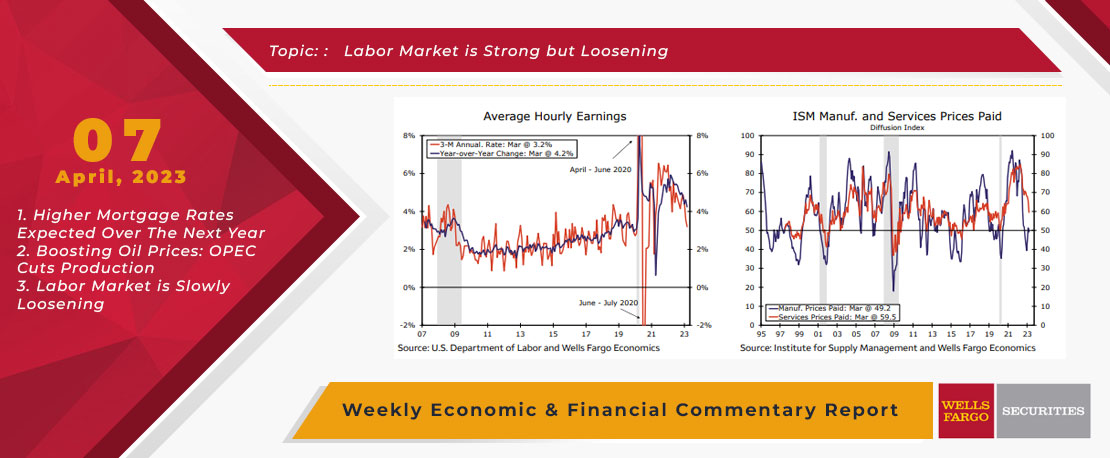

This Week's State Of The Economy - What Is Ahead? - 07 April 2023

Wells Fargo Economics & Financial Report / Apr 10, 2023

Employers added jobs at the slowest pace since 2020 in March, job openings fell and an upward trend in initial jobless claims has emerged.

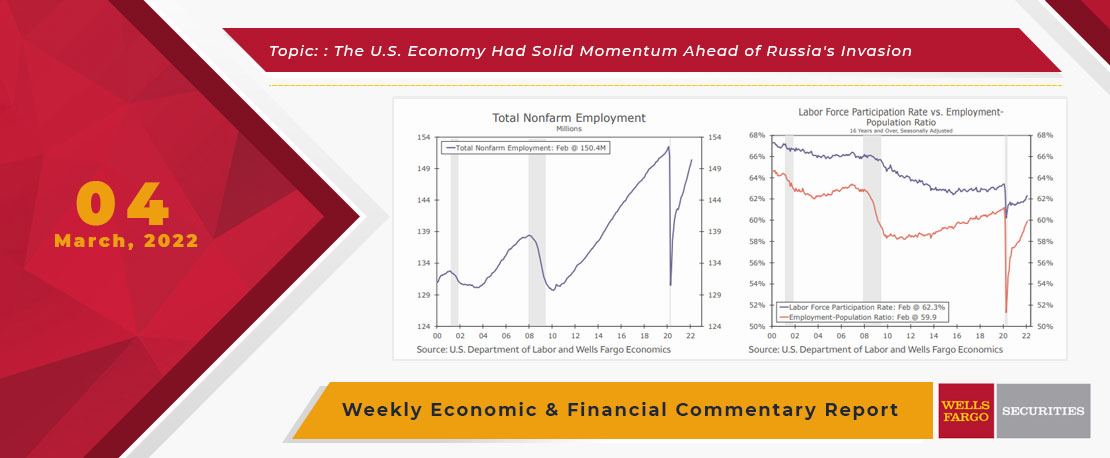

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

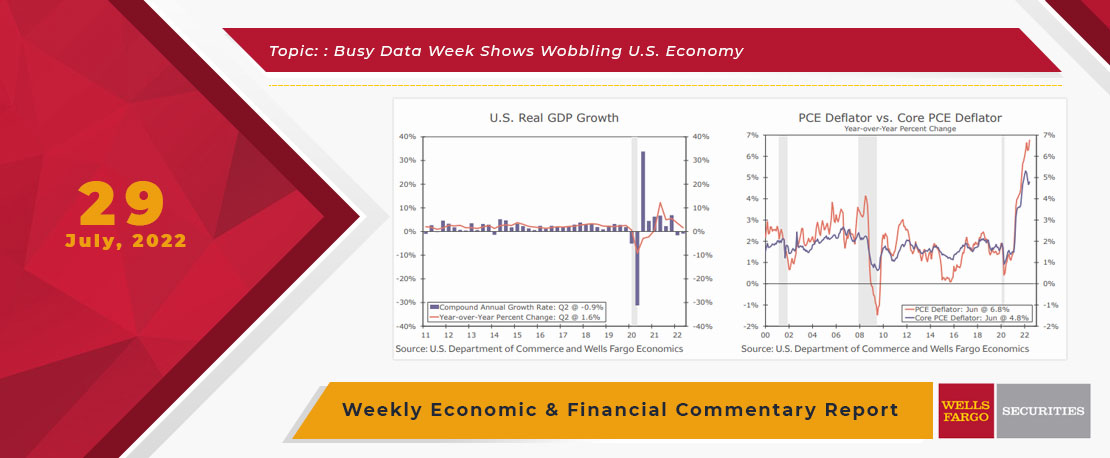

This Week's State Of The Economy - What Is Ahead? - 29 July 2022

Wells Fargo Economics & Financial Report / Jul 31, 2022

Unlike the local temperatures, data released this week showed U.S. economic growth modestly declined in Q2.

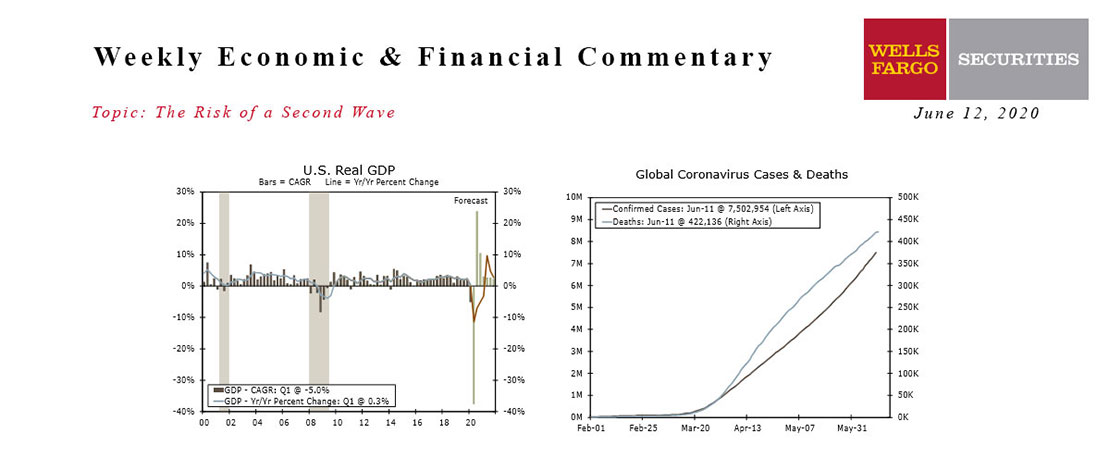

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

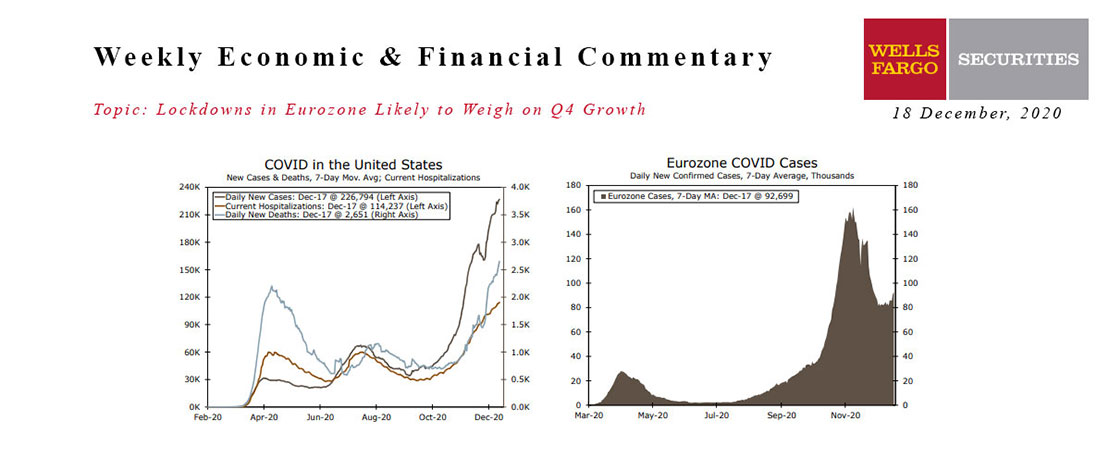

This Week's State Of The Economy - What Is Ahead? - 18 December 2020

Wells Fargo Economics & Financial Report / Dec 21, 2020

This week marked the first U.S. COVID vaccinations and the imminent rollout of a second vaccine.