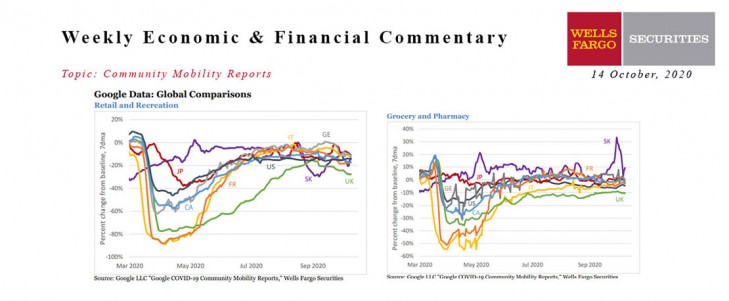

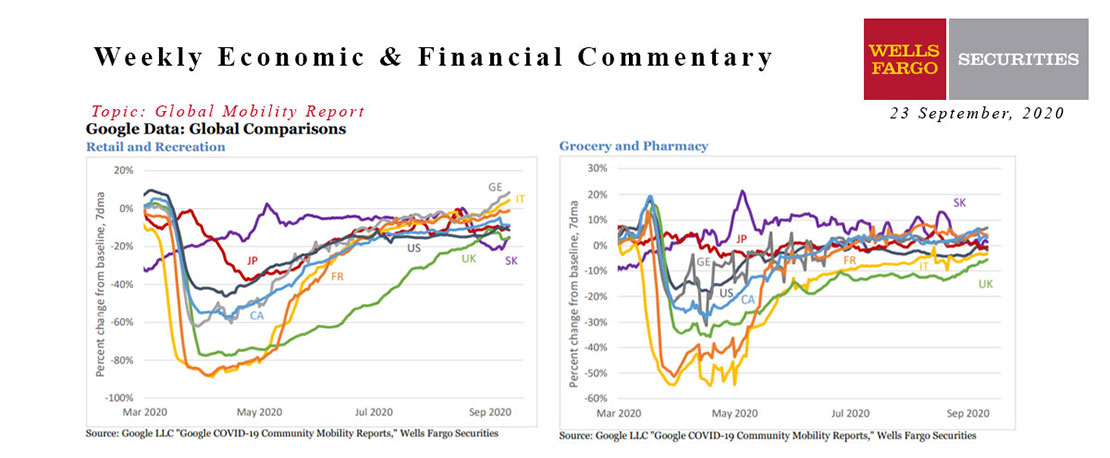

Key takeaways from this week (Google data through October 9, Apple data through October 12)

- The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline. France, Germany and Italy, along with many of their neighbors, have implemented varying degrees of restrictions on large group gatherings, travel and bars, all of which seem to be having a negative impact on retail and recreation activity.

- The United Kingdom’s negative gap is widening. U.K. retail and recreation activity has consistently lagged behind most other major developed economies this year. In recent weeks, that U.K. underperformance has continued and even worsened. Recent news that the U.K. is considering more restrictive measures, including closing pubs that do not serve food and other recreation sites, is unlikely to help.

- The United States continues to muddle through. U.S. retail and recreation activity has been essentially stuck roughly 15% below the January baseline since mid-June. The country’s largest states are all showing the same flatlining pattern, although there has been a slight ticking lower in New York relative to Florida, California and Texas.

This Week's State Of The Economy - What Is Ahead? - 04 September 2020

Wells Fargo Economics & Financial Report / Aug 29, 2020

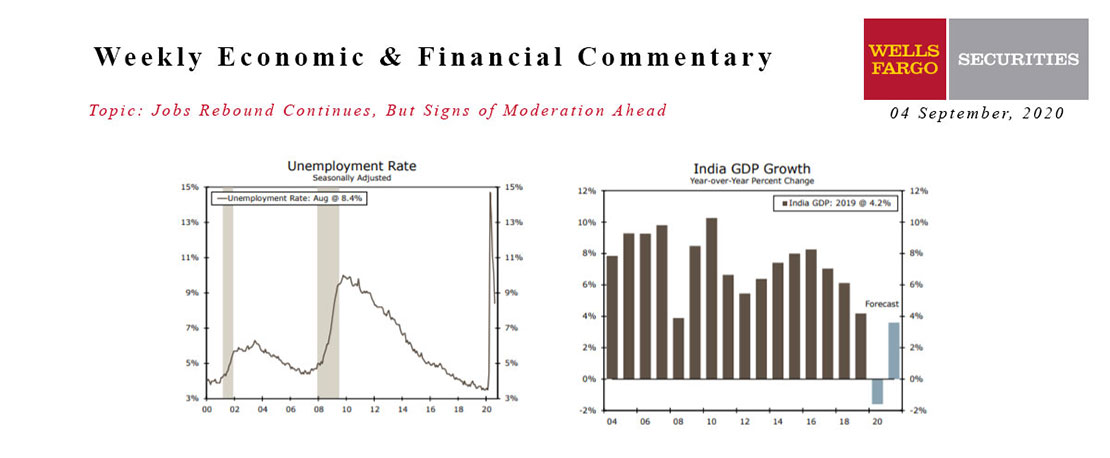

Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million.

This Week's State Of The Economy - What Is Ahead? - 11 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

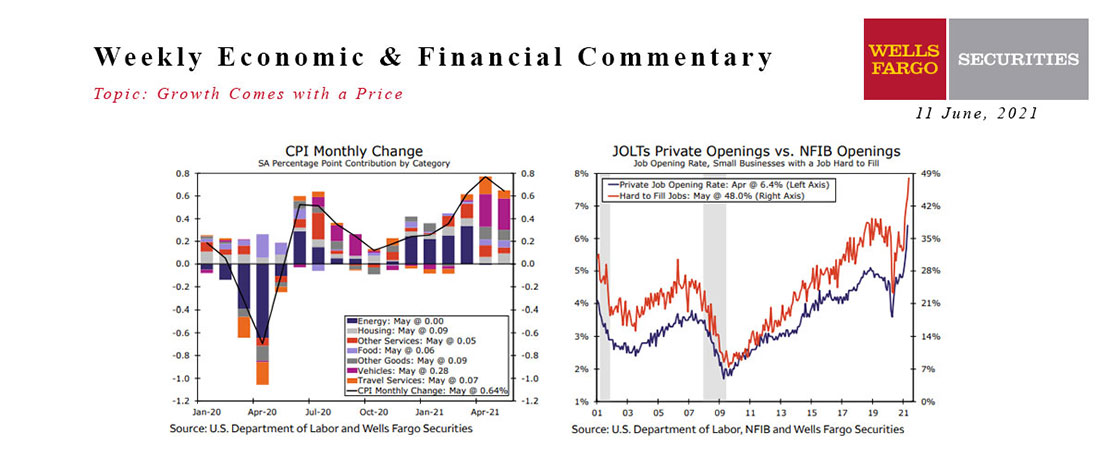

Okay, so I’ve gotten about half a dozen calls since Wednesday asking if I saw the May CPI numbers that came out this week.

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

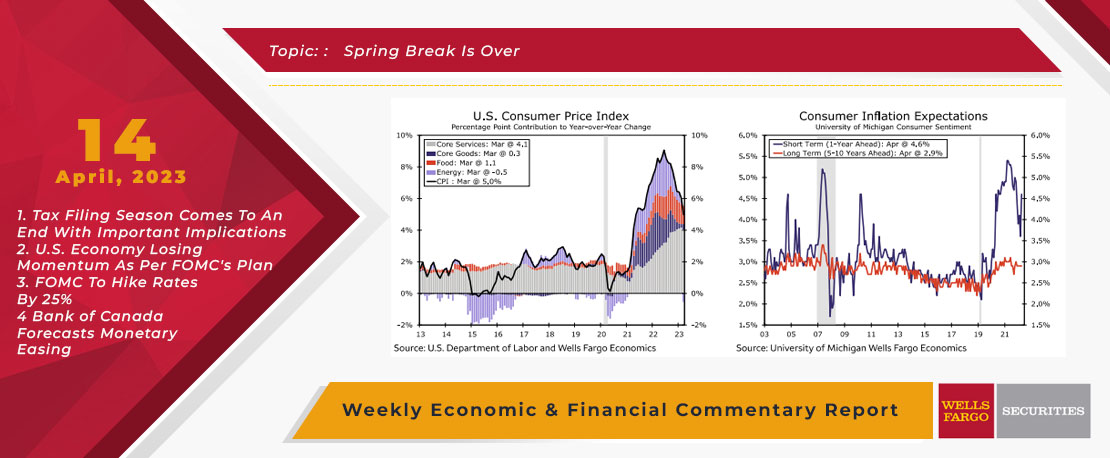

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

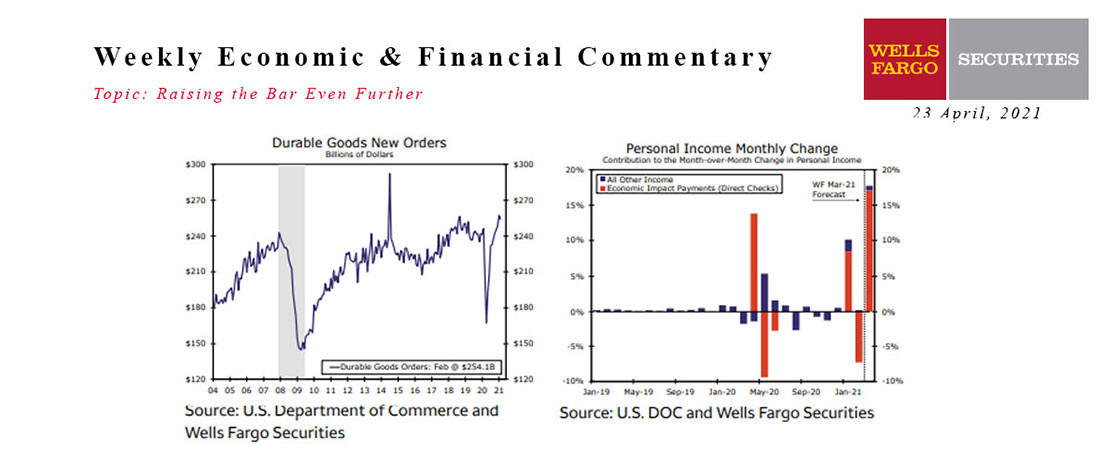

This Week's State Of The Economy - What Is Ahead? - 23 April 2021

Wells Fargo Economics & Financial Report / Apr 26, 2021

This week\'s lighter economic calendar allowed forecasters more time to assess the implications from the prior week\'s blowout retail sales report.

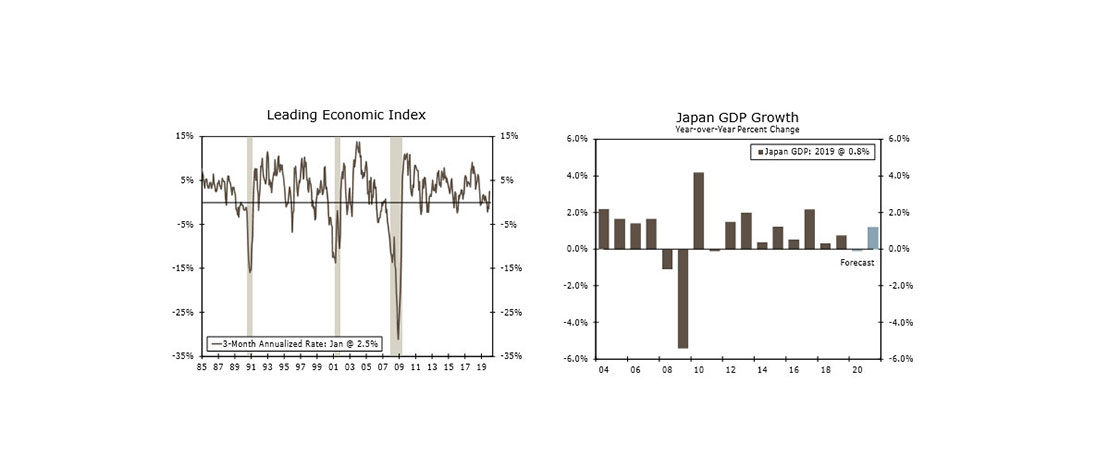

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

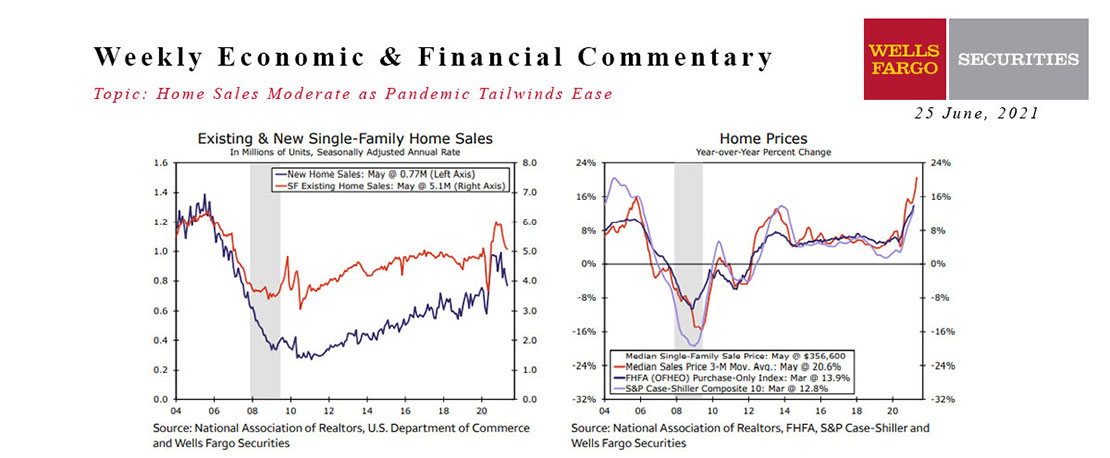

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

This Week's State Of The Economy - What Is Ahead? - 27 November 2019

Wells Fargo Economics & Financial Report / Nov 28, 2019

A series of U.K. general election polls released this week continue to show Boris Johnson’s Conservative Party with a significant lead over the opposition Labor Party.

This Week's State Of The Economy - What Is Ahead? - 27 August 2021

Wells Fargo Economics & Financial Report / Aug 30, 2021

In other economic news, output continues to ramp up across the U.S., even as the resurgence in COVID cases is leading to some pullback in consumer engagement.