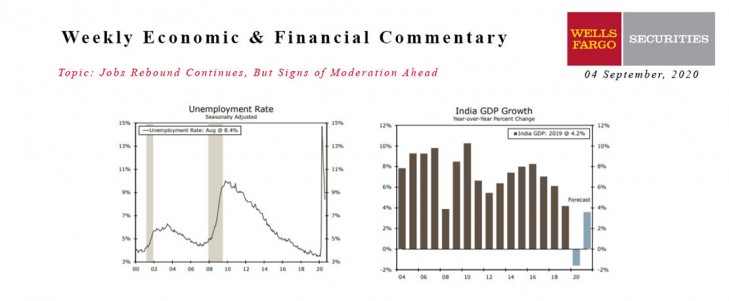

U.S. - Jobs Rebound Continues, But Signs of Moderation Ahead

- Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million. Although the labor market continued to improve, the pace of job growth is moderating.

- The one million private jobs added is down from an average of about 2.4 million the prior three months. Further, there are still nearly 30 million workers collecting unemployment insurance.

- The rebound in the labor market should continue, but we do not expect employment to reach its pre-virus position for quite some time.

Global - Q2 GDP Data Continues to Underwhelm

- While expectations for Q2 GDP were dismal, data this week continued to demonstrate how severe the COVID-19 impact has been on economic activity. In India, the economy contracted significantly in Q2, while in Brazil, the economy missed consensus forecasts and experienced the largest decline on record.

Euro zone Inflation Decelerates More Than Expected

- Inflation in the Euro zone surprised to the downside this week as headline CPI turned negative in August. The decline was surprising given the amount of support policymakers have provided the Euro zone economy.

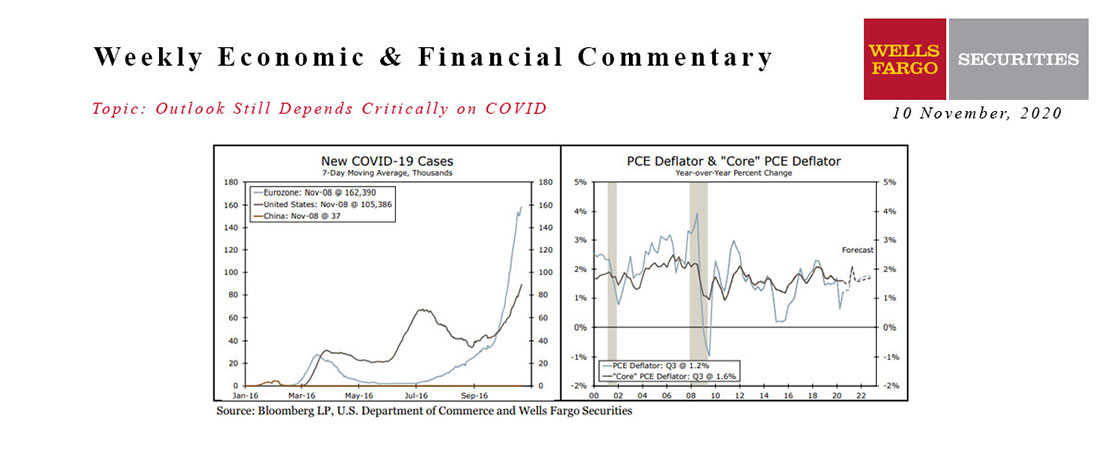

This Week's State Of The Economy - What Is Ahead? - 10 November 2020

Wells Fargo Economics & Financial Report / Nov 17, 2020

The U.S. election has come and gone, but we have not made any meaningful changes to our economic outlook, which continues to look for further expansion in the U.S. economy in coming quarters.

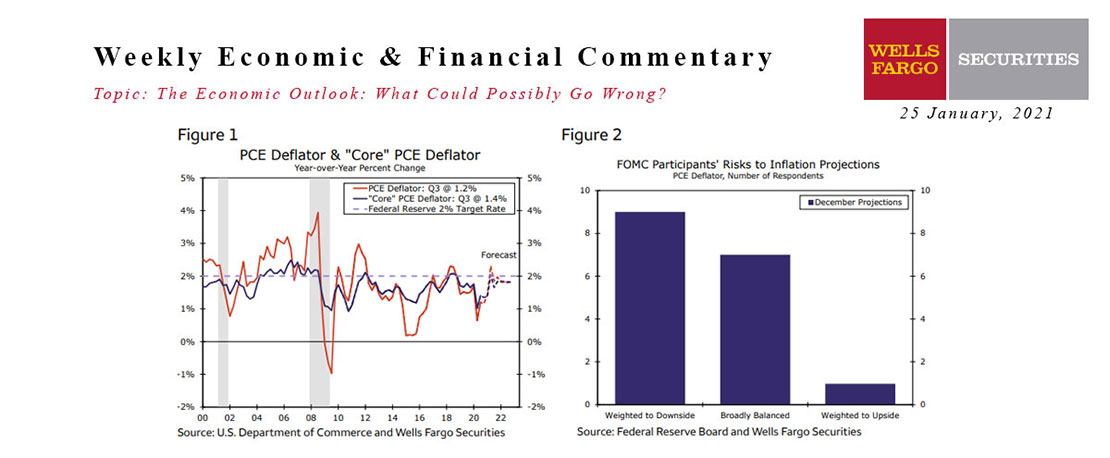

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

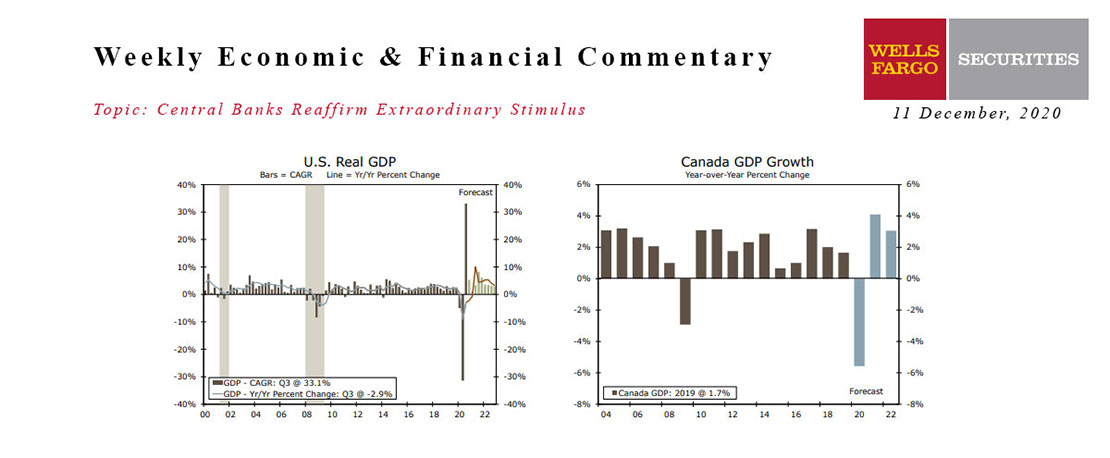

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

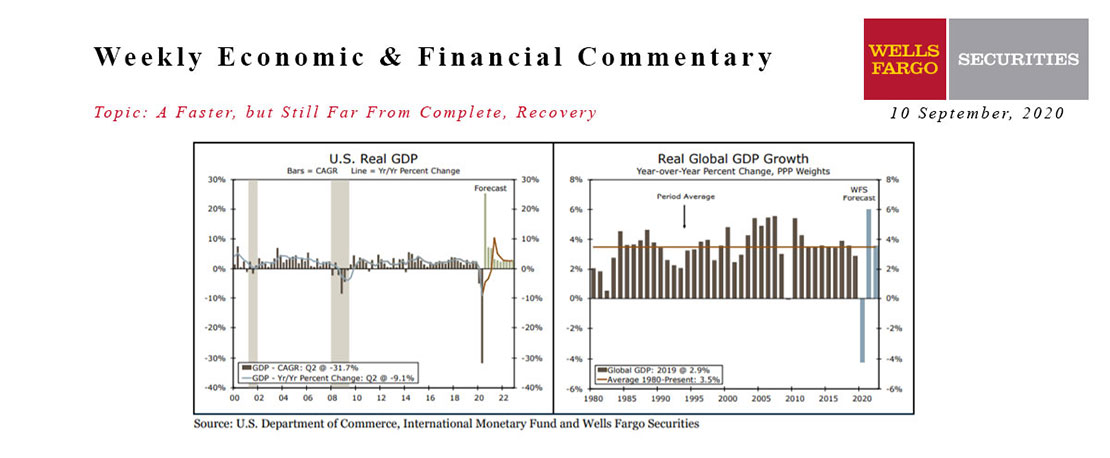

This Week's State Of The Economy - What Is Ahead? - 10 September 2020

Wells Fargo Economics & Financial Report / Sep 12, 2020

Although the recovery from the COVID recession is still far from over, the U.S. economy is bouncing back faster than many expected.

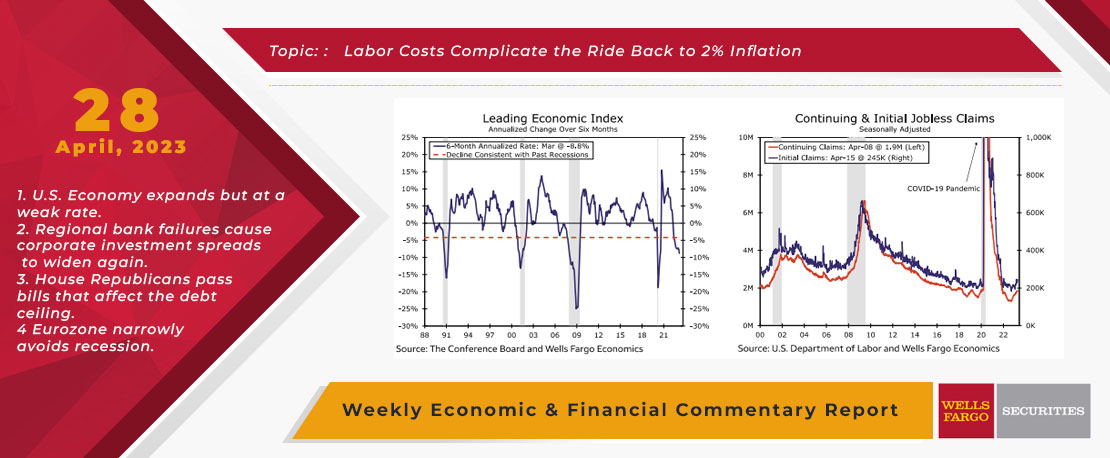

This Week's State Of The Economy - What Is Ahead? - 28 April 2023

Wells Fargo Economics & Financial Report / May 03, 2023

U.S. Economy expands but at a weak rate. Regional bank failures cause corporate investment spreads to widen again. House Republicans pass bills that affect the debt ceiling.

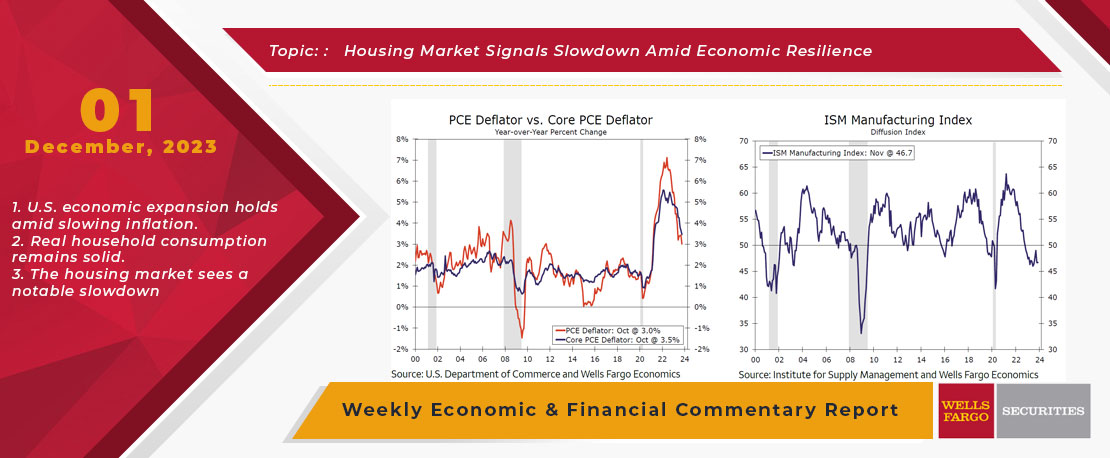

This Week's State Of The Economy - What Is Ahead? - 01 December 2023

Wells Fargo Economics & Financial Report / Dec 05, 2023

U.S. data released this week indicates the economic expansion remains alive even as inflation continues to slow. The year-ago rates of headline and core PCE inflation were the lowest since March 2021 and April 2021, respectively.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

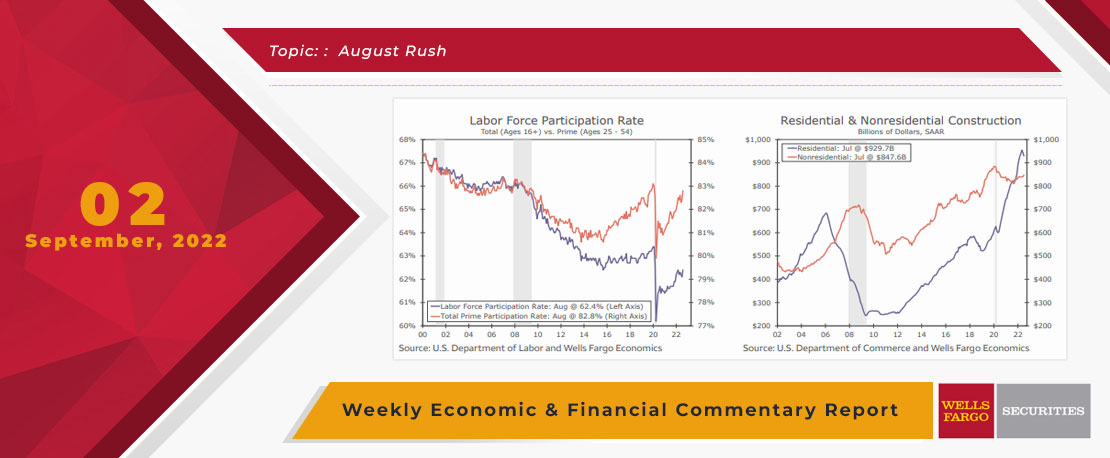

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

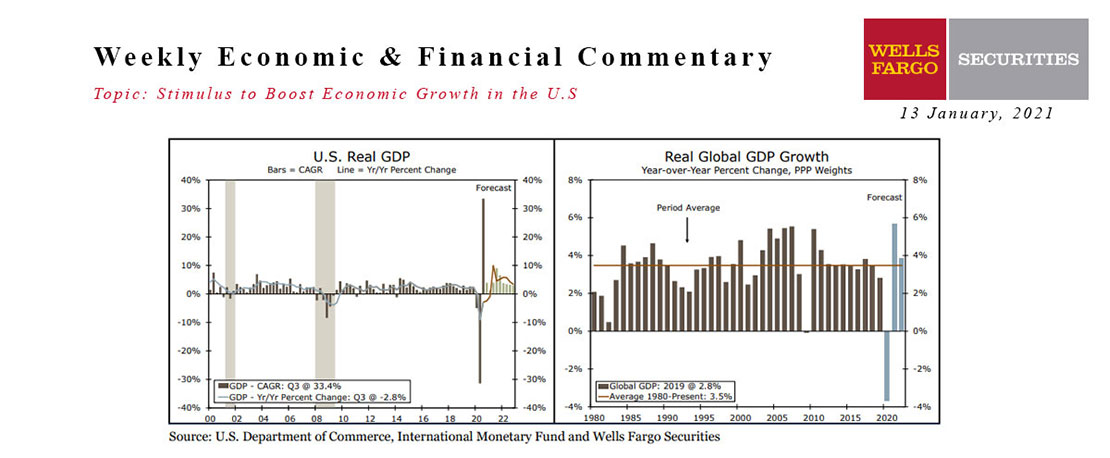

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.