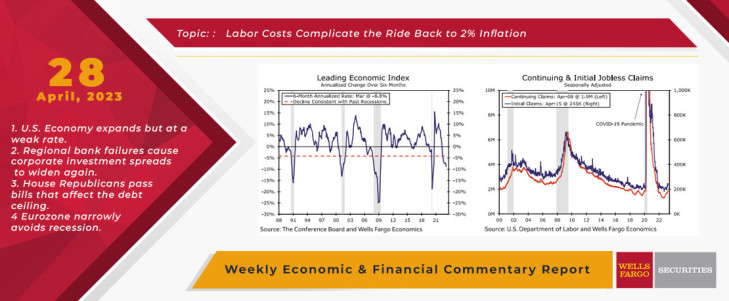

Angels manager (and long-ago former Astros third baseman) Phil Nevin was ejected from the game by the first base umpire for arguing a called third strike on a checked swing by the batter. Nevin continued to make his case with the home plate umpire and was thrown out again by the home plate ump. I guess the point was to make sure that Nevin got the message that he was gone. In much the same way as the home plate ump, the Fed is widely expected to raise the fed funds rate another 25 bps next Wednesday to make sure the economy “gets the message” after the Employment Cost Index (“ECI”) increased a hotter-than-expected 1.2% in Q1, suggesting compensation costs are not cooling as much as the average hourly earnings data indicate.

The interesting question will be whether that signals the end of rate increases for a while to give the Fed a chance to sit back and observe the impact of its handiwork, or does it increase rates again in the months that follow? The growing consensus seems to favor the former over the latter, but we’ll see.

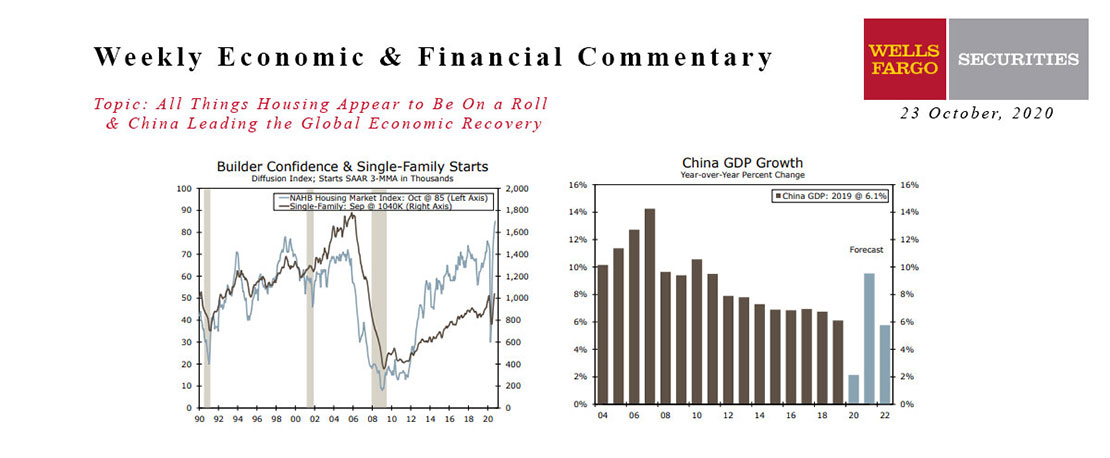

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

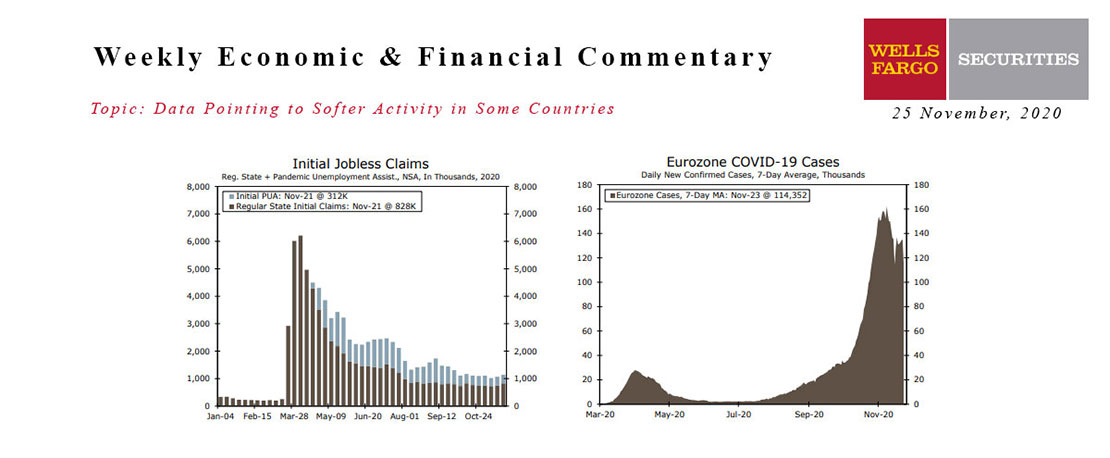

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

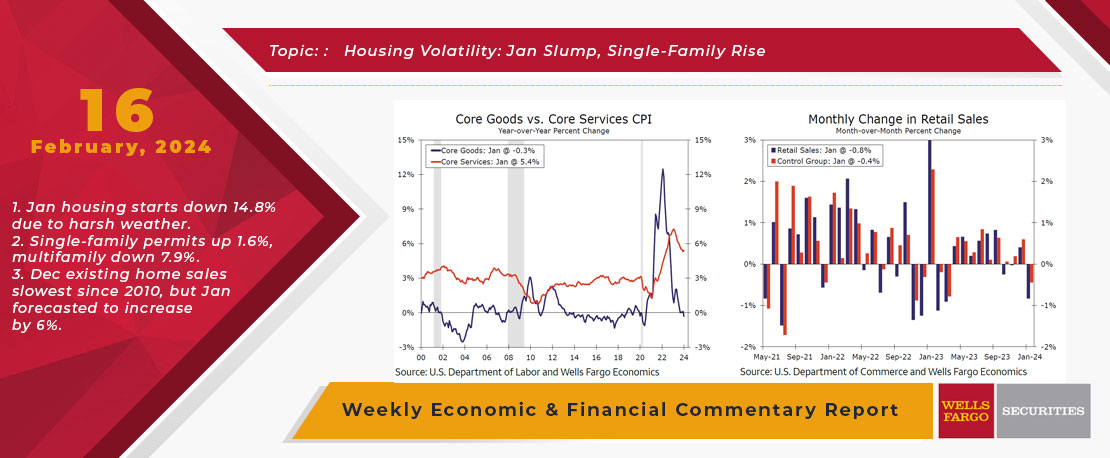

This Week's State Of The Economy - What Is Ahead? - 16 February 2024

Wells Fargo Economics & Financial Report / Feb 20, 2024

The out-of-consensus start to the year for economic data continued with a slip in retail sales and industrial production followed by a startling 14.8% drop in housing starts during January.

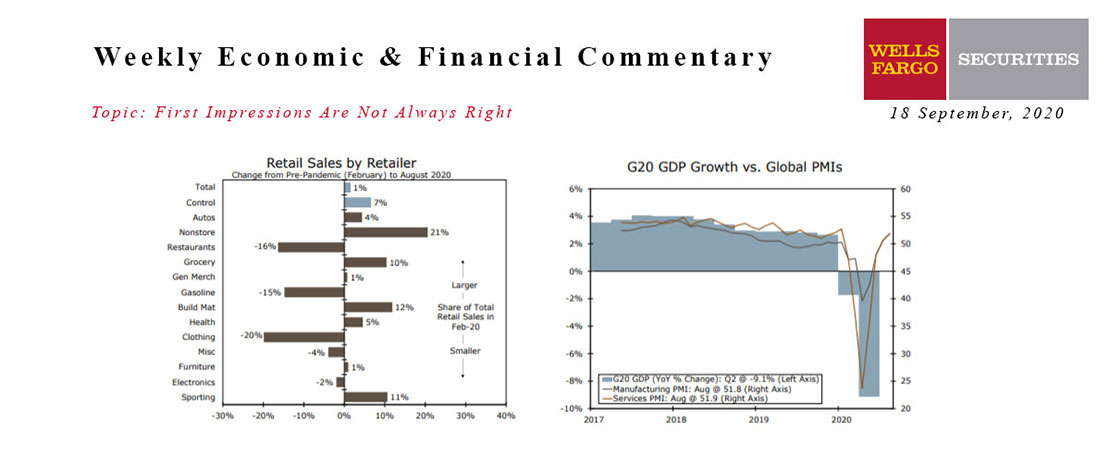

This Week's State Of The Economy - What Is Ahead? - 18 September 2020

Wells Fargo Economics & Financial Report / Sep 15, 2020

The details were generally more favorable. The retail sectors hurt most by the pandemic saw gains in August, factory output is growing and soaring homebuilder confidence suggests soft construction data this week may be transitory.

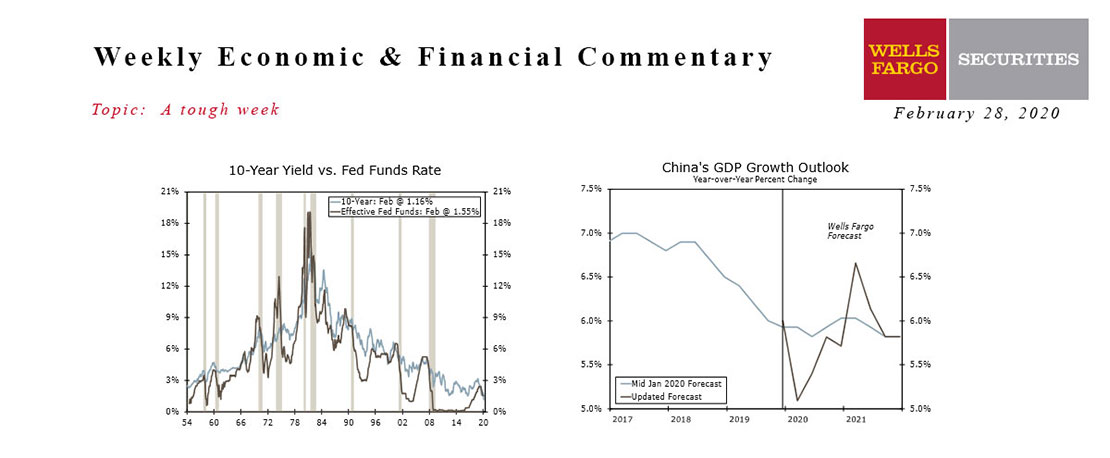

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

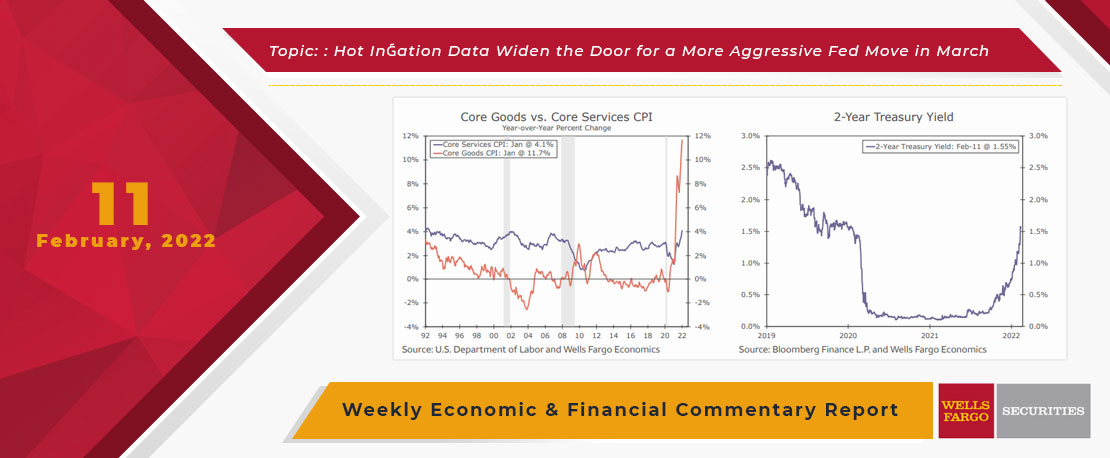

This Week's State Of The Economy - What Is Ahead? - 11 February 2022

Wells Fargo Economics & Financial Report / Feb 14, 2022

Deep thought for the week, if a tree falls in the forest, or an Olympics occurs, and no one is there to hear it or see it, did it really occur?

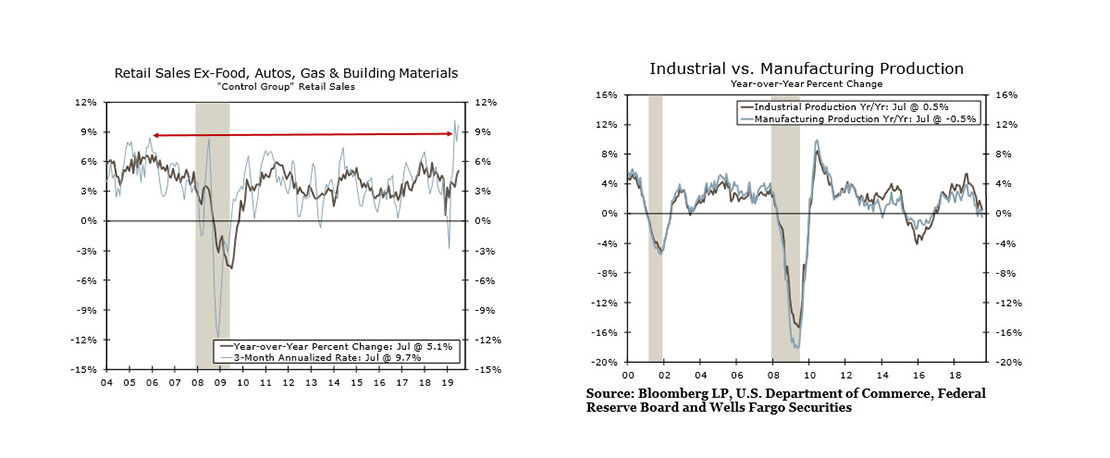

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

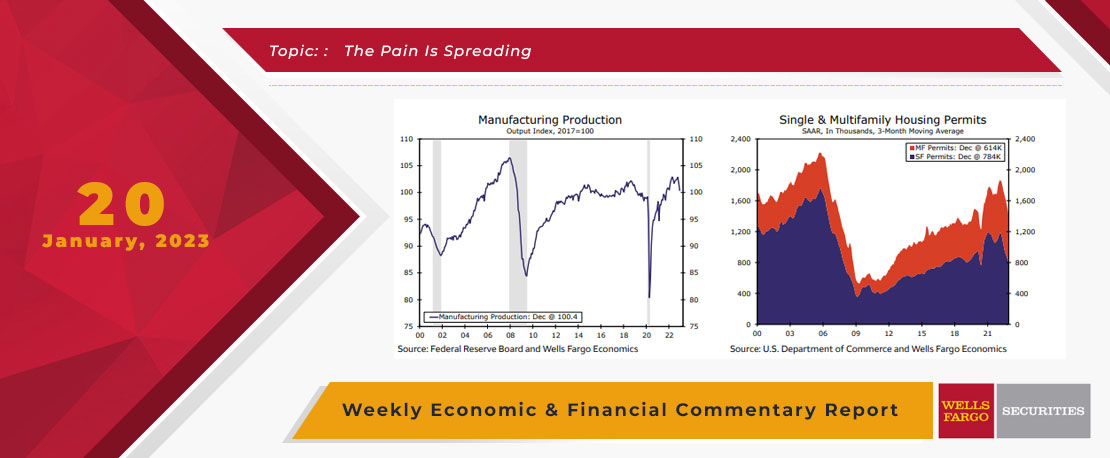

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

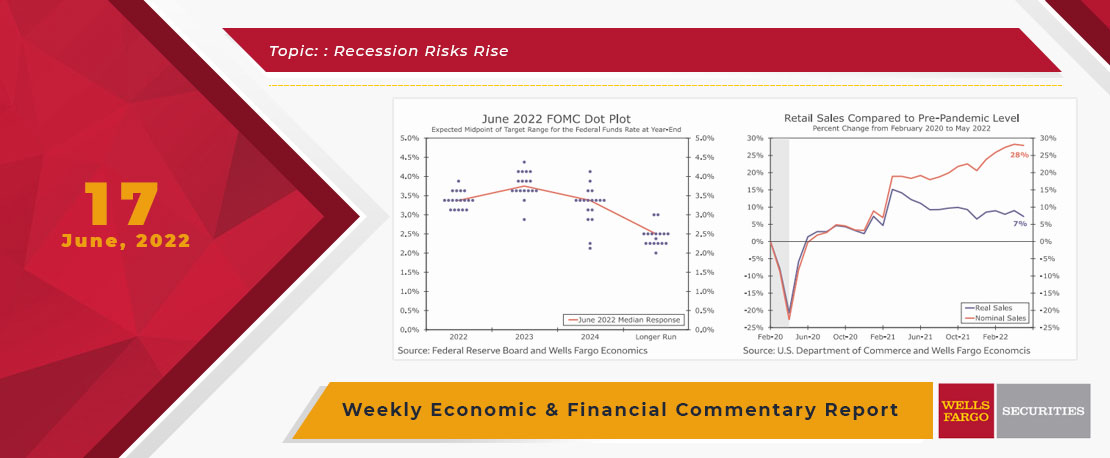

This Week's State Of The Economy - What Is Ahead? - 17 June 2022

Wells Fargo Economics & Financial Report / Jun 20, 2022

After last week\'s stronger-than-expected CPI, less surprising was the 75 point rate increase put forth by the Fed.