Rock Solid Labor Market Keeps the Fed in a Hard Place

The month of May is off to a roaring start this week. On Monday, Treasury Secretary Janet Yellen warned that debt ceiling constraints could cause the U.S. Treasury to no longer be able to meet all of its obligations by early June. For further analysis on the debt ceiling issue, please see the Topic of the Week. The Federal Reserve's battle against inflation amid new banking sector volatility was another focus of attention. As widely expected, the FOMC raised the federal funds target range by 25 bps on Wednesday. The main takeaway, however, was that the hike could be the last of this tightening cycle. More detail on the outcome of the May 3rd FOMC meeting can be found in the Interest Rate Watch section below.

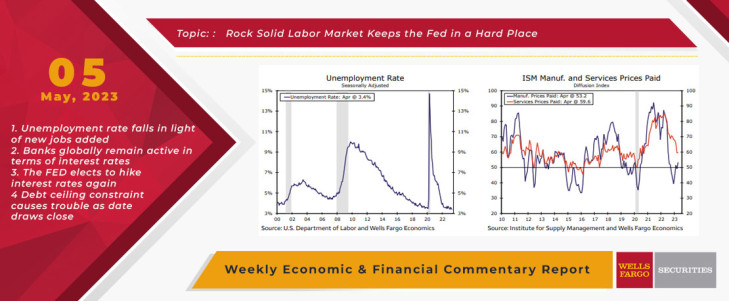

In addition to new fiscal and monetary policy guidance, a deluge of economic indicators were published this week. The state of the labor market was front and center. Employers added 253K jobs during April, easily besting the market consensus. Downward revisions to payroll gains in February and March spoiled some of April's upside surprise. That said, employers still added an average 285K net new jobs in the first four months of 2023, which reflects a more moderate but still-solid pace of hiring. The household survey also provided further evidence of a resilient labor market. Notably, the unemployment rate fell to 3.4% during the month, matching a 53-year low. After rising in each of the past four months, the labor force participation rate was essentially unchanged in April. Wage growth came in on the high-side, with average hourly earnings rising 0.5% during the month. While eyecatching, average hourly earnings growth now appears to be more in-line with other wage measures such as the Atlanta Fed Wage Tracker and the Employment Cost Index, both of which are still show a fairly strong pace of wage growth.

While the labor market appears to be rock solid at present, we still expect some cracks to form in coming months. Demand for labor clearly is cooling. While job openings remain elevated compared to pre-pandemic norms, the count of vacancies continues to trend lower and fell to 9.6 million in March, the lowest level since April 2021. So far in 2023, jobless claims have shifted slightly higher from the relatively low levels averaged last year, indicating an increased pace of layoffs. Most recently, initial claims rose to 242K in the last week of April.

The resiliency of the labor market illustrates one of the major challenges facing the Federal Reserve. Inflation has moderated, but still remains well above the Fed's 2% target. Price pressures easing without a material deterioration in job growth is an encouraging sign that the labor market is moving back into balance. That said, the path back to 2% inflation still looks like it will be a gradual process. Weak productivity growth is just one potential hurdle. Nonfarm labor productivity fell at a 2.7% annualized rate in Q1-2023, a quarterly decline that amounts to a 0.9% yearly drop. Unit labor costs picked up to a 6.3% annualized pace during the quarter. The challenge with weak productivity growth is that it could keep the pressure on labor costs, which now appear to be a driving force behind elevated service sector inflation.

One reason why service sector prices have yet to follow the same trajectory as goods prices is that demand for services has remained relatively buoyant. The ISM services index edged further into expansion territory in April, rising to 51.9 during the month. The slight improvement in the headline masked differences between current and future activity. The business activity index fell sharply during April, while the forward-looking new orders component rose markedly. Furthermore, underlying inflation pressures in the service sector have yet to fully die down, with the prices paid index inching higher during April. A similar trend was evident in the ISM manufacturing index for April. The headline manufacturing index rose to 47.1 in April, a slight gain which reflects a modest improvement in factory sector activity. The prices paid component, however, jumped up by four points and rose for the third time in four months. The upturn in prices paid suggests a growing share of surveyed producers are experiencing higher input prices.

Another potential test for the Fed will be navigating structural shifts in the economy which could prove unflinching to higher interest rates or cyclical fluctuations. Construction spending rose 0.3% during March. The monthly gain in total spending was driven almost entirely by another uptick in the nonresidential category. Manufacturing projects have been a significant driver of nonresidential outlays recently, and momentum does not appear to be slowing. During March, manufacturing outlays were over 62% above the pace registered in the same month last year. The remarkable rise largely reflects the build-out of electric vehicle production supply chains as well as new semiconductor manufacturing facilities. These structural shifts are likely to support activity as macroeconomic uncertainty, higher financing costs and tighter lending standards weigh on overall construction moving forward.

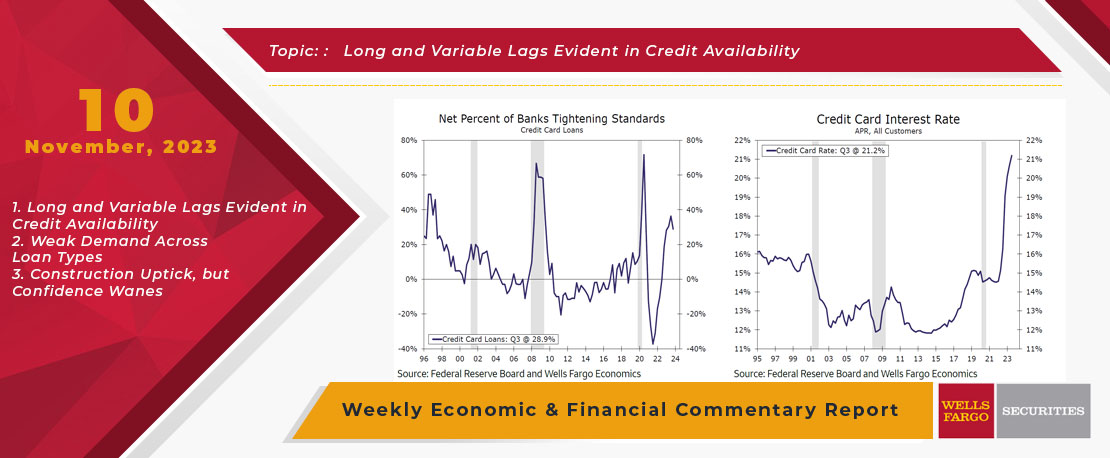

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

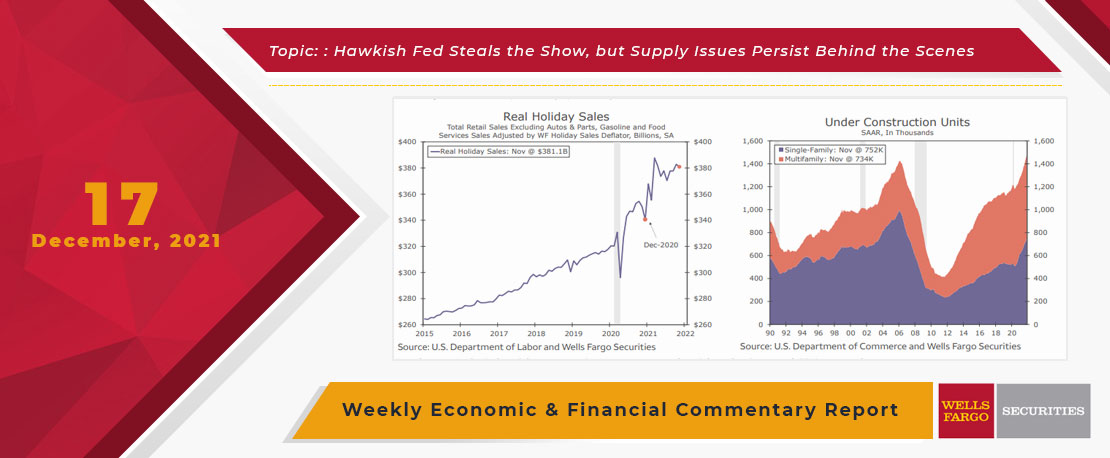

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

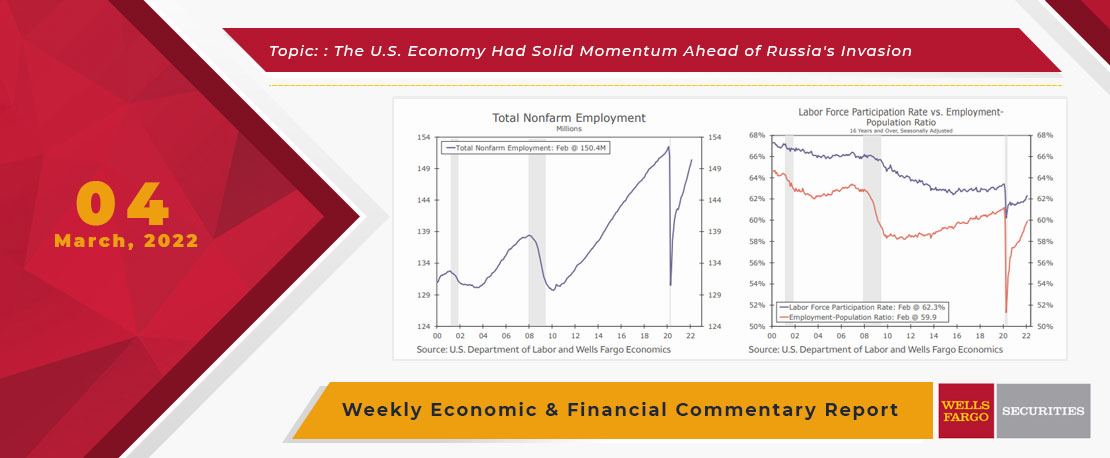

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

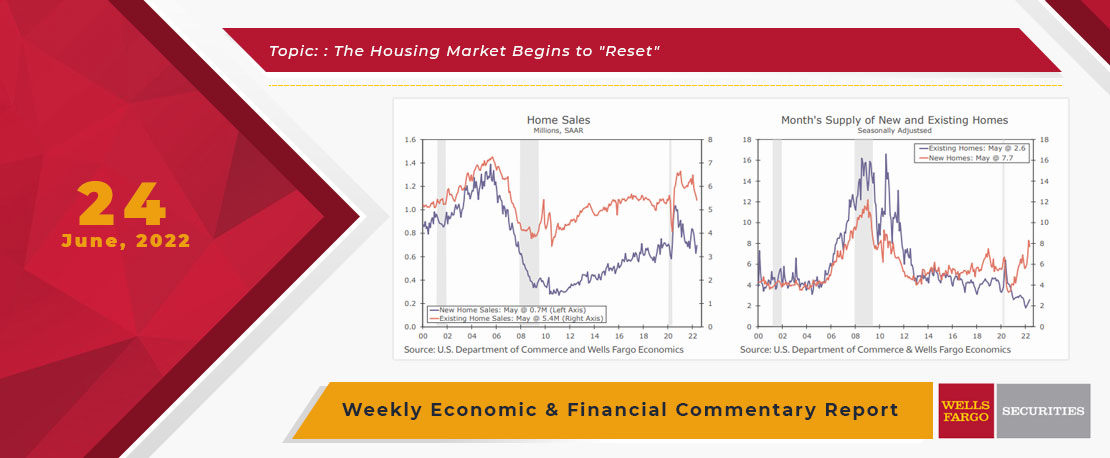

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

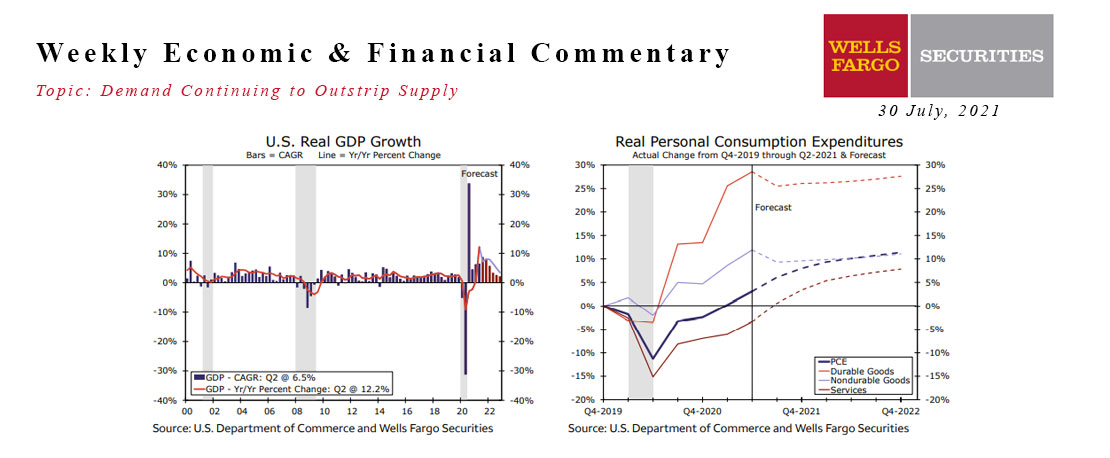

This Week's State Of The Economy - What Is Ahead? - 30 July 2021

Wells Fargo Economics & Financial Report / Aug 11, 2021

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

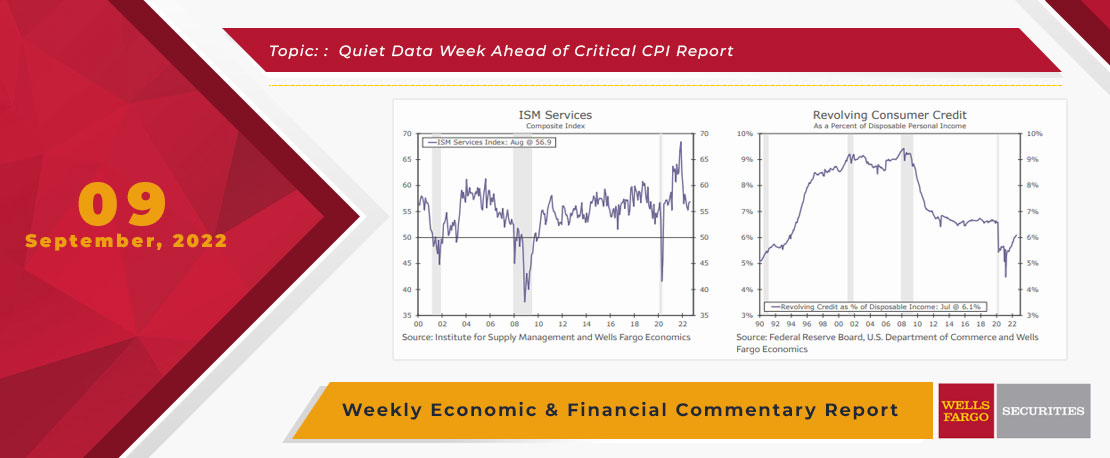

This Week's State Of The Economy - What Is Ahead? - 09 September 2022

Wells Fargo Economics & Financial Report / Sep 10, 2022

The ISM services index came in stronger than expected, and the underlying details pointed to service sector resilience with business activity and new orders notching their highest reading this year.

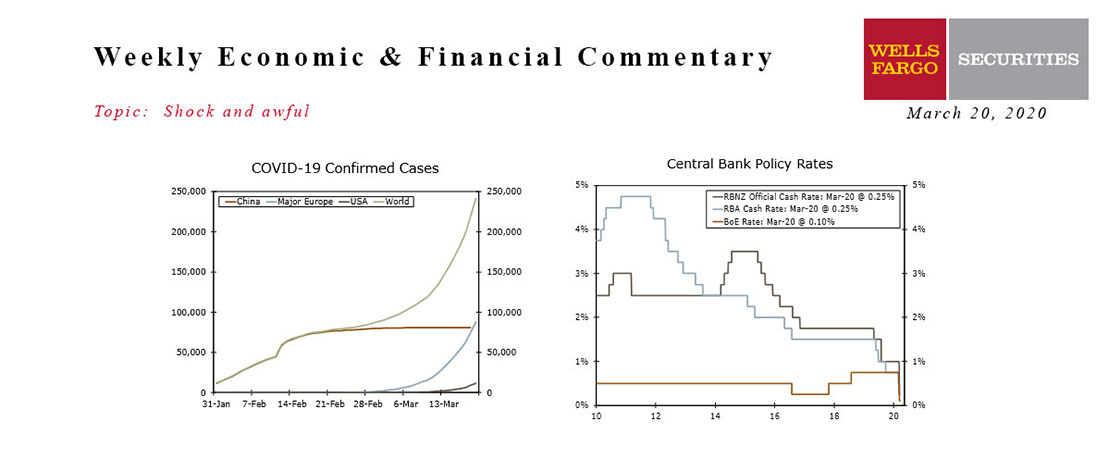

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.