It was relatively quiet on the economic front this week. The FOMC's blackout period is under way, so there was no communication from Federal Reserve officials ahead of next week's meeting and rate decision. Next week will also bring an onslaught of impactful economic data, including the Consumer Price Index (CPI), retail sales, consumer sentiment and industrial production. While the calendar was light, the data released throughout the week showed that, while downshifting, economic growth still looks to be on a positive trajectory.

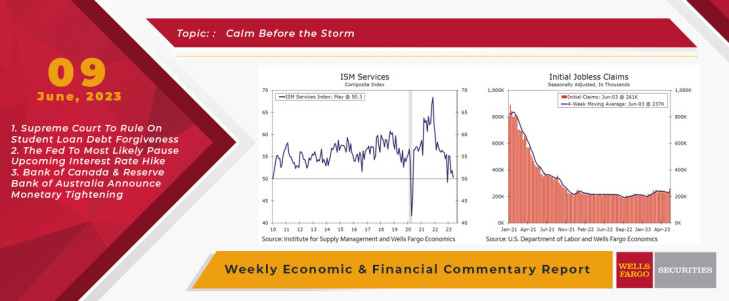

The service sector is one area that, while remaining afloat, is starting to tread water. The ISM services index declined for the fourth consecutive month in May. Despite the drop, the top-line index is still in expansion territory, although only barely. May's reading of 50.3 was the lowest since the index temporarily dipped below 50 in late 2022. Generally speaking, the service sector has been resilient to persistent inflation and higher interest rates thanks in large part to pent-up demand from the pandemic. However, the recent trend decline in the ISM services index suggests that the sector is running out of steam. The underlying details showed the extent activity is slowing. Aside from the inventory subcomponents, every major subindex moved lower in May. Notably, the backlog of orders fell almost nine points to the lowest reading since the financial crisis in 2009. The decline in the employment index was not quite as large, but the subindex fell to a contraction reading of 49.2 during May, which suggests hiring in the service sector is starting to falter.

The slip in the ISM services employment index arrived on the heels of last week's blowout nonfarm payrolls report, which revealed the U.S. economy added 339,000 net new jobs in May. The surprisingly strong gain is further evidence that, while moderating, the labor market appears to be in solid shape at present. That noted, a potential crack appeared this week. Initial jobless claims unexpectedly jumped to 261K during the week ending June 3. Claims are still relatively low, but rose to the highest level since October 2021. Considering the challenges that come along with seasonally adjusting high frequency data, any single week of data should be taken with a grain of salt. Still, the uptick in claims indicates that more firms may be reducing headcounts, which is another sign the labor market is easing up a bit. So far, the labor market has been surprisingly resilient to higher interest rates. On the other hand, the residential sector continues to serve as a reminder of how increased financing costs are weighing on the economy. After spiking to just over 7% last year, mortgage rates descended slightly and moved closer to 6% to start 2023. The modest dip in mortgage rates was enough to end the slide in housing activity seen over the course of last year, and home buying as well as new construction looks like it has been perking up slightly over the past few months. However, expectations for more restrictive monetary policy alongside stubborn inflation pressures have driven mortgage rates higher in recent weeks, with the average 30-year fixed mortgage rate reaching 6.8% in the week ending June 1. Higher borrowing costs now look to be hindering the nascent recovery in home buying. Mortgage applications for purchase dropped 1.4% during the week ending June 2, the fourth consecutive weekly decline. Mortgage applications are published weekly and thus also tend to be volatile, but the back-track in purchase applications means a full-fledged housing market recovery is still off in the distance.

Elsewhere, net exports are setting up to be a substantial drag on real GDP growth in the second quarter. The U.S. trade deficit widened by $14.0 billion to $74.6 billion in April, more than reversing the narrowing that occurred in March. Exports declined sharply during April, while imports rose only modestly. These data are consistent with our expectations for net exports to shave 1.4 percentage points off of top-line growth in Q2 GDP. Despite the drag from trade, the totality of the data this published this week lends credence to our estimates for a more moderate but still solid pace of real GDP growth in the second quarter of the year.

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

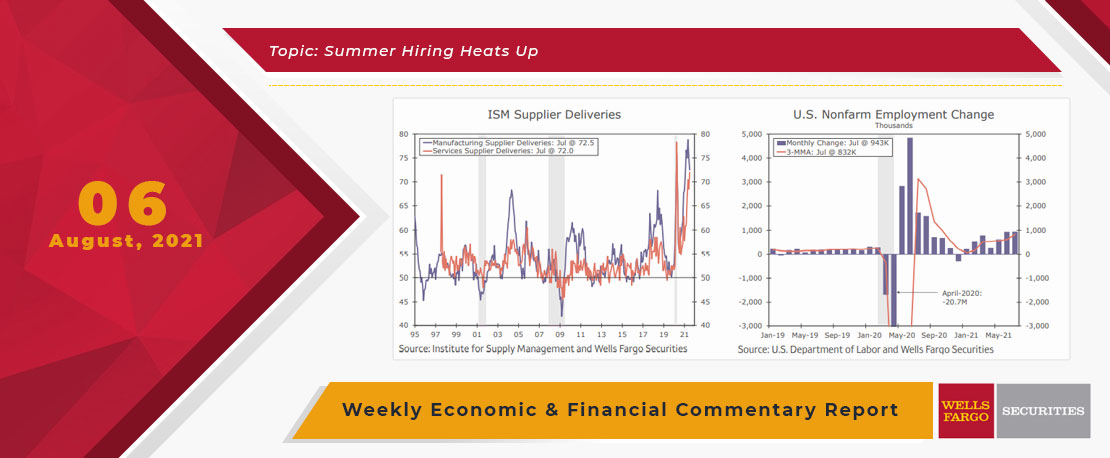

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

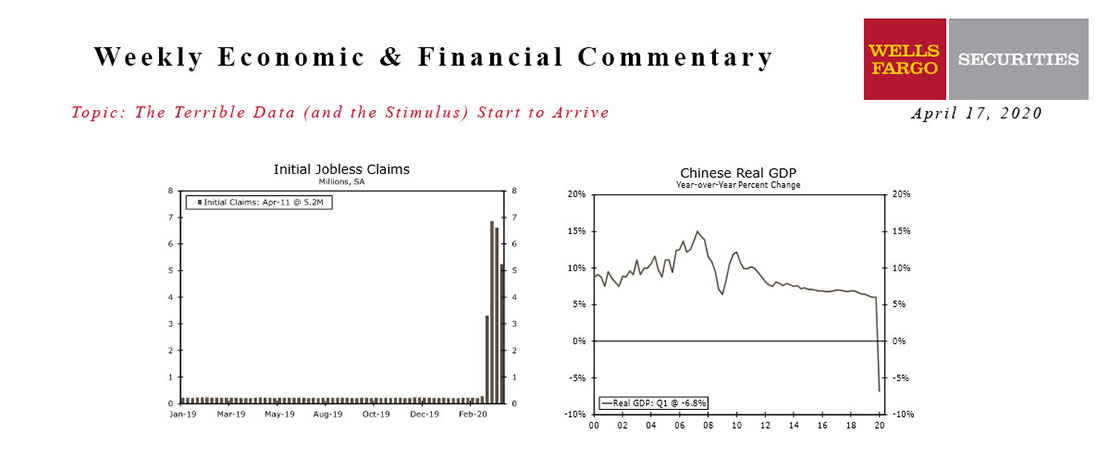

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

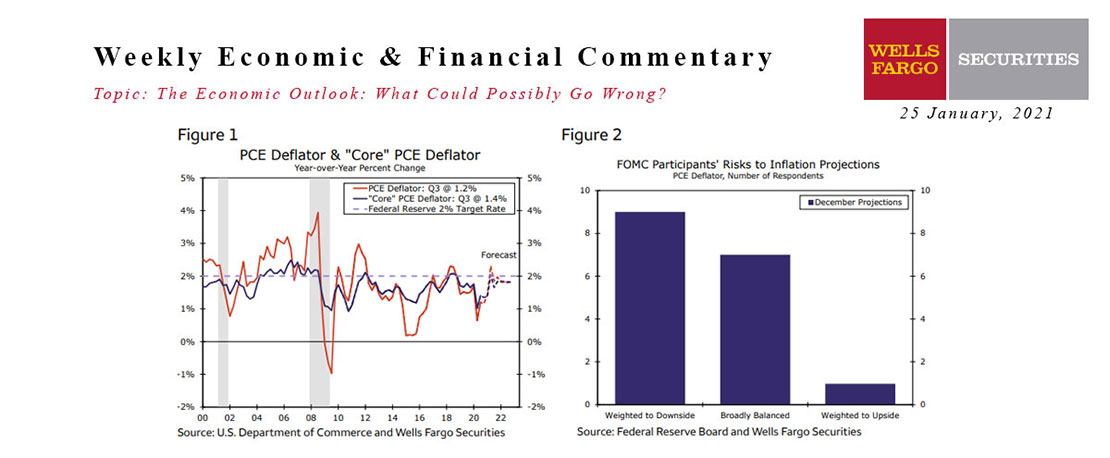

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

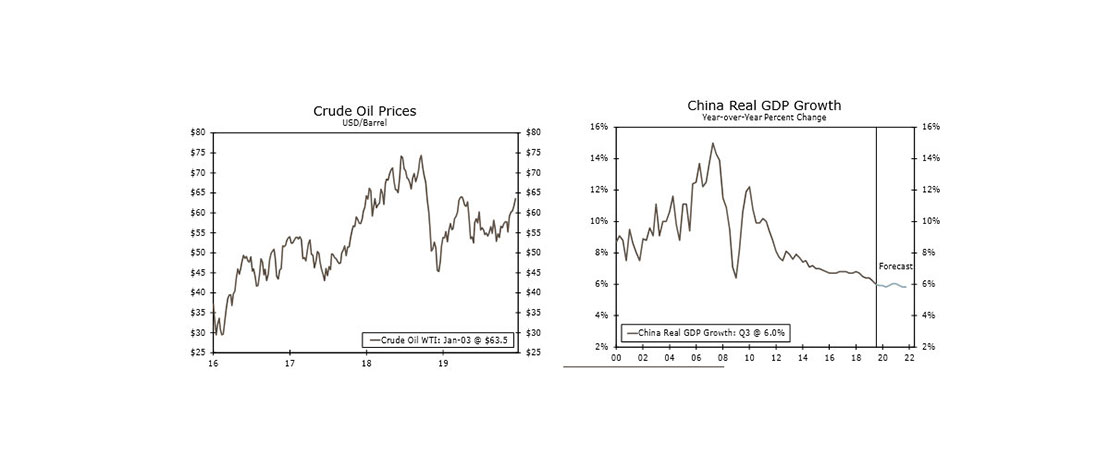

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

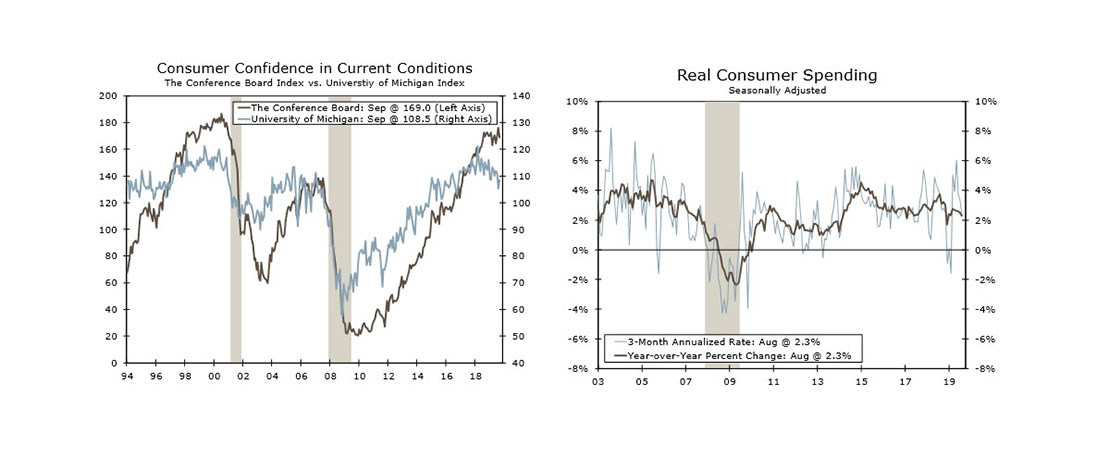

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

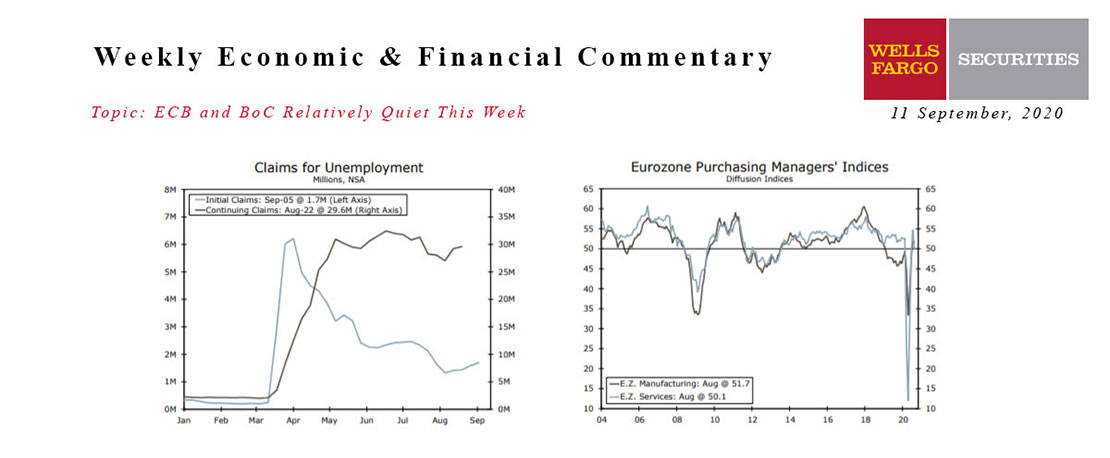

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

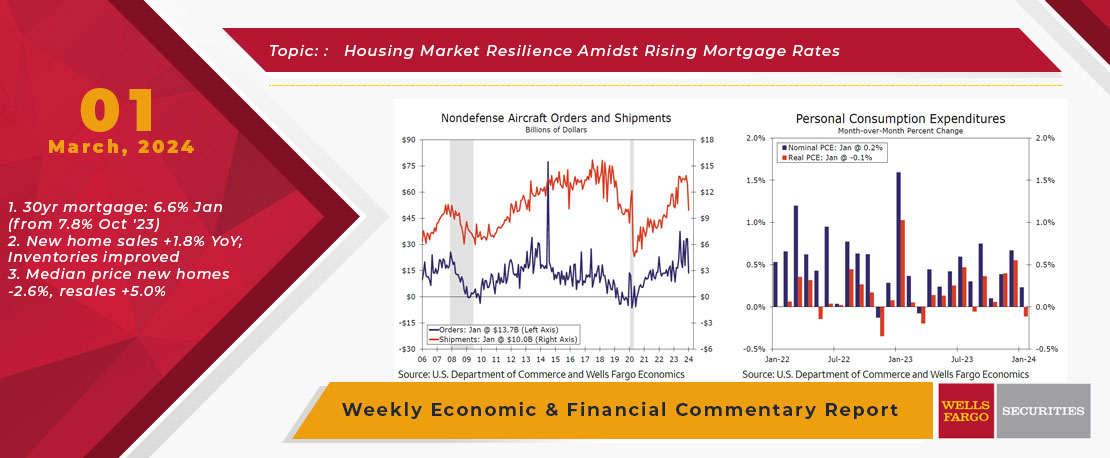

This Week's State Of The Economy - What Is Ahead? - 01 March 2024

Wells Fargo Economics & Financial Report / Mar 05, 2024

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. Despite the somewhat weak start to Q1, economic growth continues to trek along.

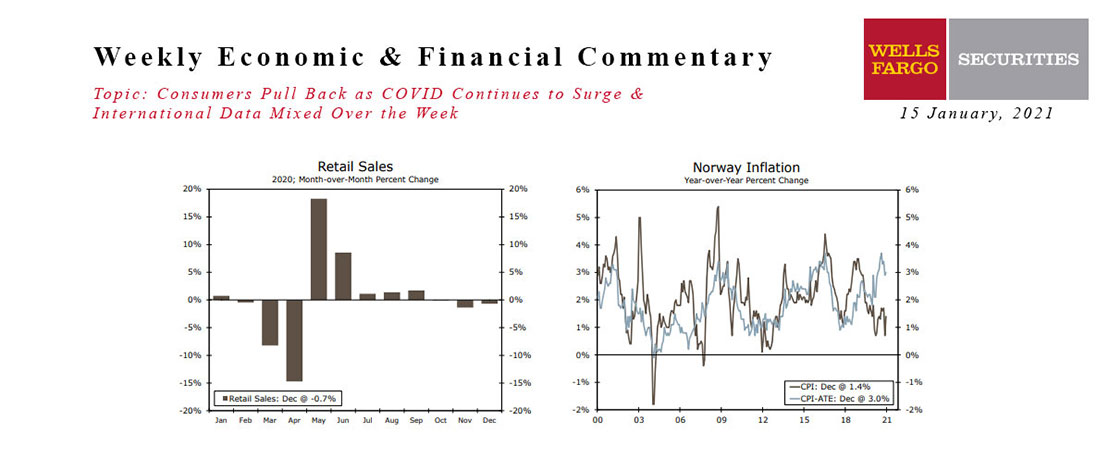

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.