Economic Growth Continues Despite Downbeat Data

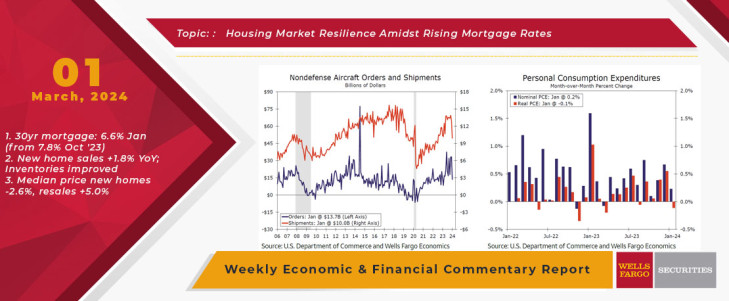

Economic data were downbeat this week, as downward revisions took some of the shine out of the marquee headline numbers. New home sales started the year off in the green, with the headline figure rising 1.5% in January. However, downward revisions to fourth quarter data take the shine out of the gain, as January’s 661K-unit sales pace was lower than December’s initially reported reading of 664K. The average 30-year mortgage rate moderated to 6.6% in January from its peak of 7.8% in late October 2023. Despite the high mortgage rate environment over this period, new home sales grew 1.8% on a year-over-year basis. High inventories have been supportive of sales growth in the market, and new home inventories improved for a sixth-straight month in January. Abundant supply has led price dynamics to remain favorable for buyers in the new home market compared to the existing home market. The median price for new homes is down 2.6% through January, while the median price for resales on the other hand have risen 5.0%. Although the new home market has been a bright spot, the larger size of the existing market in the U.S. and dearth of available supply continues to broadly constrain activity.

We also got some fresh manufacturing data this week. New orders for durable goods plunged 6.1% in January, though looking past the ever-volatile transportation sector, orders declined a more modest 0.3%. A precipitous 58.9% drop in nondefense aircraft orders were the primary driver of weakness in the headline figure, making for the largest one-month decline in the category since May 2020, when the pandemic had the airline industry in a state of panic. Core capital goods orders (nondefense ex-aircraft) eked out a 0.1% gain on the month, aided by strong orders for computers & related products as well as orders for electrical equipment, appliances & components, and signal some early signs of recovery in the underlying orders trend. Similarly, shipments of nondefense capital goods excluding aircraft were up a solid 0.8%, indicating a decent pace of underlying activity, though aircraft weakness will show up in Q1 equipment investment. Shipment trends are therefore less supportive of first quarter real equipment investment, while downward revisions to Q4-2023 equipment spending suggest a weaker outturn at the end of last year. Separately released Q4 GDP revisions brought equipment investment down to a -1.7% annualized rate from +1.0% in the advance reading.

Elsewhere, consumer confidence wavered in February; the index declined to 106.7 from 110.9 in January, surprising widespread forecaster expectations for an increase. Equity values rose to start the year, and a strong stock market is typically supportive of consumer confidence. Yet, consumers have looked past their portfolios in February, and their attention has shifted to the labor market, where they are becoming less optimistic. The labor market differential, of those viewing jobs as “plentiful” less those viewing jobs are “hard to get,” declined to 27.8% from 31.7% in January. As inflation has slowed over the past year, consumers are increasingly becoming more sensitive to perceived weakness in the jobs market, with income again the primary source of their spending. Indeed, deteriorating consumer perceptions of the labor market could spell trouble for an already slowing pace of consumer spending.

Crummy confidence weighed on consumer spending in January as real personal spending fell for the first time in five months. Even as nominal spending rising 0.2% on the month, the largest monthly increase in the PCE deflator since September (0.3%) brought real personal spending down 0.1%. The core PCE deflator rose 0.4% in January and now sits at 2.8% year-over-year. Inflation continues to be a challenge, and price gains have given households less flexibility in their spending patterns. The balance in consumer spending priorities is again shifting, and consumers’ year-over-year rate of discretionary spending growth fell to 0.8%, or the slowest pace of annual growth since early 2023. Non-discretionary outlays have grown 3.1% over the past year, and they are now again outpacing discretionary outlays.

Perhaps one of the most eye-catching data points this week was the 1.0% pop in January personal income. Growth in wages, rental income and receipts on assets all contributed heartily to the gain, but some of the strength can be chalked up to adjustments for income components, such as the Social Security cost-of-living adjustment (COLA). The COLA increased Social Security income by 3.5% in January, accounting for 20% of the monthly gain by itself despite only comprising about 6% of total income. Yet even with these strong nominal income gains, real disposable income came in flat on the month due to the previously mentioned large increase in the PCE deflator, as well as some accounting methodology of the BEA leading to an increase in taxes paid. Rising prices have continued to dent household purchasing power, and the last mile on the Fed’s inflation front is still a crucially important one for the health of household balance sheets and for the economy more broadly. For a deeper look at prices and “super core” PCE inflation, please see Topic of the Week.

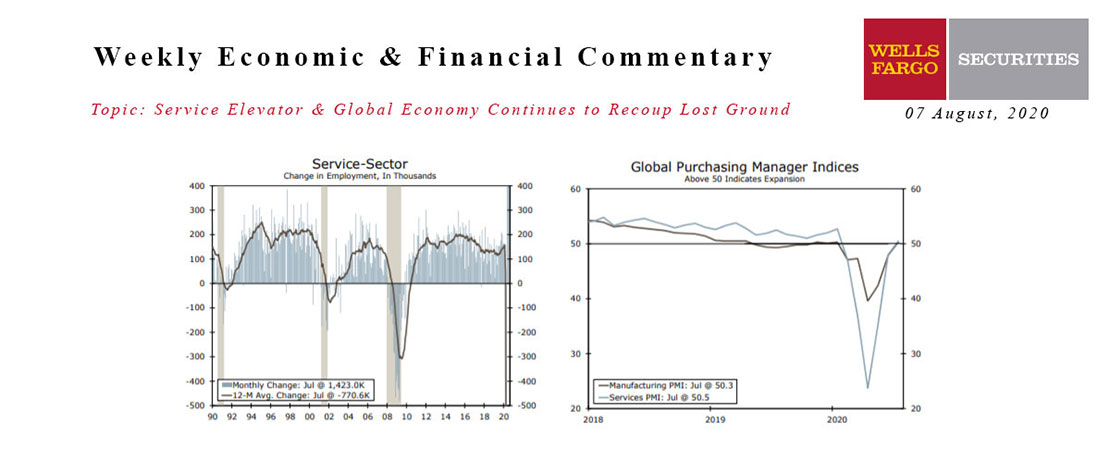

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

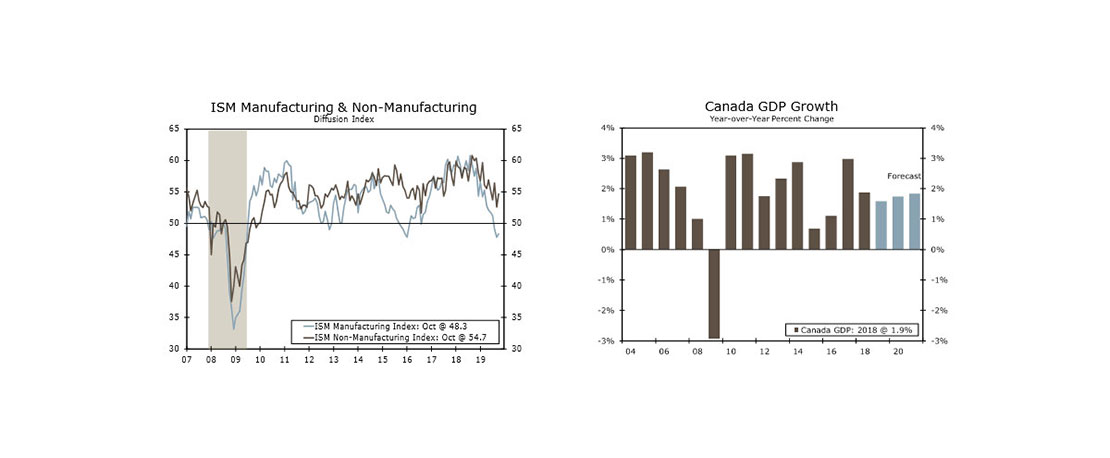

There were more signs of global recovery this week and PMI surveys improved further across the world.

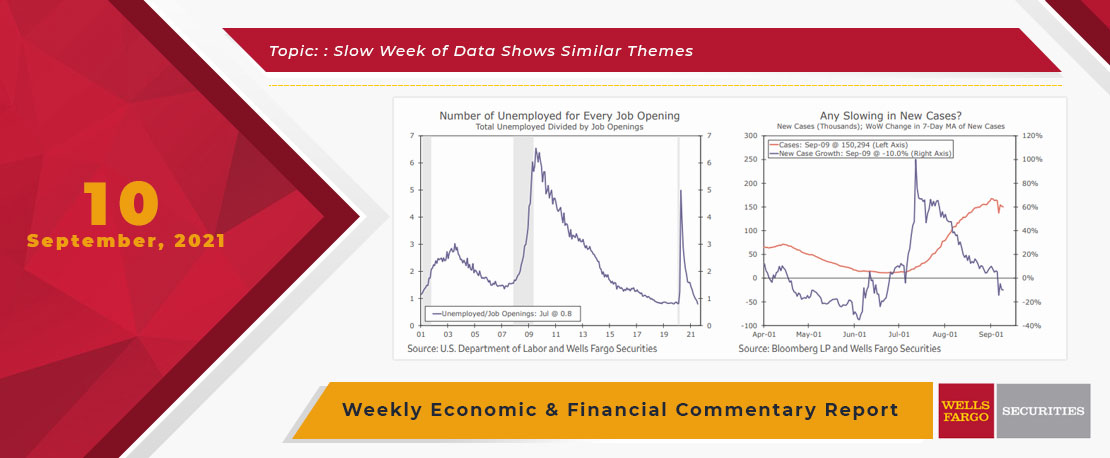

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

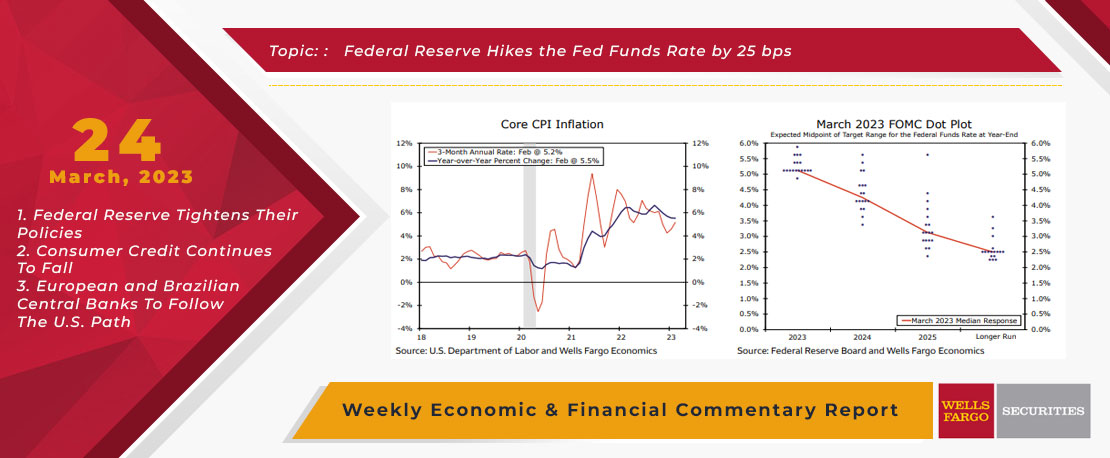

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

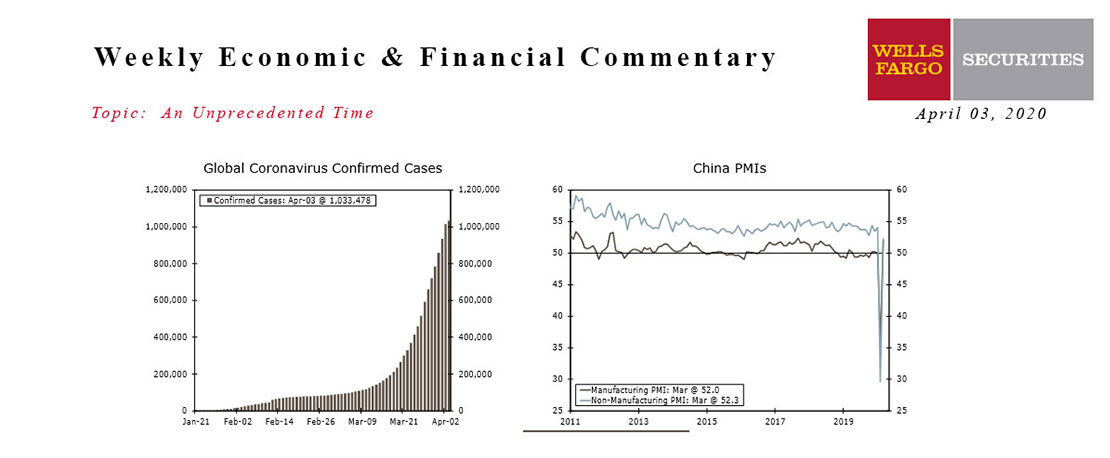

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

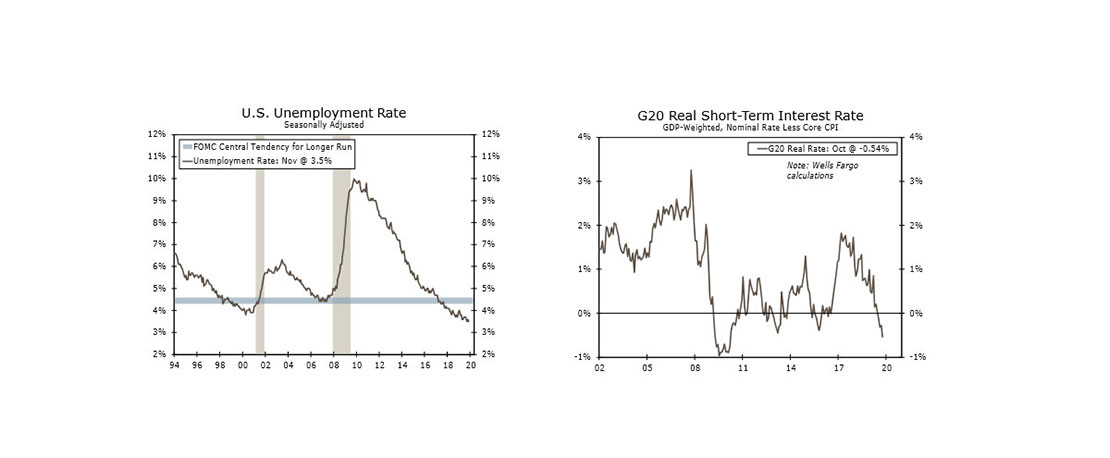

This Week's State Of The Economy - What Is Ahead? - 06 December 2019

Wells Fargo Economics & Financial Report / Dec 07, 2019

The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty.

This Week's State Of The Economy - What Is Ahead? - 08 November 2019

Wells Fargo Economics & Financial Report / Nov 09, 2019

Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

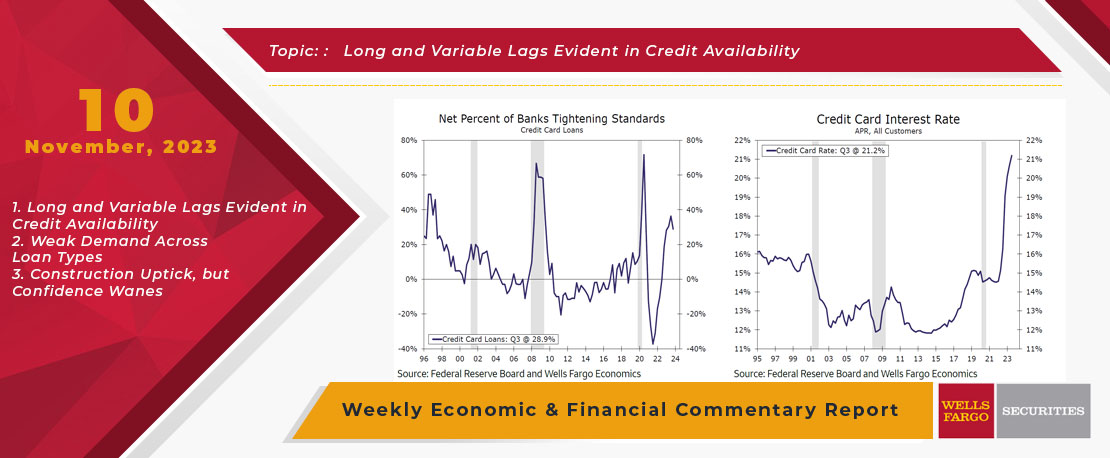

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

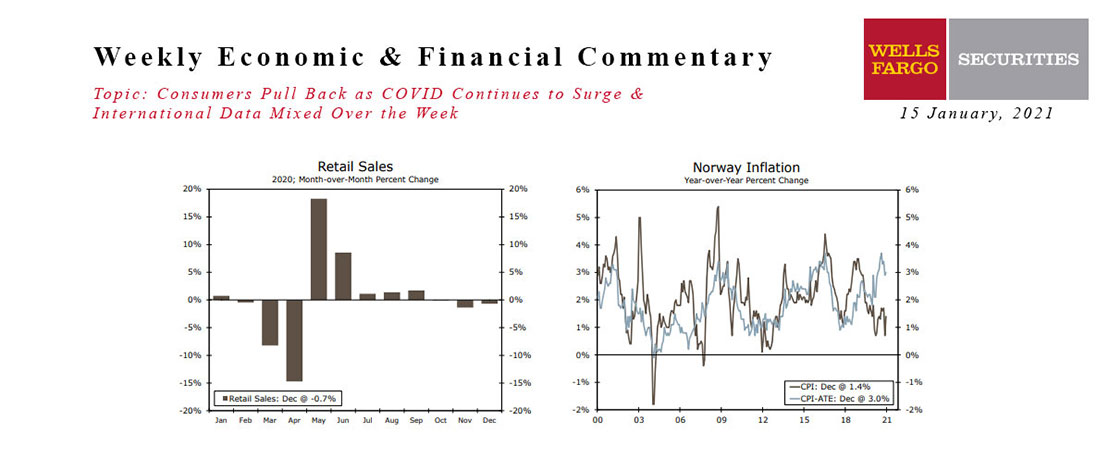

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

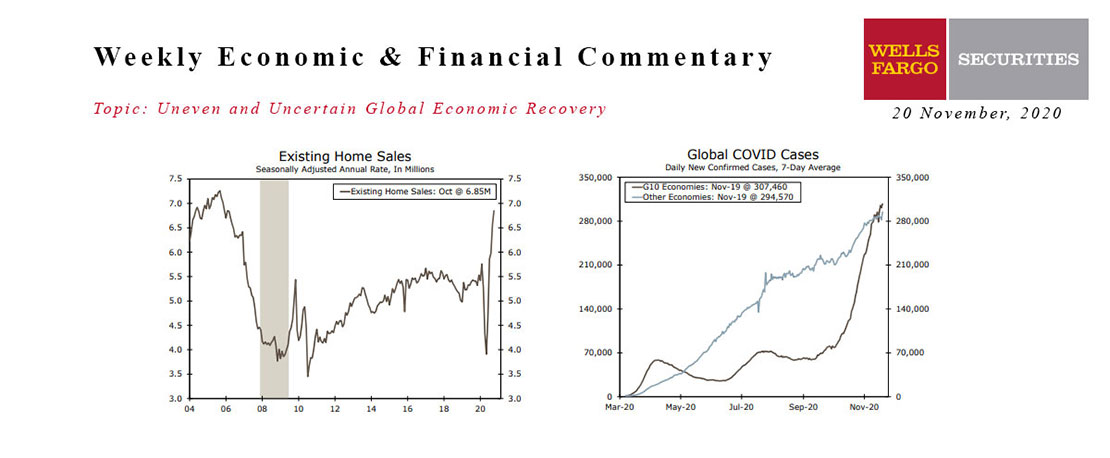

This Week's State Of The Economy - What Is Ahead? - 20 November 2020

Wells Fargo Economics & Financial Report / Nov 24, 2020

The international economic news over the past week has been somewhat mixed. On the positive side, China’s October data showed ongoing growth in manufacturing and firming retail and service sector activity.