U.S. - House Party

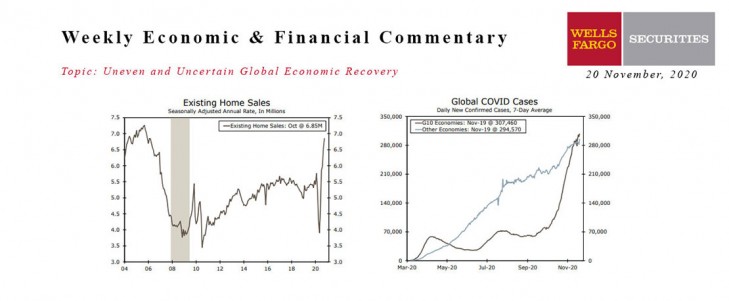

- Soaring confidence among homebuilders, a pace of residential construction activity that topped expectations and existing homes selling at the fastest pace in 14 years were the highlights of a week in which housing data dominated the economic news.

- The consumer rebound has been another strong part of the economic recovery, although retail sales figures released this week showed that spending was losing momentum in October, even as holiday sales remain on track for a banner year.

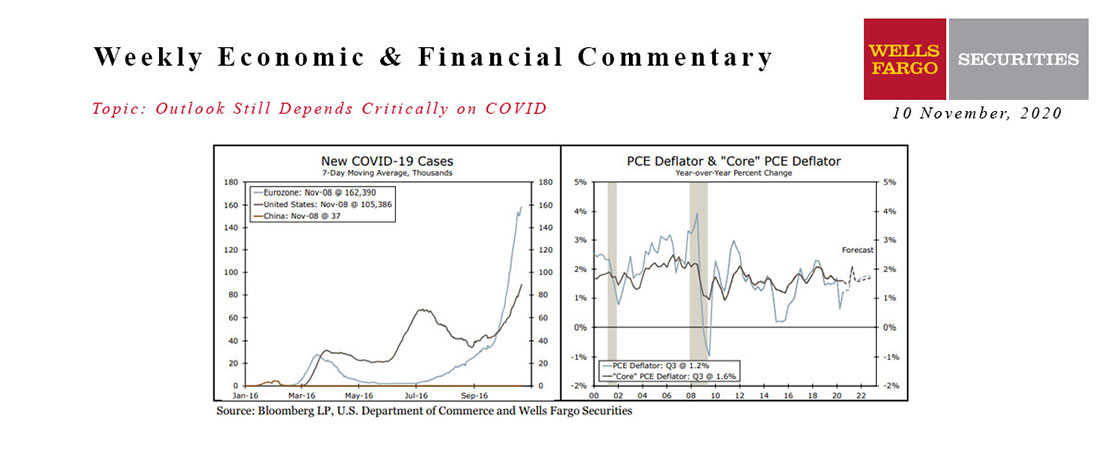

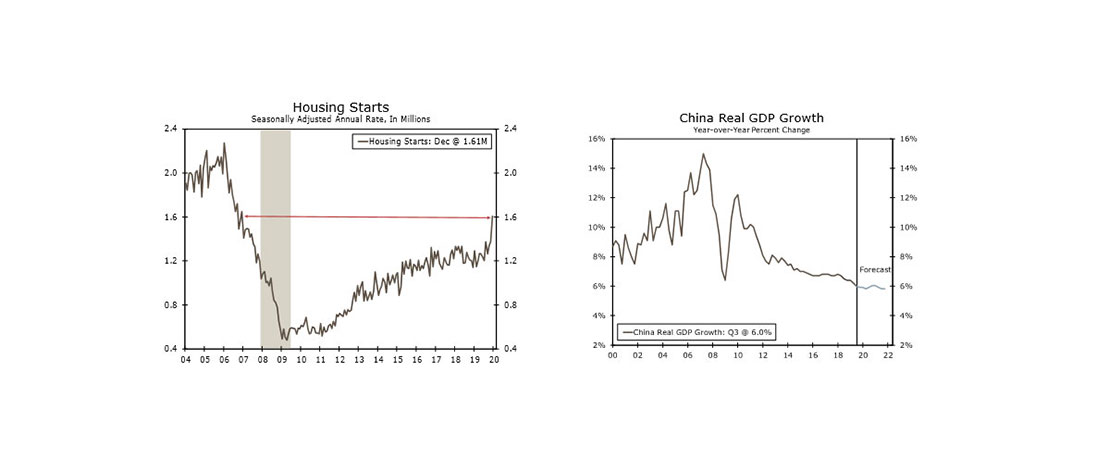

Global - Uneven and Uncertain Global Economic Recovery

- The international economic news over the past week has been somewhat mixed. On the positive side, China’s October data showed ongoing growth in manufacturing and firming retail and service sector activity. While Chinese growth is supporting the Asian region, last week did see central banks in Indonesia and the Philippines ease monetary policy further.

- The global growth outlook, especially over the interim period ahead, remains uncertain given the renewed spread of COVID cases among developed economies in particular. Growth is slowing across Europe, and next week’s Eurozone November PMIs could perhaps signal negative GDP growth in Q4.

This Week's State Of The Economy - What Is Ahead? - 14 October 2020

Wells Fargo Economics & Financial Report / Oct 14, 2020

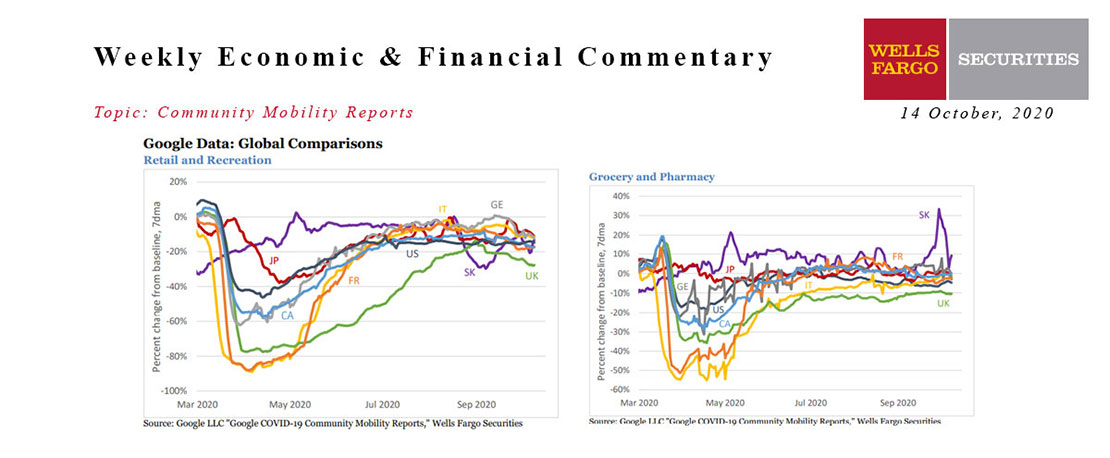

The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline.

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

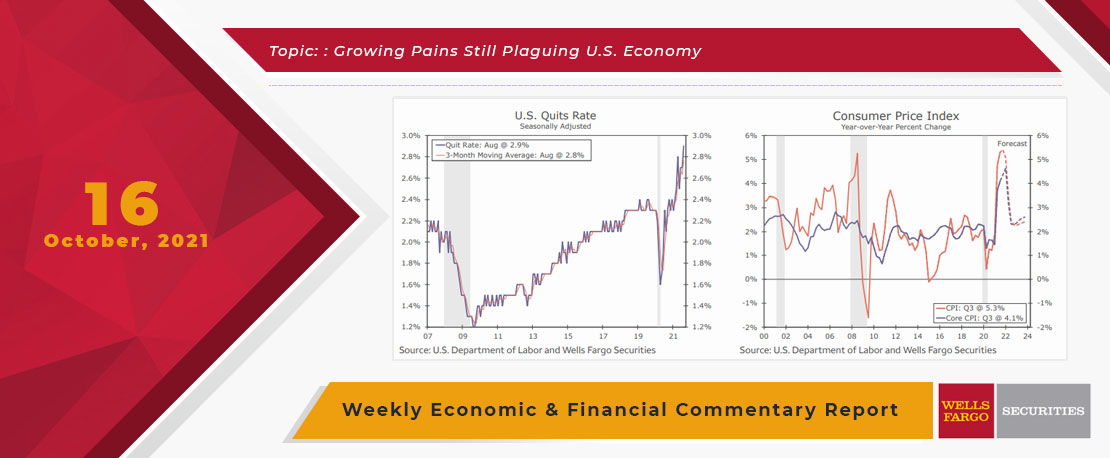

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.

This Week's State Of The Economy - What Is Ahead? - 31 January 2020

Wells Fargo Economics & Financial Report / Feb 01, 2020

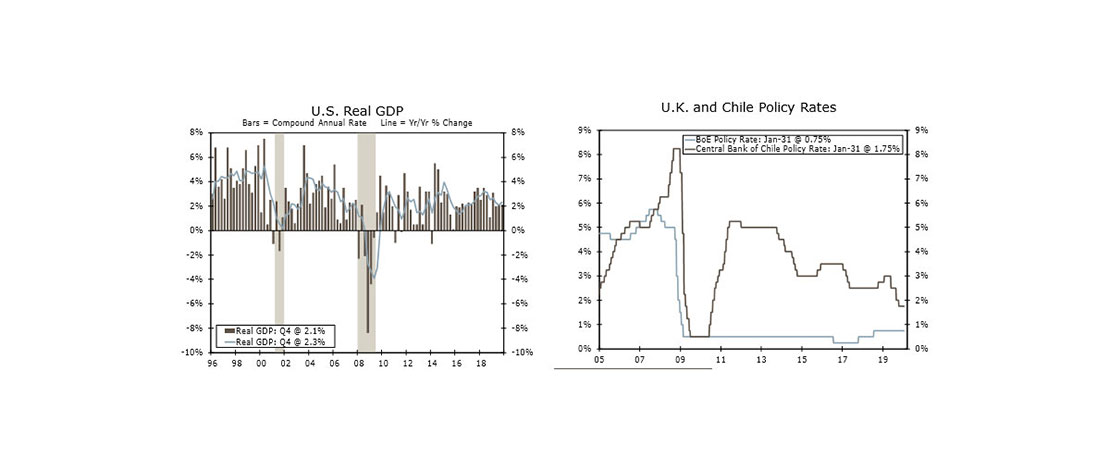

Mexico’s economy has slowed notably over the last year, with the economy contracting again in Q4, indicating a full-year contraction for 2019.

This Week's State Of The Economy - What Is Ahead? - 10 November 2020

Wells Fargo Economics & Financial Report / Nov 17, 2020

The U.S. election has come and gone, but we have not made any meaningful changes to our economic outlook, which continues to look for further expansion in the U.S. economy in coming quarters.

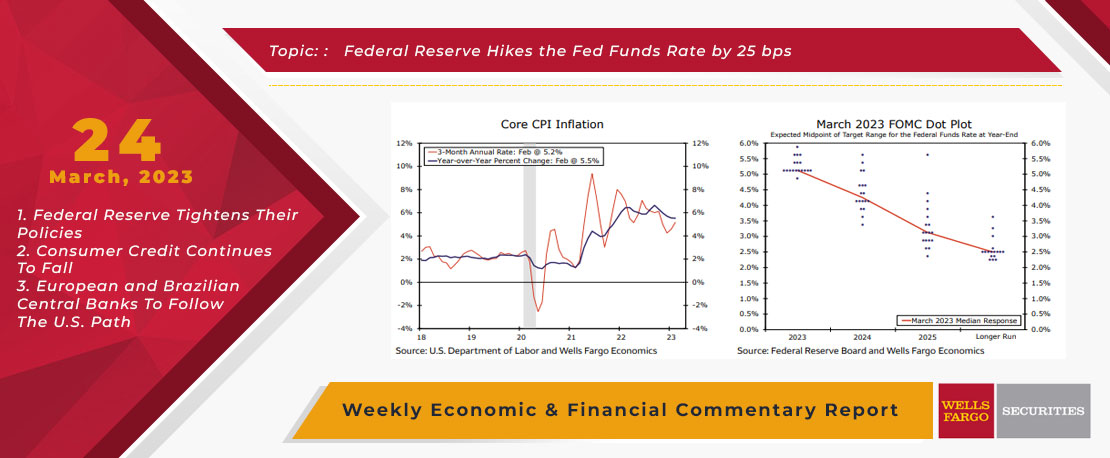

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

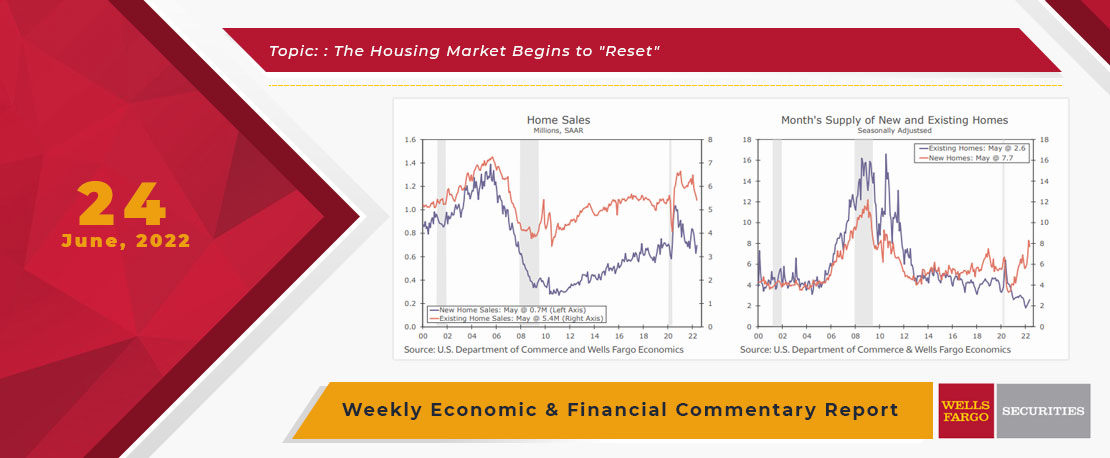

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

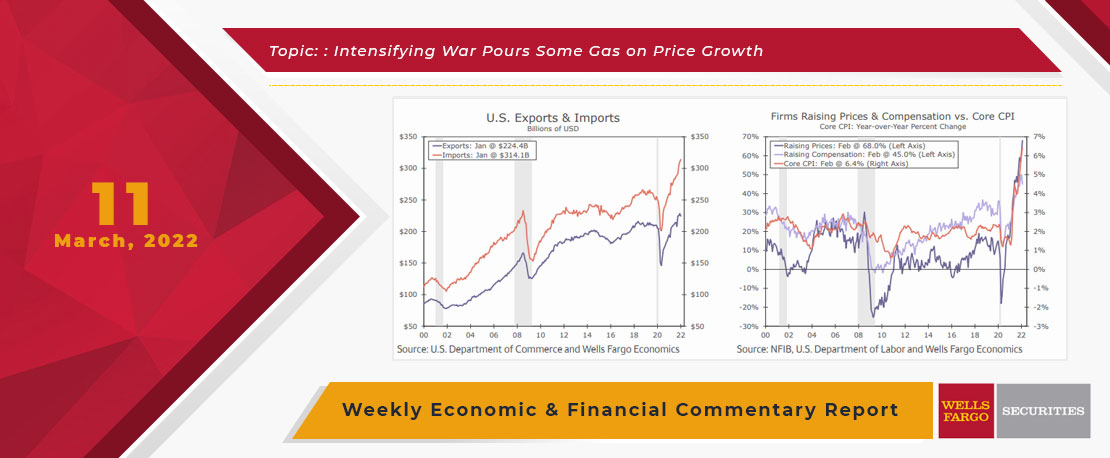

This Week's State Of The Economy - What Is Ahead? - 11 March 2022

Wells Fargo Economics & Financial Report / Mar 16, 2022

Russia\'s invasion of Ukraine continues to consume nearly all media attention and has created a level of volatility that is not yet reflected in the data released this week.

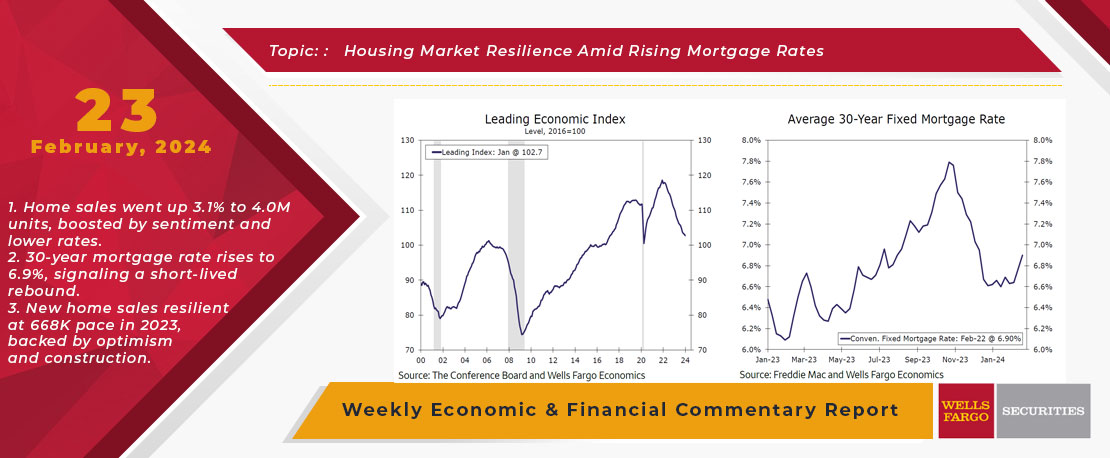

This Week's State Of The Economy - What Is Ahead? - 23 February 2024

Wells Fargo Economics & Financial Report / Feb 27, 2024

Stronger-than-expected inflation, underpinned by the mildly hawkish minutes from the January FOMC meeting, drove a move higher in mortgage rates.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

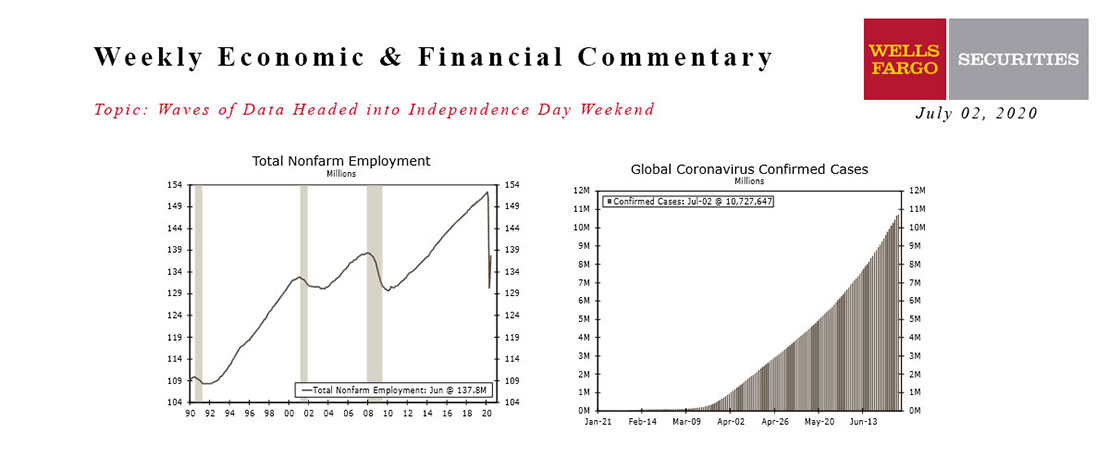

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.