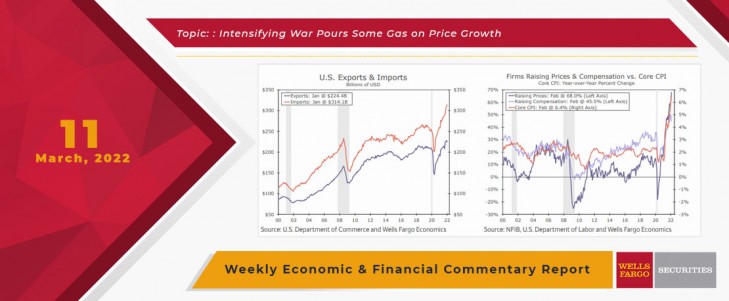

Russia's invasion of Ukraine continues to consume nearly all media attention and has created a level of volatility that is not yet reflected in the data released this week, which was mostly collected from that time long ago before the Russian invasion of Ukraine. Some data points that still seem relevant are the U.S. trade deficit, which widened to a record $89.7B in January, while job openings remained elevated and consumer prices continued their string of white-hot gains in February. My “commodity of the day” today is Nickel. Check it out on p. 11. It was $27,582/metric ton just last Friday and $48,241/metric ton today. Wow.

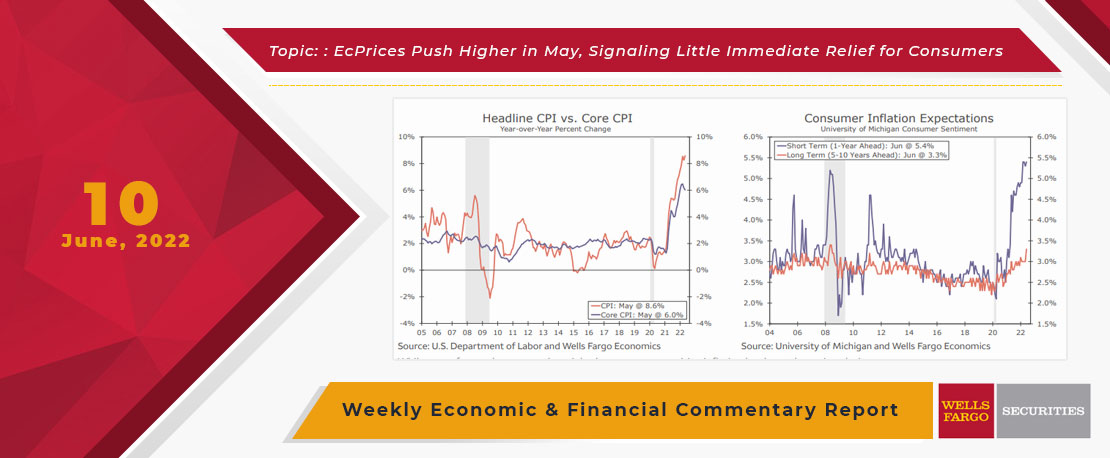

This Week's State Of The Economy - What Is Ahead? - 10 June 2022

Wells Fargo Economics & Financial Report / Jun 13, 2022

CPI increases continue to sizzle like this weekend’s temperature, putting consumers in a worse mood than Texas Rangers fans (with their 9.5 games back $500 million middle infield).

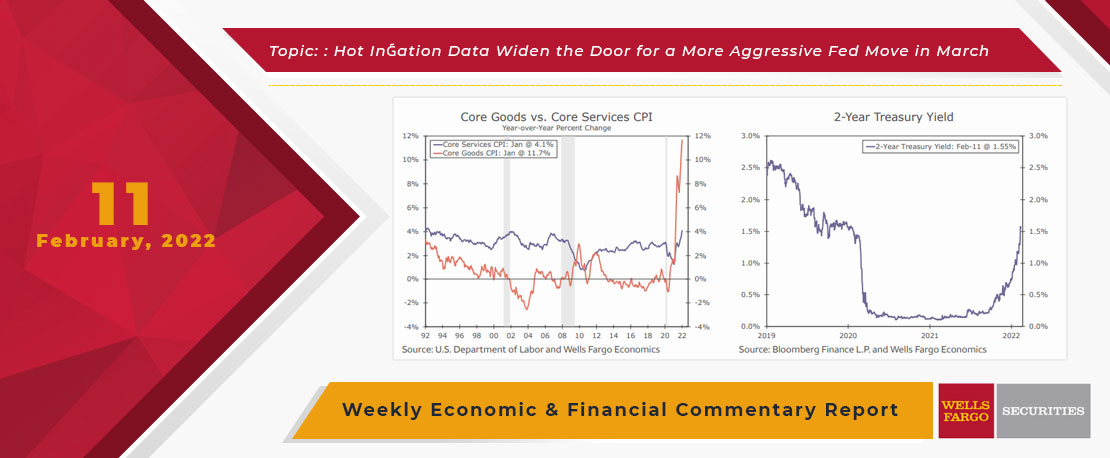

This Week's State Of The Economy - What Is Ahead? - 11 February 2022

Wells Fargo Economics & Financial Report / Feb 14, 2022

Deep thought for the week, if a tree falls in the forest, or an Olympics occurs, and no one is there to hear it or see it, did it really occur?

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

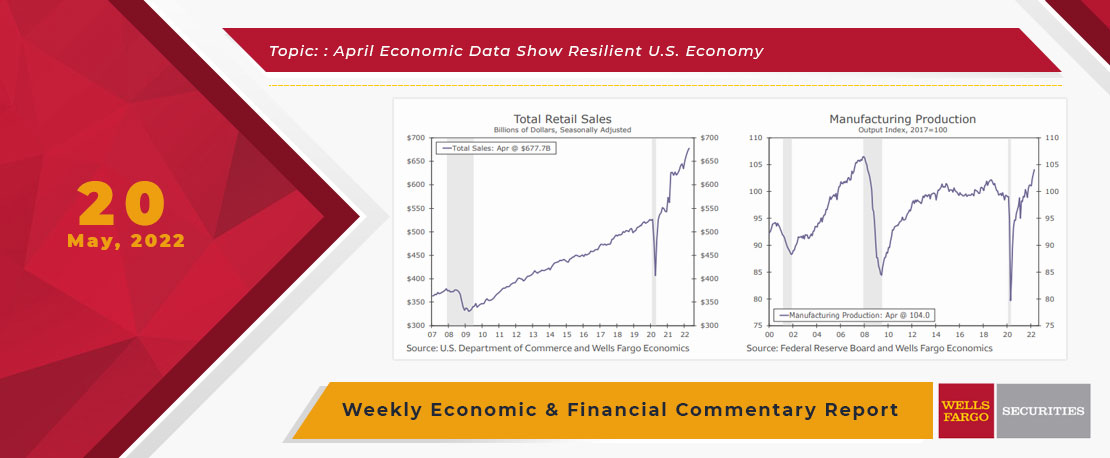

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

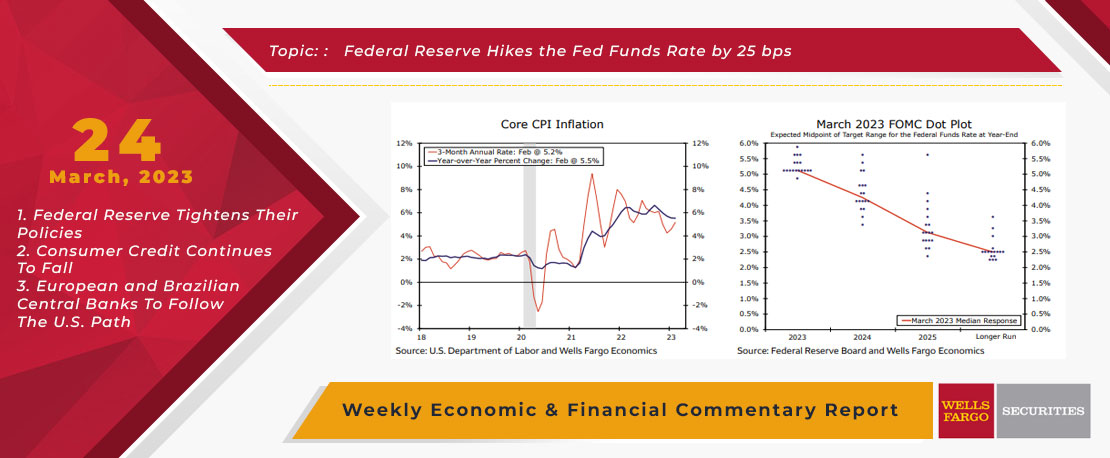

This Week's State Of The Economy - What Is Ahead? - 24 March 2023

Wells Fargo Economics & Financial Report / Mar 29, 2023

The FOMC hiked the federal funds rate by 25 bps on Wednesday amid continued strength in the labor market and elevated inflation.

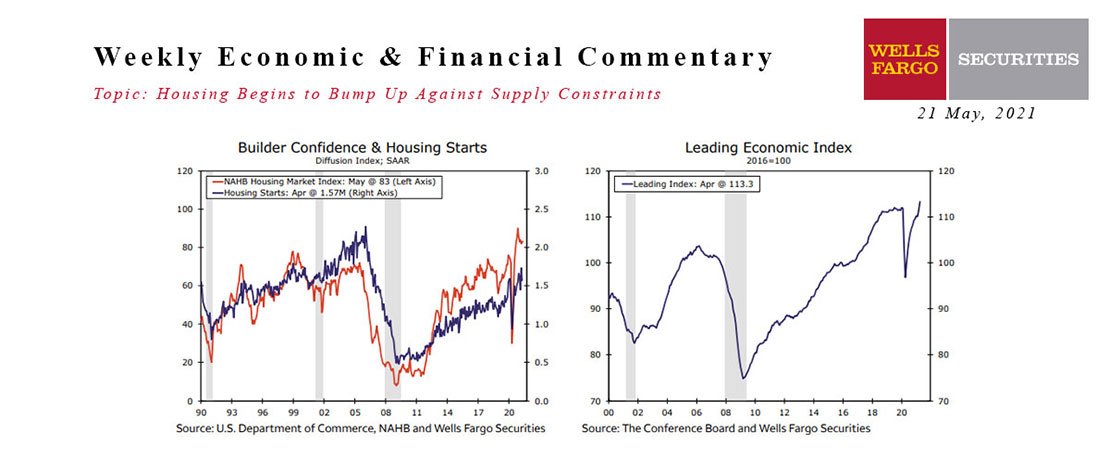

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

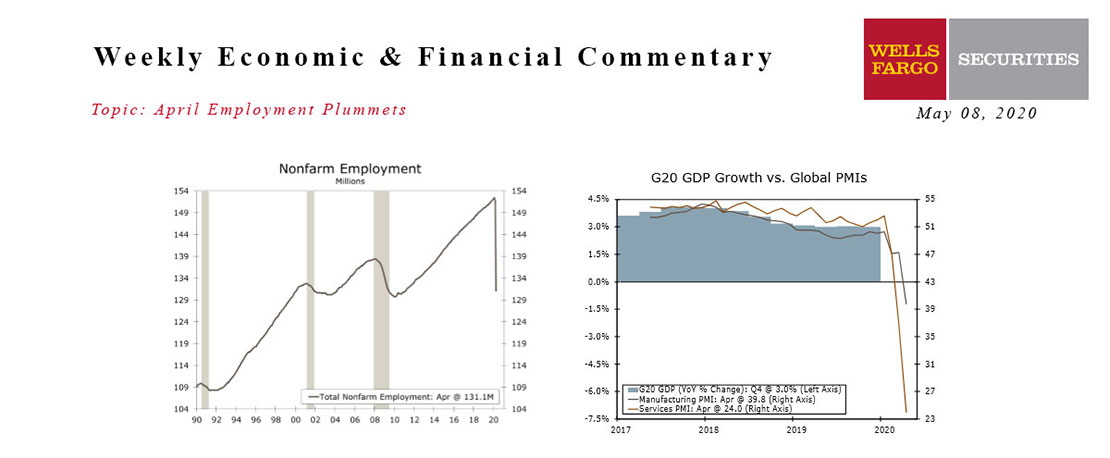

This Week's State Of The Economy - What Is Ahead? - 08 May 2020

Wells Fargo Economics & Financial Report / May 15, 2020

April nonfarm payrolls confirmed what we already knew—the labor market is collapsing. By the survey week of April 12, net employment had fallen by 20,500,000 jobs.

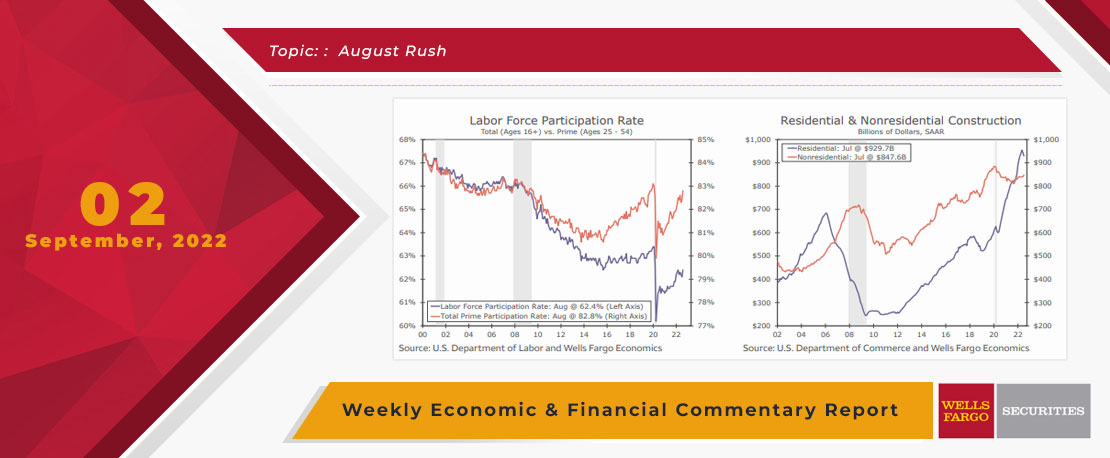

This Week's State Of The Economy - What Is Ahead? - 02 September 2022

Wells Fargo Economics & Financial Report / Sep 05, 2022

More job seekers also lifted the participation rate to 62.4% and thus easing some tightness in the job market even as payrolls expanded.

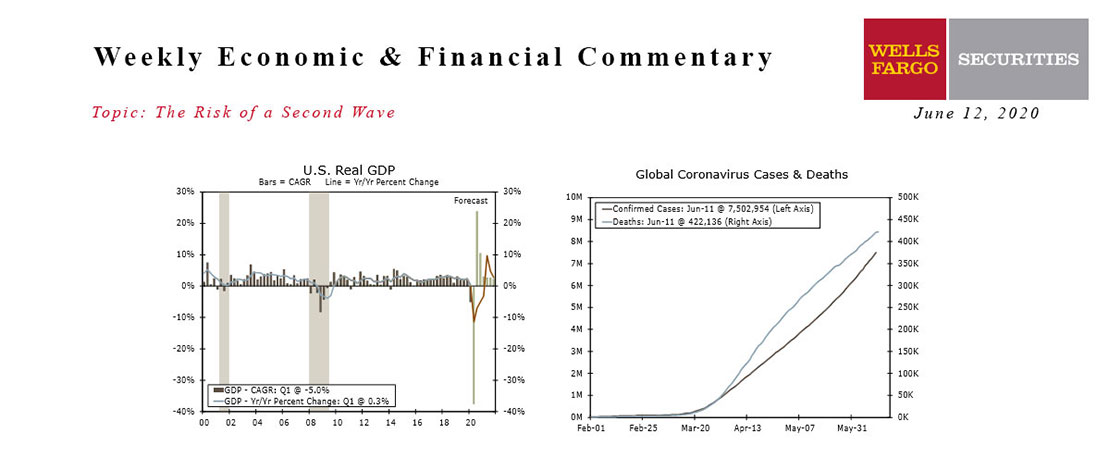

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.