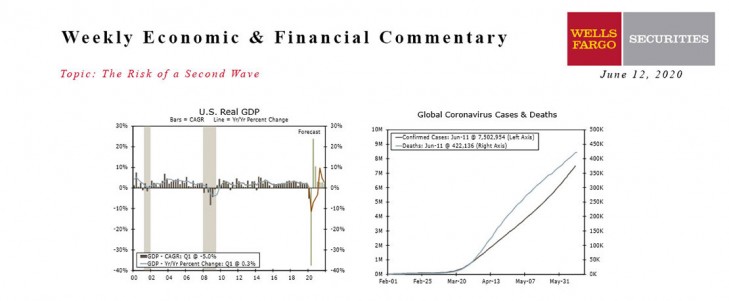

U.S. - The Risk of a Second Wave

- Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

- Re-opening the economy without a vaccine always entailed the risk of a second wave, which is the largest risk to a steady economic recovery.

- While we are monitoring this serious risk, we continue to expect the gradual re-opening of the economy to result in a measured rebound in activity.

Global - COVID-19 Curve Flattening, but Not Everywhere

- This week, activity and sentiment data flow were relatively thin, with COVID-19 still dominating headlines and influencing the path of financial assets. Cases at the global level continue to rise, albeit at a slower pace, while Latin American countries have been unable to flatten the curve.

- In that context, concerns over a second wave of infections weighed on financial markets and risk assets, in particular equities and foreign currencies. Emerging currencies sold off sharply toward the end of the week, while international equities relinquished some of the gains of the past month or so.

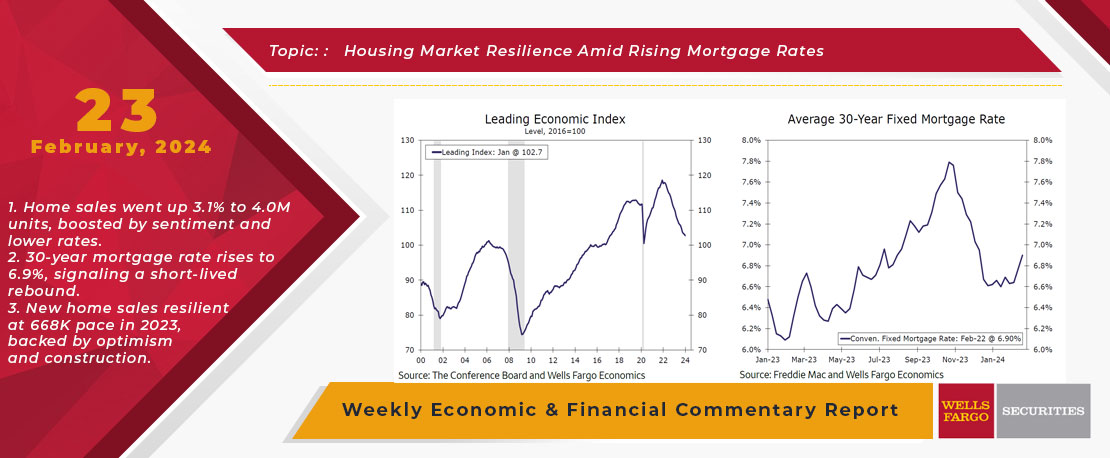

This Week's State Of The Economy - What Is Ahead? - 23 February 2024

Wells Fargo Economics & Financial Report / Feb 27, 2024

Stronger-than-expected inflation, underpinned by the mildly hawkish minutes from the January FOMC meeting, drove a move higher in mortgage rates.

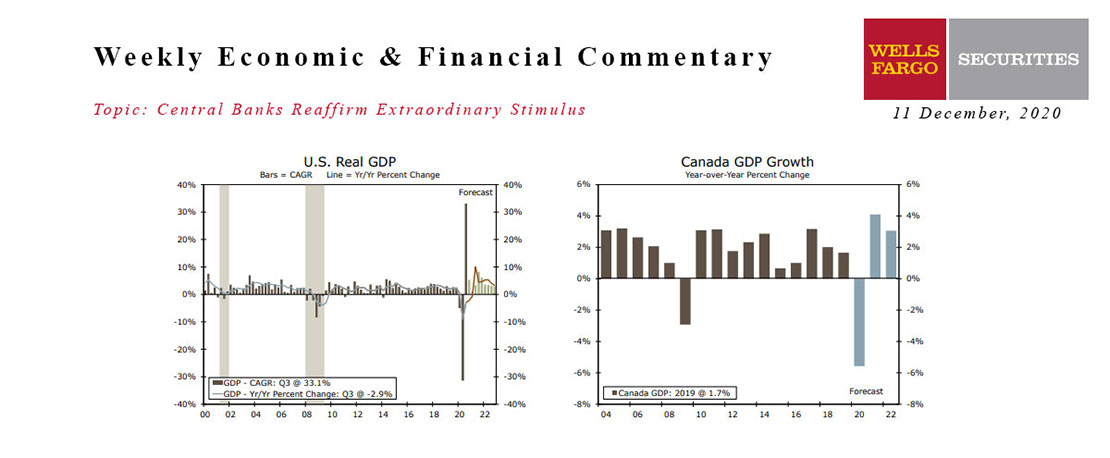

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

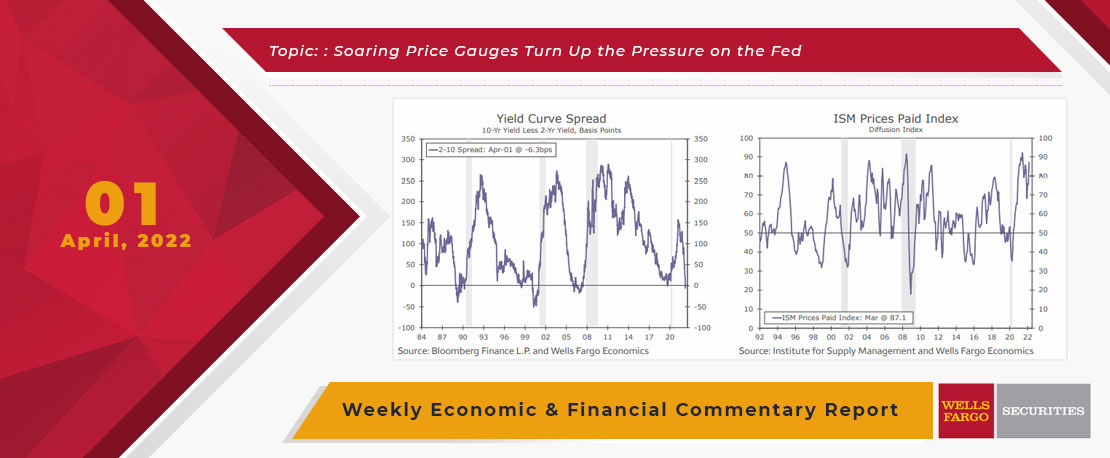

This Week's State Of The Economy - What Is Ahead? - 01 April 2022

Wells Fargo Economics & Financial Report / Apr 05, 2022

The key factor that will drive interest rates is the Fed’s belated effort to rein-in inflation.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

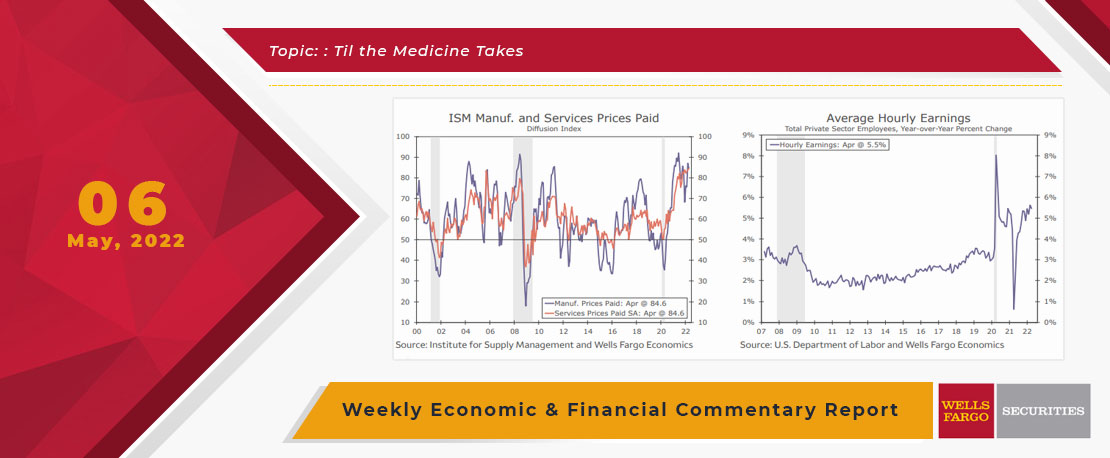

This Week's State Of The Economy - What Is Ahead? - 06 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

Unlike Yordan Alvarez, no one is expecting the Fed to stand back and admire their handiwork after this weeks 50 basis point increase in the Fed Discount Rate. Similar to Yordan, their effort is more of a single and not a home run.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

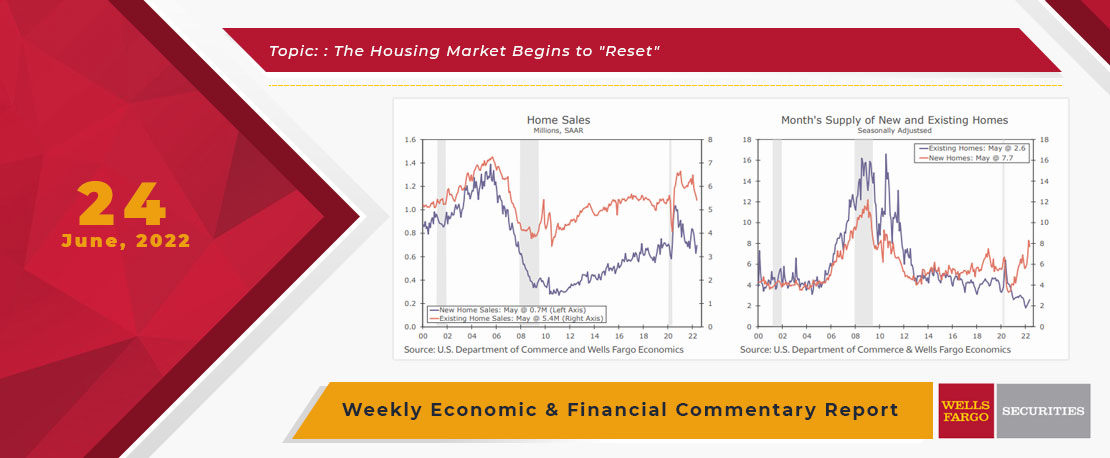

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

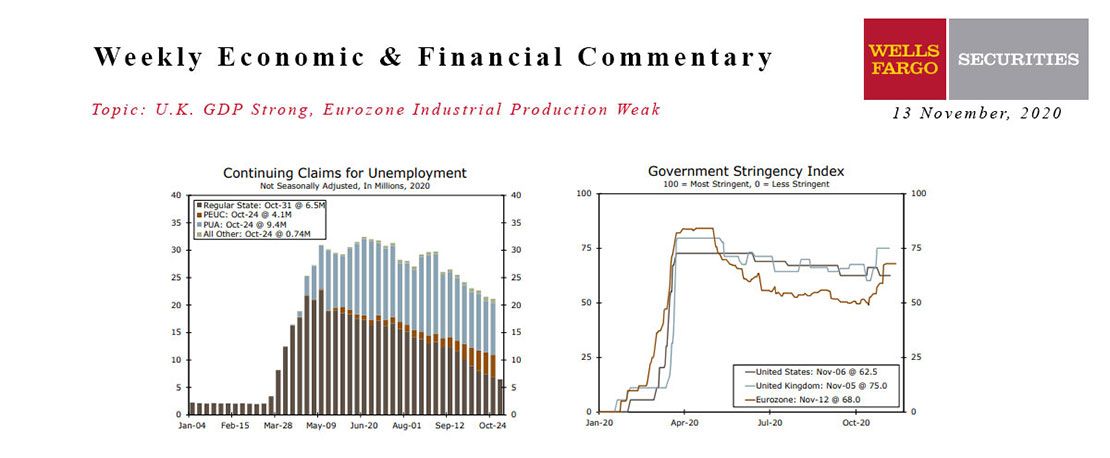

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

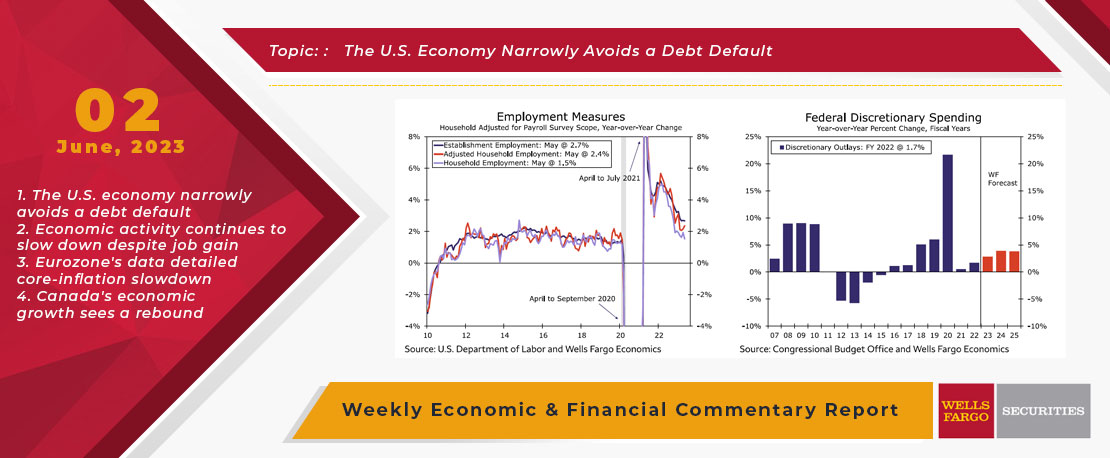

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

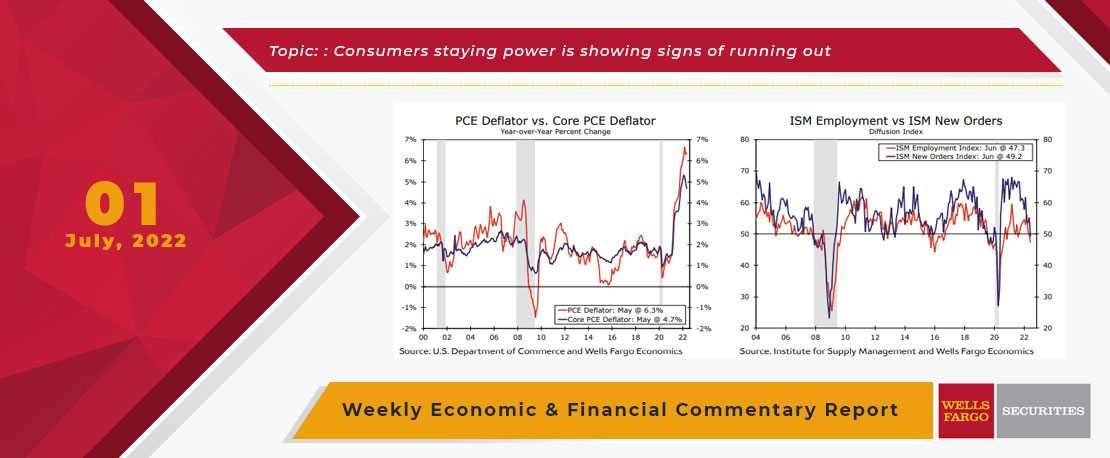

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.