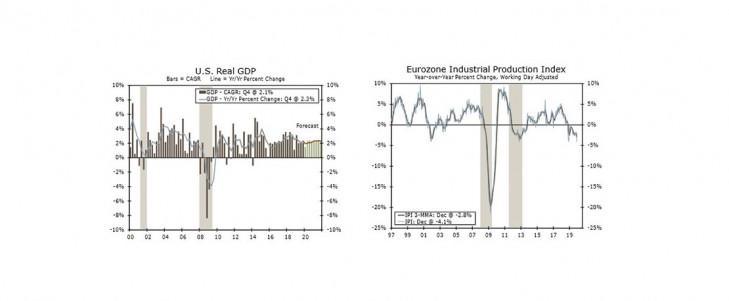

U.S. - Overarching Economic Themes Remain in Place

- Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

- The industrial sector remains challenged, however, as total production declined for the fourth time over the past five months.

- The U.S. economy remains firmly on its expansion path, yet we are mindful of the risks to the outlook, including the ongoing coronavirus threat. Amid what should be a soft start, we look for U.S. real GDP to increase 2.0% this year.

Global - China Near-term Outlook Remains Challenging

- A revision to diagnosis methodology led to a nearly 30% jump in new reported cases of coronavirus in China, and while many of those cases are days or weeks old, the revision only raises further questions over the extent to which China’s economy will be affected by the outbreak. Still, the country’s top officials have been resolute that the country can still hit its 2020 GDP targets.

- The Eurozone is among the more exposed major developed economies—bad news for its already struggling manufacturing sector, especially in Germany, which is the most exposed to China of the Eurozone’s major economies.

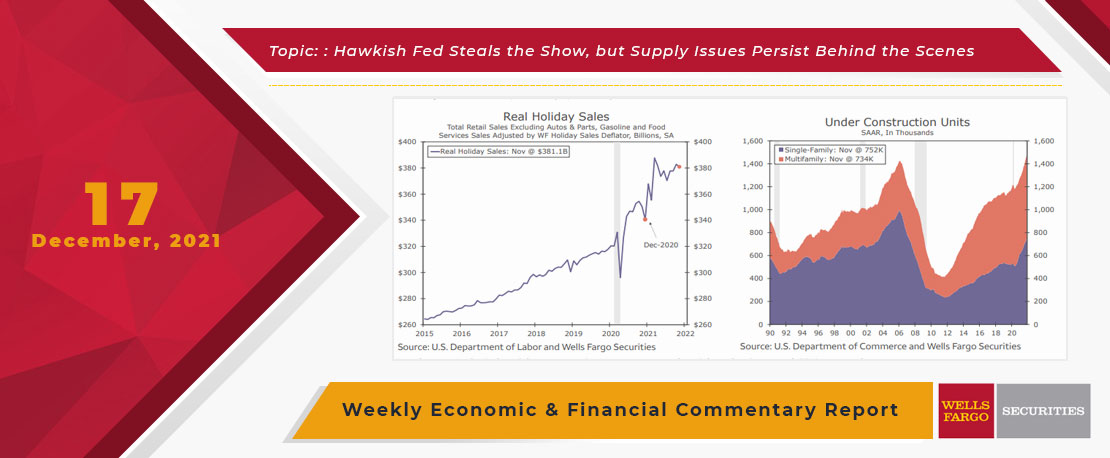

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

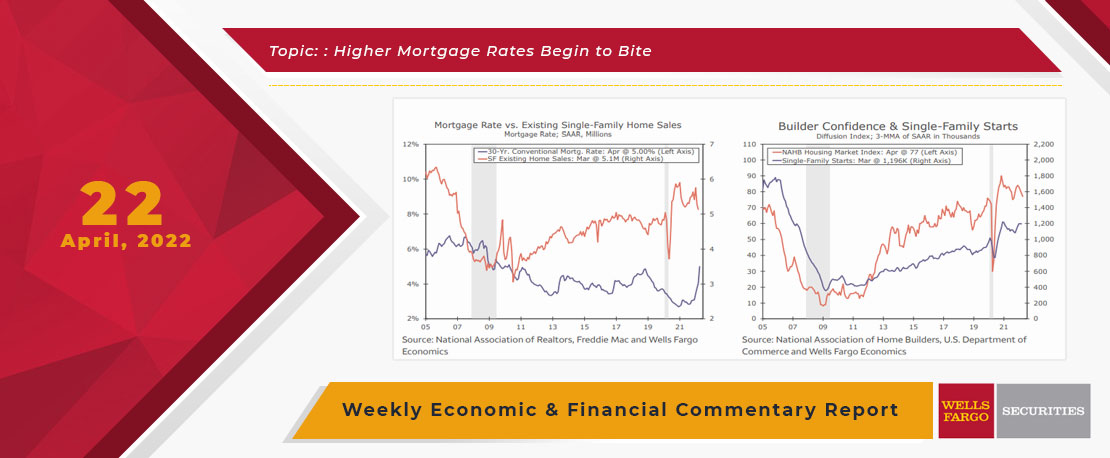

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

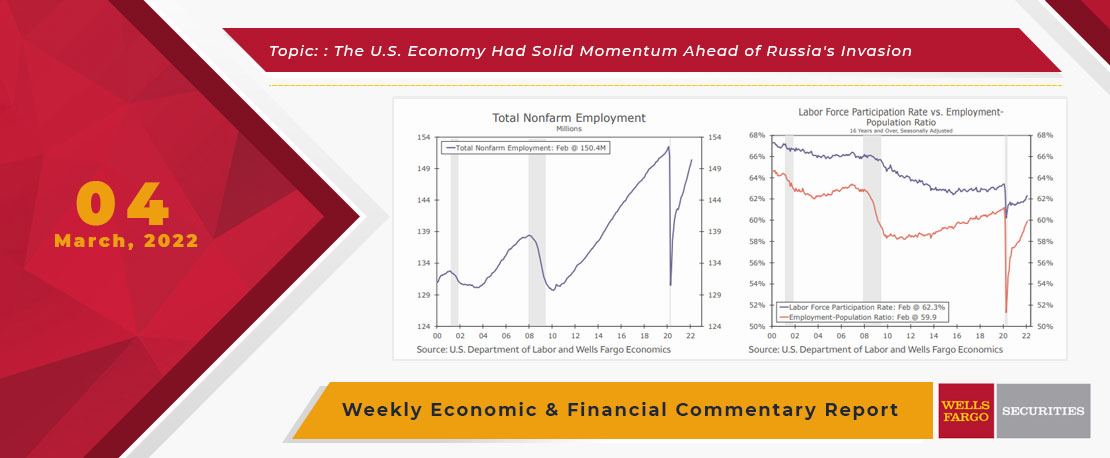

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

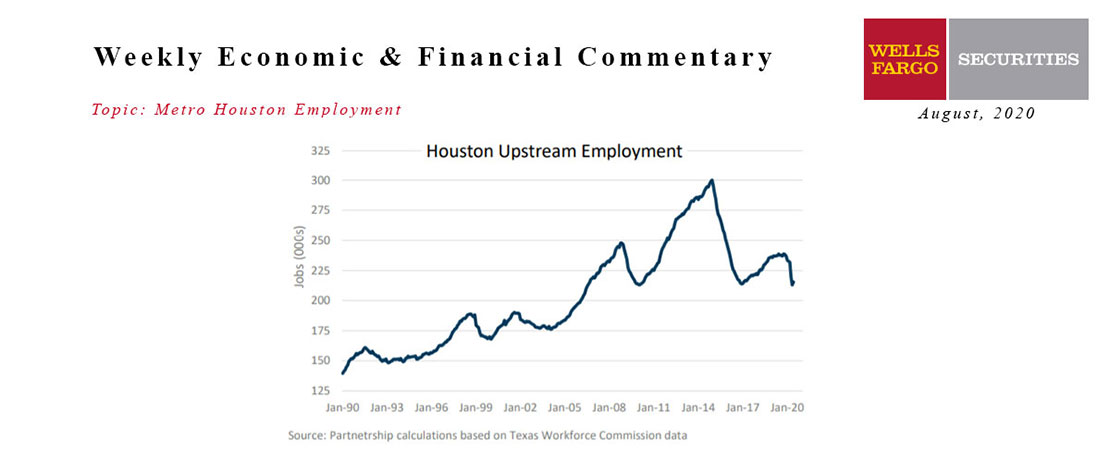

August 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Aug 22, 2020

Downstream involves the refining and processing of oil and natural gas into fuels, chemicals, and plastics. All three sectors are well-represented in Houston.

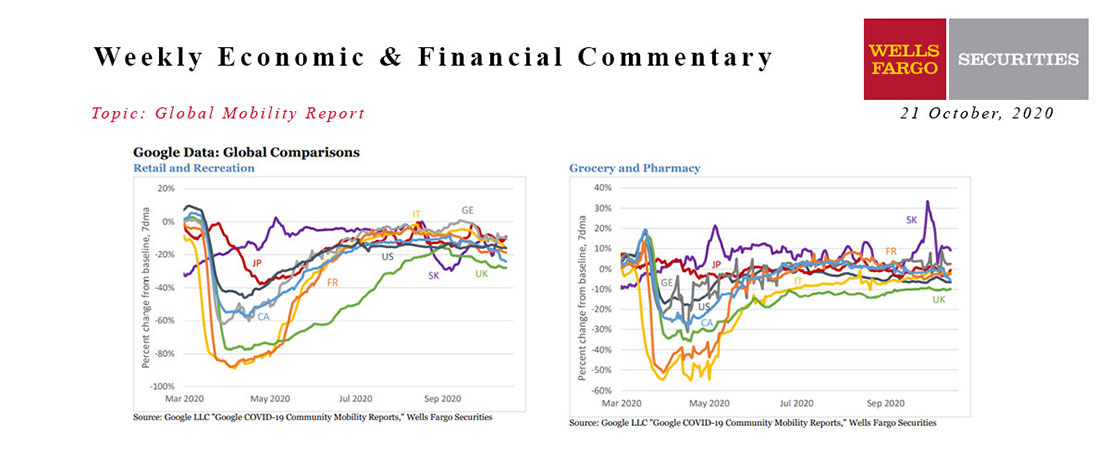

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

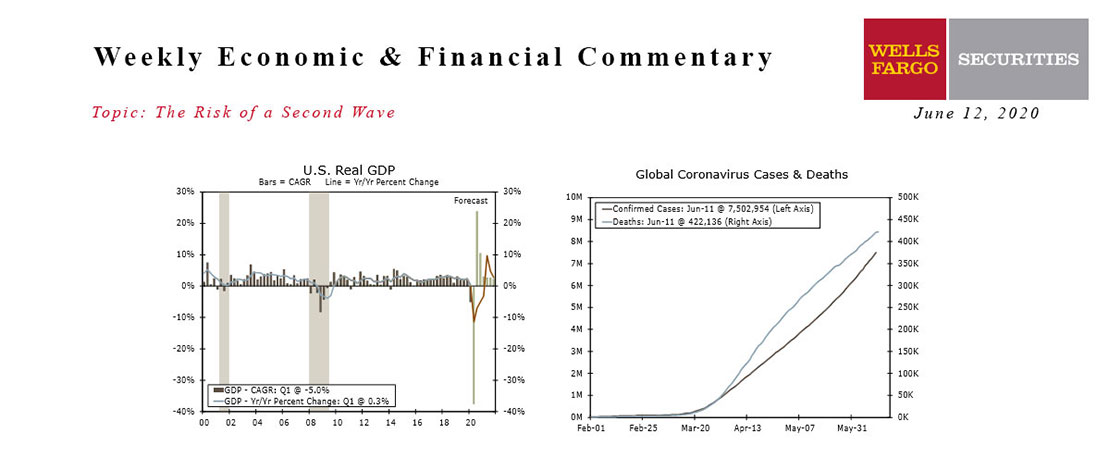

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

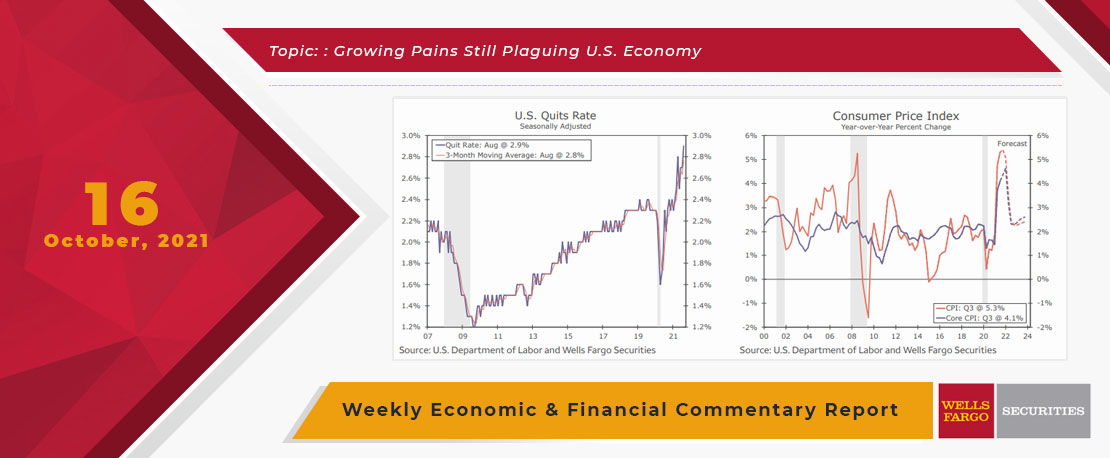

This Week's State Of The Economy - What Is Ahead? - 16 October 2021

Wells Fargo Economics & Financial Report / Oct 22, 2021

The first economic data released this week in the United States reinforced the theme that labor supply and demand are struggling to come into balance.

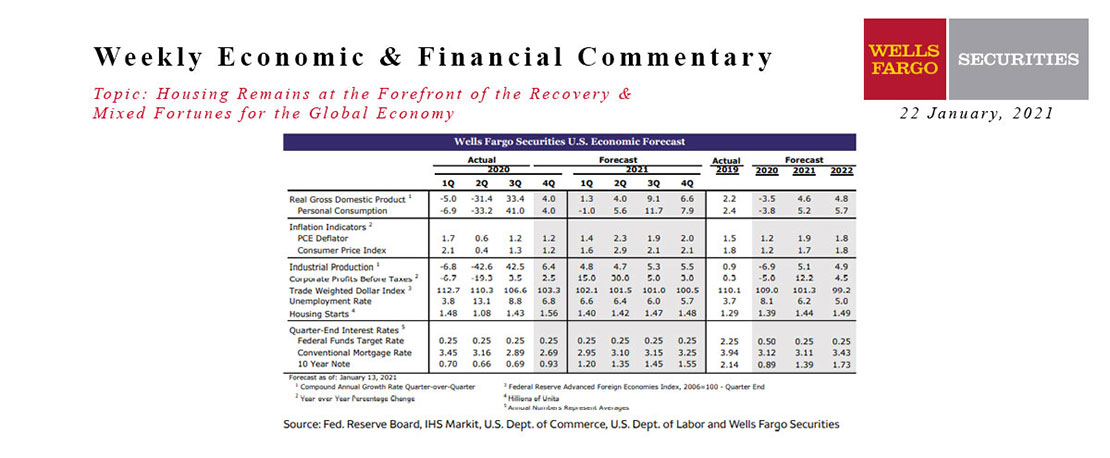

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

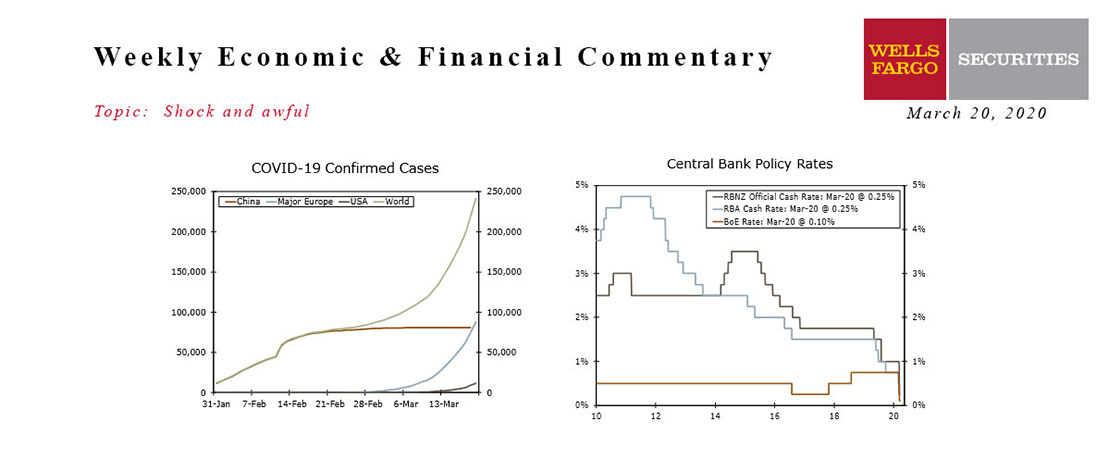

This Week's State Of The Economy - What Is Ahead? - 20 March 2020

Wells Fargo Economics & Financial Report / Mar 21, 2020

Daily life came to a screeching halt this week as governments, businesses and consumers took drastic steps to halt the COVID-19 pandemic.

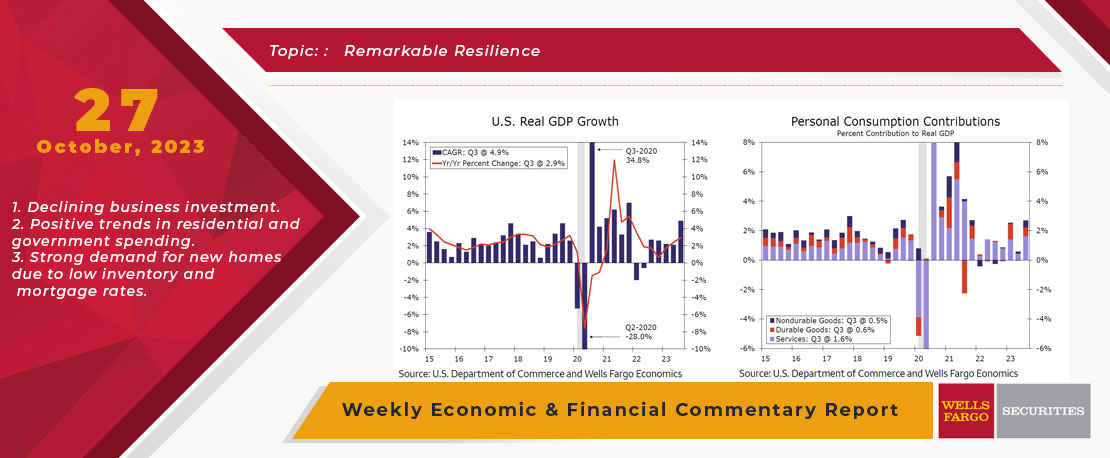

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.