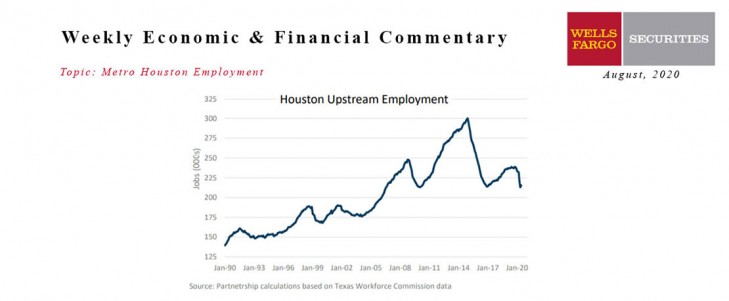

“How much of Houston’s economy is tied to energy?”

“Is Houston less dependent on energy than it was 10, 20 or 30 years ago?”

Energy Defined

Before answering either question, one must first define the industry. Oil and gas has three sectors: upstream, mid-stream, and downstream. Upstream includes exploration, production, and oilfield services. Midstream focuses on the processing, transportation, and storage of crude and natural gas. Downstream involves the refining and processing of oil and natural gas into fuels, chemicals, and plastics. All three sectors are well-represented in Houston.

Energy's Contribution to Houston's GDP

Every December, the Bureau of Economic Analysis (BEA) publishes its estimates of gross domestic product (GDP) for all 384 U.S. metro areas. BEA estimates that oil and gas extraction accounted for $20.5 billion (4.3 percent) of Houston’s GDP in ’18. That’s down from $33.1 billion or 7.7 percent in ’14.

Metro Houston Employment

Metro Houston added 55,000 jobs in June. That’s on top of the 78,200 jobs added in May. Despite the surge, local employment remains 217,700 jobs below its February pre-COVID level. The largest job gains occurred in restaurants and bars, retail and arts, entertainment and recreation. Government, manufacturing and transportation, ware-housing and utilities and energy continued to lose jobs. Of the major sectors, only finance and insurance has returned to its pre-COVID employment level.

SNAPSHOT – KEY ECONOMIC INDICATORS

Crude Oil

The closing spot price for West Texas Intermediate (WTI), the U.S. benchmark for light, sweet crude, averaged $40.69 per barrel during the last week of July ’20, down 28.0 percent from $56.05 for the same period in ’19. The COVID-19 pandemic continues to reduce global economic activity. However, oil prices rose in July as OPEC and partner countries maintained production cuts and the United States continued to reduce drilling activity.

Home Sales

The Houston area housing market has fully regained its spring losses and returned to pre-COVID sales volumes though the recovery may be short-lived as listings dry up. Houston-area realtors sold 10,975 single-family homes in July ’20, up 23.0 percent from the same month last year and the most ever for a single month in Houston. Year-to-date sales totaled 51,388 single-family homes, up 2.7 percent from the first seven months of ’19.

Natural Gas

The cost of consumer goods and services as measured by the Consumer Price Index for All Urban Consumers (CPI-U) rose 1.0 percent nationwide from July ’19 to July ’20, according to the U.S. Bureau of Labor Statistics. Core inflation (all items less the volatile food and energy categories) increased 1.6 percent since July ’19.

Rig Count

Baker Hughes reports 244 drilling rigs were working in the U.S. during the second week of August ’20. That’s down 691 rigs, or 73.9 percent, from the same week in August last year.

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

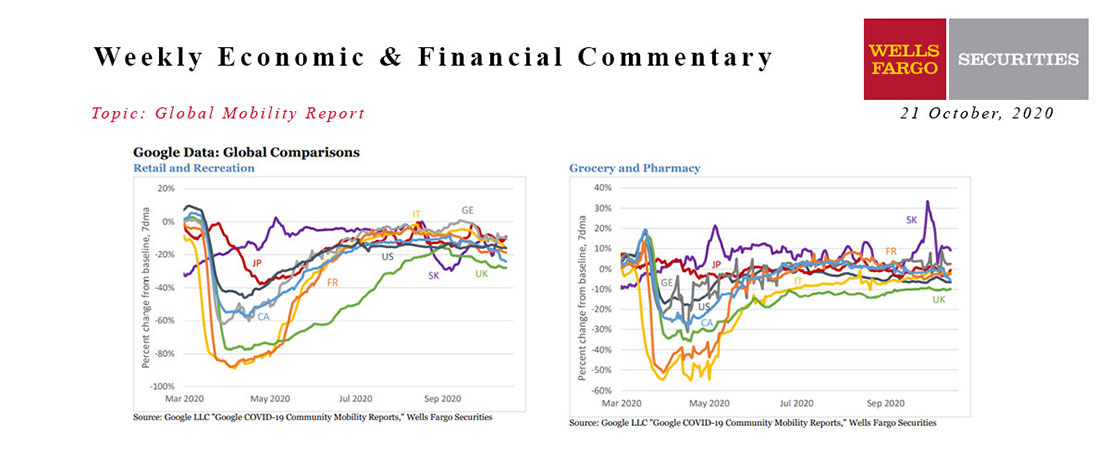

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

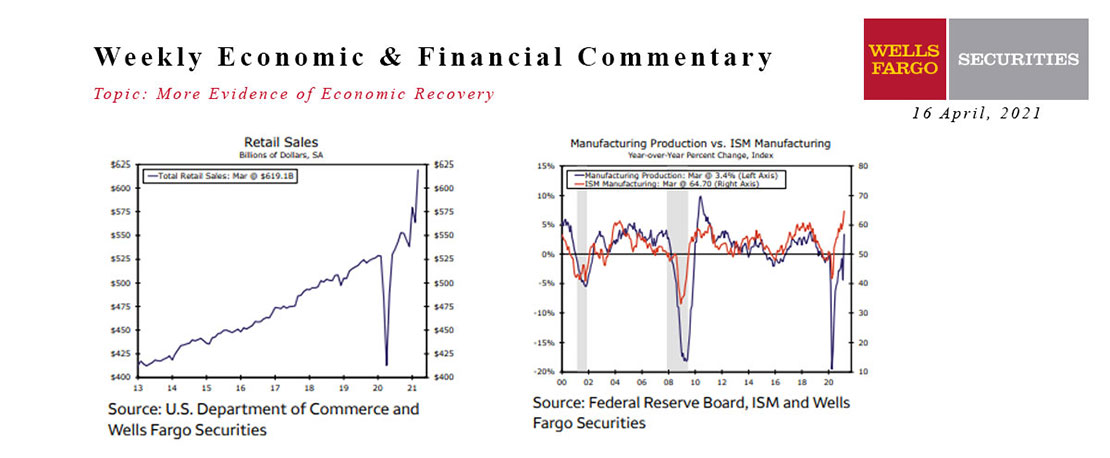

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

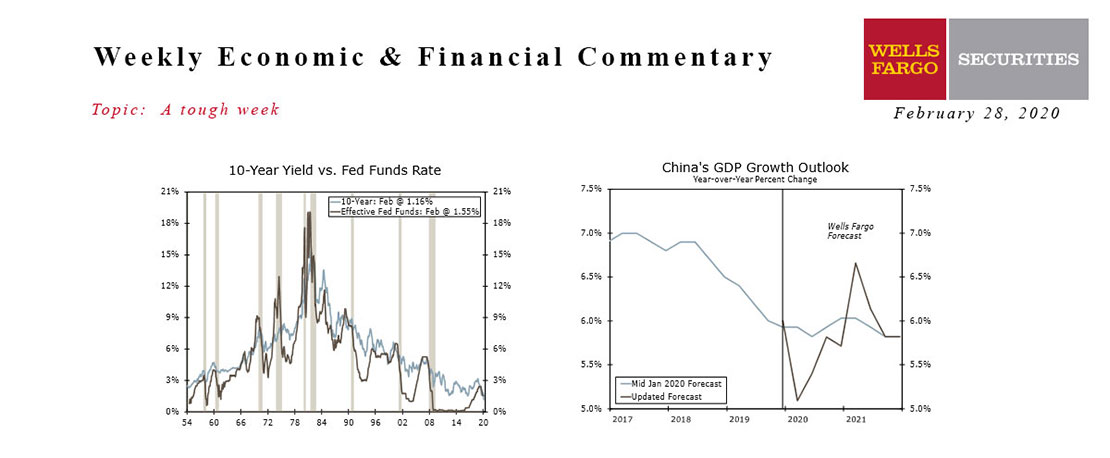

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

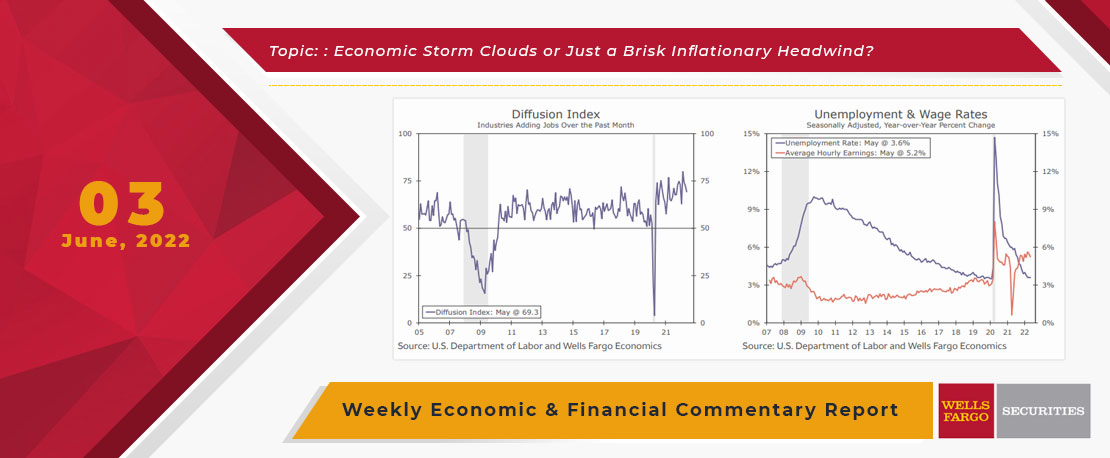

This Week's State Of The Economy - What Is Ahead? - 03 June 2022

Wells Fargo Economics & Financial Report / Jun 08, 2022

While talk of recession has kicked up in recent weeks, the majority of economic data remain consistent with modest growth.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

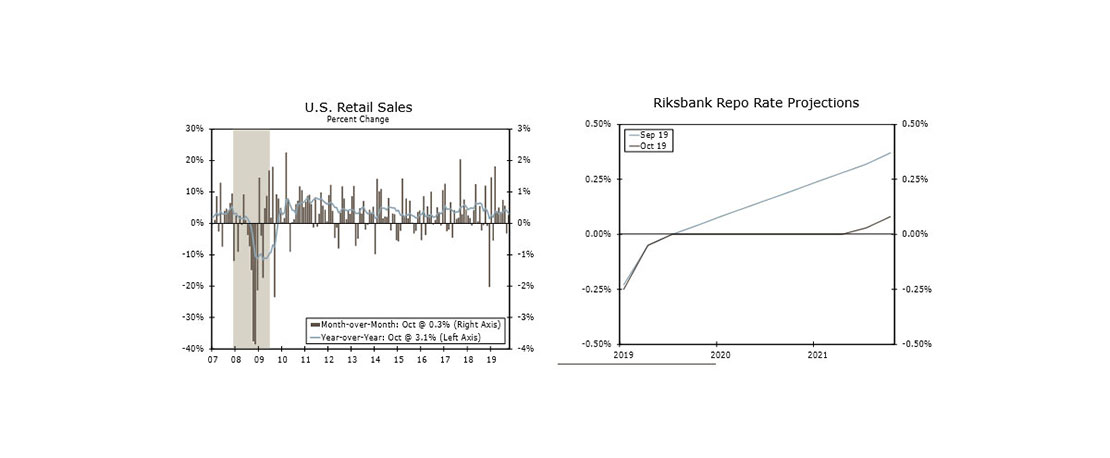

This Week's State Of The Economy - What Is Ahead? - 15 November 2019

Wells Fargo Economics & Financial Report / Nov 16, 2019

Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.

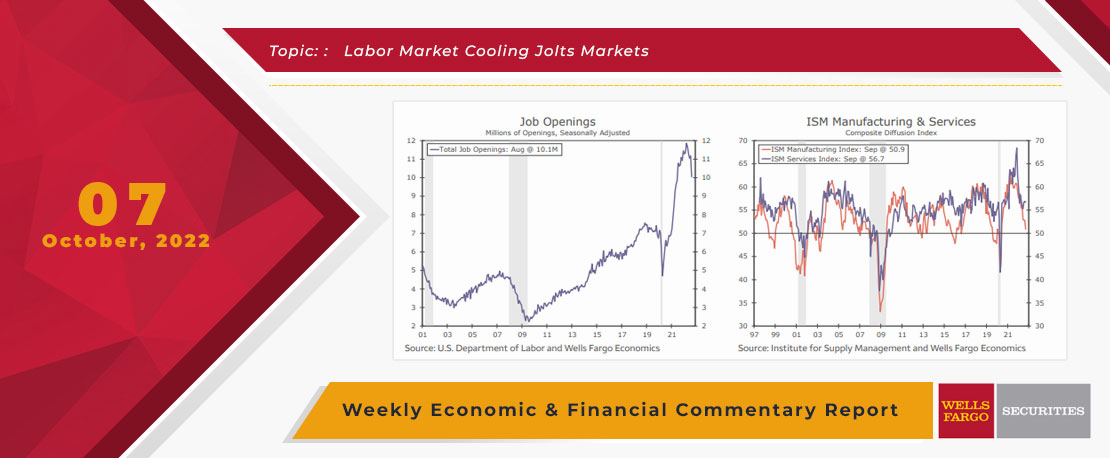

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

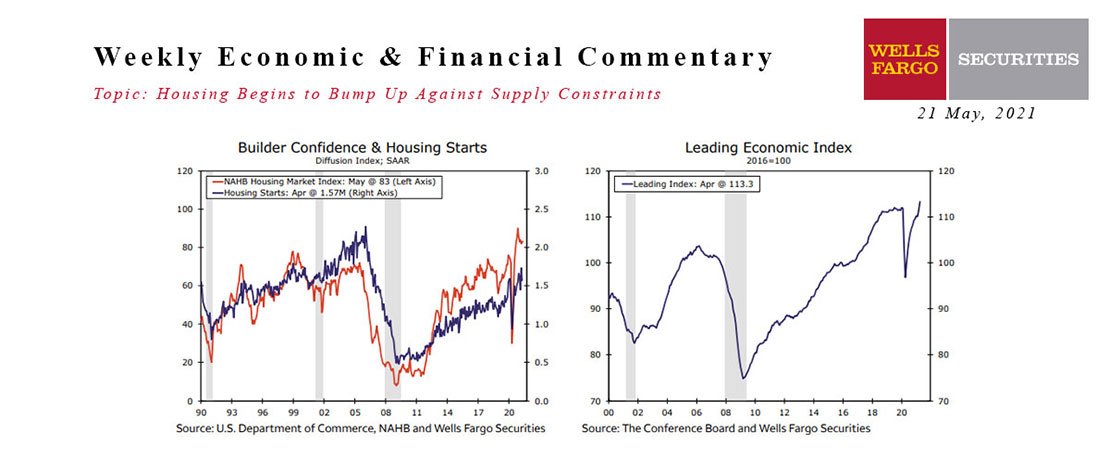

This Week's State Of The Economy - What Is Ahead? - 21 May 2021

Wells Fargo Economics & Financial Report / May 25, 2021

Over the past year, the housing market has become white-hot.

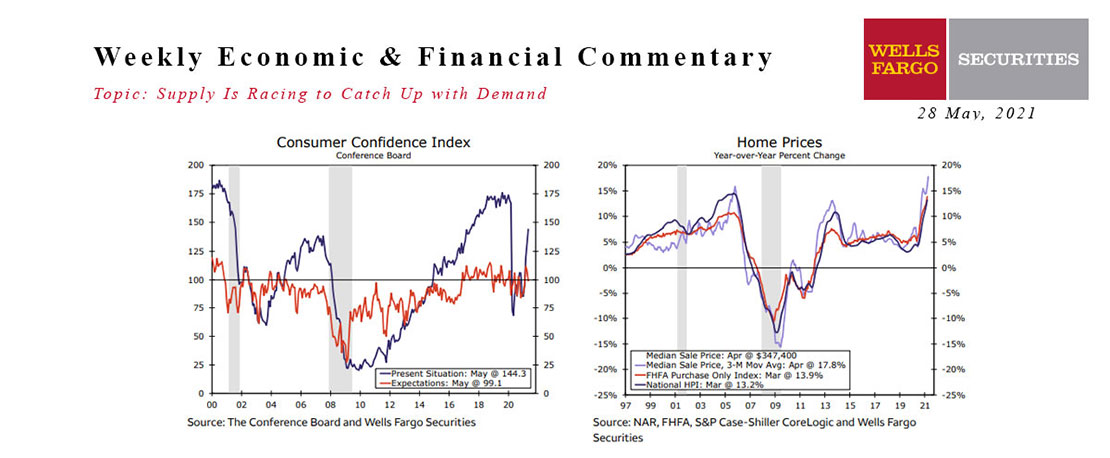

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.