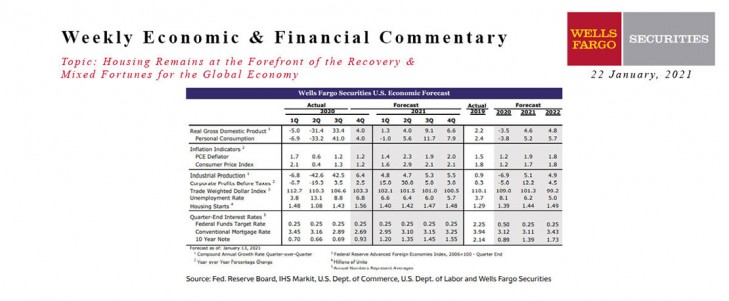

U.S. - Housing Remains at the Forefront of the Recovery

- Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%. Total starts are running at a 1.67 million-unit pace, the strongest pace since 2006. Existing home sales rose 0.7% to a 6.76 million-unit pace in December. Mortgage applications for purchase are up 14.7% over the year as of January 15.

- The NAHB Housing Market Index fell to 83 in January. Builder confidence remains exceptionally high, but the index has slipped in recent months alongside rising material prices and the latest COVID surge. Initial jobless claims fell to 900K during the week ended January 16. Despite the drop, new filings remain elevated, which means another negative print for payrolls in January is possible.

Global - Mixed Fortunes for the Global Economy

- This past week saw some reports showing mixed fortunes for key international economies. China reported another solid GDP increase in Q4, while for full-year 2020 GDP rose 2.3%, the only major global economy to enjoy positive growth last year. Elsewhere, Japan and Mexico appear to be experiencing a steady rather than especially strong rebound, while Eurozone PMI surveys hint at a renewed contraction across the region in late 2020 and early 2021.

- For now, central banks are sitting on the sidelines. The European Central Bank held monetary policy steady and, with regard to its asset purchases, said that it might not use its full envelope of asset purchases, but equally that its purchase program could be re-calibrated. The Bank of Canada kept policy unchanged, though hinted at an eventual tapering in bond purchases as confidence in the economic recovery improves, while the Bank of Japan held monetary policy unchanged at its meeting this week.

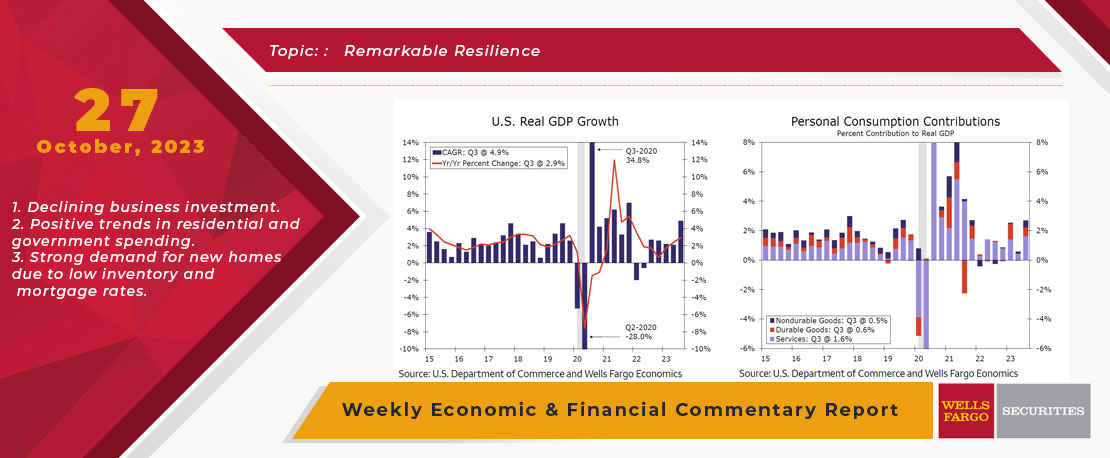

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.

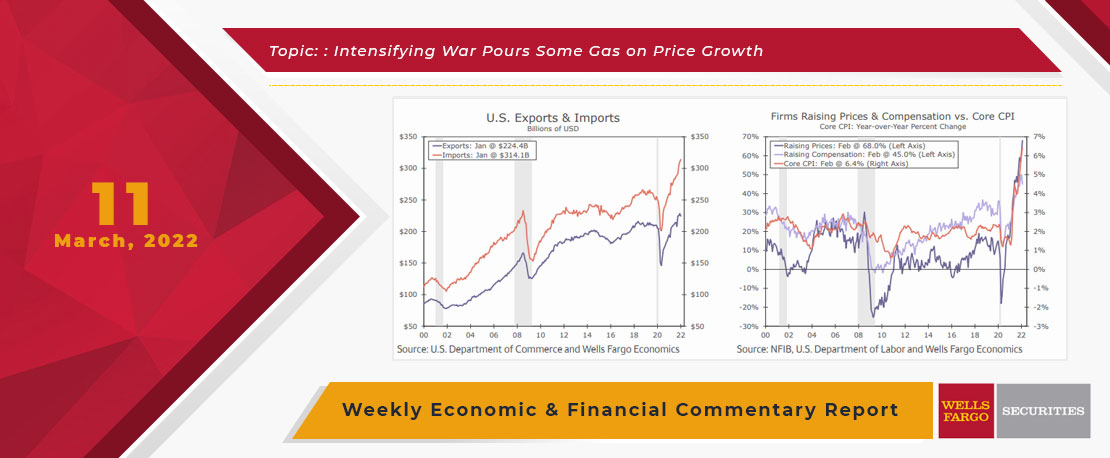

This Week's State Of The Economy - What Is Ahead? - 11 March 2022

Wells Fargo Economics & Financial Report / Mar 16, 2022

Russia\'s invasion of Ukraine continues to consume nearly all media attention and has created a level of volatility that is not yet reflected in the data released this week.

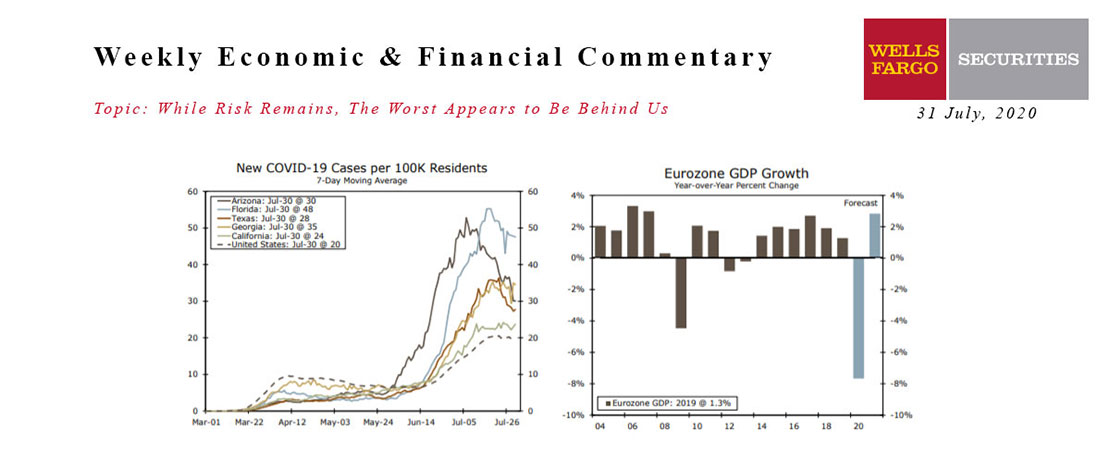

This Week's State Of The Economy - What Is Ahead? - 31 July 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

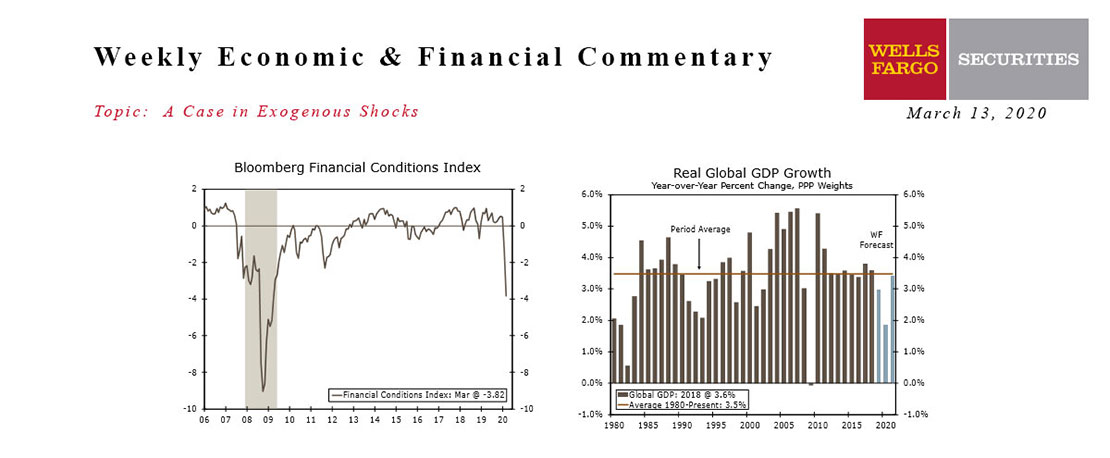

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

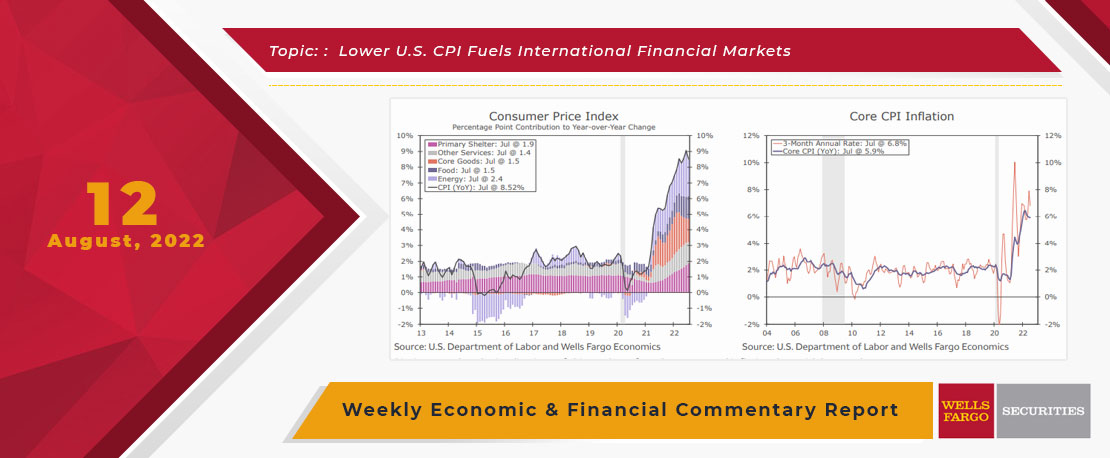

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

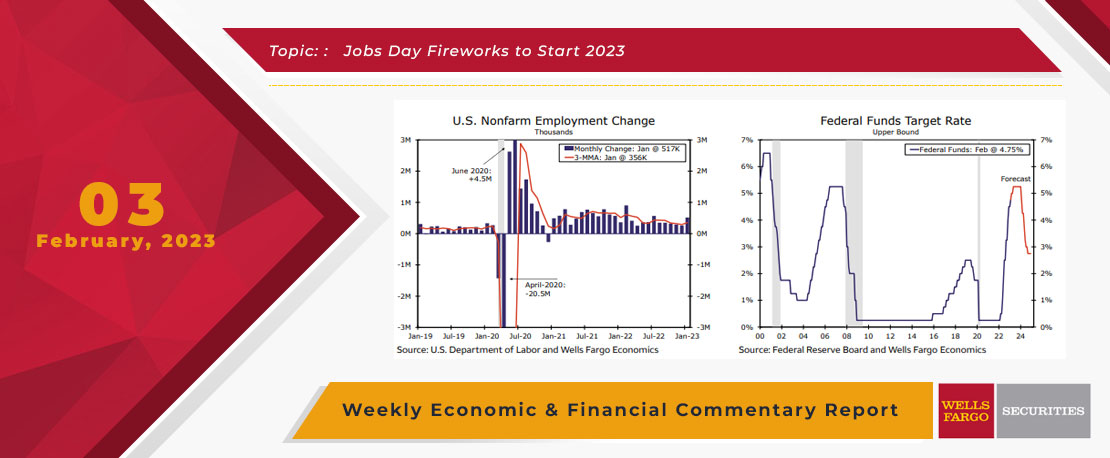

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

This Week's State Of The Economy - What Is Ahead? - 14 January 2022

Wells Fargo Economics & Financial Report / Jan 18, 2022

As you may have already seen, inflation is running almost as hot as the stock of our favorite bank. The Consumer Price Index (CPI) rose 7.0% year-over-year in December, the fastest increase in nearly 40 years.

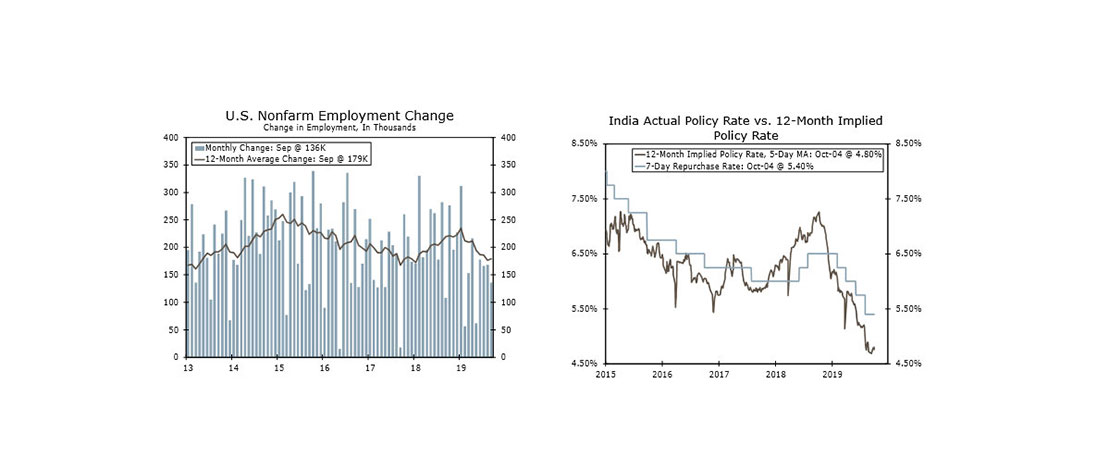

This Week's State Of The Economy - What Is Ahead? - 4 October 2019

Wells Fargo Economics & Financial Report / Oct 05, 2019

Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

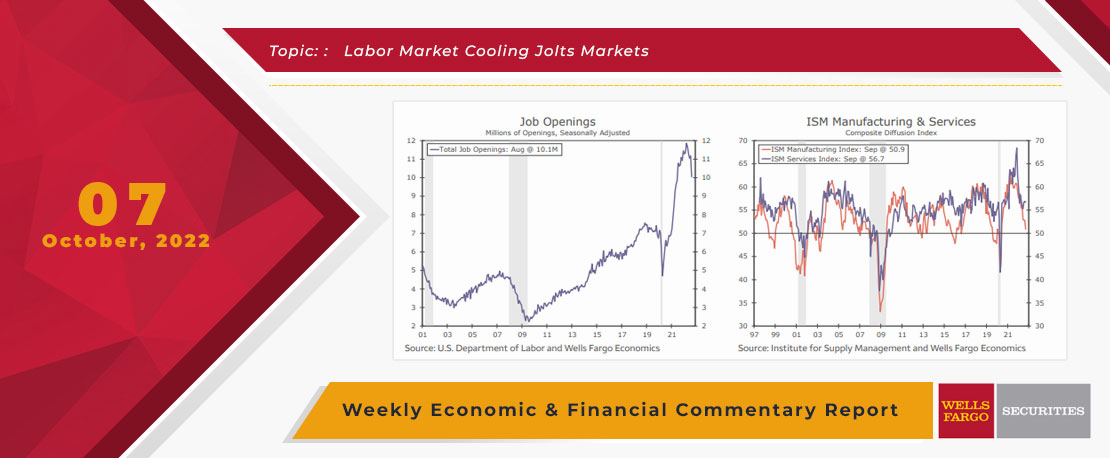

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.