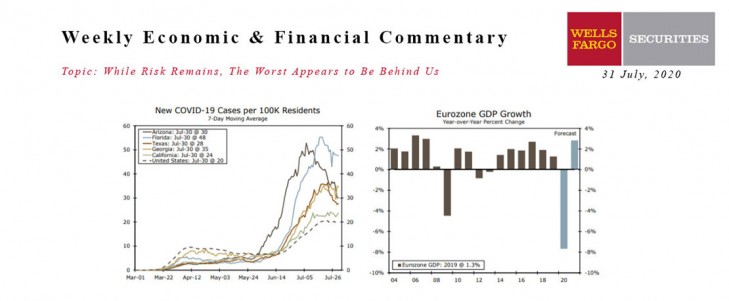

U.S. - While Risk Remains, The Worst Appears to Be Behind Us

- The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

- Real GDP declined in line with expectations, plunging at a record 32.9% annual rate.

- Jobless claims rose for a second consecutive week, and continuing claims also increased.

- Consumer confidence faltered as the second wave of COVID-19 infections triggered a pullback in economic engagement.

Global - Q2 GDP Data Shows Impact of COVID-19

- As expected, Mexico’s economy contracted significantly in the second quarter. The effects of COVID-19 and collapse in oil prices weighed heavily on the economy in Q2, while a lack of fiscal policy support from the current administration adds challenges to Mexico’s growth outlook going forward.

- GDP data were released across Europe as well, with the German economy recording a third straight quarterly contraction. Eurozone GDP performed roughly in line with expectations, recording a large decline in Q2. Despite the large contraction, we are optimistic on the Eurozone economy’s prospects for the second half of the year.

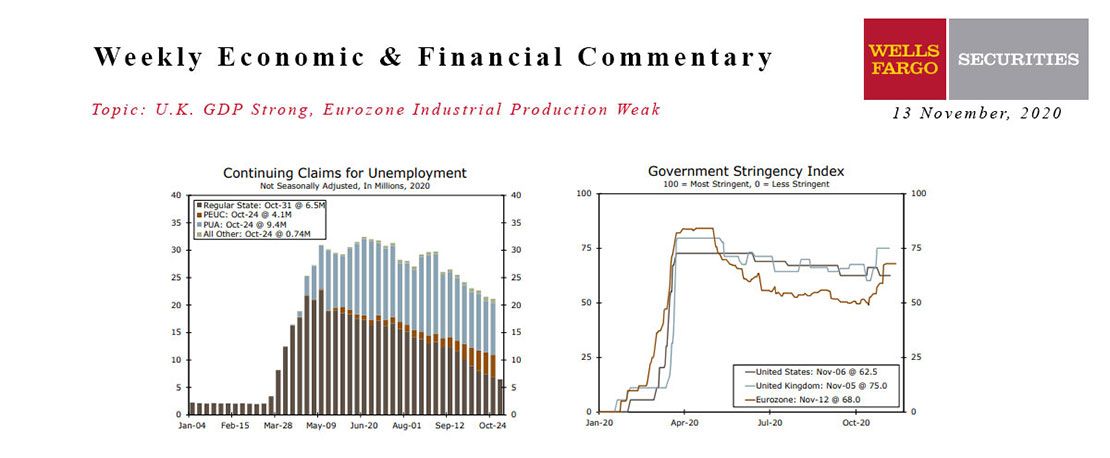

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

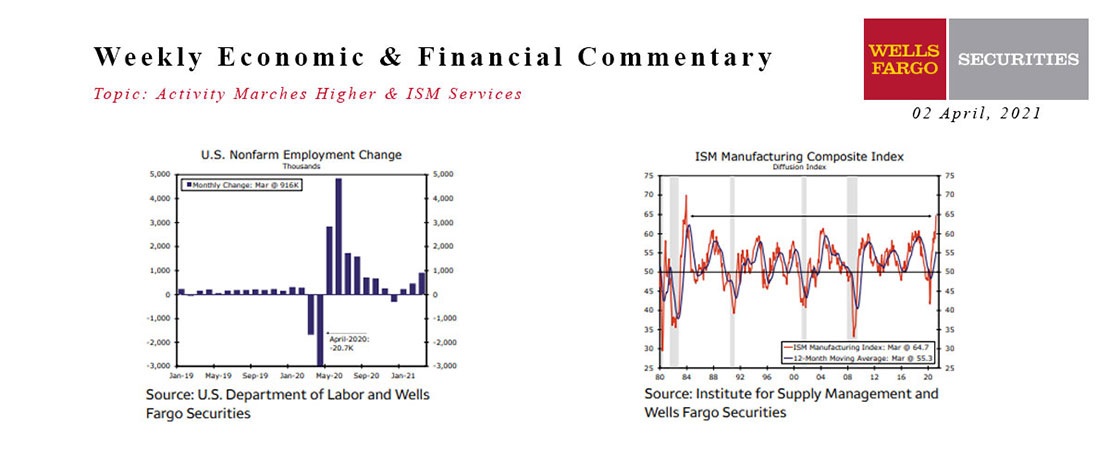

This Week's State Of The Economy - What Is Ahead? - 02 April 2021

Wells Fargo Economics & Financial Report / Apr 08, 2021

Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

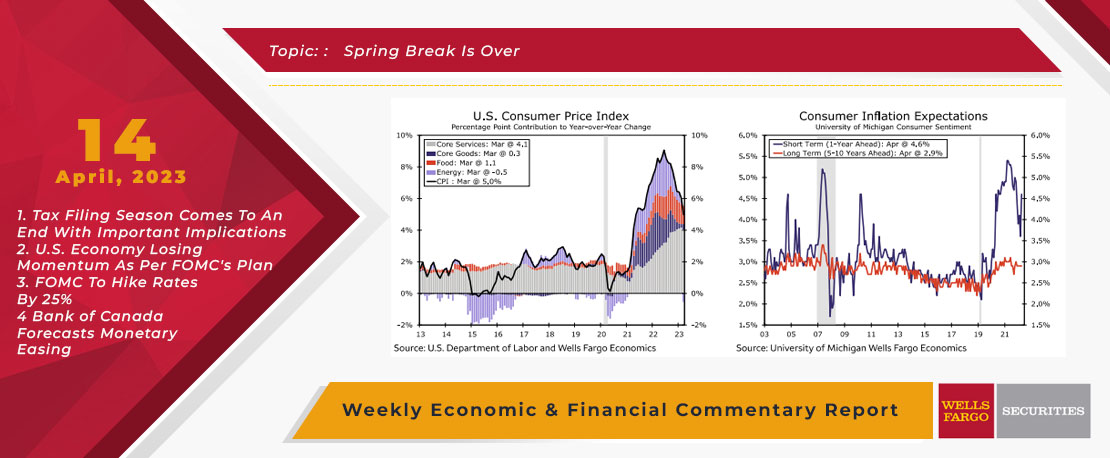

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

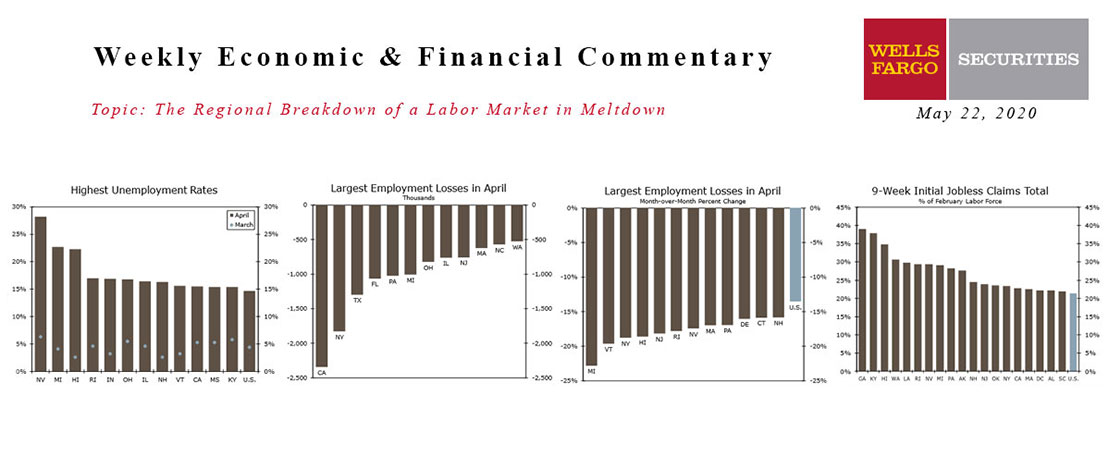

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.

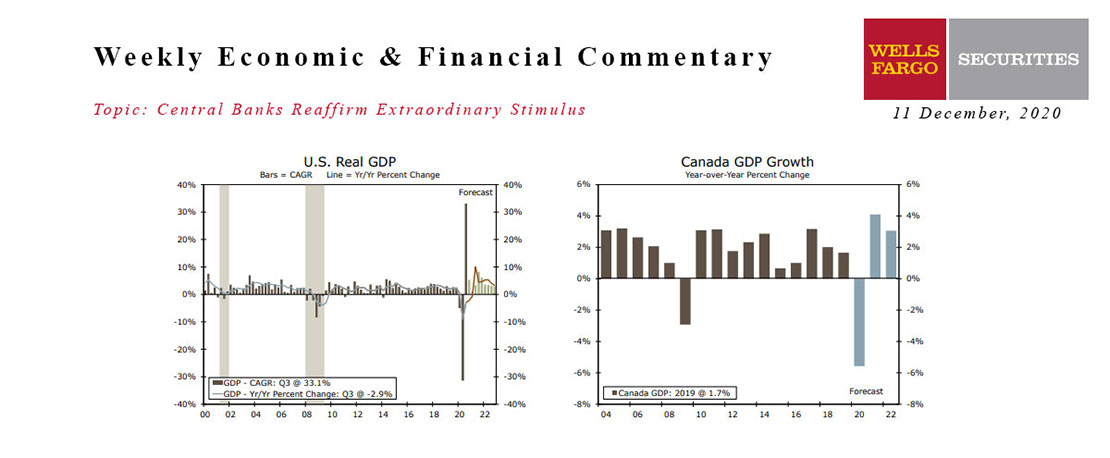

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

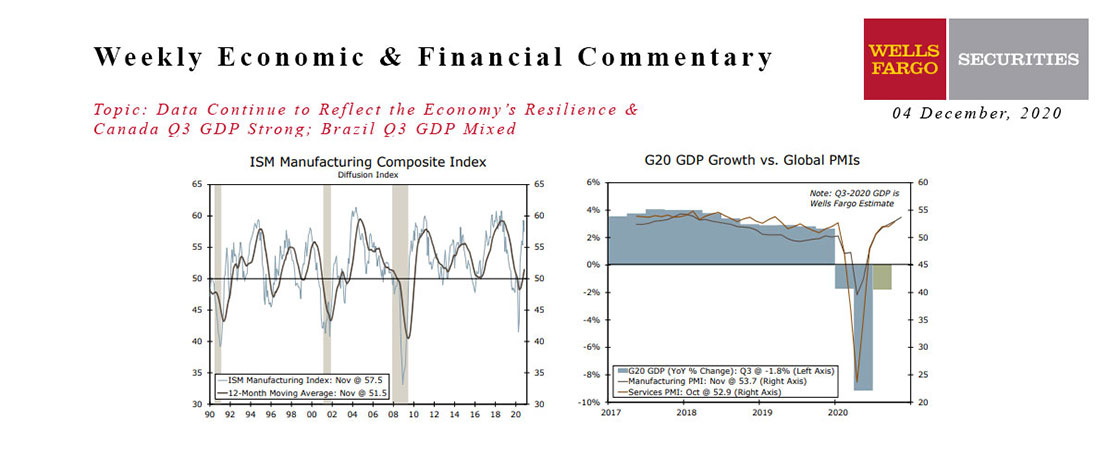

This Week's State Of The Economy - What Is Ahead? - 04 December 2020

Wells Fargo Economics & Financial Report / Dec 09, 2020

Manufacturing held up relatively well in November, despite a larger-than-expected dip in the ISM manufacturing survey. The nonfarm manufacturing survey rose slightly.

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

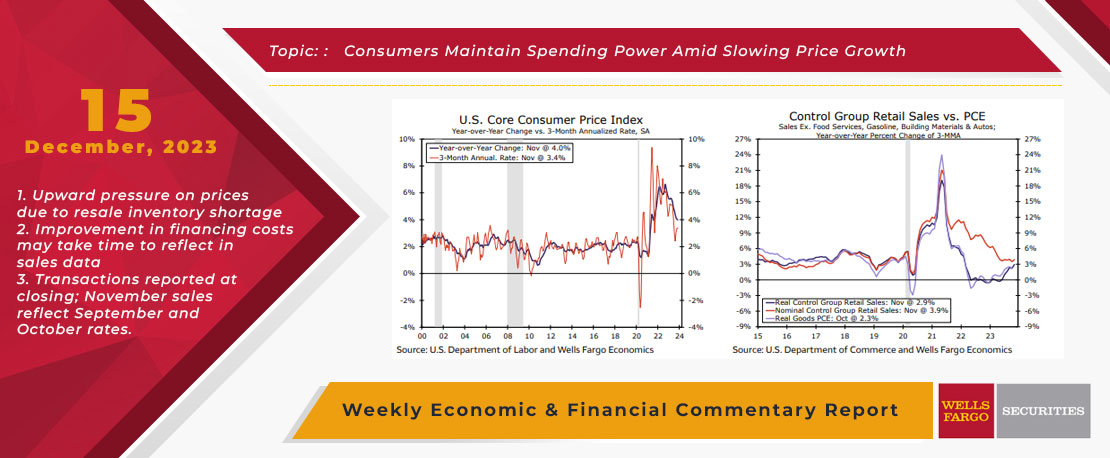

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

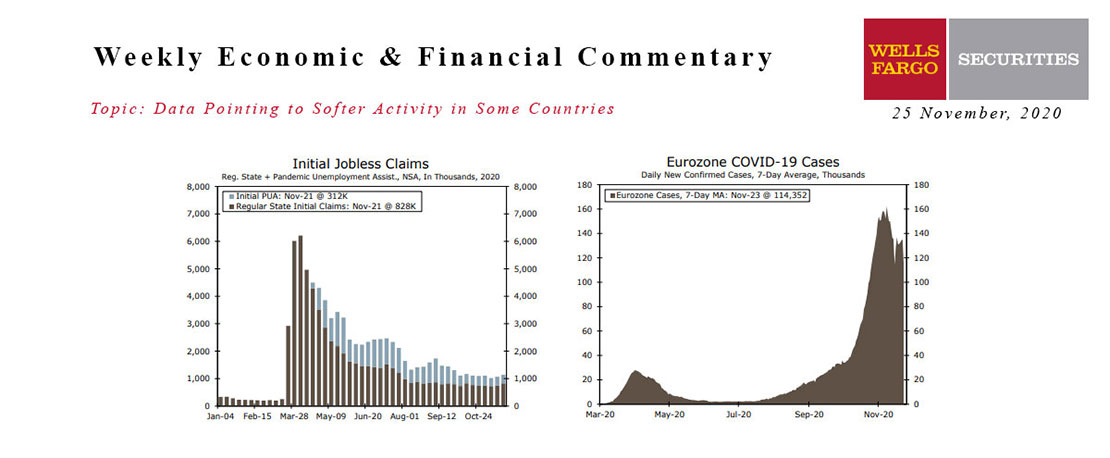

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.