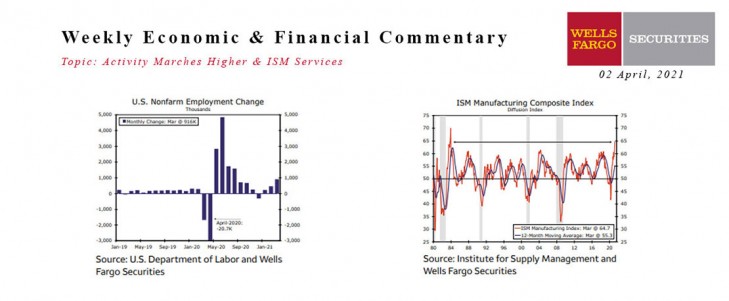

U.S. Review - Activity Marches Higher

- Increased vaccinations and an improving public health position led to an easing of restrictions and pickup in activity across the country in March. Firms' need for labor has increased to meet demand and employers added a whopping 916K jobs last month as the recovery gained momentum (see Chart). Prior job gains were revised higher as well, but the March figure still denotes a significant pickup from the first two months of the year.

- For the second consecutive month, the hard-hit leisure & hospitality industry posted a solid gain (+280K), as in-person activity continues to recover. Construction payrolls also jumped 110K last month after severe winter weather weighed on the industry in February. Overall, hiring was broad based with nearly every major industry reporting gains. The few exceptions were the autos & parts and information industries, which reported very modest declines in net hiring of -1K and -2K, respectively. The unemployment rate slid 0.2 percentage points to 6.0% in March.

U.S. Outlook - ISM Services • Monday

The ISM Services index was not immune to the slowdown seen across the economy in February. The index slipped 3.4 points to its slowest pace of expansion since May 2020. The new orders index fell even further, down 9.9 points to 51.9, though some of this decline may reect the fact that long-depleted inventories have at last been restocked.

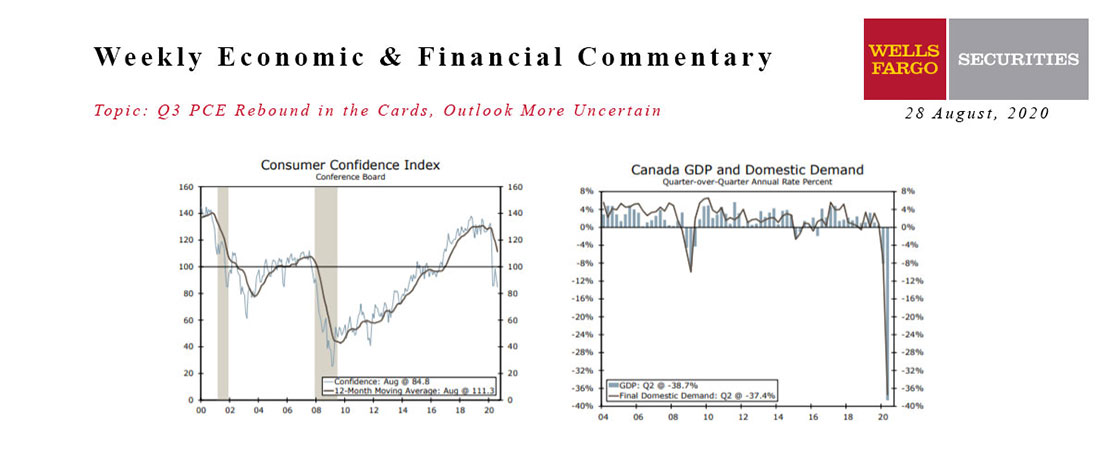

This Week's State Of The Economy - What Is Ahead? - 28 August 2020

Wells Fargo Economics & Financial Report / Aug 26, 2020

After a revised look at GDP this week suggested the second quarter may not have been quite as bad as first estimated, attention shifts to the current quarter.

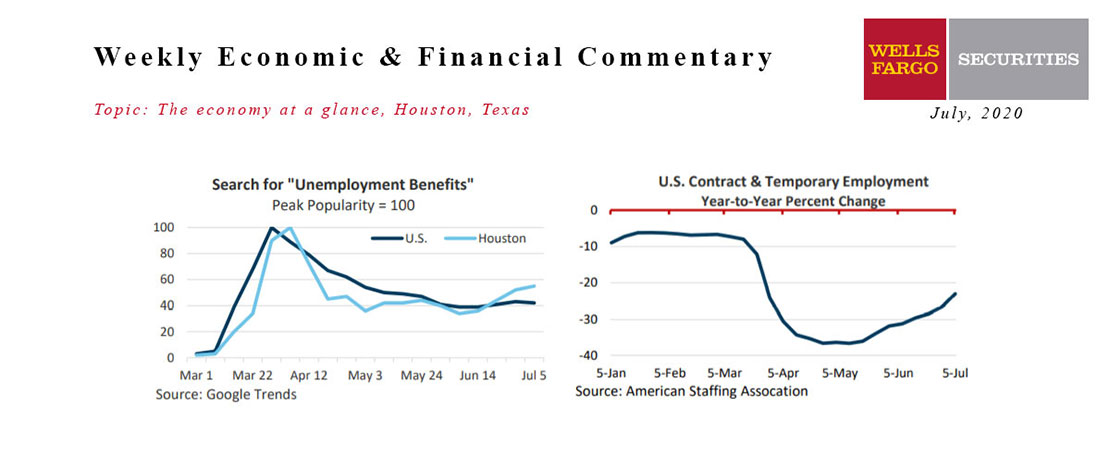

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

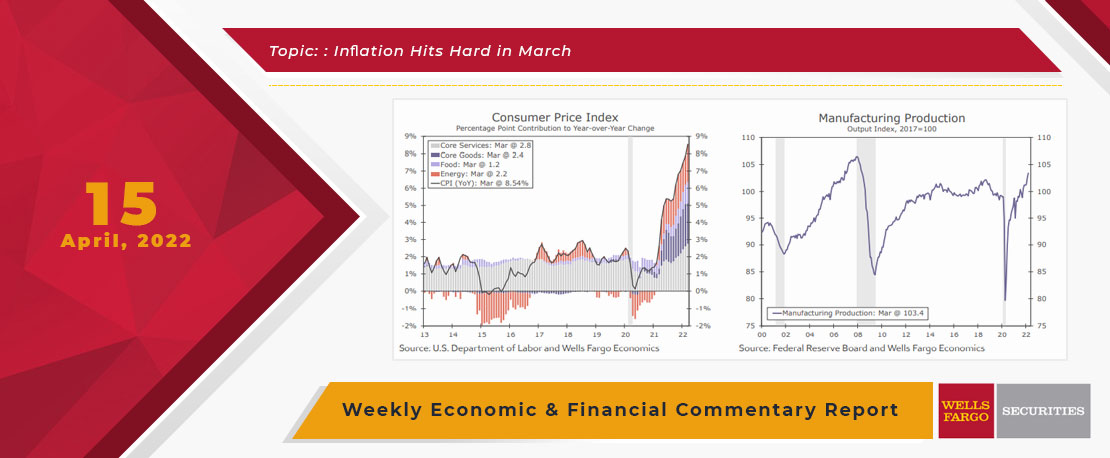

This Week's State Of The Economy - What Is Ahead? - 15 April 2022

Wells Fargo Economics & Financial Report / Apr 18, 2022

What do pollen and the Consumer Price Index (CPI) have in common? Answer; both are hitting new highs. This week’s U.S. economic data was led by the largest month monthly increase in the Consumer Price Index (CPI) since September 2005.

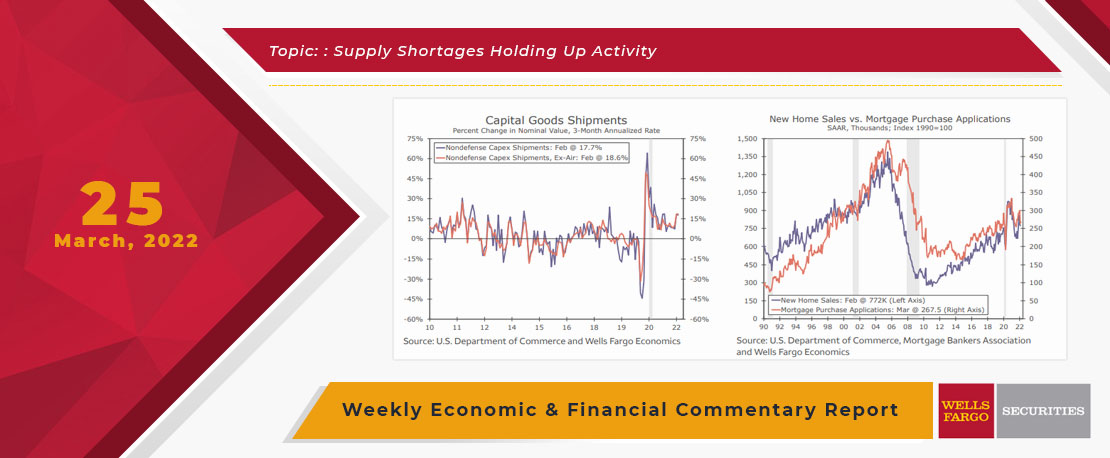

This Week's State Of The Economy - What Is Ahead? - 25 March 2022

Wells Fargo Economics & Financial Report / Mar 27, 2022

The fact that capital goods shipments surprised on the upside was one of the few things that went right in this week\'s durable goods report.

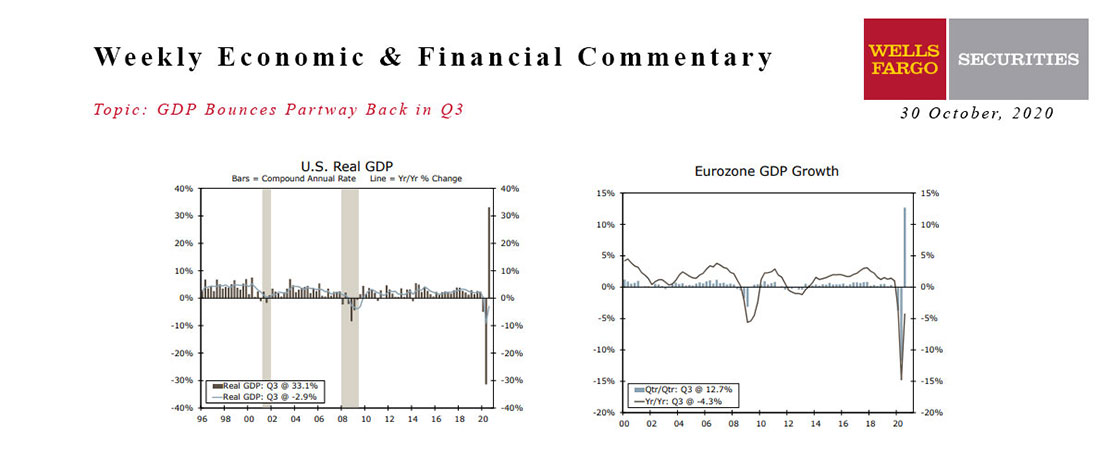

This Week's State Of The Economy - What Is Ahead? - 30 October 2020

Wells Fargo Economics & Financial Report / Oct 27, 2020

Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain.

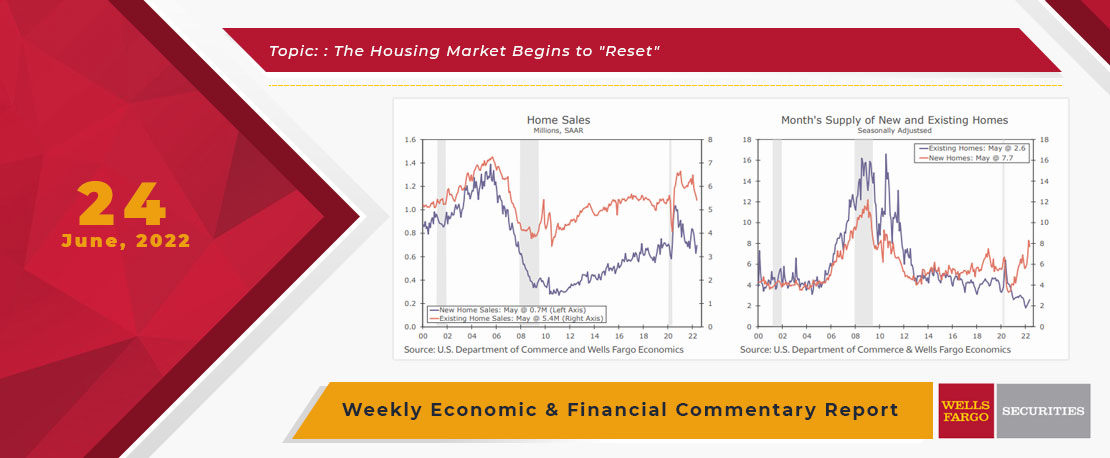

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

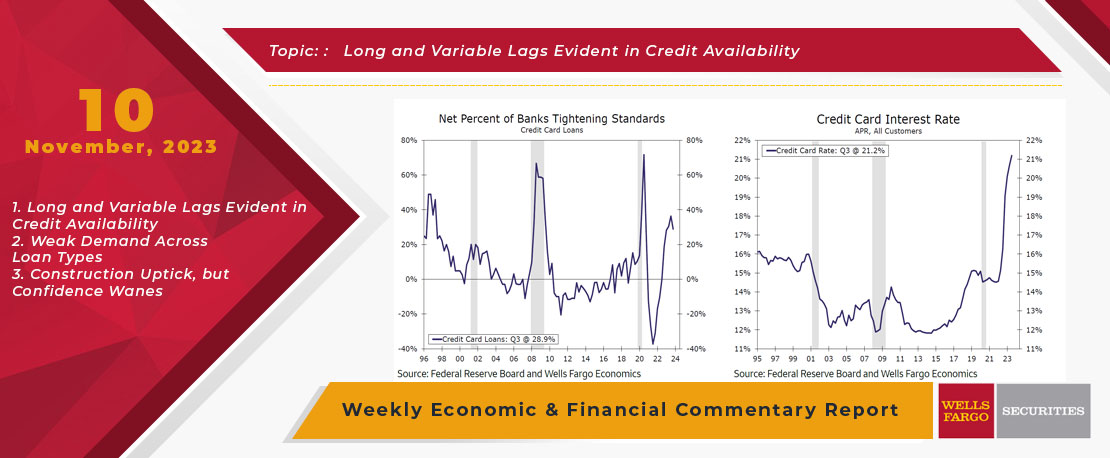

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

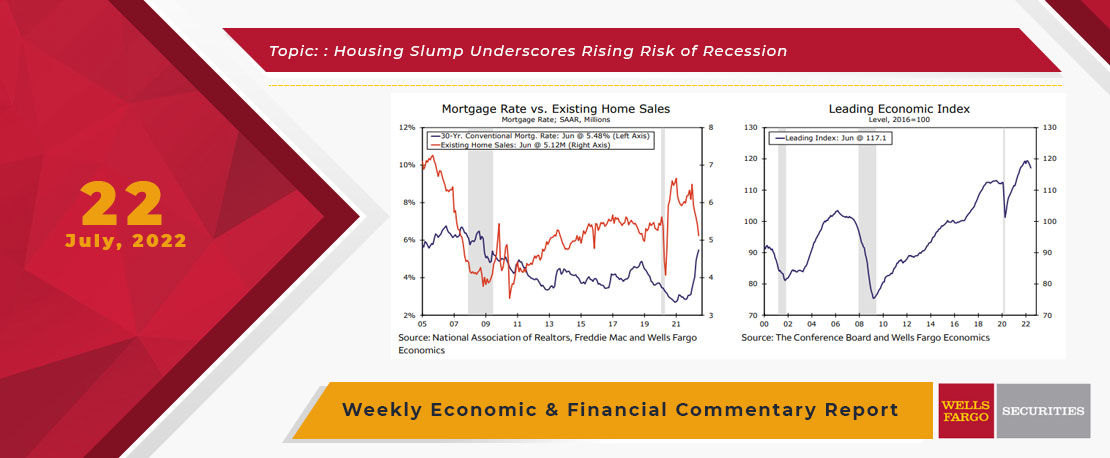

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

This Week's State Of The Economy - What Is Ahead? - 03 May 2024

Wells Fargo Economics & Financial Report / May 10, 2024

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions.