Financial markets reacted in a zig-zag pattern to this week's economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy. At the same time, consumer goods spending and manufacturing activity are slowing, but not yet to a worrying degree consistent with contraction, and not enough to aid in bringing inflation lower. This week's data have thus further confirmed our view that the FOMC will press ahead with another 75 bp rate hike at its meeting next week. For more detail on our expectations for its meeting, please see our Domestic Outlook and Interest Rate Watch sections.

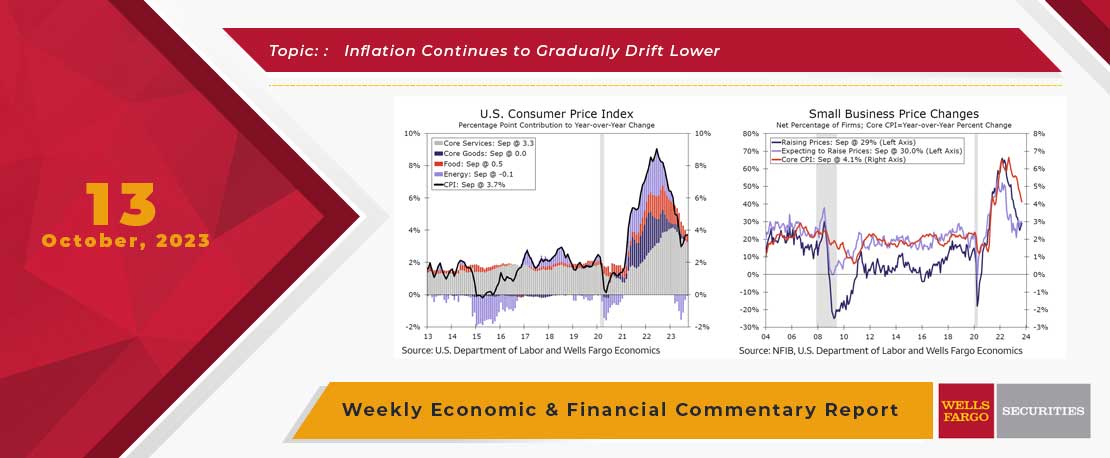

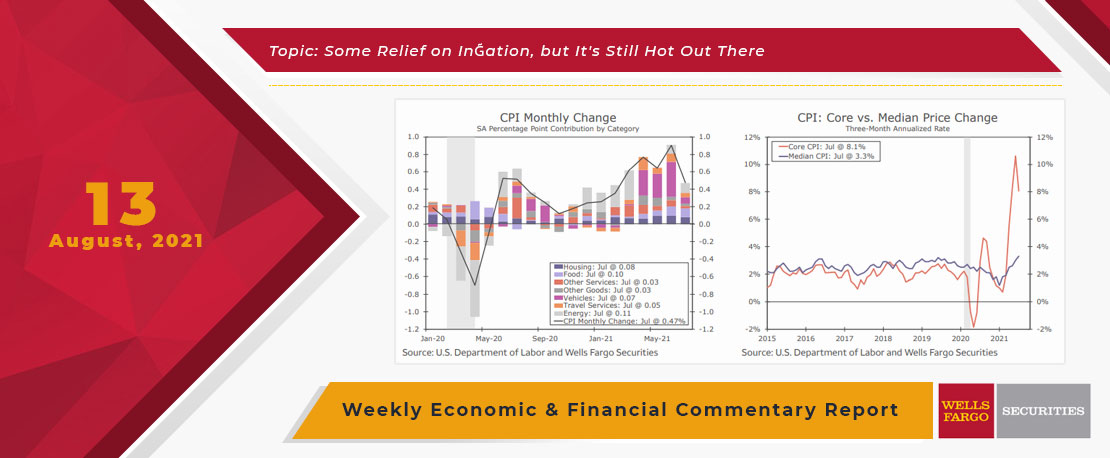

Wednesday's release of the August Consumer Price Index received the most market attention, in part because it came in hotter than the consensus estimate but also because the underlying details were a bit disappointing. Consumer prices rose 0.1% last month, while the consensus Bloomberg estimate had been looking for an equivalent 0.1% decline. This price gain still helped lower the year-over-year rate of price growth to 8.3%, which is a welcome but insufficient step in relieving excruciatingly high inflation for Americans.

The 0.6% gain in core inflation (excluding food and energy), which was more than double the consensus expectation, demonstrates that price pressure remains widespread across the economy. Core goods inflation specifically remained strong (+0.5%) despite indications that supply chains are functioning more smoothly, inventory stockpiles are building and goods spending is gradually slowing. Goods prices thus did not provide the needed offset to higher core services inflation, which saw a 0.6% rise due in part to stronger shelter inflation. Over the past three months, the core CPI has advanced at a 6.5% annualized pace, more than triple the Fed's 2% target (chart). A sustained return to 2% inflation remains even more distant at present, and the price data suggest more has to be done to rein in this stubbornly high level of inflation.

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

This Week's State Of The Economy - What Is Ahead? - 4 October 2019

Wells Fargo Economics & Financial Report / Oct 05, 2019

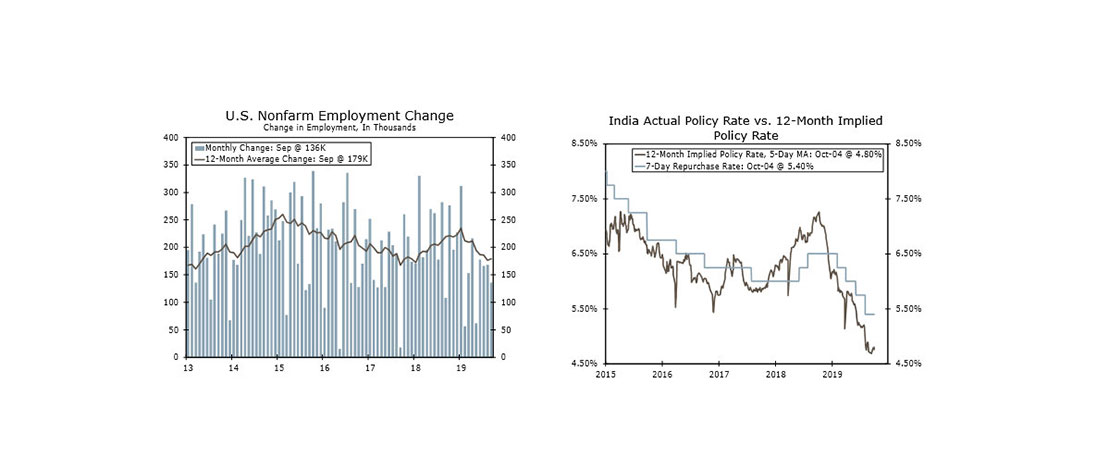

Survey evidence flashed signs of contraction in the manufacturing sector and indicated weakness spreading to the services side of the economy, while employers added a less-than-expected 136K jobs in September.

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

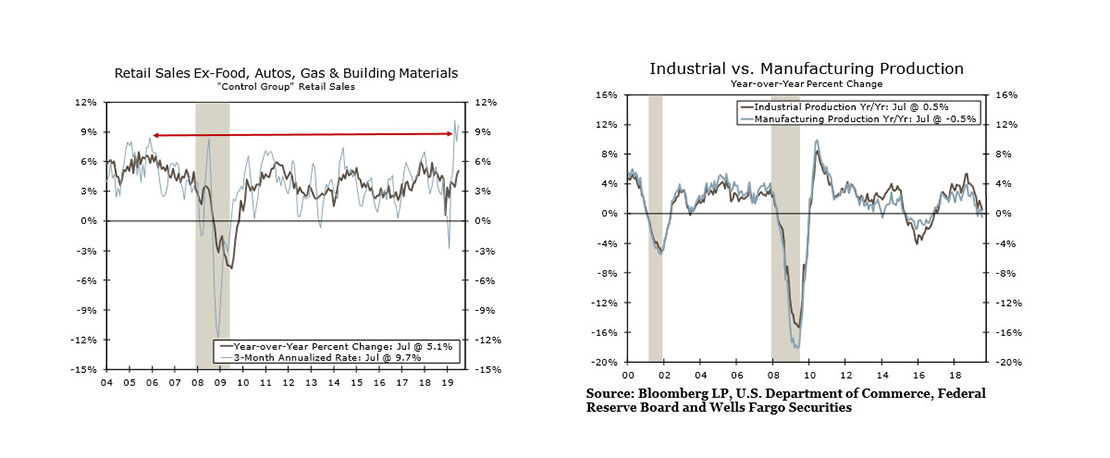

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

This Week's State Of The Economy - What Is Ahead? - 10 July 2020

Wells Fargo Economics & Financial Report / Jul 13, 2020

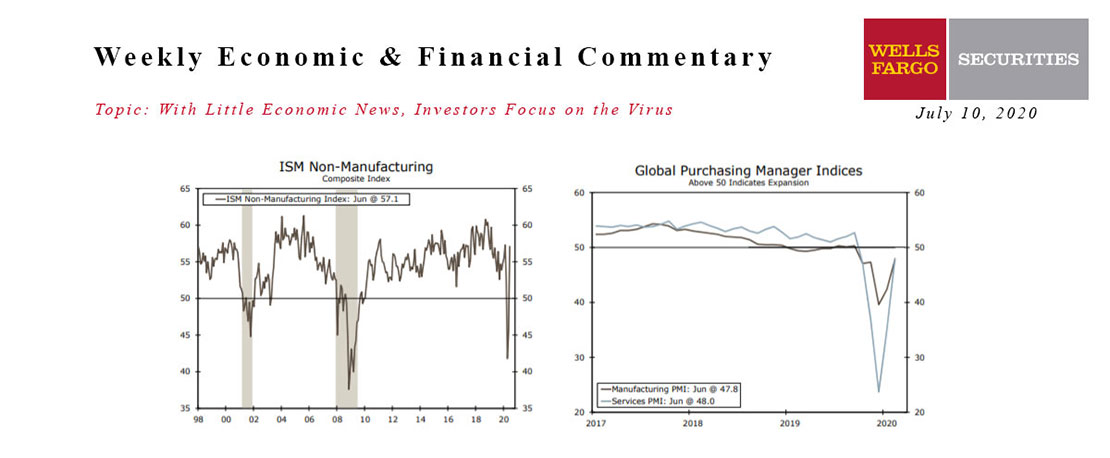

The ISM non-manufacturing index jumped 11.7 points to 57.1, reflecting the broadening re-opening of the economy.

This Week's State Of The Economy - What Is Ahead? - 31 March 2023

Wells Fargo Economics & Financial Report / Apr 08, 2023

This week brought glimpses of market stabilization after weeks of turmoil. Although consumers seem unfazed by the uproar, tighter credit conditions coming down the pipeline will likely weigh on growth.

This Week's State Of The Economy - What Is Ahead? - 13 August 2021

Wells Fargo Economics & Financial Report / Aug 19, 2021

The general outlook remains positive as households have accumulated over $2T in excess savings on their balance sheets and net worth has risen across all income groups.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

28 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Feb 08, 2021

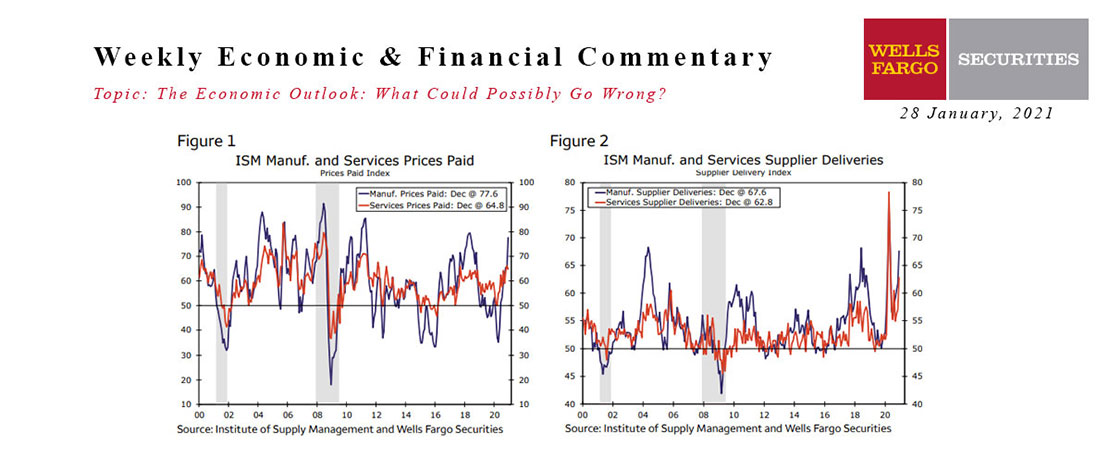

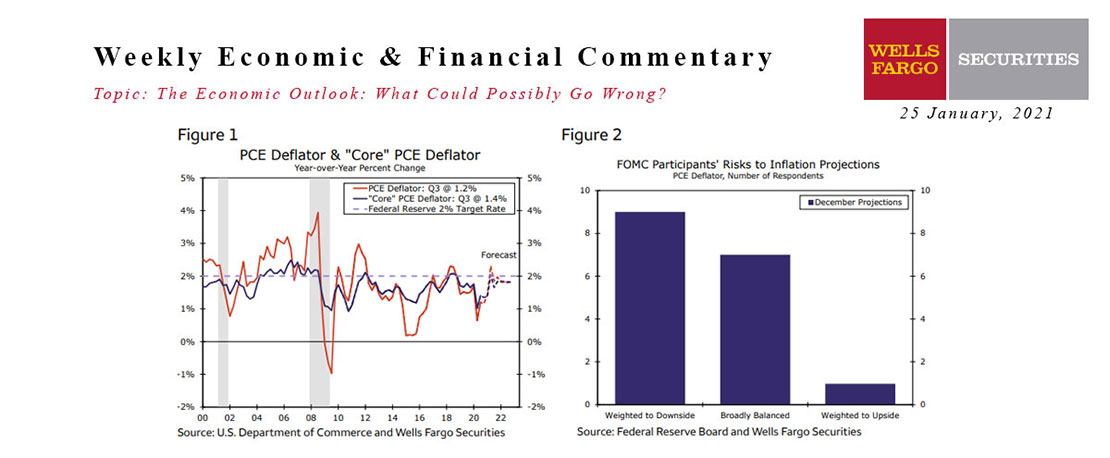

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years.

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

This Week's State Of The Economy - What Is Ahead? - 24 February 2023

Wells Fargo Economics & Financial Report / Feb 28, 2023

Existing home sales declined 0.7% in January, while new home sales leaped 7.2%. Real personal spending shot higher in January, and solid growth in discretionary spending suggests continued consumer resilience.