This week brought glimpses of market stabilization after weeks of turmoil from the fallout from several regional bank failures. The Fed’s swift response and active communication certainly played a role. In a pair of congressional hearings on Tuesday and Wednesday, Fed Vice Chair for Supervision Michael Barr reiterated Chair Powell’s prior sentiment that the banking system remains broadly stable. When speaking on contagion risks, Barr emphasized the Federal Reserve’s commitment to continued financial stability, stating “we will continue to closely monitor conditions in the banking system and are prepared to use all of our tools for any size institution, as needed, to keep the system safe and sound.” These comments reinforce our view that the broader banking system remains in solid financial health, and the events of the past month are unlikely to trigger a repeat of the global financial crisis.

Although banking flare-ups have so far been contained, tighter credit conditions are likely to persist for some time. Credit spreads have narrowed over the past two weeks, but remain wider today than before the banking system first showed signs of instability in early March. Firms looking to grow and invest will also likely face stricter lending standards in the months ahead. These developments put downward pressure on economic growth, underpinning our expectations for a recession later this year.

So far, there is little indication that banking sector uproar has rocked consumers. The Consumer Confidence index rose from 103.4 in February to 104.2 in March, a survey period that encompassed the recent bank failures. Instead, favorable labor market conditions continued to flatter consumer perceptions. Despite its slip over the month, March’s labor differential, defined as the percentage of consumers viewing jobs as plentiful minus the percentage viewing jobs as hard to get, posted its second-highest reading since June 2022. That said, consumers are still wary about the near-term outlook. The expectations index improved to 73.0 in March but has read below 80—the level that historically signifies a high likelihood of recession within one year—for 12 of the past 13 months.

In the same vein, consumers’ appetite to spend at the start of the year proved to be even stronger than originally thought. The 1.1% real spending increase in January was revised higher to a 1.5% jump in today’s personal income and spending report, providing an even stronger tailwind for Q1 GDP growth. As expected, January’s surge led to some giveback in February. Stacked up against persistent inflation, this deceleration amounted to a 0.1% decline in real spending—the third real decline in the past four months. Yet tight labor markets continue to support income growth, providing consumers with a more sustainable source of spending power as their excess savings dwindle. Real disposable personal income rose for the eighth straight month, advancing 0.2% in February.

from the National Association of Realtors suggest that the median home price bounced back in February, reflecting renewed buyer interest brought on by lower mortgage rates in December and January. Although mortgage rates have since resumed their climb, some of that momentum seems to have carried forward to February, evidenced by the upside surprise in pending home sales (+0.8%).

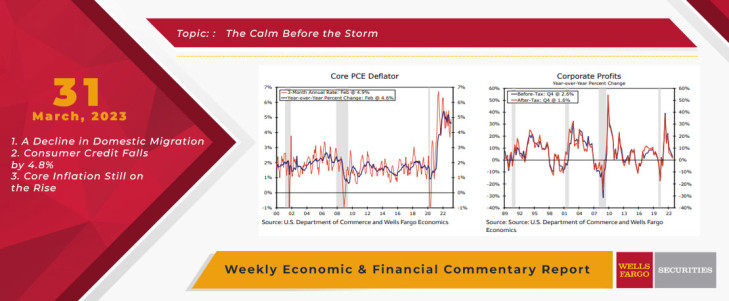

This week, we also received the final estimate of GDP growth and the first estimate of corporate profits for Q4-2022. The 2.6% annualized pace of GDP growth was little changed from the prior estimate (2.7%); however, consumer spending was revised down to half of its original strength (1.0% versus 2.1% first reported). Consistent with weak consumer spending and elevated labor costs at the end of the year, economy-wide profits fell by $60.5 billion in the fourth quarter. On top of tighter credit conditions and stricter lending standards coming down the pipeline, we expect declining profits to lead to a pullback in capital expenditures.

Looking to next week, all eyes will be on nonfarm payrolls. The Fed will only get one more look at employment and inflation before the next FOMC meeting in May, each of which will reflect conditions in March. February's core PCE deflator was a step in the right direction, coming in below expectations at 0.3% with January's increase also revised lower. However, the 4.9% three-month annualized rate is still uncomfortably high for the Fed. Economic momentum in Q1 makes it unlikely that March's readings will give the Fed enough room to justify a pause. As such, we continue to expect a 25 bps hike at the next meeting. By mid-June, however, we expect to see more material deceleration in inflation and signs of slowing activity that prompt the Fed to end its tightening cycle.

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

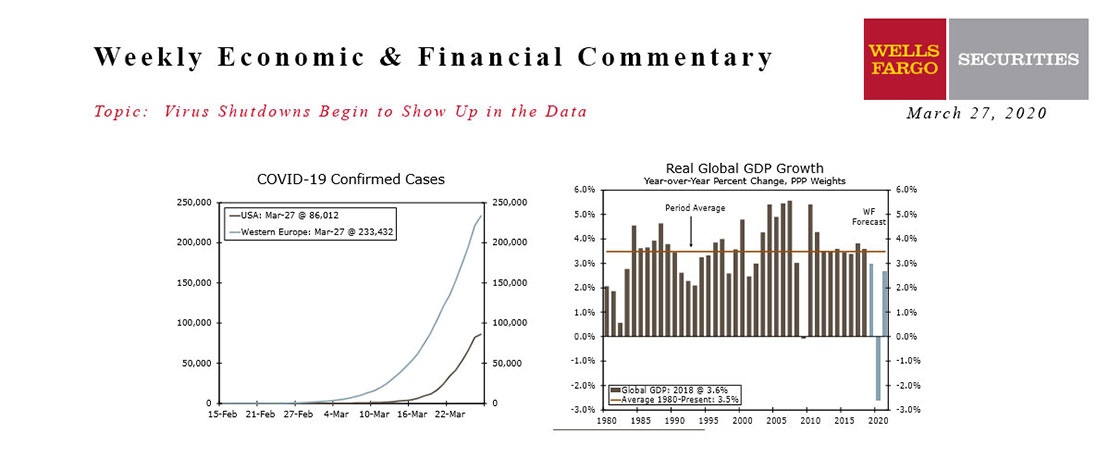

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

This Week's State Of The Economy - What Is Ahead? - 25 September 2020

Wells Fargo Economics & Financial Report / Sep 28, 2020

Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.

This Week's State Of The Economy - What Is Ahead? - 05 April 2024

Wells Fargo Economics & Financial Report / Apr 09, 2024

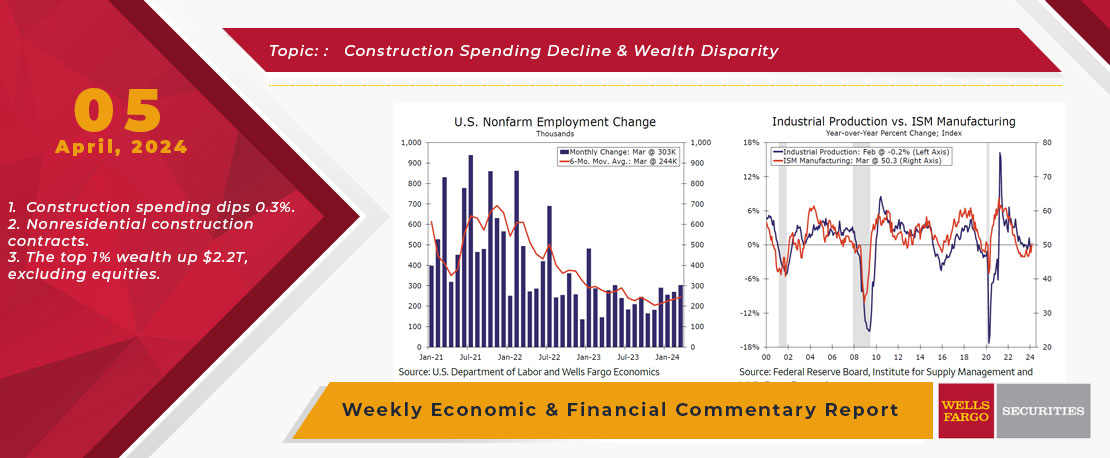

Nonfarm payrolls expanded 303K in March, surpassing all estimates submitted to Bloomberg. The continued strength in hiring suggests less urgency for policymakers at the Federal Reserve to lower the target range of the fed funds rate.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

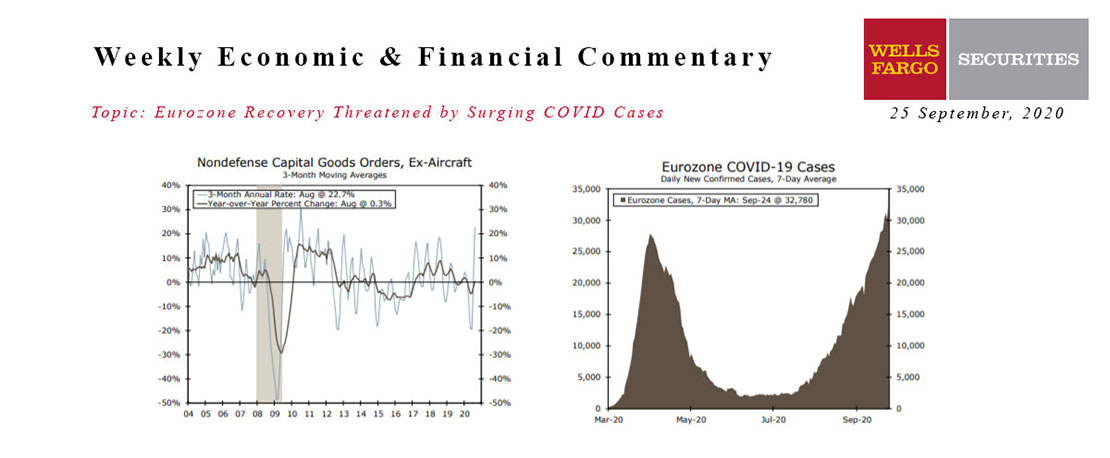

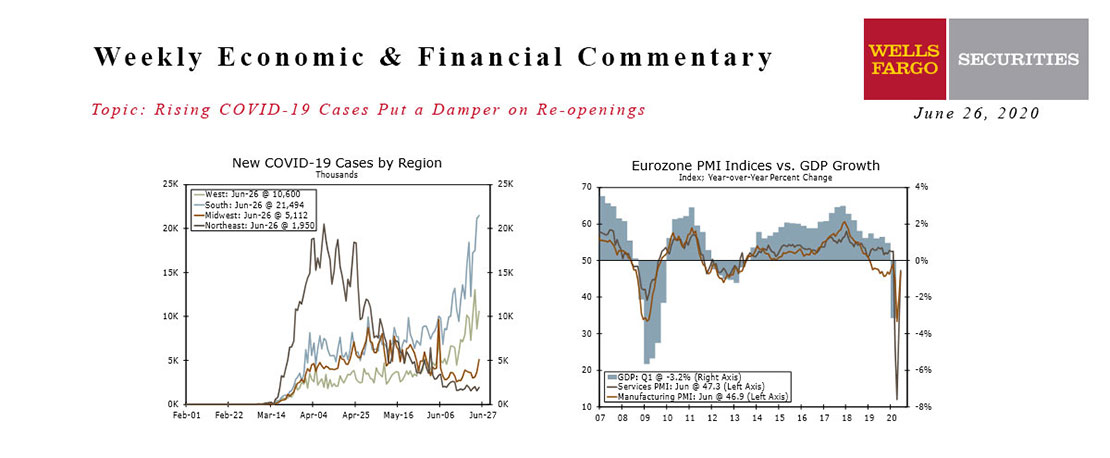

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

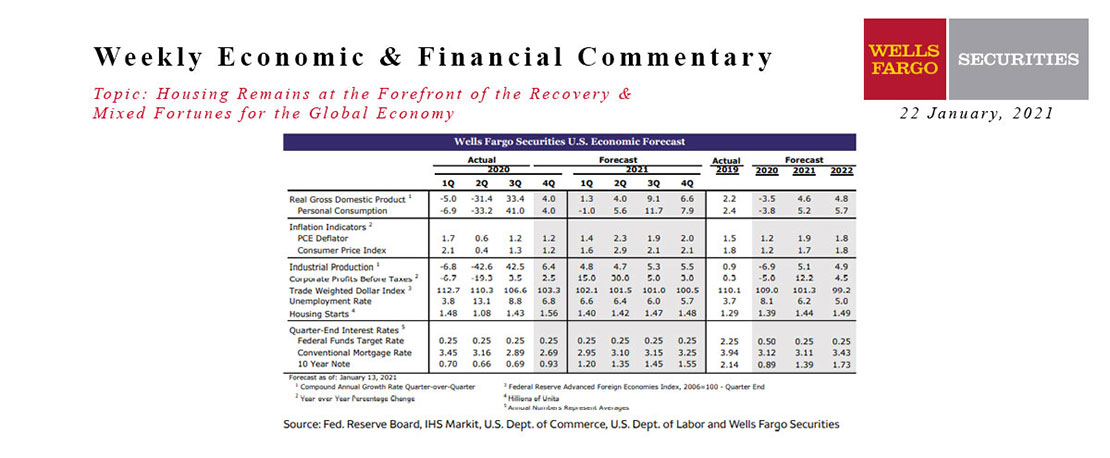

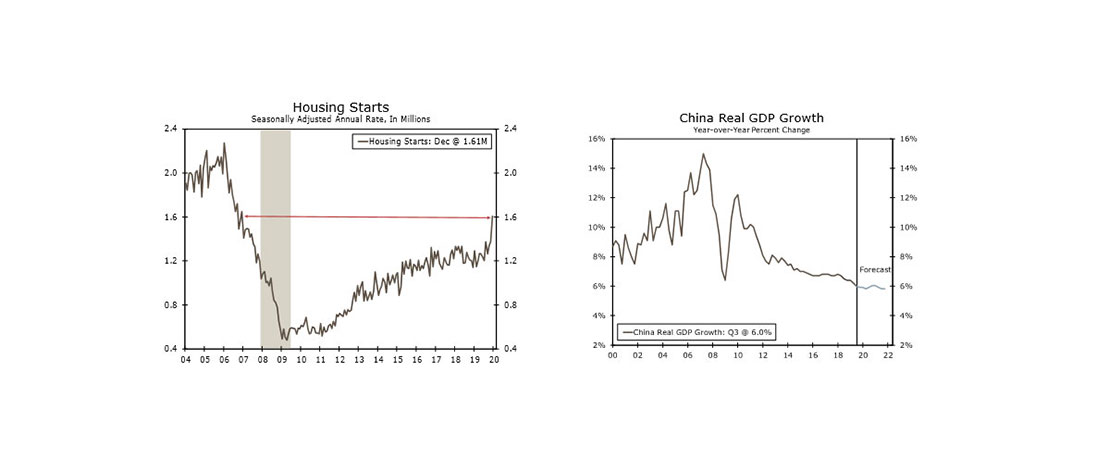

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

September 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Sep 19, 2020

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

This Week's State Of The Economy - What Is Ahead? - 21 June 2024

Wells Fargo Economics & Financial Report / Jun 25, 2024

Retail sales rose just 0.1% over the month, falling short of consensus and suggesting that consumers may finally be feeling some spending fatigue.

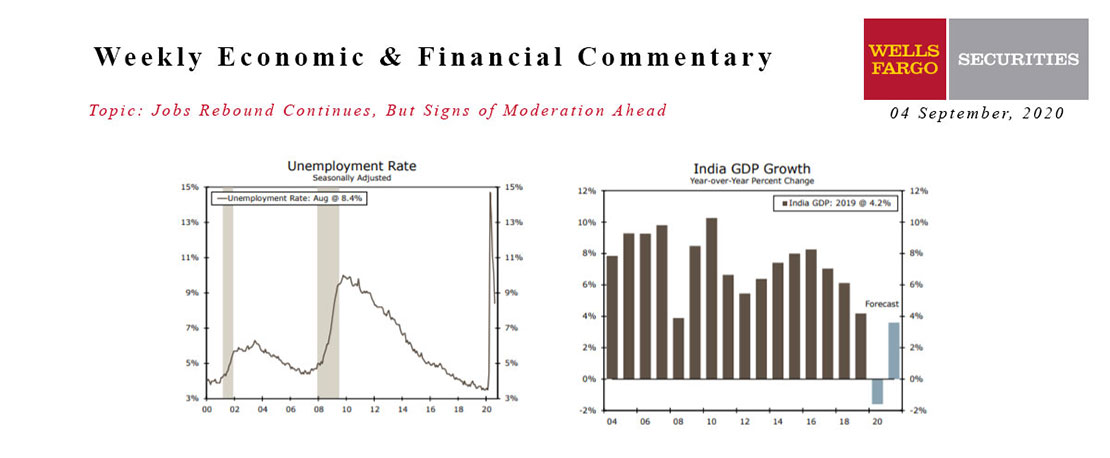

This Week's State Of The Economy - What Is Ahead? - 04 September 2020

Wells Fargo Economics & Financial Report / Aug 29, 2020

Employers added jobs for the fourth consecutive month in August, bringing the total number of jobs recovered from the virus-related low to 10.5 million.