U.S. - More Strong Housing Numbers

- Existing home sales rose 2.4% to a 6.0-million unit annual pace. The surge in sales further depleted inventories and pushed prices sharply higher.

- The IHS Market Purchasing Managers’ survey noted that manufacturing conditions improved in September.

- New home sales soared 4.8% to a 1.011-million unit pace, marking the strongest sales pace since September 2006.

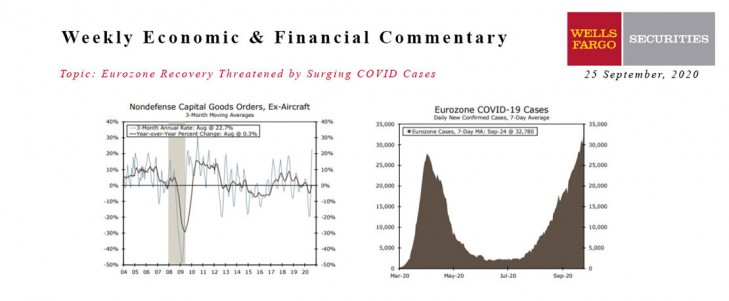

- Durable goods orders were stronger than the 0.4% headline gain suggests. Core nondefense capital goods orders rose 1.8%, and are up at a 22.7% pace over the past three months.

Global - Eurozone Recovery Threatened by Surging COVID Cases

- Surging new COVID-19 cases across Europe have threatened the continent’s economic recovery. Daily new cases are now above the peak seen in March/April, although this does not account for differences in testing.

- Against this backdrop, Eurozone September PMI indices were closely scrutinized by market participants this week. The services PMI showed further weakness, falling into contraction territory at 47.6.

- Elsewhere, the Bank of Mexico cut its overnight interbank interest rate 25 bps to 4.25%. Most forecasters in the Bloomberg survey expected the cut.

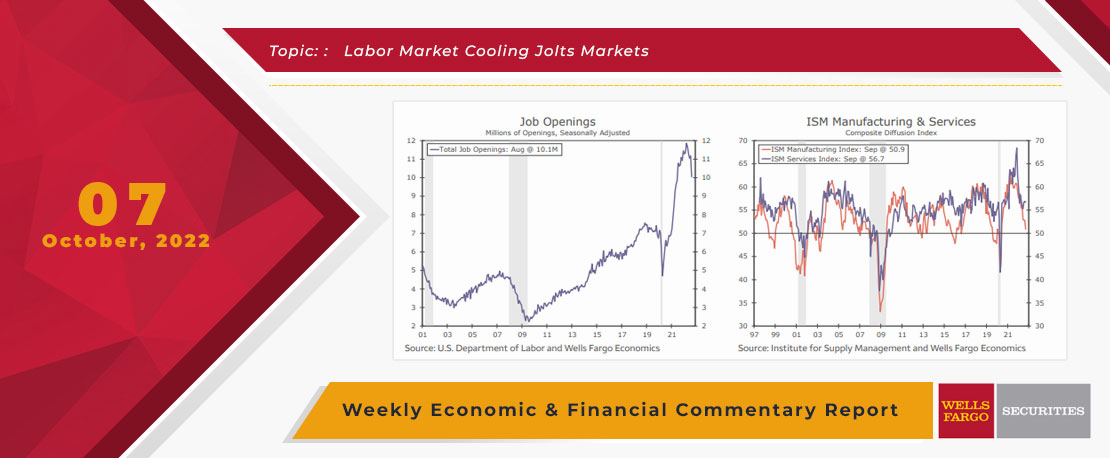

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

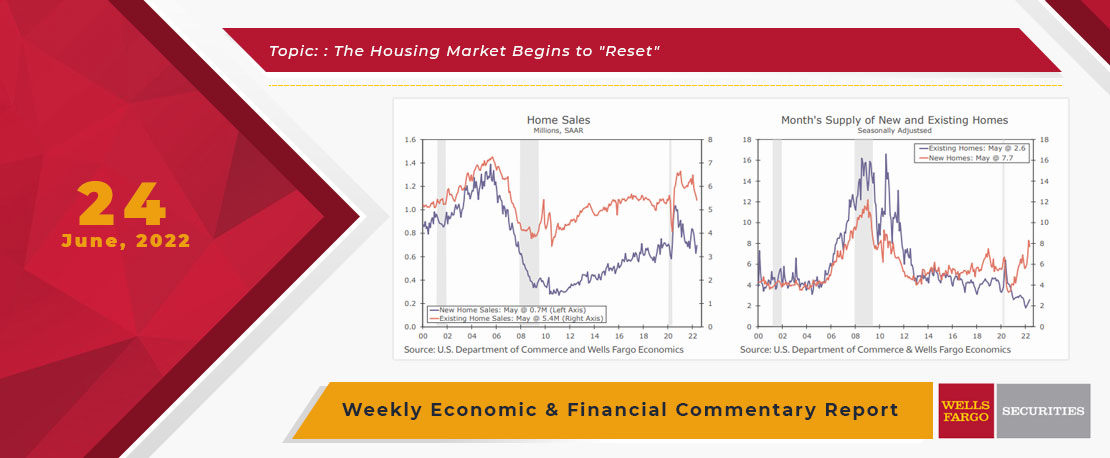

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.

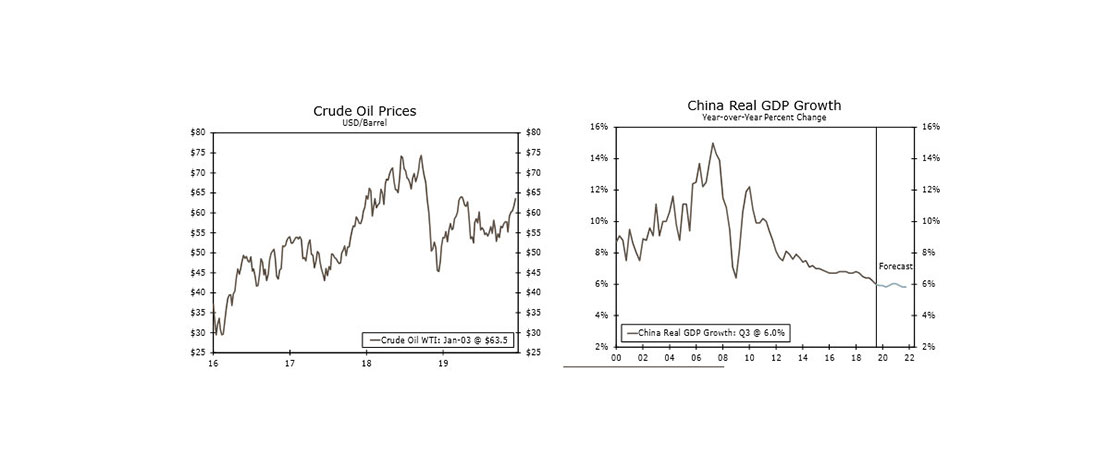

This Week's State Of The Economy-What Is Ahead?

Wells Fargo Economics & Financial Report / Aug 03, 2019

How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy?

This Week's State Of The Economy - What Is Ahead? - 03 May 2024

Wells Fargo Economics & Financial Report / May 10, 2024

The Federal Reserve can afford patience thanks to a resilient labor market. During April, total nonfarm payrolls rose by 175,000 net jobs, continuing a string of solid monthly payroll additions.

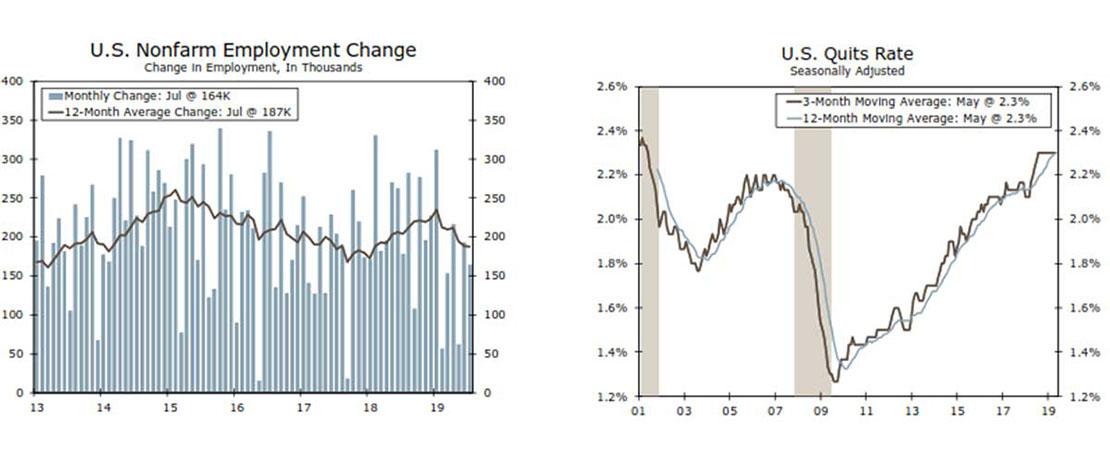

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

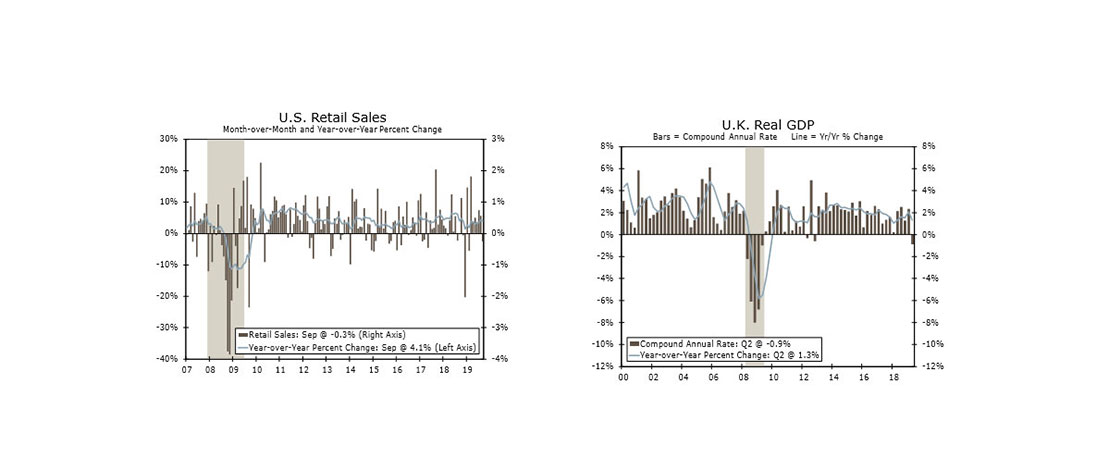

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

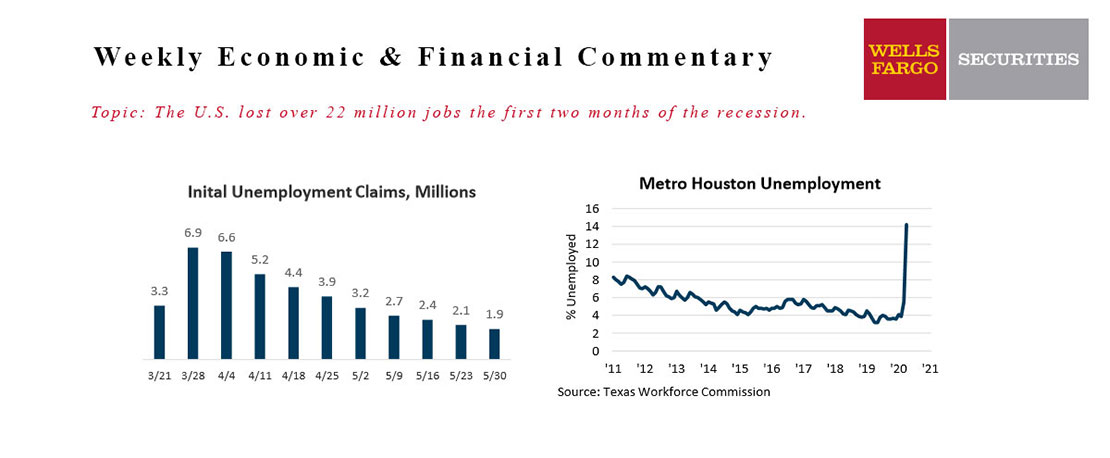

June 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jun 18, 2020

The Fed expects to hold interest rates near zero through the end of this year, perhaps well into next year, and maybe even into ’22.

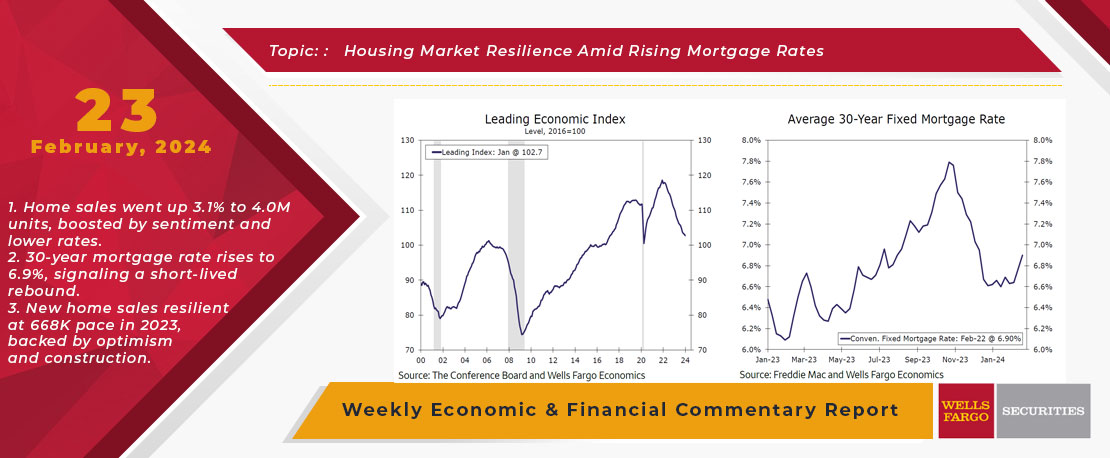

This Week's State Of The Economy - What Is Ahead? - 23 February 2024

Wells Fargo Economics & Financial Report / Feb 27, 2024

Stronger-than-expected inflation, underpinned by the mildly hawkish minutes from the January FOMC meeting, drove a move higher in mortgage rates.

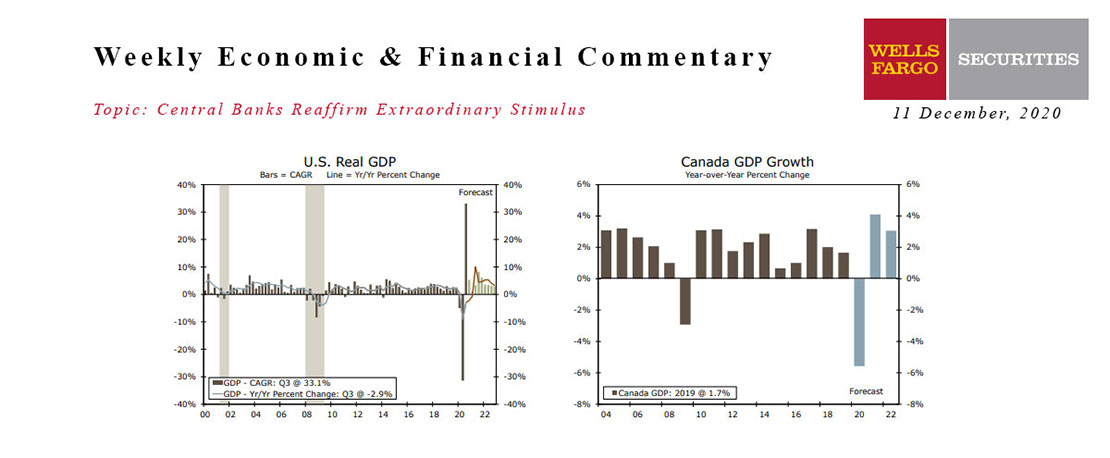

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

This Week's State Of The Economy - What Is Ahead? - 03 January 2020

Wells Fargo Economics & Financial Report / Jan 04, 2020

Markets were also pressured from the latest ISM manufacturing report, which signaled further deterioration in the sector with the index falling to its lowest level since 2009.

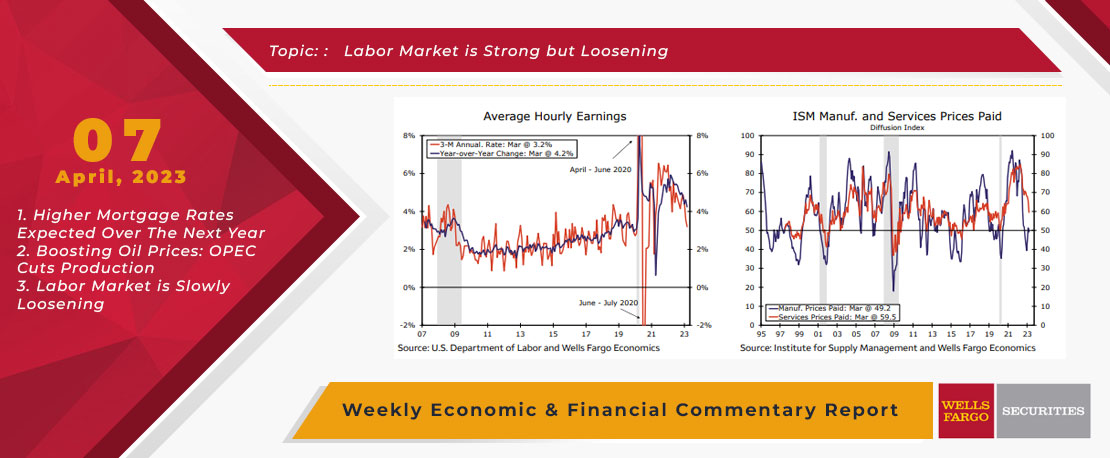

This Week's State Of The Economy - What Is Ahead? - 07 April 2023

Wells Fargo Economics & Financial Report / Apr 10, 2023

Employers added jobs at the slowest pace since 2020 in March, job openings fell and an upward trend in initial jobless claims has emerged.