How will Fed rates-cut and Trump 10% tariff on $300 Billion Chinese Goods countered by Chinese currency devaluation against Dollar, affect inflation and economic slowdown in US economy? Read the comprehensive reports from Wells Fargo Securities Economics Group.

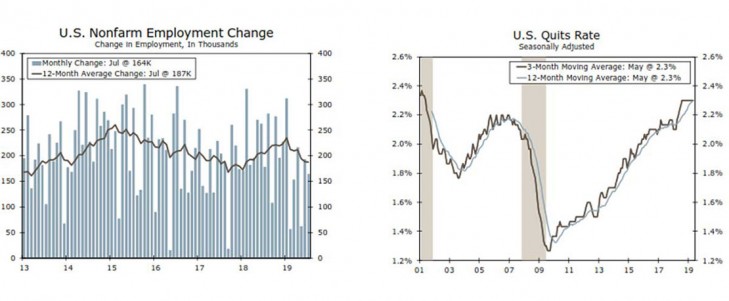

The Fed cut rates this week for the first time since December 2008, lowering the fed funds rate 25 bps to 2.25% in a move widely telegraphed by Fed officials and wholly anticipated by financial markets. Attention was more focused on the Fed's next move, and whether or not 25 bps would be sufficient to sustain the expansion. Markets took the move as a mildly hawkish cut, with the yield curve flattening and equities falling in response. Chair Powell gave investors a lot to digest in his post-meeting press conference, particularly with his mixed messaging on whether or not this cut was the start of an easing cycle. Powell termed it a mid-cycle adjustment but also indicated the Fed was not necessarily done. We still expect the factors that necessitated this cut will compel the Fed to cut once more this year. Powell cited the downside risks from weak global growth and trade policy uncertainty and sub-target inflation as reasons to insure against an early end to the expansion.

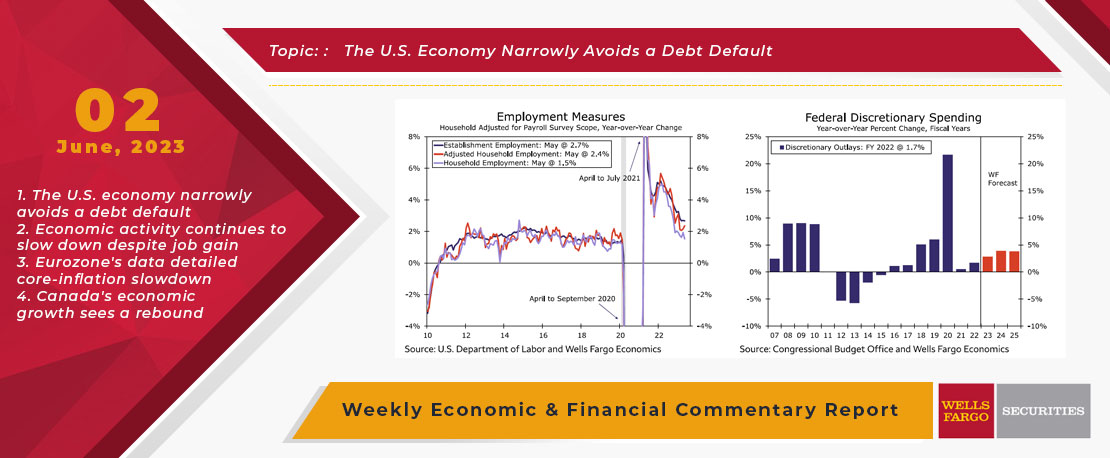

This Week's State Of The Economy - What Is Ahead? - 02 June 2023

Wells Fargo Economics & Financial Report / Jun 06, 2023

This week, Congress and the president prevented what would have been the first default in U.S. history by agreeing to suspend the debt ceiling through the end of 2024.

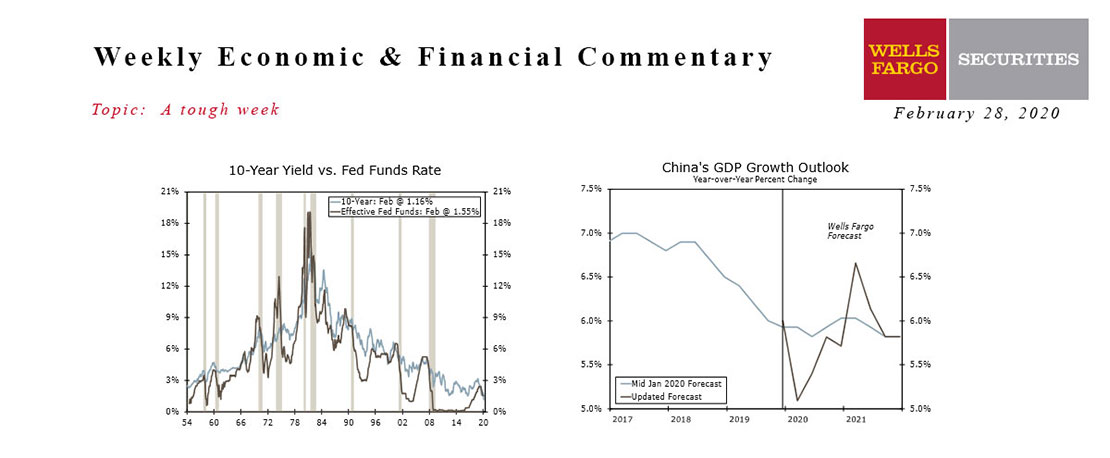

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

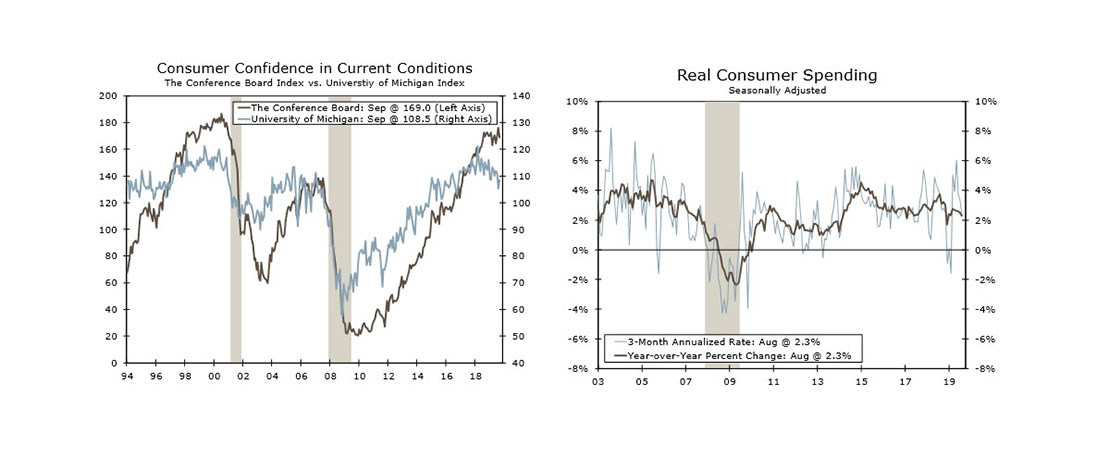

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

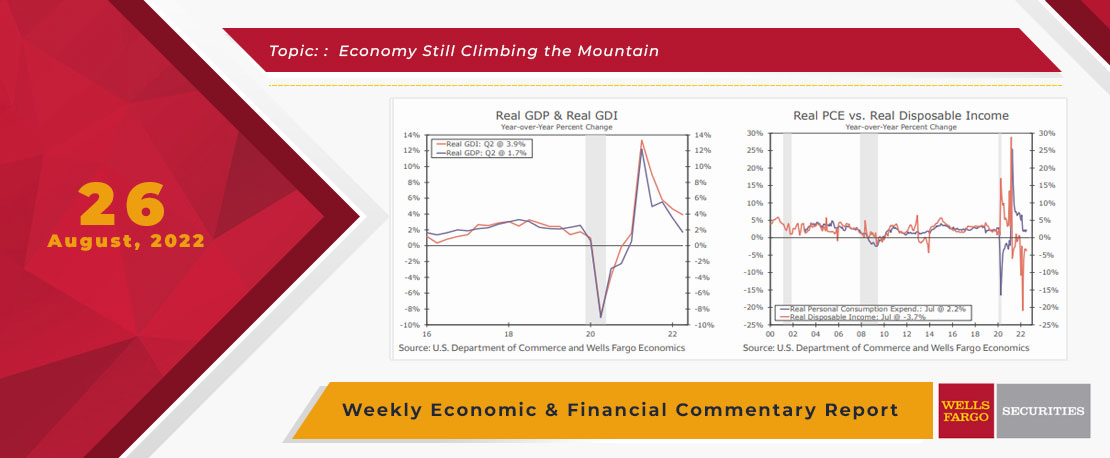

This Week's State Of The Economy - What Is Ahead? - 26August 2022

Wells Fargo Economics & Financial Report / Aug 29, 2022

I can understand how the opportunity to participate in lots of scintillating economic policy discussions could make fishing look exciting in comparison.

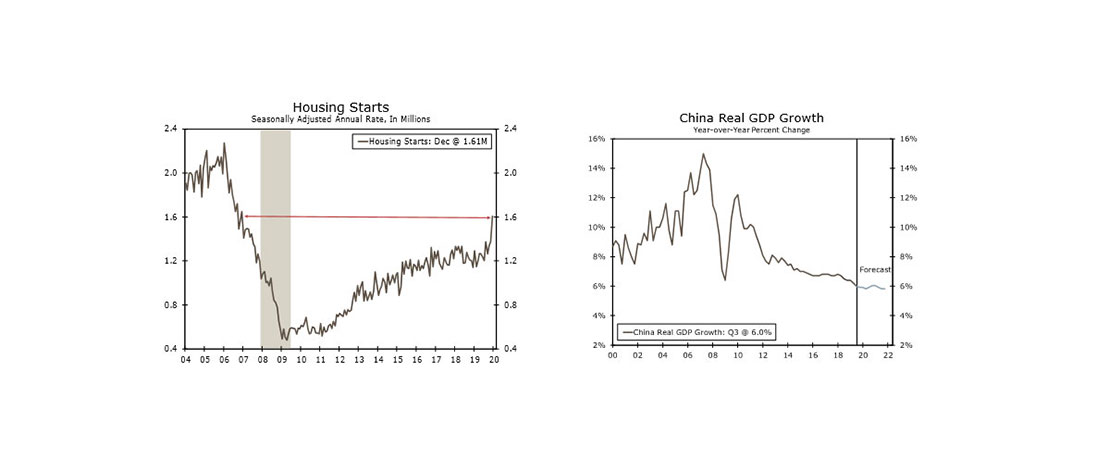

This Week's State Of The Economy - What Is Ahead? - 17 January 2020

Wells Fargo Economics & Financial Report / Jan 18, 2020

Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years. Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

This Week's State Of The Economy - What Is Ahead? - 13 May 2022

Wells Fargo Economics & Financial Report / May 18, 2022

While small business enthusiasm appears to have stalled, as owners are concerned about their ability to continue to pass on higher costs to consumers, cautious enthusiasm around rookie Jeremy Pena’s start persists.

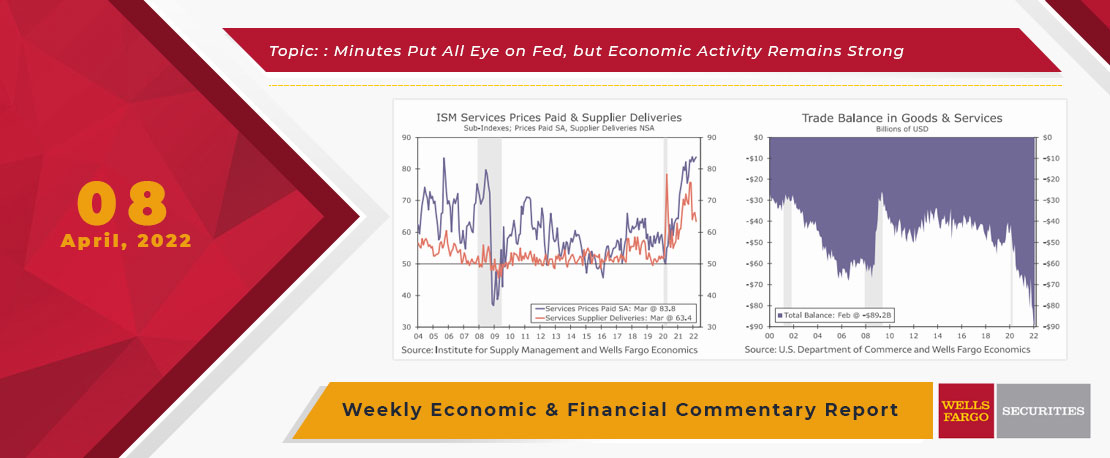

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.

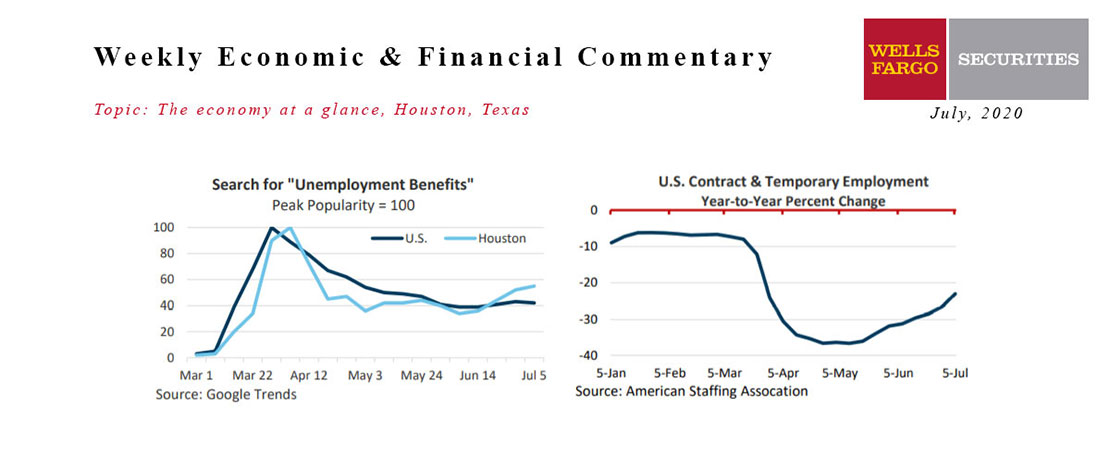

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

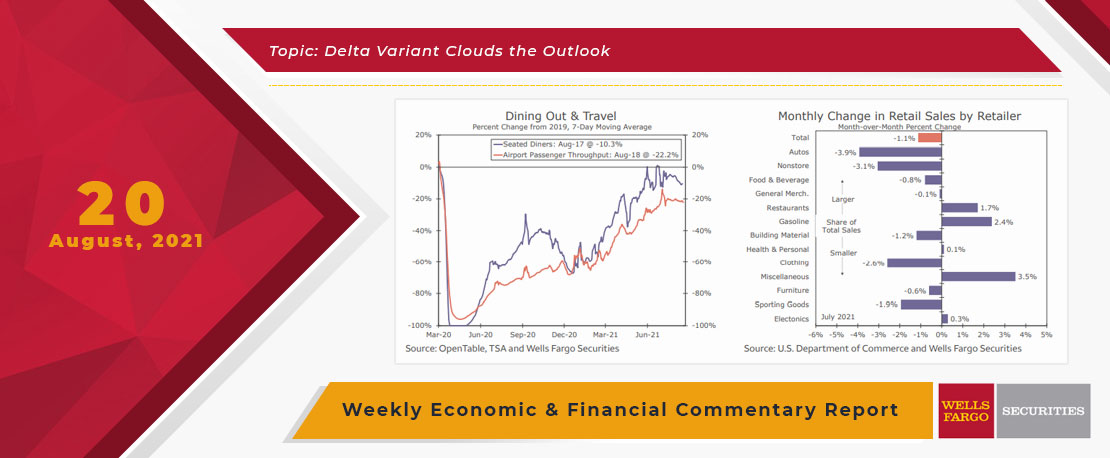

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

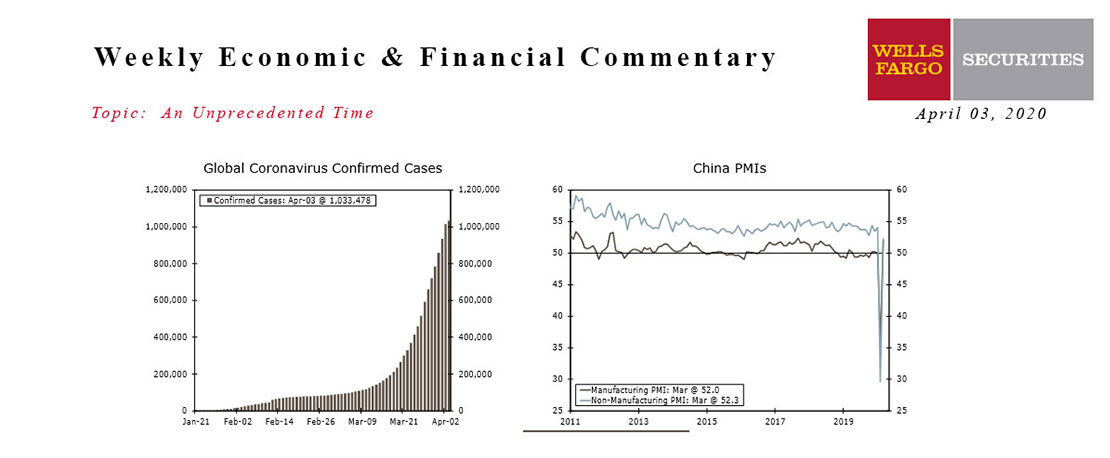

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.