U.S - An Unprecedented Time

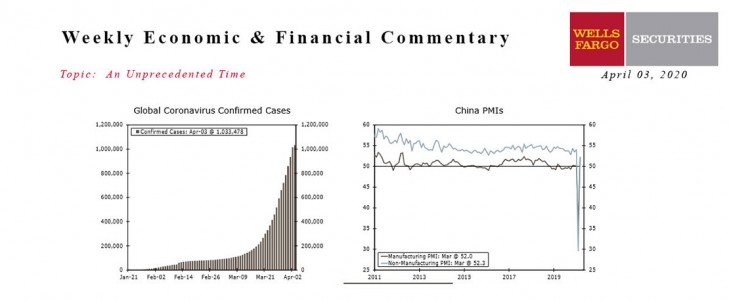

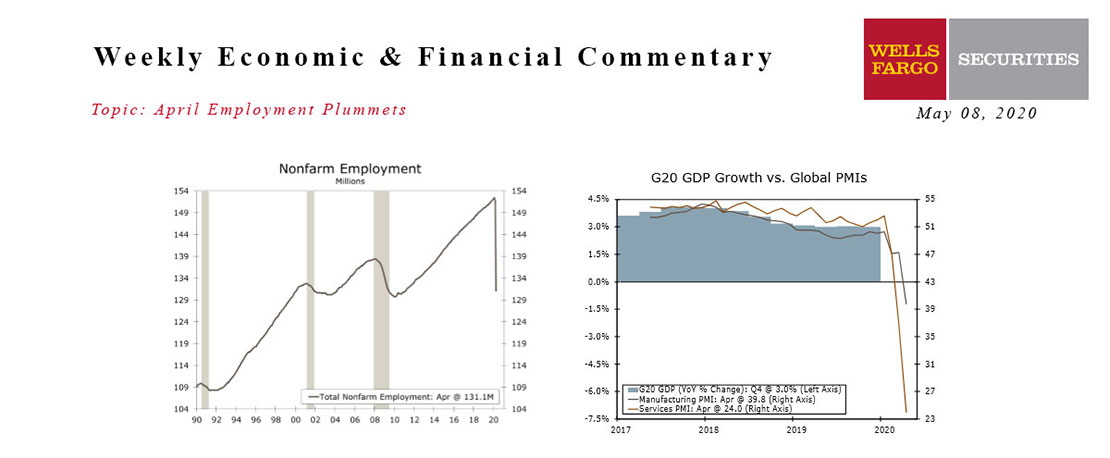

- Data this week began to show just how large the coronavirus-related impact on the economy will be. Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.

- Employers reported payrolls declined by 701 K workers in March. This decline comes before the worst of the coronavirus-related impacts on the once-strong labor market and only hints at what’s in store. Job losses will be in the millions in April.

- President Trump tweeted favorable comments of Russia and Saudi Arabia’s relationship, but it’s unclear if coordinated production cuts will occur. Oil prices remain exceptionally low.

Global - Sentiment Indicators Still Point Down in Many Countries

- This week, we received a bit more detail on the economic impact many international economies face following the outbreak of the coronavirus. Initial market sentiment indicators still pointed down in most countries with the Market manufacturing and services PMIs revised lower in the Euro zone and United Kingdom.

- China’s PMIs returned to expansion in March, with the manufacturing PMI climbing 16.3 points. Meanwhile the non-manufacturing index also rose, and the index for small firms surged the most since 2017.

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

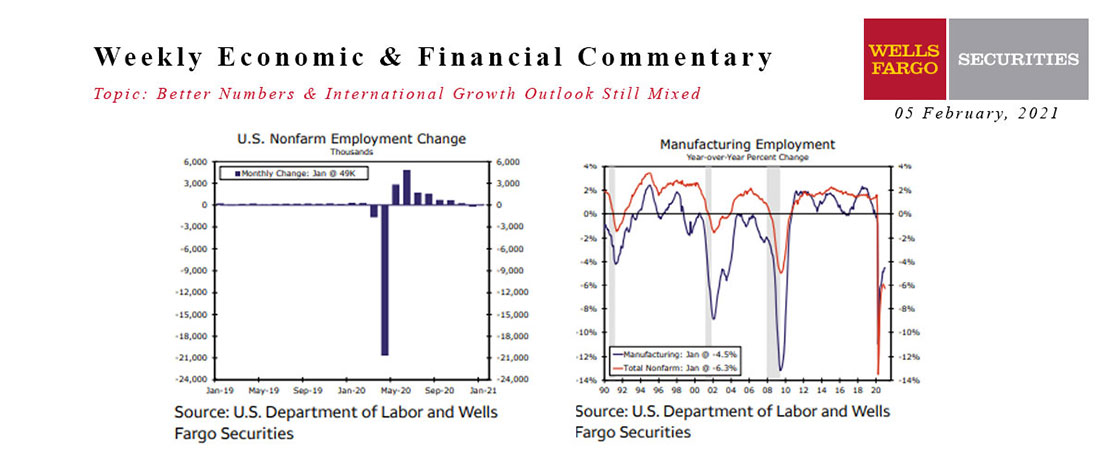

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

This Week's State Of The Economy - What Is Ahead? - 23 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

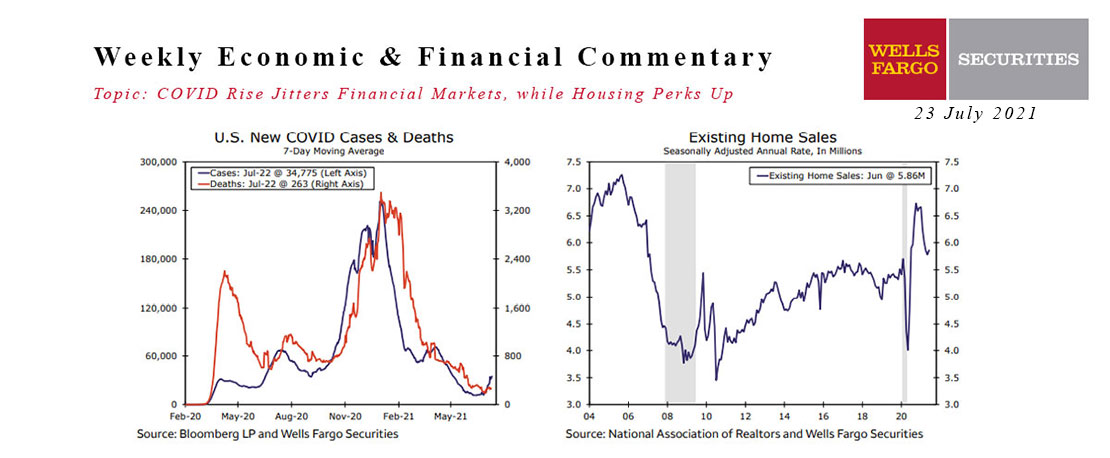

In the biggest financial news this week not connected to college football conference realignment, July\'s NAHB Housing Market Index slipped one point to 80.

This Week's State Of The Economy - What Is Ahead? - 18 November 2022

Wells Fargo Economics & Financial Report / Nov 21, 2022

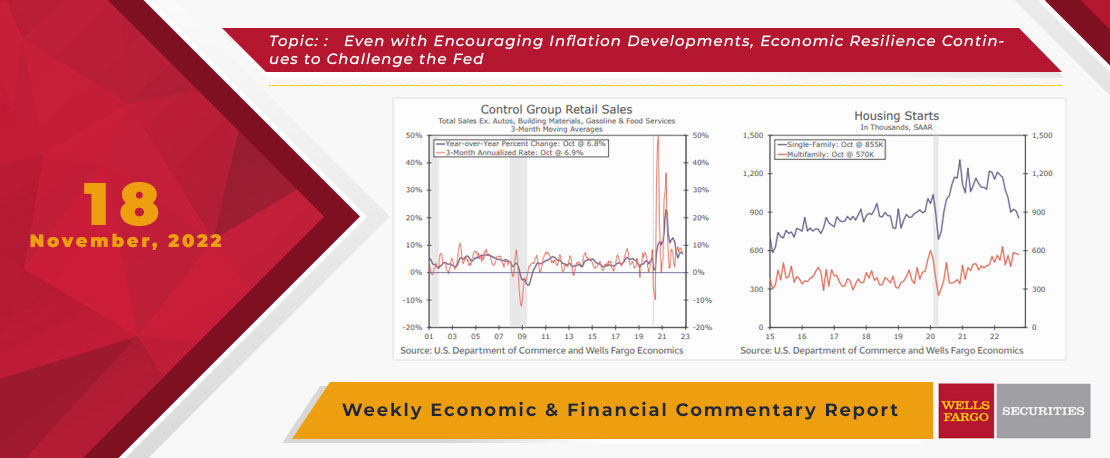

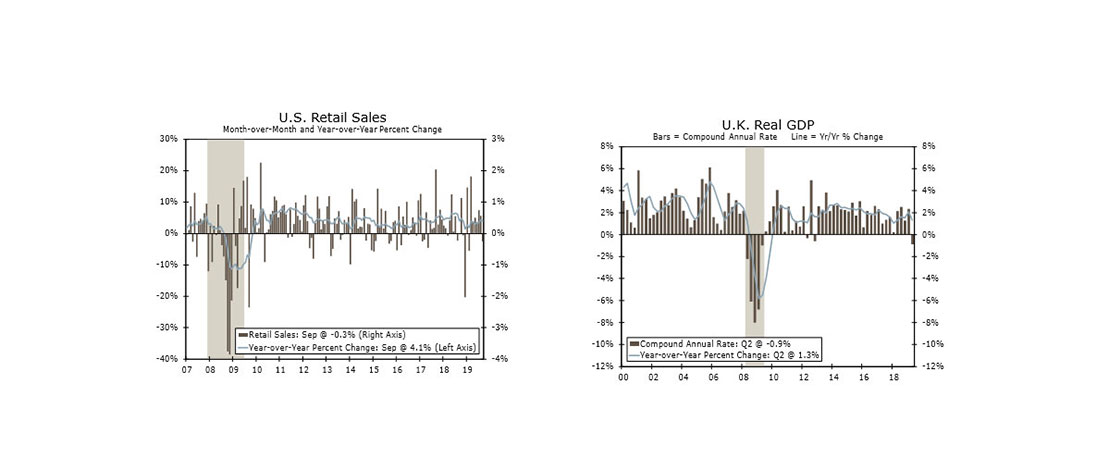

The resiliency of the U.S. consumer was also on display, as total retail sales increased a stronger-than-expected 1.3% in October, boosted, in part, by a 1.3% jump in motor vehicles & parts and a 4.1% rise at gasoline stations.

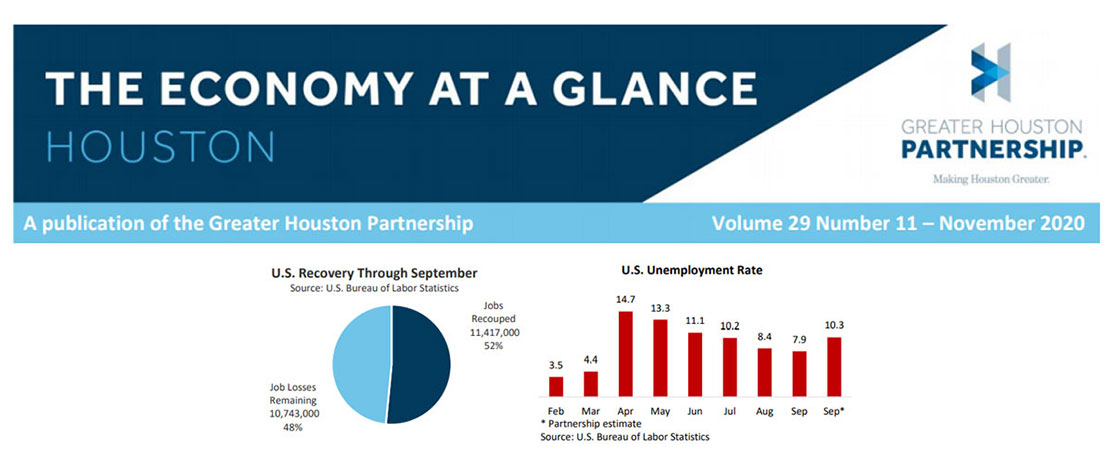

November 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Nov 12, 2020

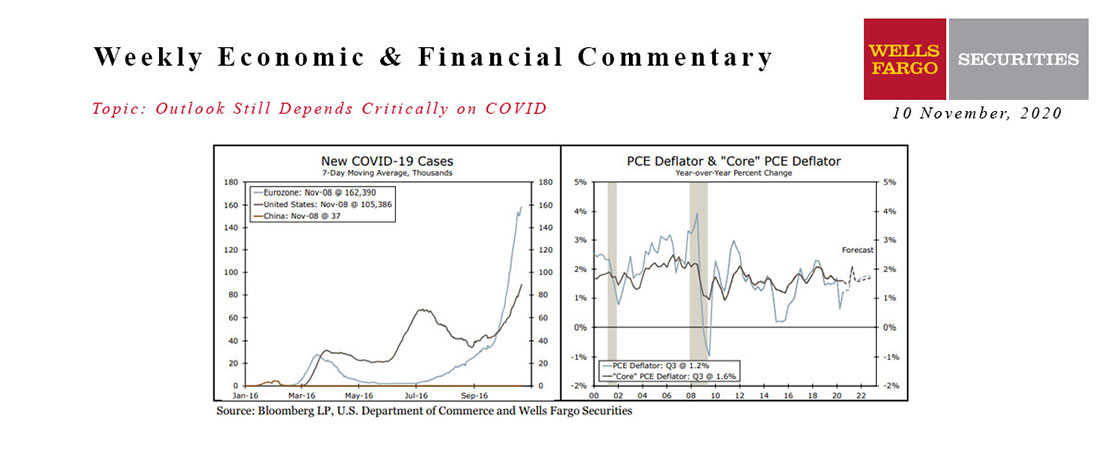

U.S. gross domestic product (GDP) grew 7.4 percent, or $1.3 trillion in Q3, adjusted for inflation.

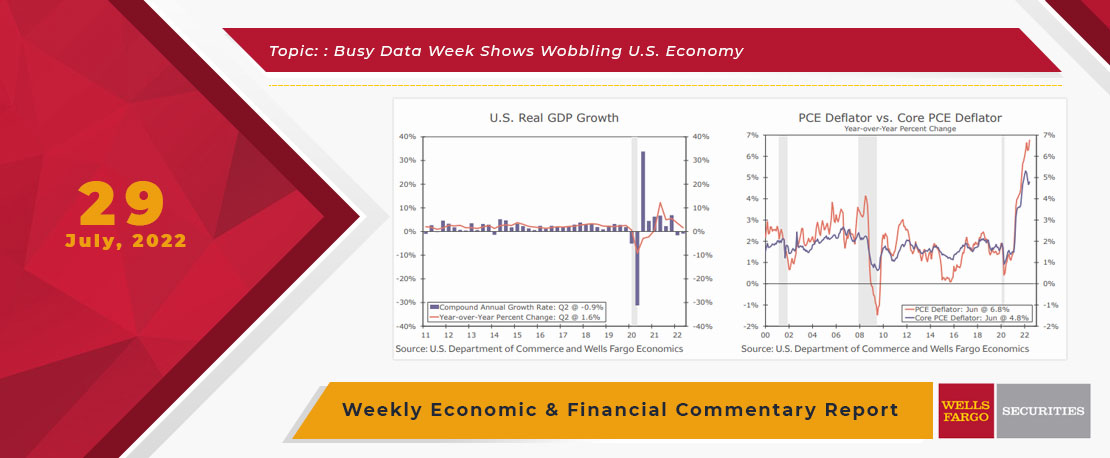

This Week's State Of The Economy - What Is Ahead? - 29 July 2022

Wells Fargo Economics & Financial Report / Jul 31, 2022

Unlike the local temperatures, data released this week showed U.S. economic growth modestly declined in Q2.

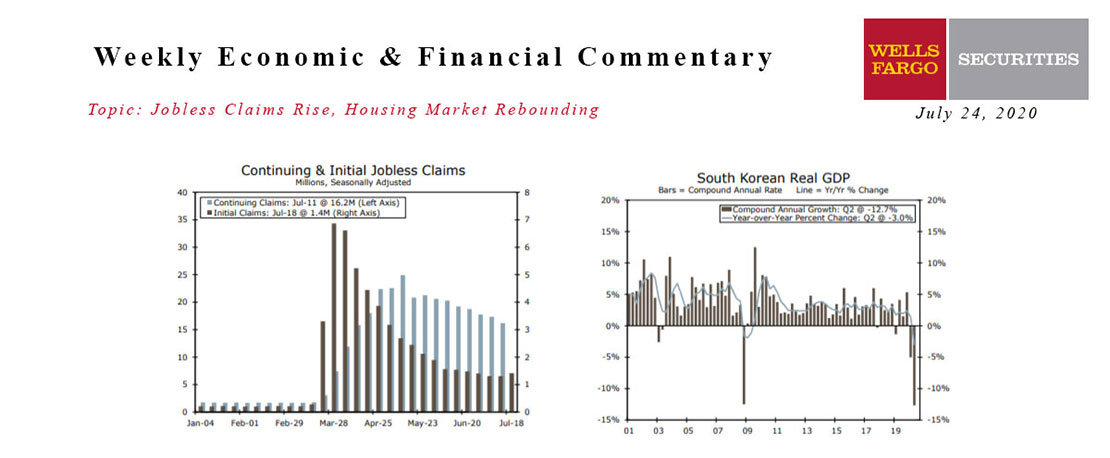

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

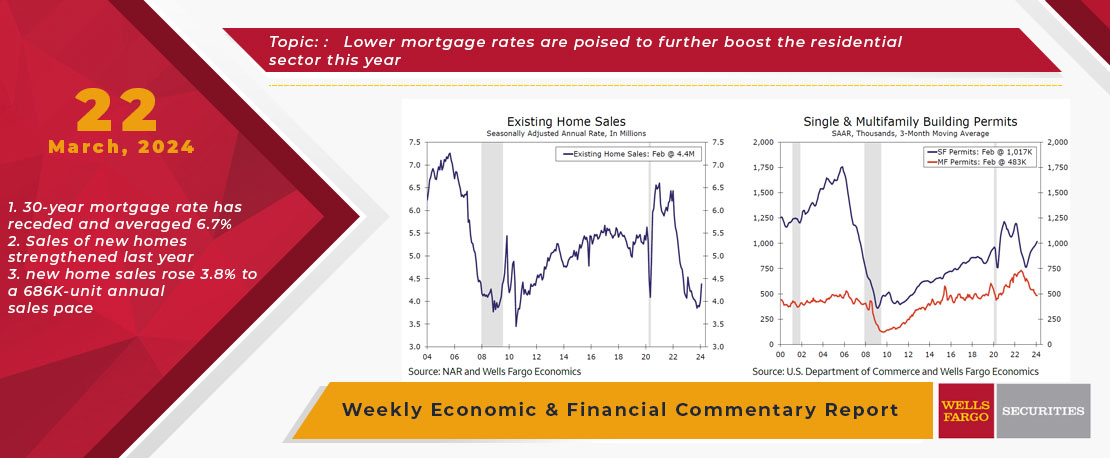

This Week's State Of The Economy - What Is Ahead? - 22 March 2024

Wells Fargo Economics & Financial Report / Mar 25, 2024

During February, existing home sales and housing starts both topped expectations and rose at robust rates. Meanwhile, initial jobless claims have remained subdued so far in March.

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

This Week's State Of The Economy - What Is Ahead? - 10 November 2020

Wells Fargo Economics & Financial Report / Nov 17, 2020

The U.S. election has come and gone, but we have not made any meaningful changes to our economic outlook, which continues to look for further expansion in the U.S. economy in coming quarters.

This Week's State Of The Economy - What Is Ahead? - 08 May 2020

Wells Fargo Economics & Financial Report / May 15, 2020

April nonfarm payrolls confirmed what we already knew—the labor market is collapsing. By the survey week of April 12, net employment had fallen by 20,500,000 jobs.