The FOMC decision took center stage this week amid an otherwise light economic calendar. As widely expected, the Federal Reserve did not make any major changes to the federal funds target rate or pace of balance sheet runoff. Wednesday’s meeting was not entirely devoid of new information, however. In the press conference, Chair Powell seemed to downplay the relatively hot inflation prints so far this year and reaffirmed that less restrictive monetary policy is coming closer into view. The FOMC’s latest Summary of Economic Projects also provided some noteworthy changes. For more details, please see the Interest Rate Watch section.

Although thin, the stream of incoming data received in recent days indicates that the U.S. economy is still expanding at a solid pace with the housing sector continuing to provide a tailwind. Residential fixed investment—which is a component of total GDP and mostly includes spending on new housing construction, brokers commissions from home sales and home improvements—declined sharply in 2022 and the first half of 2023 as the Fed tightened monetary policy and interest rates shot higher. More recently, however, a turnaround has become apparent. Residential investment rose solidly during the second half of 2023 and, if this week’s slew of housing data are any guide, should expand further in the coming quarters.

Lower mortgage rates are poised to further boost the residential sector this year. Since peaking around 8% last October, the average 30-year mortgage rate has receded and averaged 6.7% so far this year. Even this slight decline in financing costs looks like it was enough to have pulled affordability-crunched buyers off the sidelines. After rising solidly in January, existing home sales topped expectations and surged 9.5% during February. Although still relatively slow, last month's 4.38 million-unit pace marks the strongest pace in a year. The recent plateau in mortgage applications for purchase suggests that home sales may not move at quite the same pace in the coming months. During the week ended March 15, mortgage purchase applications fell slightly and, on balance, have moved more or less sideways so far in 2024. That noted, resales should continue to improve over the longer run as easier monetary policy brings about a gradual decline in mortgage rates.

An improving resales trend should translate to growth in brokers commissions, especially as low supply continues to exert upward pressure on home prices. However, strengthening single-family construction is likely to continue as the primary force behind expanding residential investment. On balance, total housing starts have been essentially flat over the first two months of the year, as February’s surge in overall starts made up for a sharp weather-induced drop in January. The number of residential groundbreakings moving sideways is largely a result of an ongoing downdraft in multifamily construction, which has offset gains from single-family projects. Multifamily development, which comprises a smaller share of investment, is downshifting in the wake of softening apartment market conditions and tighter construction lending. By contrast, single-family starts have steadily trended higher over the past year. Single-family permits have taken a similar upward trajectory, with permits climbing again during February. The gain in permits suggests that home builders are planning to scale up production in light of improving economic growth prospects, the increased ability to offset higher interest rates with pricing incentive and higher confidence that adverse affordability and availability in the resale market will translate to stronger sales in the future.

February's rise in single-family permits was one factor behind the recent upturn in the Leading Economic Index (LEI). The LEI advanced 0.1% in February, the first monthly gain in nearly two years. ISM manufacturing new orders, consumer expectations and the interest rate spread continued to weigh on the headline index. On the plus side, the average weekly hours component provided a substantial lift, while stock prices continued to gain over the month. Another contributor to the upswing was initial jobless claims. During the week ended March 16, jobless claims fell to 210K from 212K the week prior. Overall, applications for unemployment insurance remain subdued, or as Chair Powell put it at the FOMC press conference on Wednesday, “very, very low.” All told, the low level of claims indicates that the labor market is still holding up quite well, which only bolsters our expectation for the turnaround in the residential sector to continue as a tailwind for economic growth throughout in 2024.

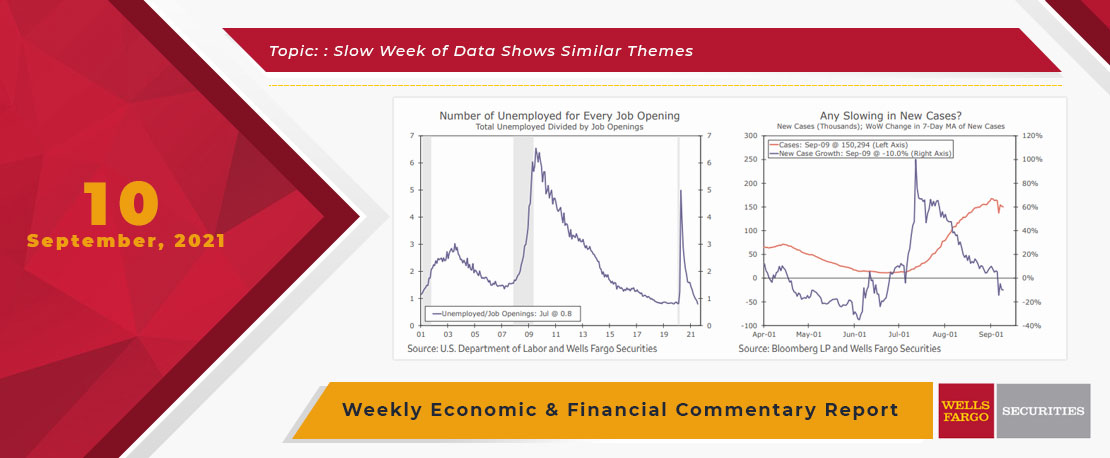

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.

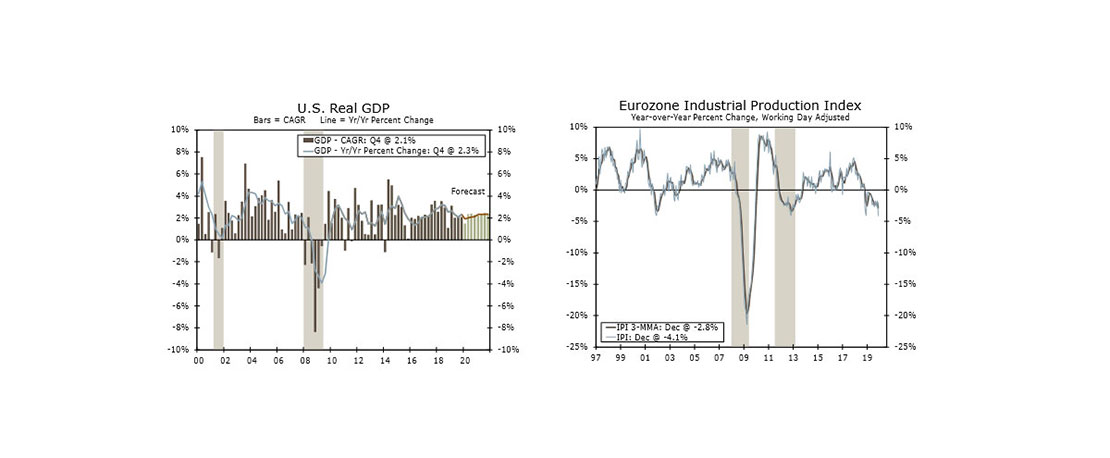

This Week's State Of The Economy - What Is Ahead? - 14 February 2020

Wells Fargo Economics & Financial Report / Feb 15, 2020

Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

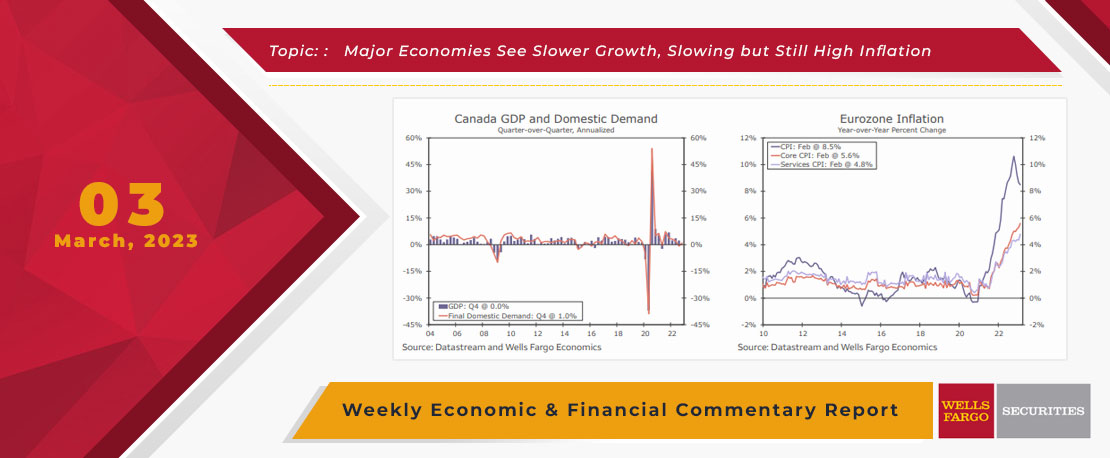

This Week's State Of The Economy - What Is Ahead? - 03 March 2023

Wells Fargo Economics & Financial Report / Mar 07, 2023

Looking at Q4 GDP, Australia\'s economy grew by less than expected, GDP was flat for the quarter in both Canada and Switzerland, and Sweden\'s economy contracted in the final quarter of last year.

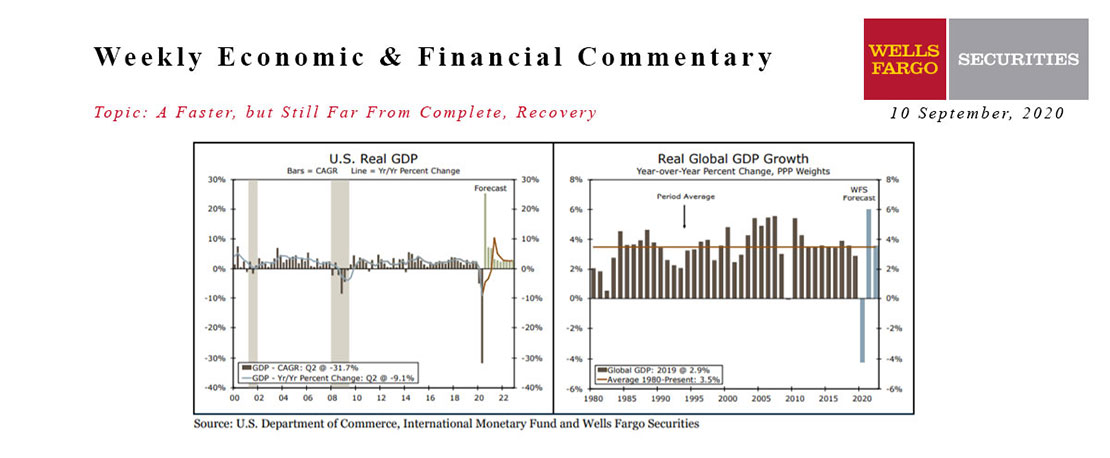

This Week's State Of The Economy - What Is Ahead? - 10 September 2020

Wells Fargo Economics & Financial Report / Sep 12, 2020

Although the recovery from the COVID recession is still far from over, the U.S. economy is bouncing back faster than many expected.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

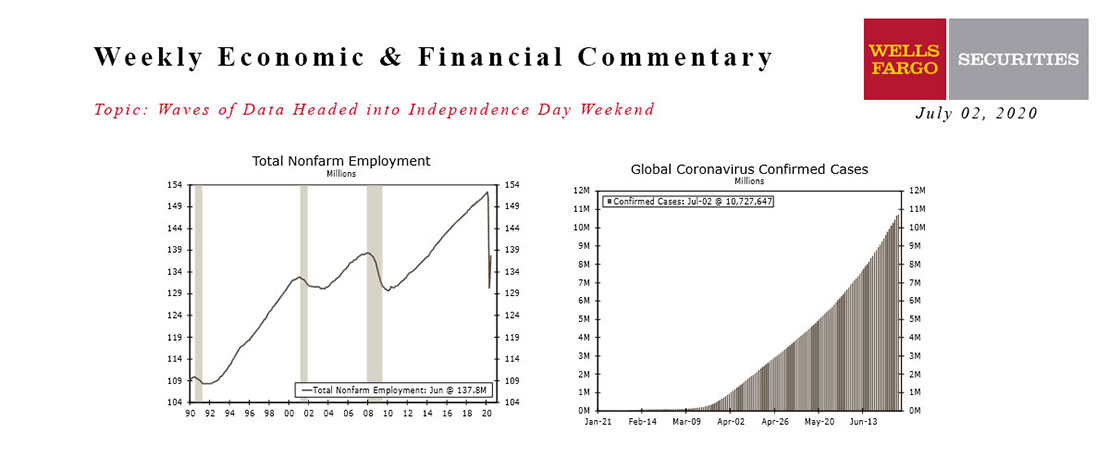

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

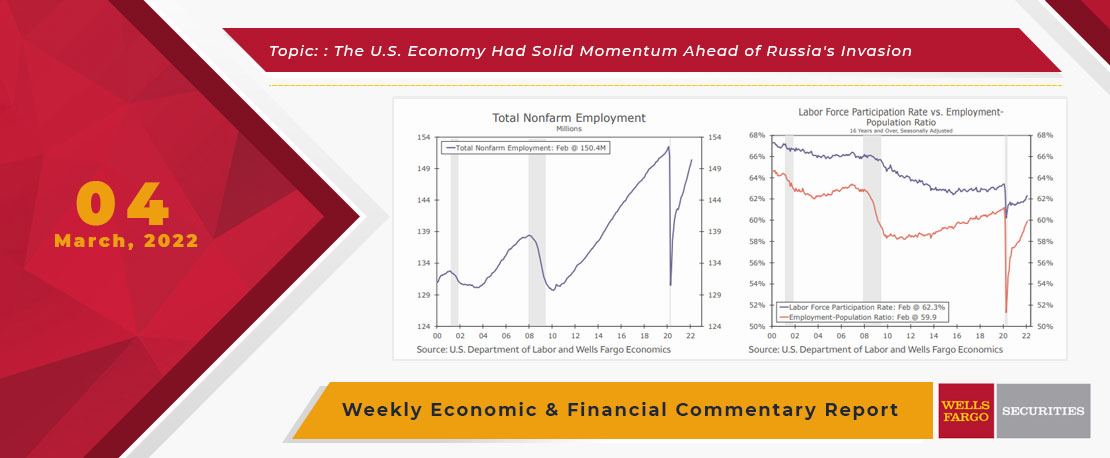

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

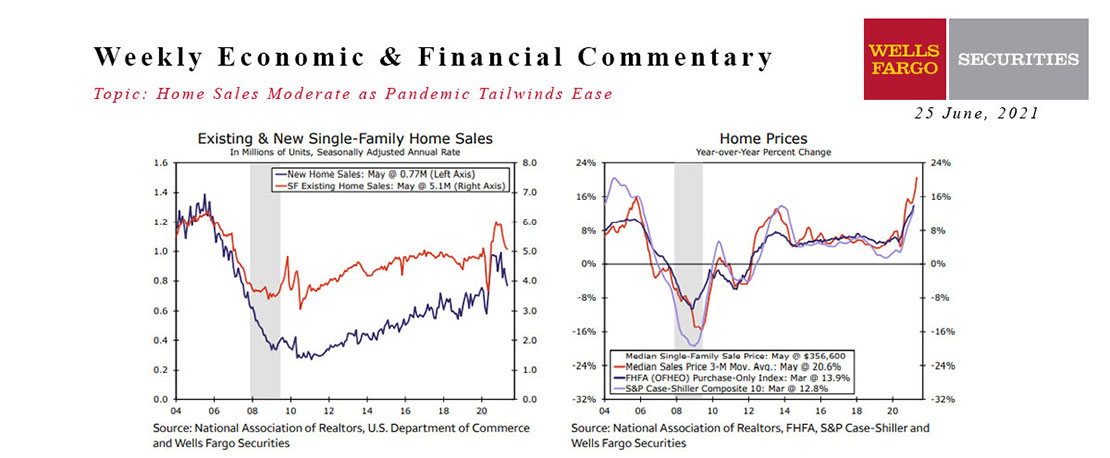

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

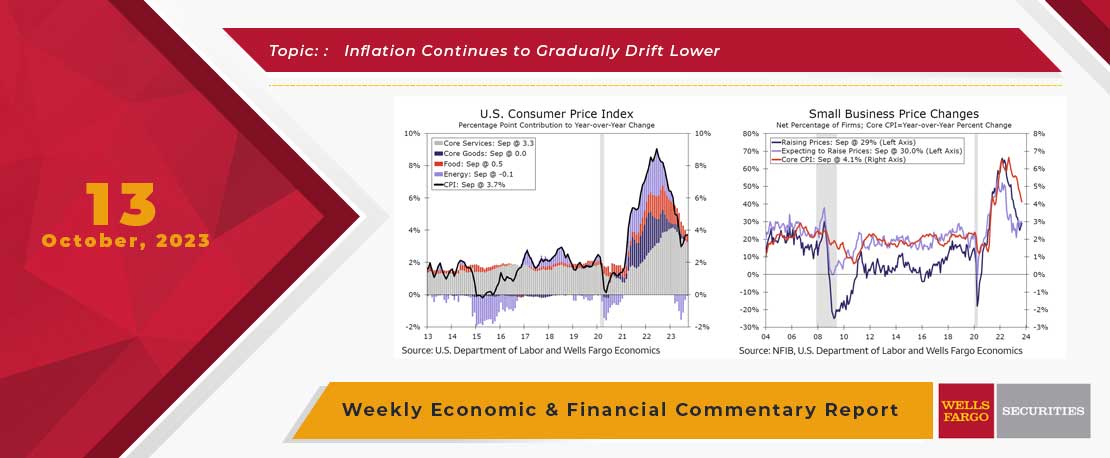

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.