Major Economies See Slower Growth, Slowing but Still High Inflation

Among the most notable news on global growth this week was the latest data from China. The official manufacturing and service sector PMIs both rose more than expected in February, a development that has prompted us to upgrade our forecast for Chinese economic growth, as we discuss in more detail in the Topic of the Week.

Elsewhere, however, this week's news largely consisted of slower growth late in 2022 for many of the major developed economies. Canada's Q4 GDP was a significant downside surprise, with the flat quarterly outcome below the consensus forecast for moderate growth during the quarter. The details were only modestly better—consumer spending rose at a 2.0% quarter-over-quarter annualized pace but business investment fell at a 5.3% pace, contributing to overall final domestic demand growing at a moderate 1.0% pace. The report also revealed a 3.0% quarter-over-quarter (not annualized) increase in household disposable income; although with that increase reflecting higher government benefits and some one-off transfers, it is perhaps not as favorable as it might appear at first glance. Finally, with respect to the monthly contours of economic growth, December GDP fell 0.1% month-over-month, though Statistics Canada's early estimate is that January GDP rose 0.3%. Overall, we see nothing in these figures that would suggest a resumption in policy rate hikes from the Bank of Canada.

Australia's economic growth at the end of 2022 was also a modest downside surprise. Australia's Q4 GDP rose 0.5% quarter-over-quarter, below the consensus forecast for a 0.8% increase. Consumer spending rose moderately by 0.3%, while private investment fell 1.7%, contributing to a flat quarterly outcome for final domestic demand. Given the improving outlook for China's economy, we believe the soft patch for Australian growth will prove temporary. Thus even with Australia's January CPI also slowing to 7.4% year-over-year, we fully expect the Reserve Bank of Australia to again raise its policy interest rate at its monetary policy meeting next week.

The theme of softer-than-expected growth was also prominent in Europe. Switzerland's Q4 GDP was unchanged for the quarter, slightly below the 0.1% quarter-over-quarter gain forecast by the consensus. Consumer spending and investment spending both rose in the quarter but were offset by a fall in exports. Swiss indicators for early 2023 are mixed, with the February KOF leading indicator rising to 100.0, but the manufacturing PMI unexpectedly easing to 48.9. Finally, Sweden's Q4 GDP rose 0.5% quarter-over-quarter, broadly as expected, and by 0.2% year-over-year.

On the inflation front, the most significant news internationally this week was from the Eurozone, with the February CPI surprising to the upside. Headline inflation eased only slightly to 8.5% year-over-year, while core inflation quickened further to 5.6%, the fastest pace of record. Services inflation quickened to 4.8%, which was also the fastest pace on record. The firm inflation readings were relatively broadbased not only across categories but also across countries. Looking at national-level data for February, this week also had upside (harmonized) CPI surprises for Germany (9.3% year-over-year), France (7.2%), Spain (6.1%) and Italy (9.9%). The firm February inflation reading, in our view, clinches the case for a 50 bps rate increase from the European Central Bank (ECB) at its March monetary policy meeting, a move that had already been very clearly signaled by the ECB at its most recent policy announcement. It also suggests upside risk to our current base case forecast for 25 bps increase at the ECB's May meeting.

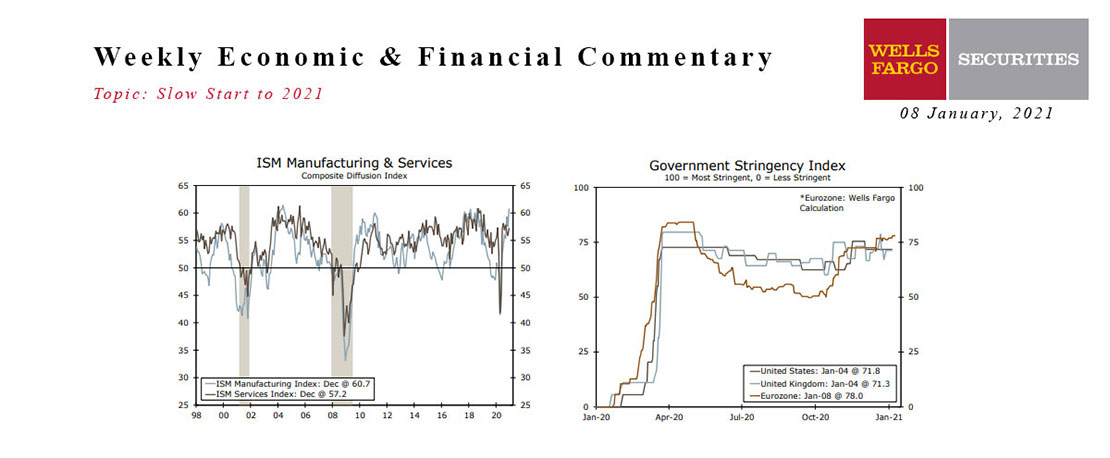

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

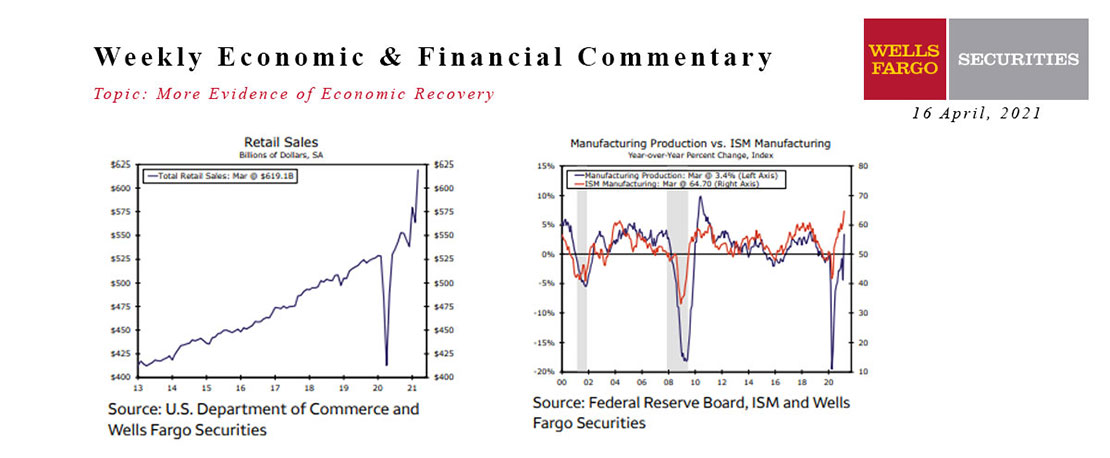

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

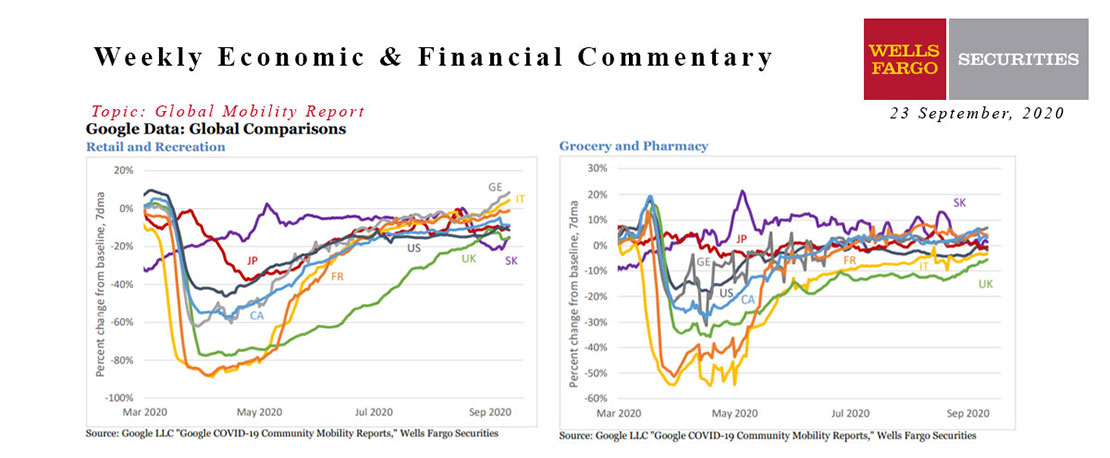

This Week's State Of The Economy - What Is Ahead? - 23 September 2020

Wells Fargo Economics & Financial Report / Sep 22, 2020

European activity is surging. Germany and Italy are leading the way, but France is close behind despite an ongoing rise in cases. The Google data are a bit outdated, but are hard to reconcile with today’s weak Eurozone services PMI figures.

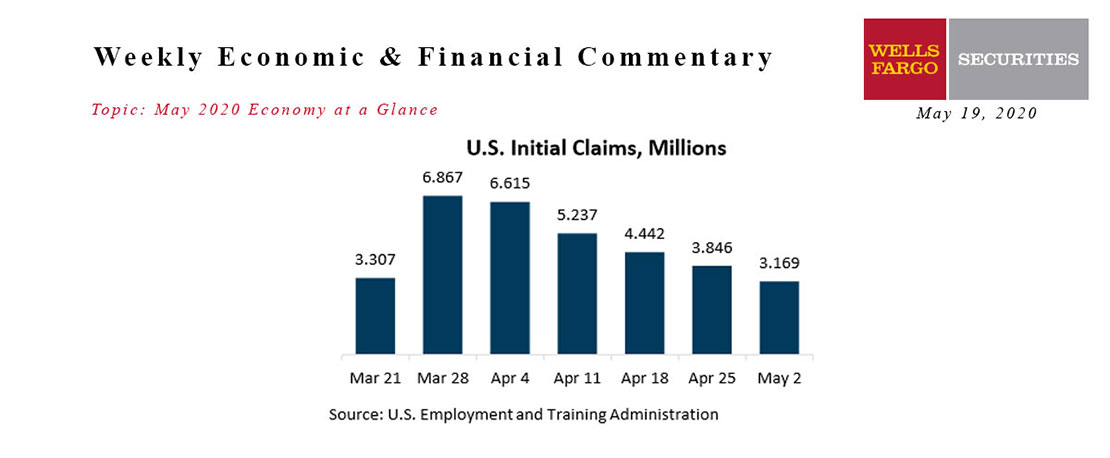

May 2020 Economy at a Glance

Wells Fargo Economics & Financial Report / May 19, 2020

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs.

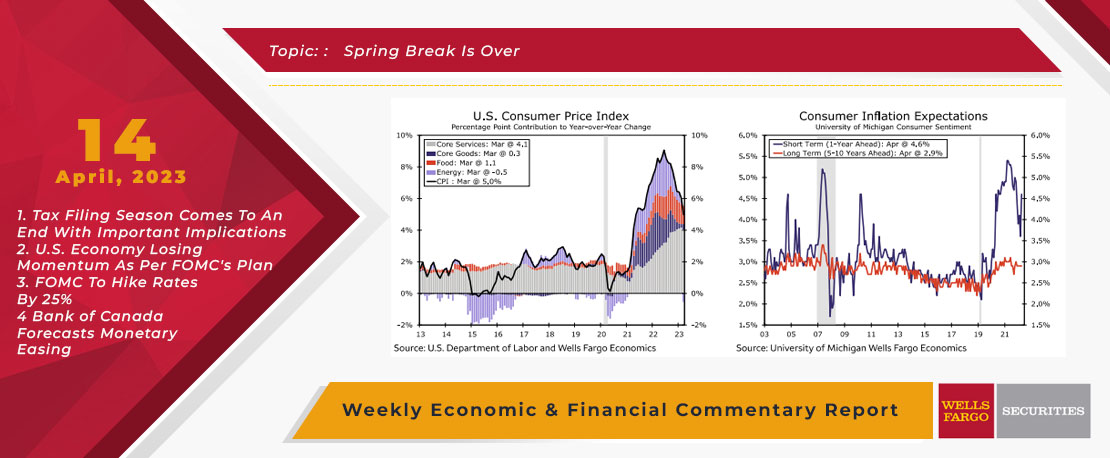

This Week's State Of The Economy - What Is Ahead? - 14 April 2023

Wells Fargo Economics & Financial Report / Apr 20, 2023

In March retail sales fell 1.0%, manufacturing production slipped 0.5% and the consumer price index rose a modest 0.1%.

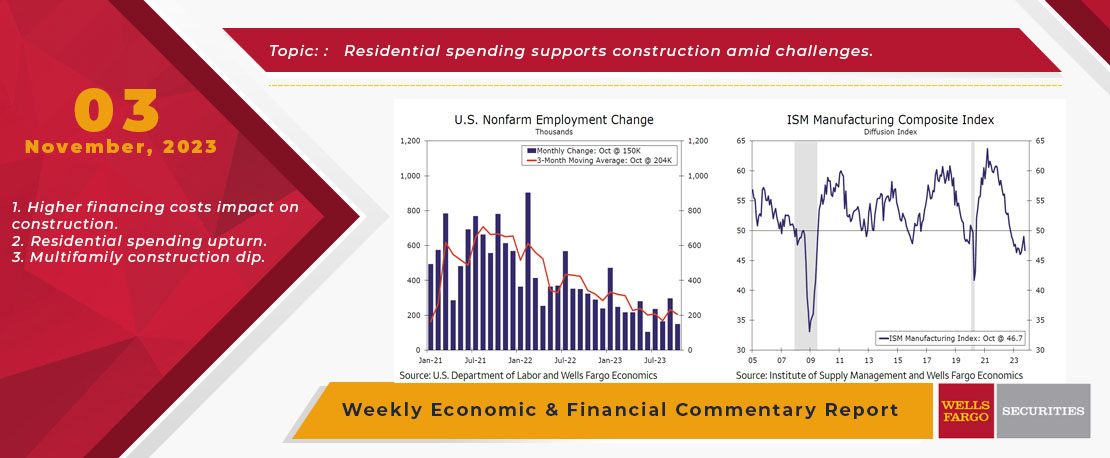

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

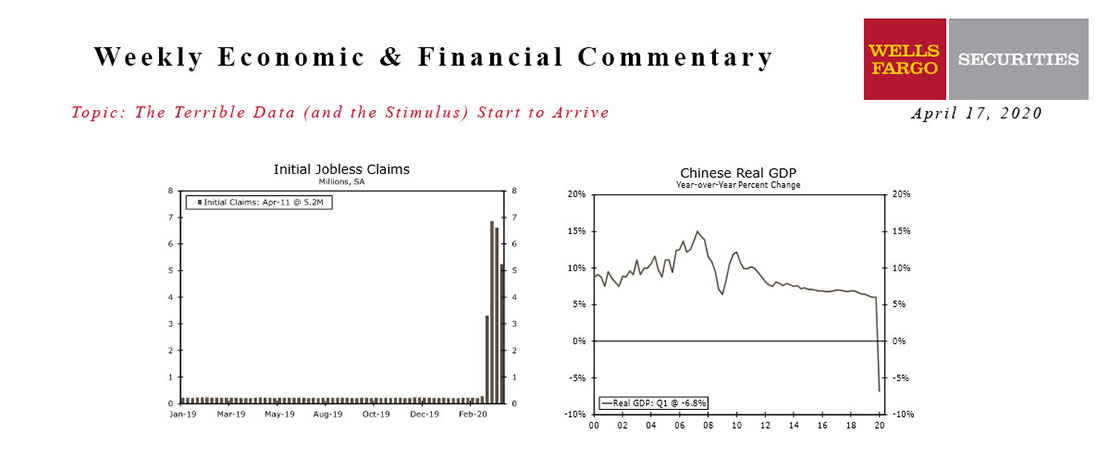

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

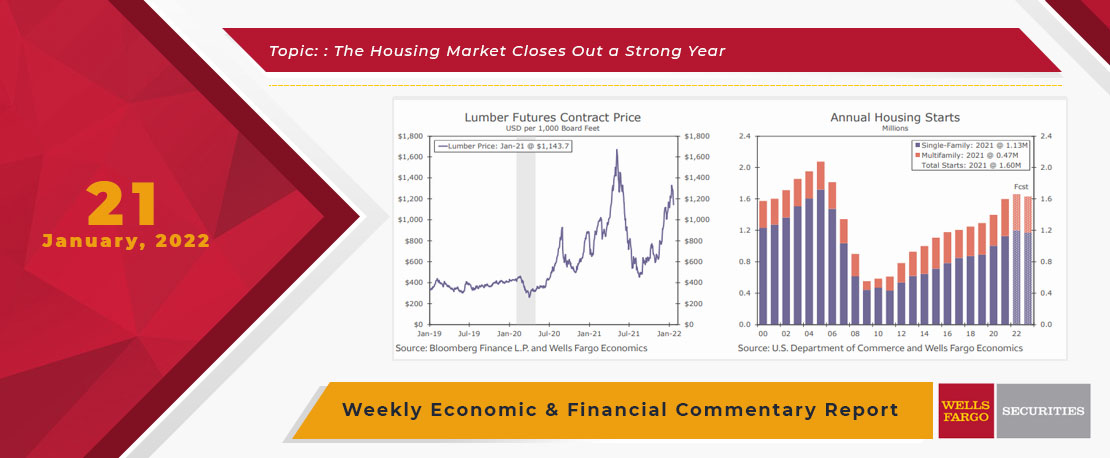

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

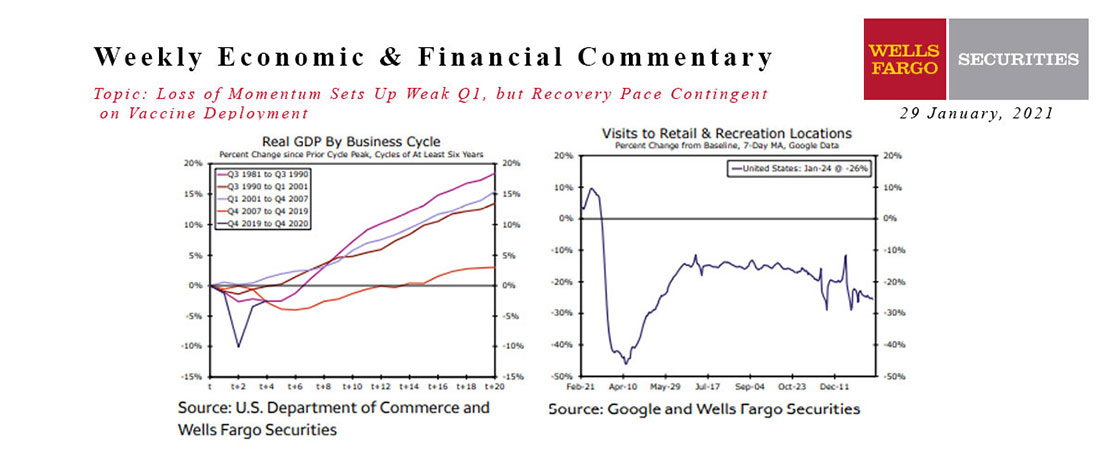

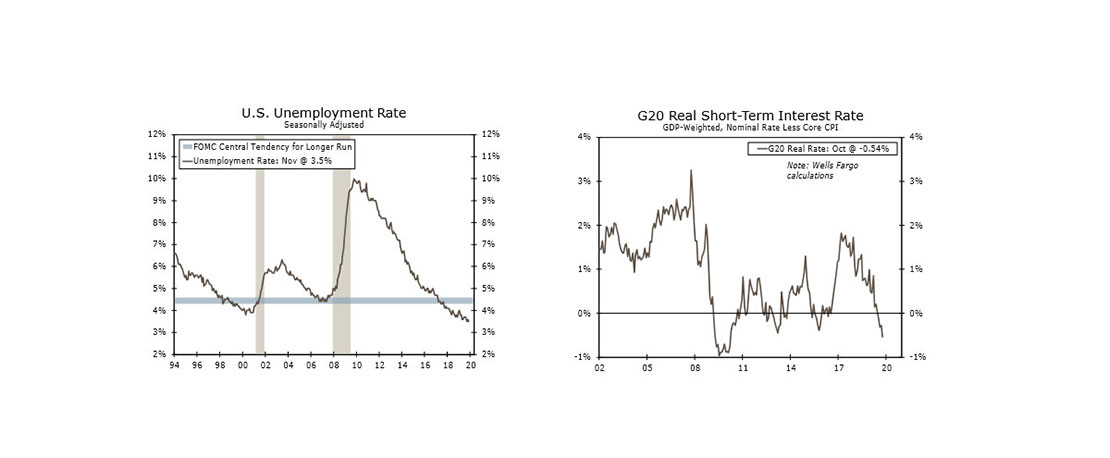

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

This Week's State Of The Economy - What Is Ahead? - 06 December 2019

Wells Fargo Economics & Financial Report / Dec 07, 2019

The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty.