U.S. Outlook

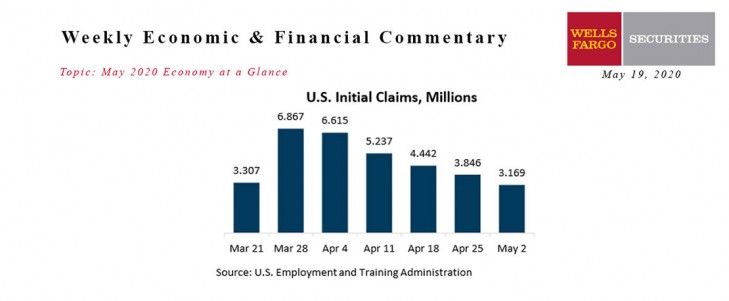

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs. Employers cut 881,000 in March and another 20.5 million in April, the largest one-month loss in the nation’s history. Losses already exceed those of the Great Recession, in which 8.7 million Americans were laid off.

Texas Outlook

More than 1.8 million workers in Texas have filed initial claims for unemployment insurance since mid-March. Though claims peaked in early April, they remain elevated as the Texas Workforce Commission struggles to process a backlog of applications. Employment data for the state and its 25 metro areas won’t be released until May 22, but unemployment rates and job loss percentages will likely mirror that of the U.S.

Houston Outlook

Nearly 380,000 Houstonians have filed for unemployment insurance between March 21 and May 2. Sectors with the most claims include full-service restaurants, offices of dentists, temporary help services, department stores, and limited-service restaurants. Local claims will likely top 400,000 by the end of May. Houston’s unemployment rate will mirror the national rate, hitting the mid-teens in April and possibly reaching 20 percent in May.

Energy Outlook

The oil markets have begun the slow and painful recovery process from the collapse brought on by the COVID-19 pandemic. At the peak, 4 billion people lived under some form of restriction or isolation, according to the International Energy Agency (IEA). Since mid-April, 65 countries have reopened. IEA expects the number of people living under restrictions should drop to 2.8 billion by the end of May. Another 85 countries will ease restrictions in June.

U.S. Trends

Baker Hughes reports the number of rigs actively drilling for oil or gas fell to 339 in mid-May, a 57.4 percent drop from since the first of the year. There are fewer rigs working in the U.S. today than there were at the bottom of the fracking bust when count fell to 404 rigs in May ’16.

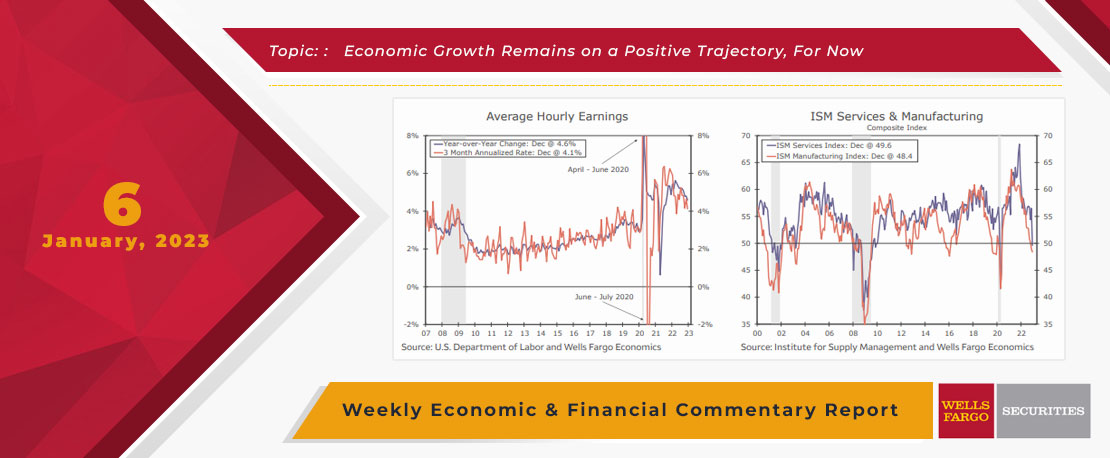

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

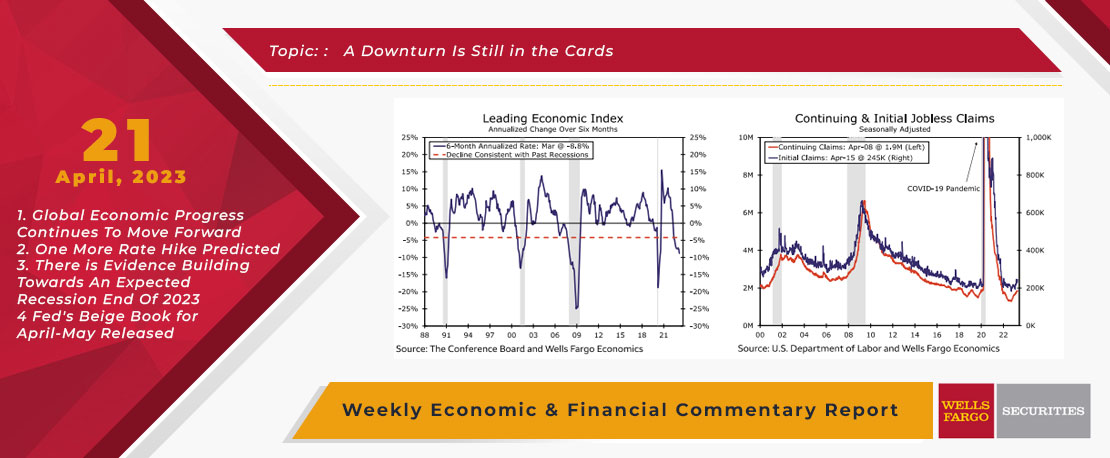

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

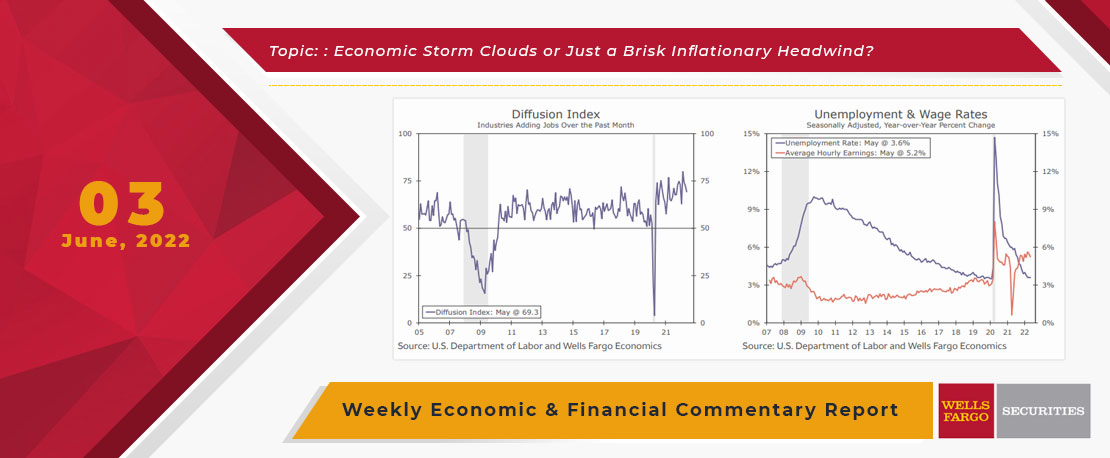

This Week's State Of The Economy - What Is Ahead? - 03 June 2022

Wells Fargo Economics & Financial Report / Jun 08, 2022

While talk of recession has kicked up in recent weeks, the majority of economic data remain consistent with modest growth.

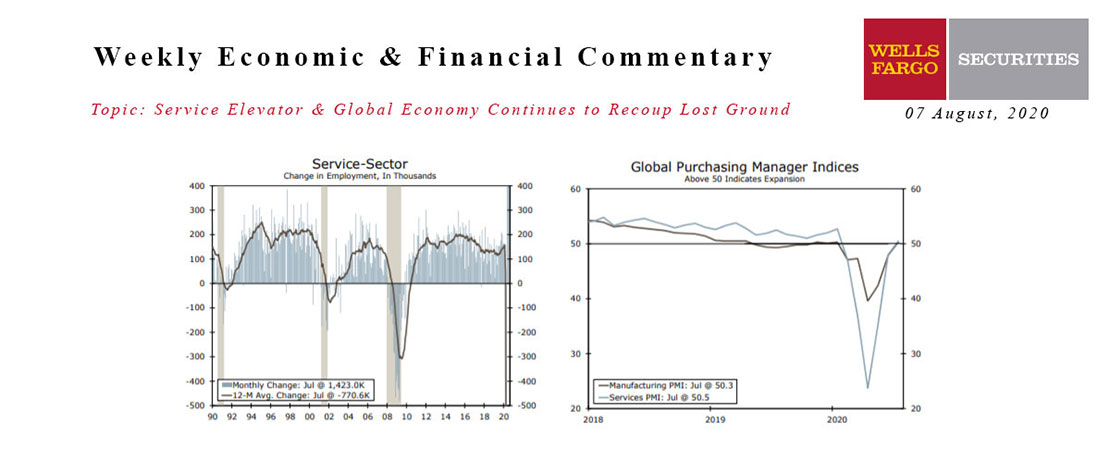

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

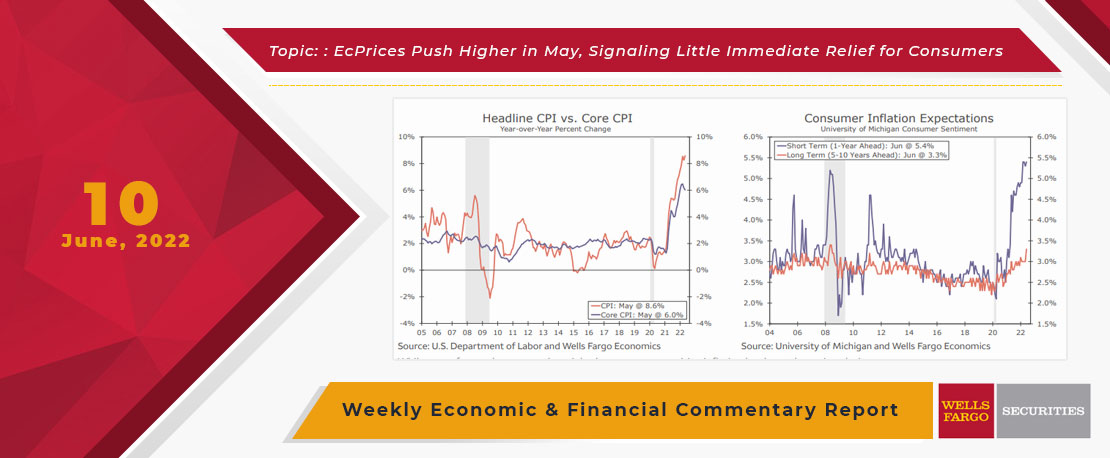

This Week's State Of The Economy - What Is Ahead? - 10 June 2022

Wells Fargo Economics & Financial Report / Jun 13, 2022

CPI increases continue to sizzle like this weekend’s temperature, putting consumers in a worse mood than Texas Rangers fans (with their 9.5 games back $500 million middle infield).

This Week's State Of The Economy - What Is Ahead? - 30 September 2022

Wells Fargo Economics & Financial Report / Oct 03, 2022

Just as I know the folks in Florida are resilient and will recover in time, incoming data indicate a slowing yet resilient economy.

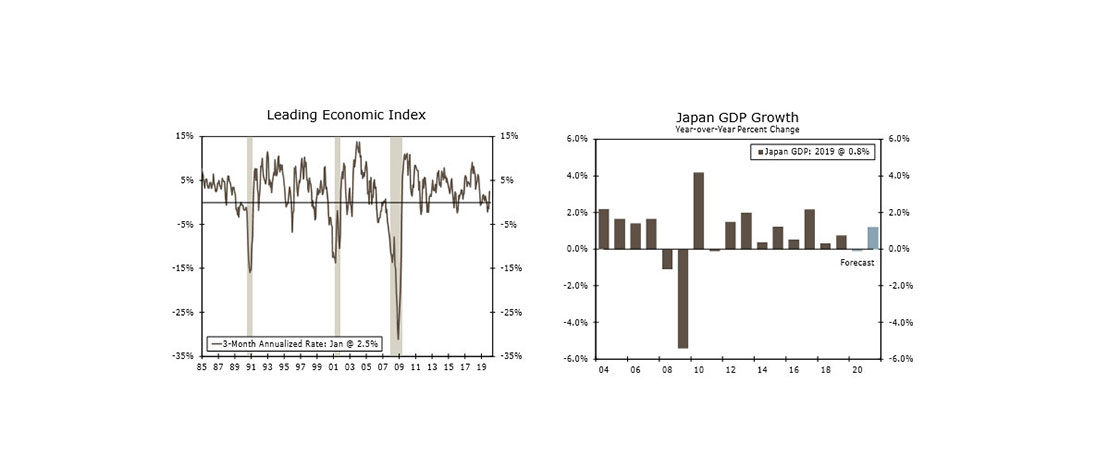

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

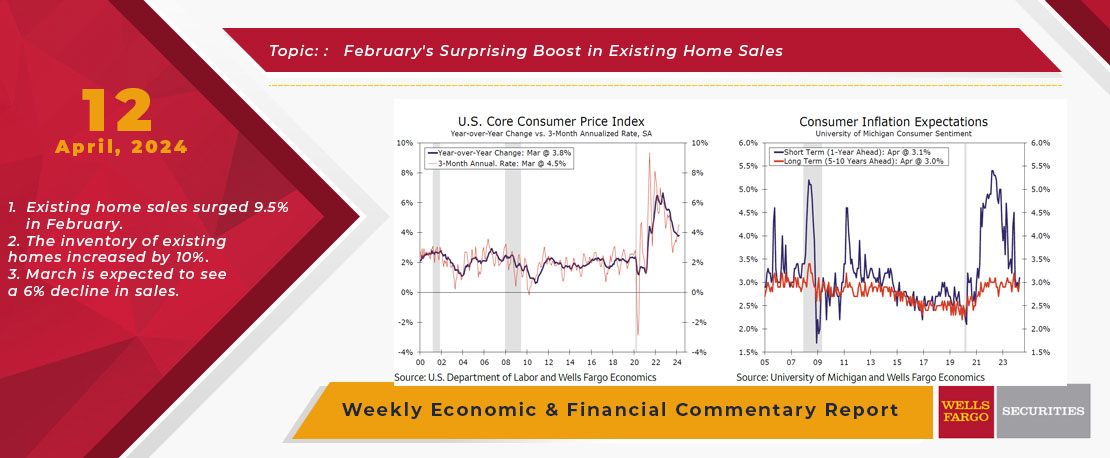

This Week's State Of The Economy - What Is Ahead? - 12 April 2024

Wells Fargo Economics & Financial Report / Apr 18, 2024

The March consumer price data dominated the economic discussion this week and are the latest to support that the timing and degree of Fed easing will be later and smaller than many of us previously expected.

This Week's State Of The Economy - What Is Ahead? - 24 May 2024

Wells Fargo Economics & Financial Report / May 29, 2024

Homebuying retreated in April following a leg up in mortgage rates. Meanwhile, durable goods orders surprised to the upside, suggesting the manufacturing industry is on better footing.

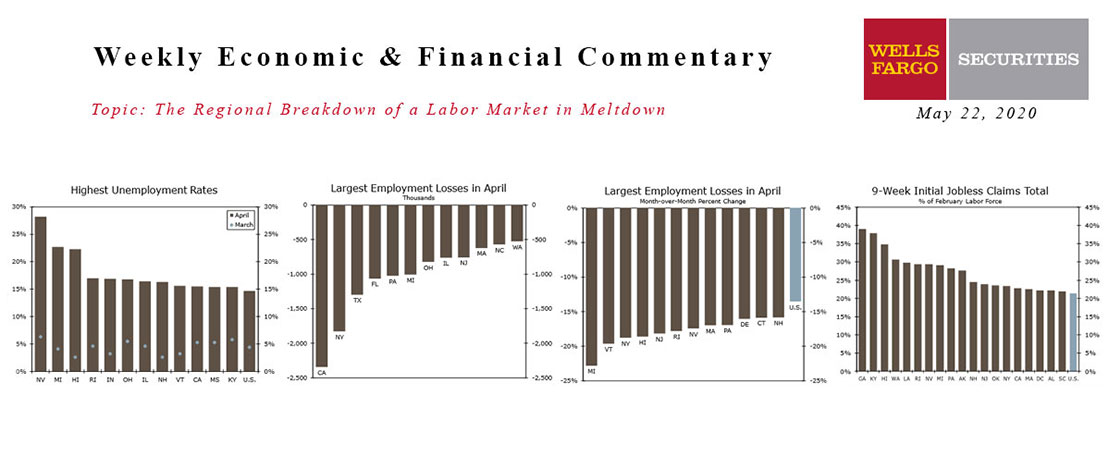

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.