The economic data released during the holiday-shortened week are consistent with our view that U.S. economic growth remained firmly in positive territory during the final quarter of 2022. That noted, a modest contraction in growth beginning in mid-2023 remains our base case forecast as the lagged effects of high inflation and monetary tightening take hold.

Ongoing strength in the labor market helps corroborate our view that the economy is on a positive growth path at present. Nonfarm payrolls rose by a solid 223K during December, a slight downshift from the 256K gain posted in November. Despite the slight moderation, the job-gain easily beat market expectations. The nonfarm payroll gain was in line with the ADP employment report for December, which showed a 235K gain. Despite the sturdy pace of hiring during the month, job growth appears to be moderating from the robust rate seen in the first half of 2022.

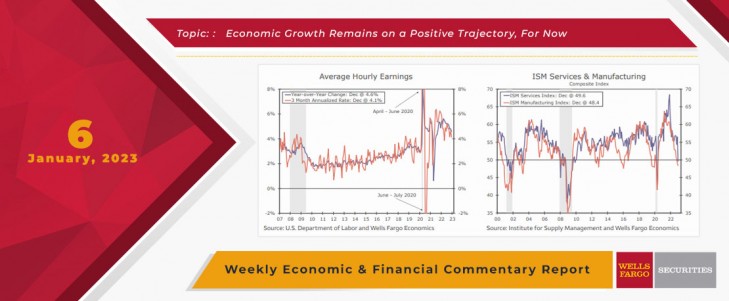

A decline in the unemployment rate to 3.5% in December from 3.6% the month prior is another reminder that the labor market remains tight. A rise in the labor force participation rate during December is an encouraging sign that labor supply is improving. Alongside the uptick in labor force participation, average hourly earnings moderated to 0.3% during the month, a softer gain than the downwardly revised 0.4% monthly increase in November. The moderation in earnings is at least one sign that wage growth is cooling. Still, average hourly earnings are running at a 4.1% annualized pace over the past three months, which is still well above what the Fed believes would be consistent with sustained 2% inflation. All told, this report does little to alter our view that the FOMC will remain in tightening mode when it concludes its first meeting of 2023 on February 1. As we write in the Interest Rate Watch, the FOMC minutes for December's meeting revealed that a monetary pivot is not likely imminent, as inflation remains hot and employment growth remains strong.

A modest drop in job openings is another sign that, while softening, labor demand remains relatively strong currently. The Job Openings and Labor Turnover Survey (JOLTS) revealed that the count of job vacancies fell to 10.46 million in November from 10.51 million in October, a smaller decline than consensus estimates. Chair Powell has hinted on several occasions that the vacancy-to-unemployed ratio, which remained highly elevated in November, needs to come down in order to ease wage pressures and reduce overall inflation.

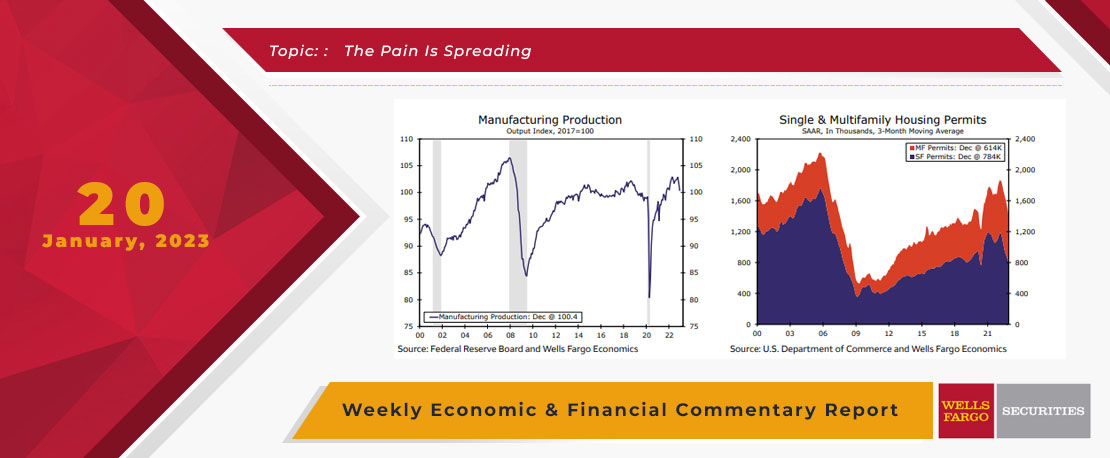

This Week's State Of The Economy - What Is Ahead? - 20 January 2023

Wells Fargo Economics & Financial Report / Jan 20, 2023

The housing sector has borne the brunt of the Fed\'s efforts to slow the economy, and this week\'s data showed the industry continues to reel.

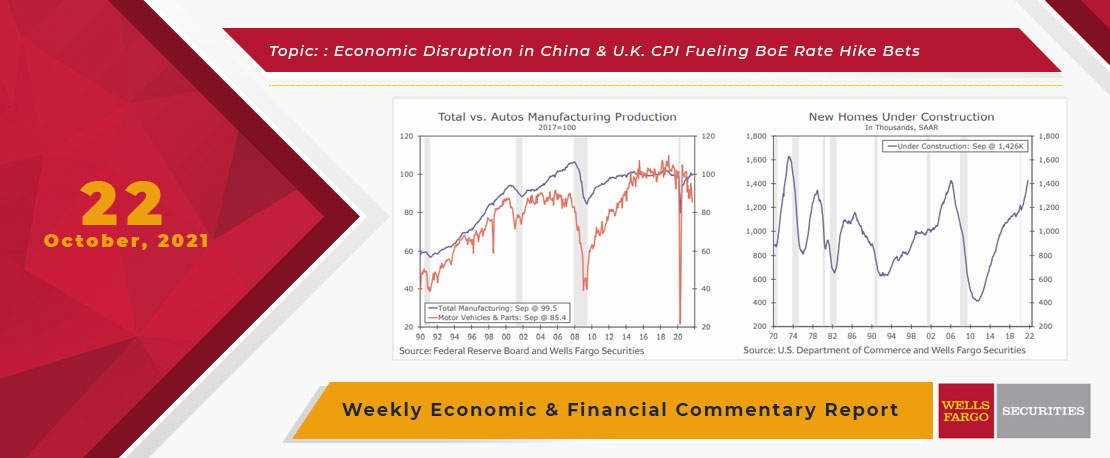

This Week's State Of The Economy - What Is Ahead? - 22 October 2021

Wells Fargo Economics & Financial Report / Oct 25, 2021

Restrictions from a renewed COVID outbreak in China, regulatory changes weighing on local financial markets and a potential collapse of Evergrande have all contributed to a slowdown in Chinese economic activity.

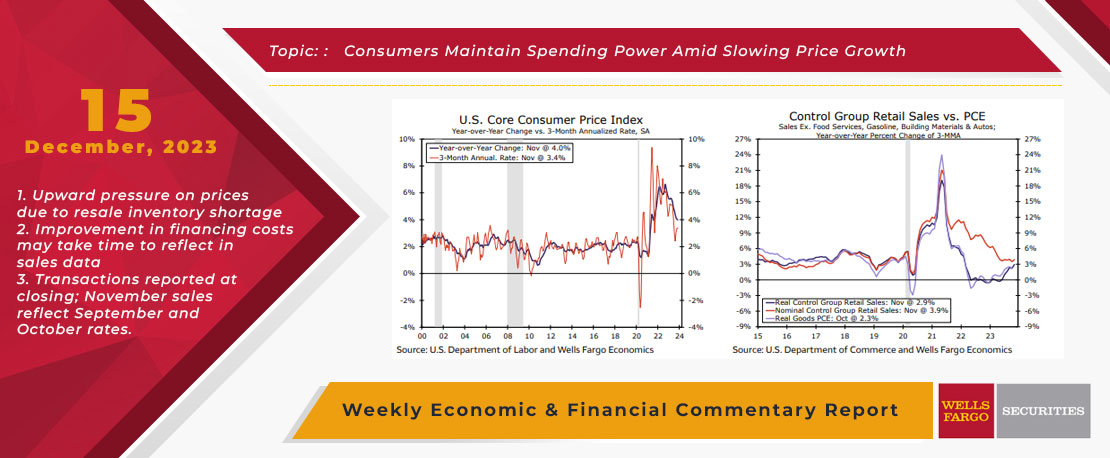

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

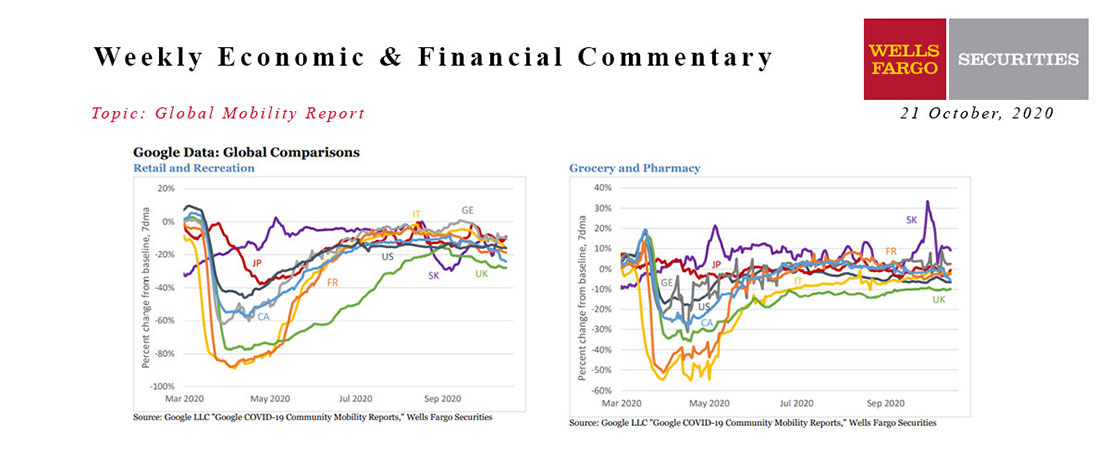

This Week's State Of The Economy - What Is Ahead? - 21 October 2020

Wells Fargo Economics & Financial Report / Oct 21, 2020

Mobility is continuing to trickle lower in several major developed market economies. The U.K., France, Italy and Canada have all seen some further modest declines in retail/recreation visits.

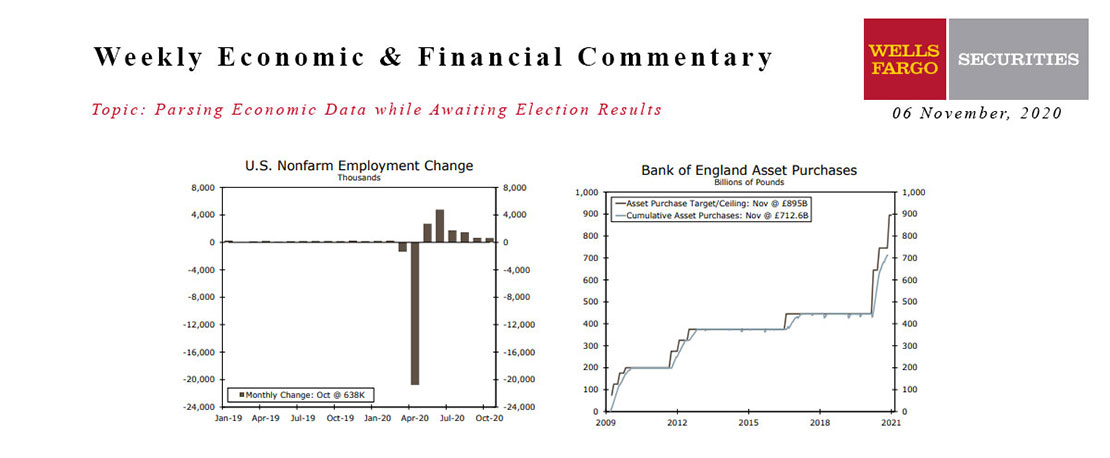

This Week's State Of The Economy - What Is Ahead? - 06 November 2020

Wells Fargo Economics & Financial Report / Nov 10, 2020

As of this writing, the outcome of the U.S. presidential election is undecided. Joe Biden, however, appears likely to become president based off of his growing lead in several key states.

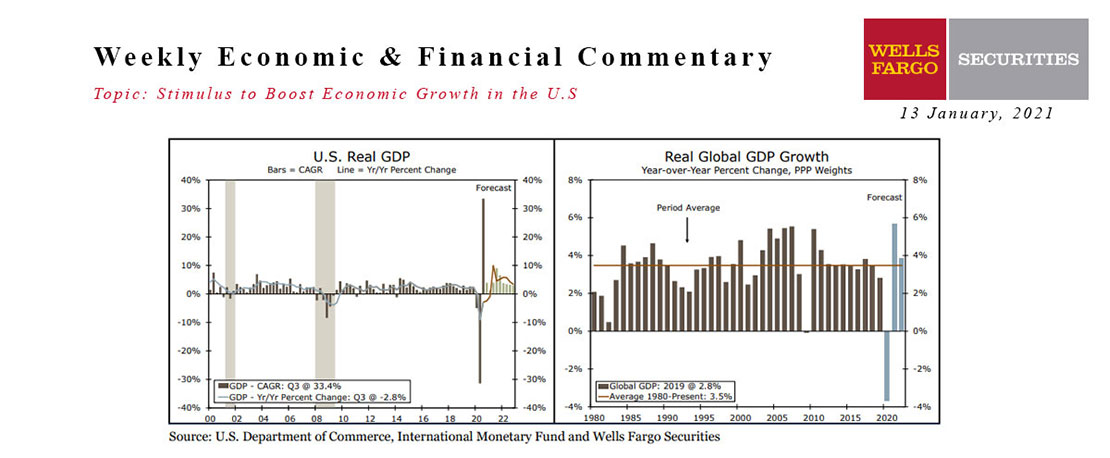

13 January 2021 Monthly Outlook Report

Wells Fargo Economics & Financial Report / Jan 19, 2021

The U.S. economy appears to be losing some momentum as the calendar turns to 2021 and the public health situation continues to deteriorate.

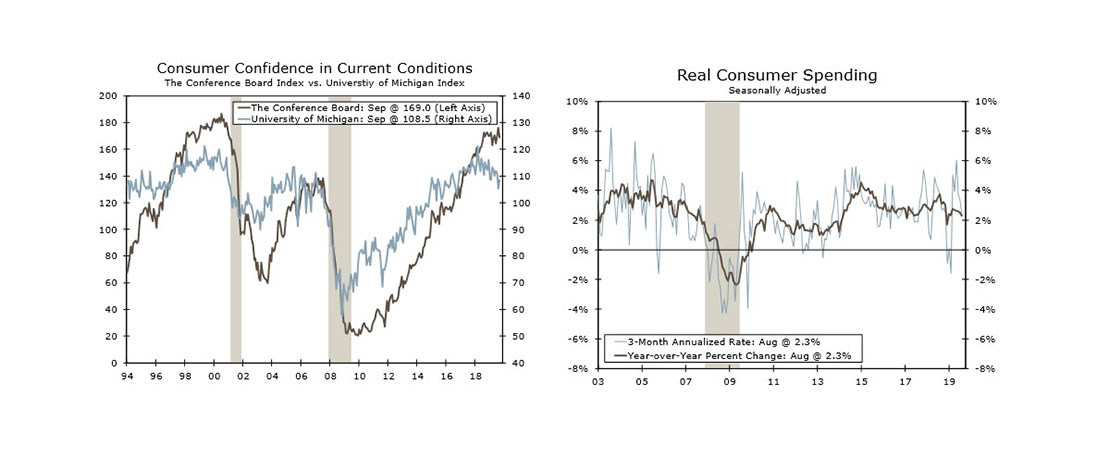

This Week's State Of The Economy - What Is Ahead? - 27 September 2019

Wells Fargo Economics & Financial Report / Sep 28, 2019

The release of the transcript of President Trump\'s phone conversation with Ukraine President Volodymyr Zelenskiy and the whistle blower complaint overshadowed most of this week\'s economic reports and took bond yields modestly lower.

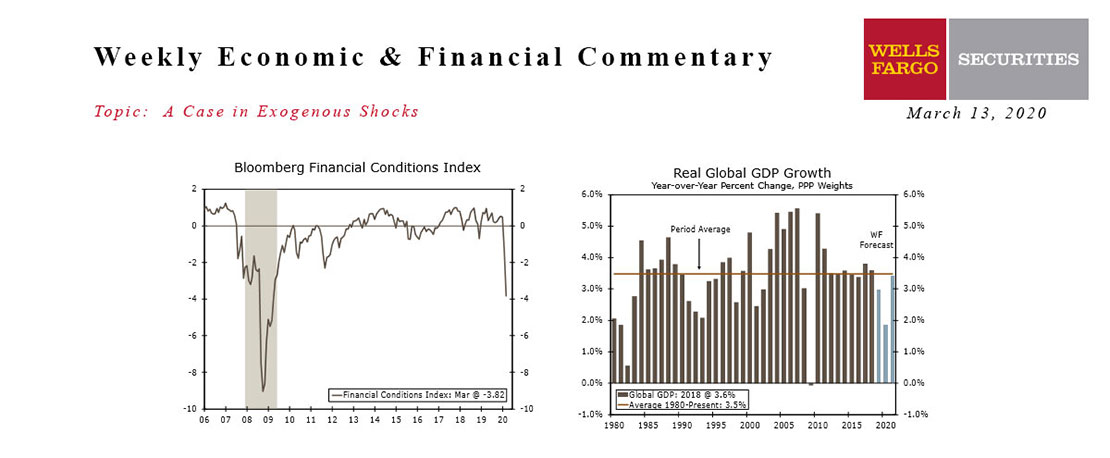

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

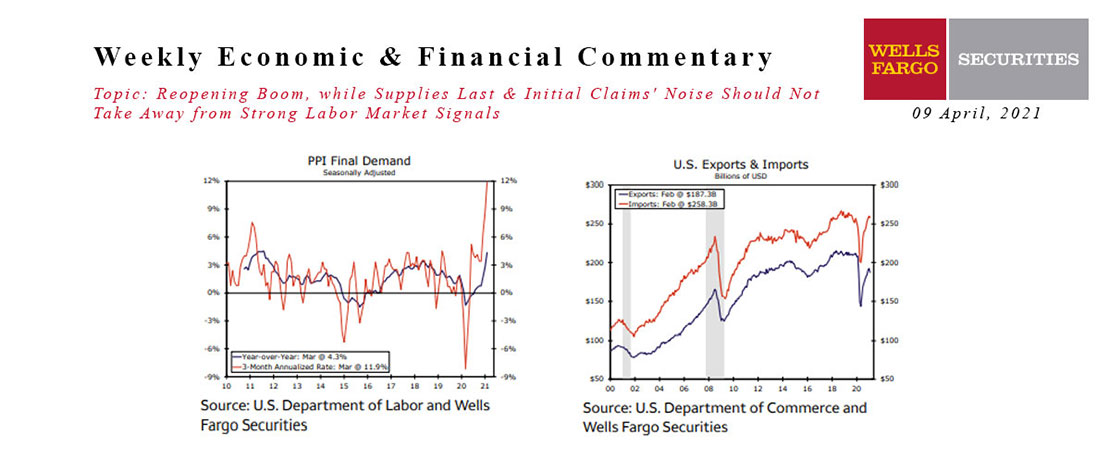

This Week's State Of The Economy - What Is Ahead? - 09 April 2021

Wells Fargo Economics & Financial Report / Apr 10, 2021

This week\'s economic data kicked of with a bang. The ISM Services Index jumped more than eight points to 63.7, signaling the fastest pace of expansion in the index\'s 24-year history.

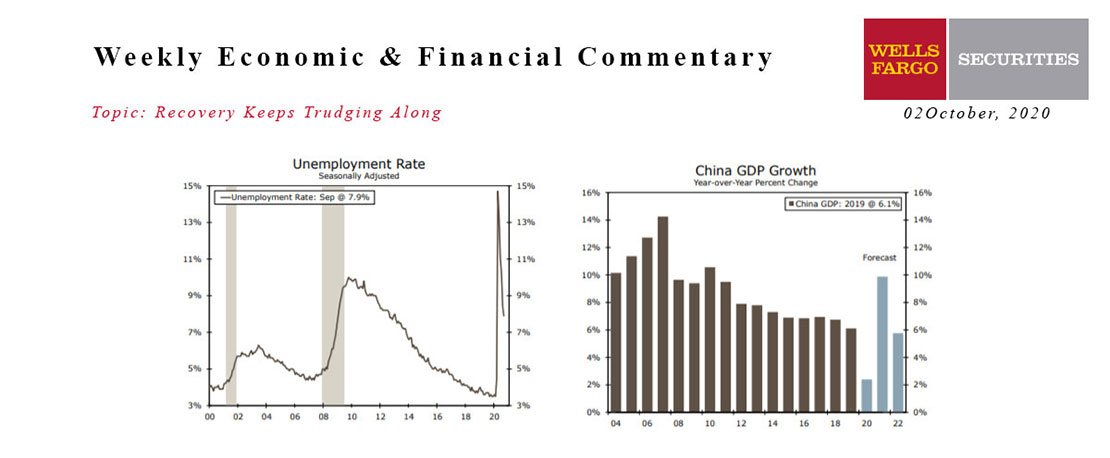

This Week's State Of The Economy - What Is Ahead? - 02 October 2020

Wells Fargo Economics & Financial Report / Sep 29, 2020

In what was a jam-packed week of economic data, the jobs report, prospects of additional fiscal stimulus and the president’s positive COVID-19 test result commanded markets’ attention.