Incoming economic data demonstrate that while the economy is losing momentum, activity remains resilient. Consumer confidence rose to the highest level in six months in September, and stripping out some volatility in new orders for durable goods revealed stabilization in demand and strength in Q3 equipment spending. The third release of second-quarter GDP growth also included revisions that put the economy in a stronger position coming out of the pandemic-induced recession than previously thought. Consumer spending in particular has been unwavering, with real personal spending rising 0.1% in August.

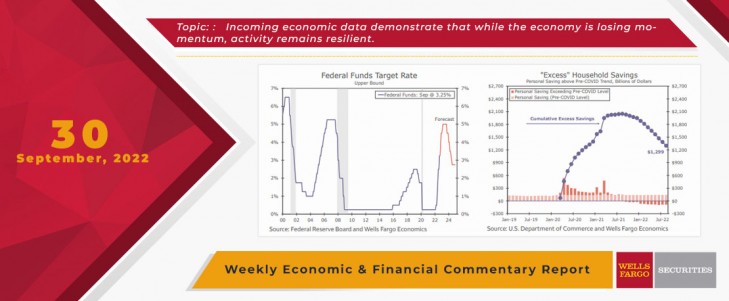

With little indication that households have lost their staying power, we have adjusted our forecast. The current resilience in economic activity does not dismiss an eventual recession, but it does make it less likely that a recession will start by the beginning of next year. Near-term strength also means more monetary tightening will likely be necessary to slow growth sufficiently enough to quell elevated inflation. As we detail in this week's Interest Rate Watch, we now project the FOMC to hike its federal funds rate by an additional 125 bps this year and another 50 bps at the start of next year, which would bring the target range of the federal funds rate to 4.75%-5.00% by March (chart).

Importantly, we still see the economy falling into a mild recession next year, but we now expect it to take place slightly later, beginning in the second rather than first quarter, as the lagged effects of monetary policy begin to bite more meaningfully into consumption and weigh on the ability of firms to hire. An important consideration is that the economic trade off for growth today is the potential for a worse hit to households later. Consumers have increasingly relied on their balance sheets to spend with wage gains not keeping pace with inflation. The longer that lasts, the larger the deterioration in household finances. For this reason, we are now looking for a slightly larger decline in real personal consumption expenditures in our latest projections with a peak-to-trough decline of 1.0% compared to 0.6% previously

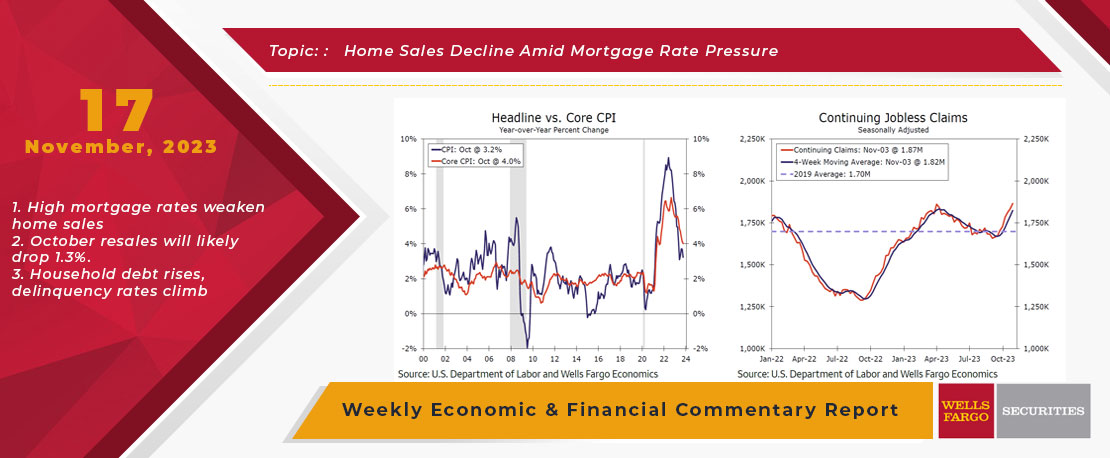

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

This Week's State Of The Economy - What Is Ahead? - 31 May 2024

Wells Fargo Economics & Financial Report / Jun 04, 2024

Markets digested a light lineup of economic data on the holiday-shortened week. The second look at first quarter GDP revealed an economy increasingly pressured by high interest rates as headline growth was revised lower.

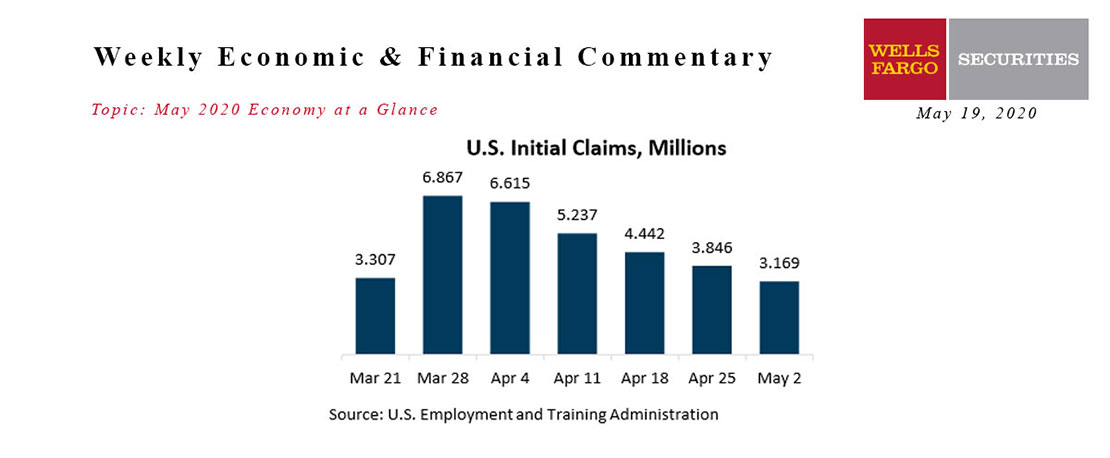

May 2020 Economy at a Glance

Wells Fargo Economics & Financial Report / May 19, 2020

The U.S. is in a severe recession caused by the sudden shutdown due to the COVID-19 pandemic. Since the lock down began, the nation has lost 21.4 million jobs.

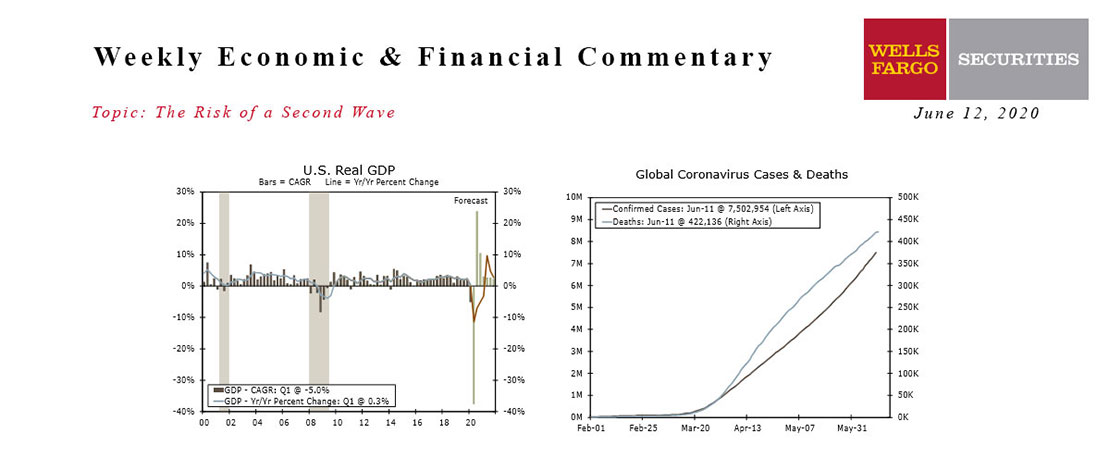

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

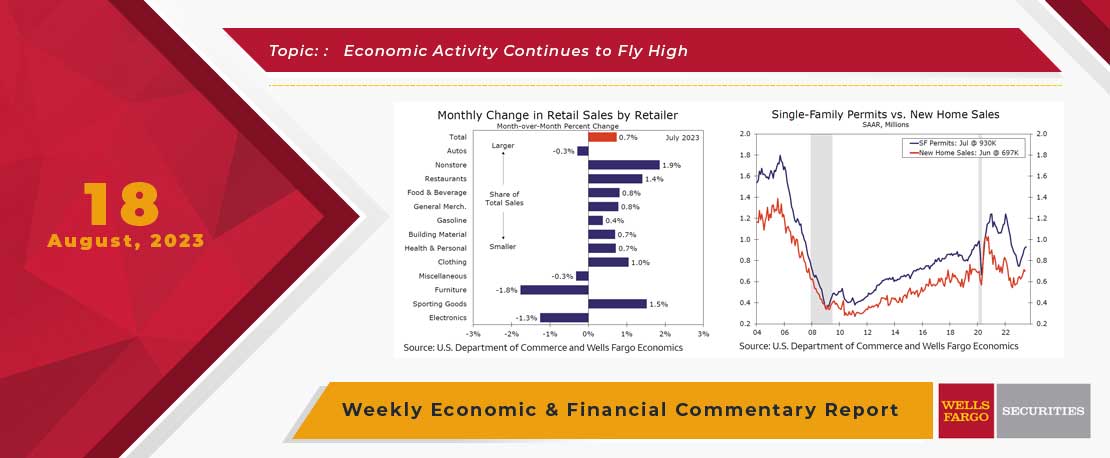

This Week's State Of The Economy - What Is Ahead? - 18 August 2023

Wells Fargo Economics & Financial Report / Aug 23, 2023

The FOMC meeting minutes acknowledged the economy\'s resilience and continued to stress the Committee\'s resolve to bring inflation back down toward its 2% goal.

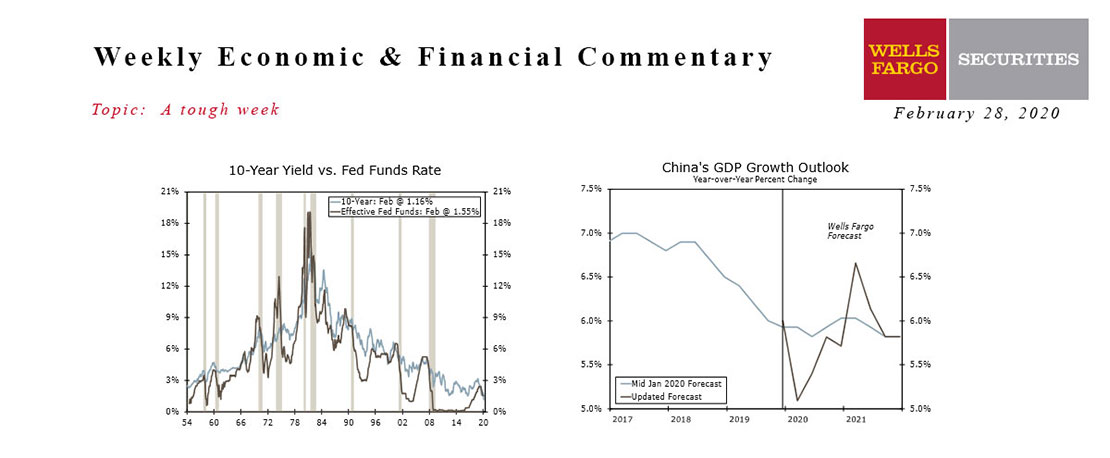

This Week's State Of The Economy - What Is Ahead? - 28 February 2020

Wells Fargo Economics & Financial Report / Feb 29, 2020

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

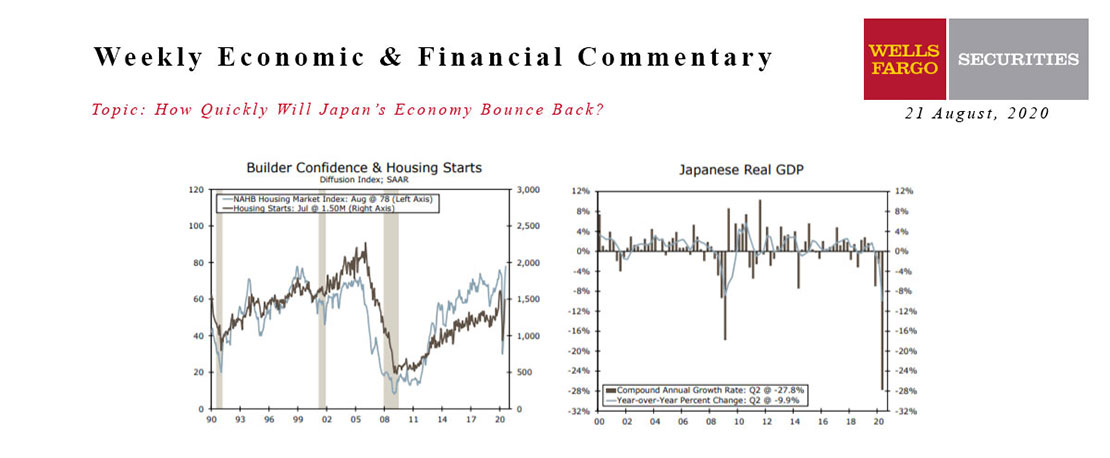

This Week's State Of The Economy - What Is Ahead? - 21 August 2020

Wells Fargo Economics & Financial Report / Aug 18, 2020

Despite indications of lost momentum elsewhere, residential construction activity is picking up steam.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

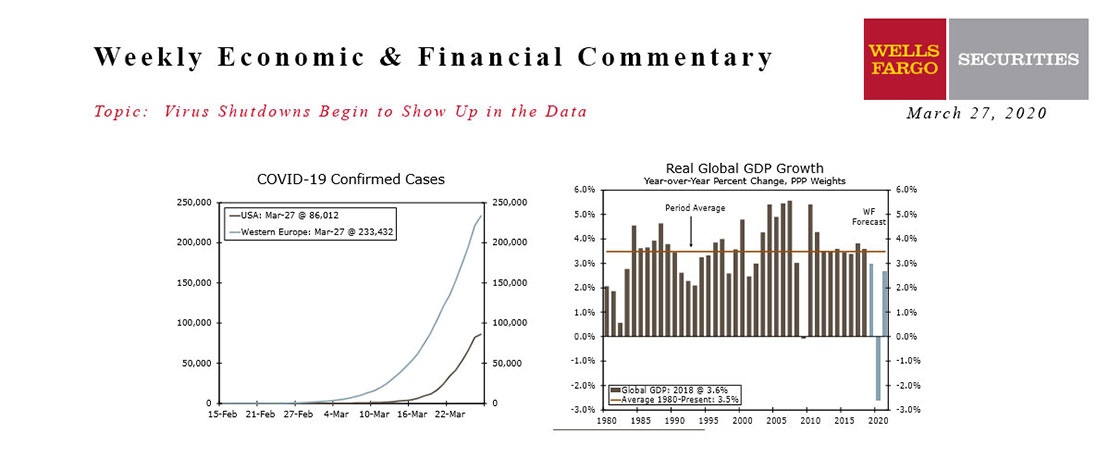

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

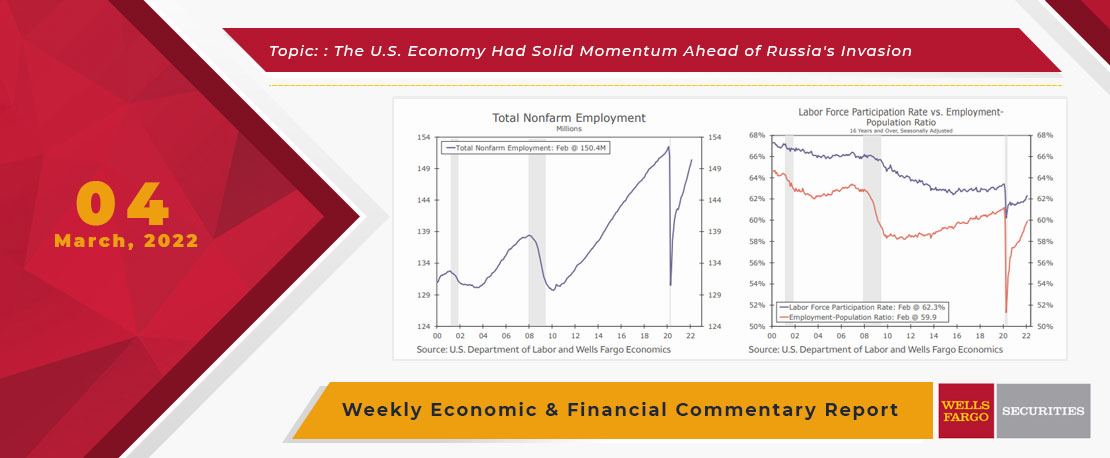

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.