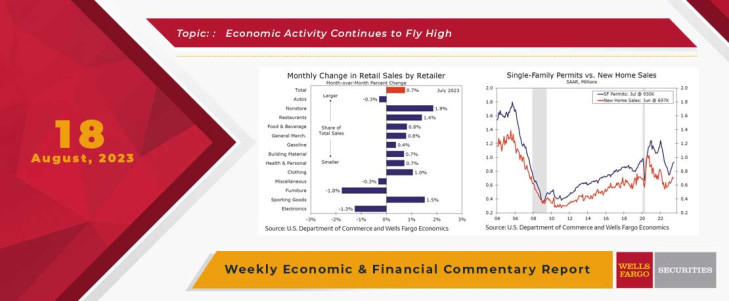

Last week, consumer and producer price indices showed inflation pressures continuing to gradually ease in July. Inflation's descent has occurred alongside a streak of stronger-than-expected economic data, and this week was no exception. Retail sales surprised to the upside in July, rising 0.7% over the month. Growth was fairly broad-based, with nine of the 13 retailer categories reporting increased sales (chart). Control group sales, which feeds into the Bureau of Economic Analysis' calculation of real personal consumption expenditures, rose an even stronger 1.0%. The outturn presents some upside risk to our 2.0% (annualized) call for real GDP in the third quarter; the Atlanta Fed's GDPNow model estimate for Q3 jumped nearly a full percentage point to 5.0% on the sales data.

The renewed strength in retail sales, if sustained, could lend some support to the factory sector in the coming months. Industrial production rose an above-consensus 1.0% in July, bolstered by a surge in utilities output and motor vehicle & parts manufacturing. While headline production came in better than expected, growth in manufacturing activity has been choppy this year—the overall level of manufacturing output stands just 0.2% above where it started 2023. Manufacturers remain broadly cautious of not overproducing and careful not to take on too much inventory in this tight credit environment.

Borrowing costs continue to rise. Freddie Mac's average 30-year fixed mortgage rate crested a 21-year high this week (see Credit Market Insights), driven in large part by the recent ascent in longer-dated Treasury yields (see Interest Rate Watch). Higher mortgage rates crimped the housing market for the better part of 2022. Still, home buying demand has found firmer footing this year, especially in the new home market where builders are offering price cuts, rate buy-downs and other incentives to move on their inventory. The trend improvement in new home sales has put some wind in the sails of residential construction (chart). Single-family building permits rose for the sixth straight month in July and are running at a 930,000-unit annual pace. Permits typically lead housing starts by one to two months, and the recent acceleration suggests that single-family home construction will continue to recover this year.

In short, activity data show the U.S. economy expanding at a solid rate. The underlying resilience has led many economists, us included, to upgrade their outlooks. The minutes from the July FOMC meeting rang with a similar tune, as the Committee noted "the economy had been showing considerable momentum." At the same time, the FOMC stressed that "inflation remained unacceptably high" and appeared resolute in holding its benchmark rate higher for longer to ensure price growth is sustainably brought down toward its 2% objective. The participants also cited upside risks to inflation that, if realized, would necessitate further policy tightening. The hawkish stance underpins our expectation that restrictive monetary policy, even in the face of strong activity, will tip the U.S. economy into a mild recession in early 2024.

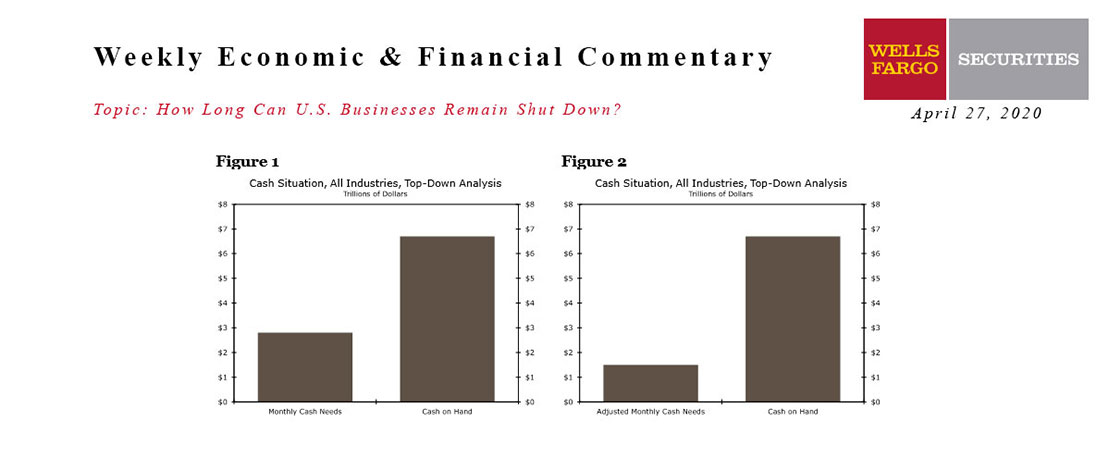

How Long Can US Businesses Remain Shut Down?

Wells Fargo Economics & Financial Report / Apr 29, 2020

The sudden stop in economic activity caused by the COVID-19 pandemic means that many businesses will need to rely on their cash reserves to survive the next few months.

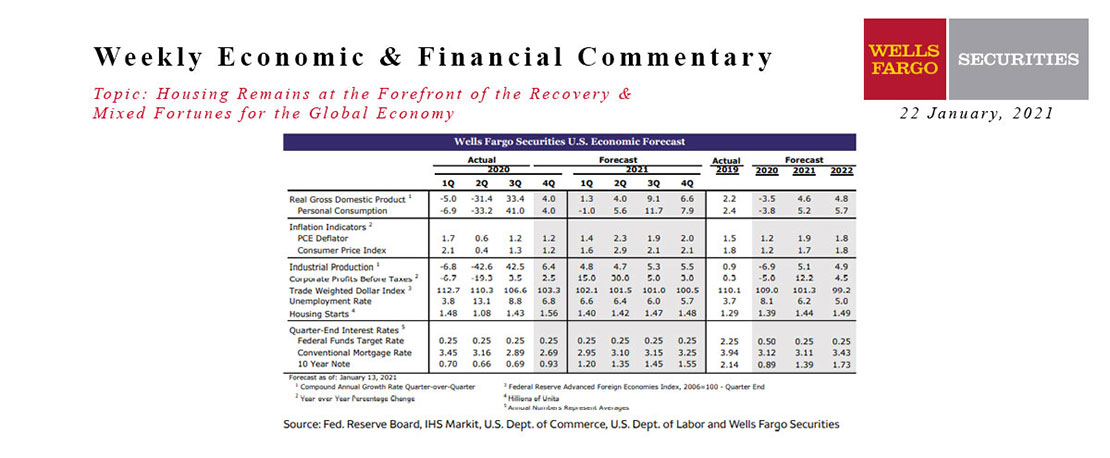

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

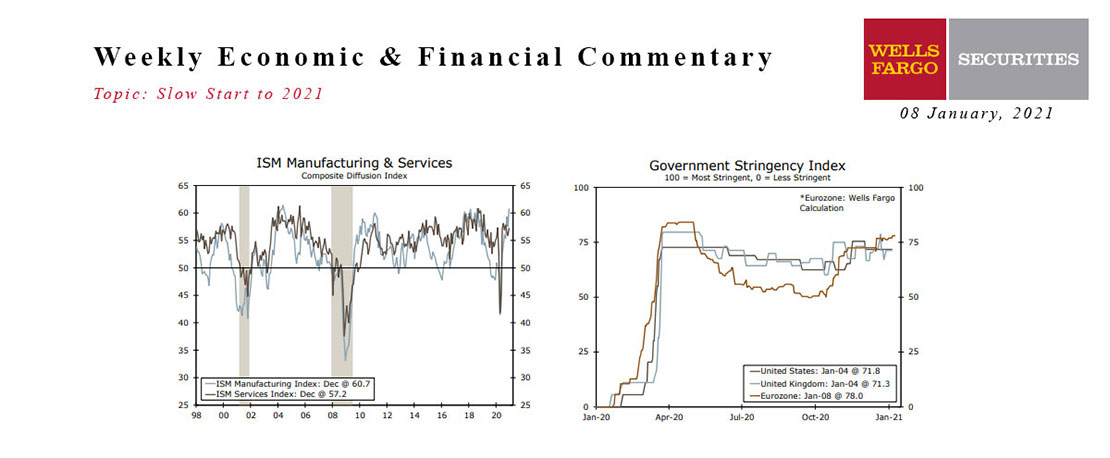

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

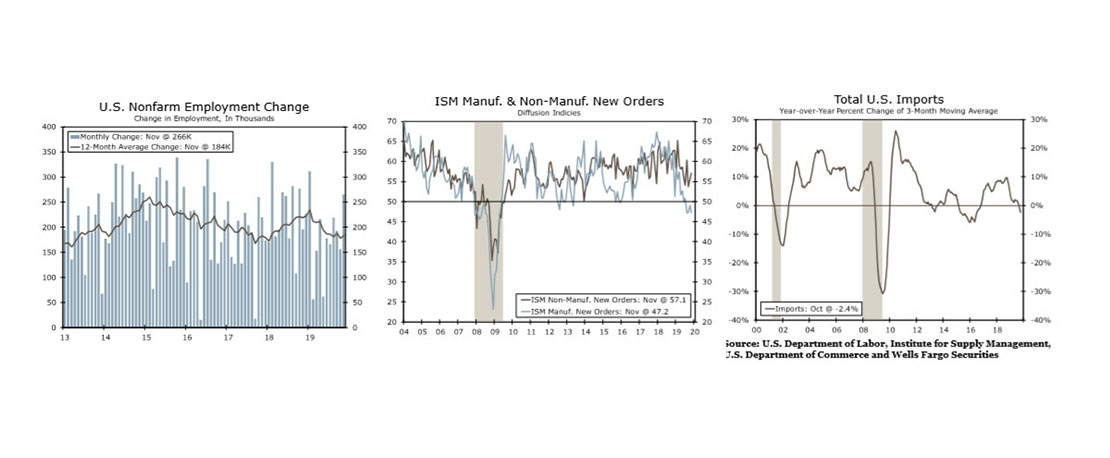

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

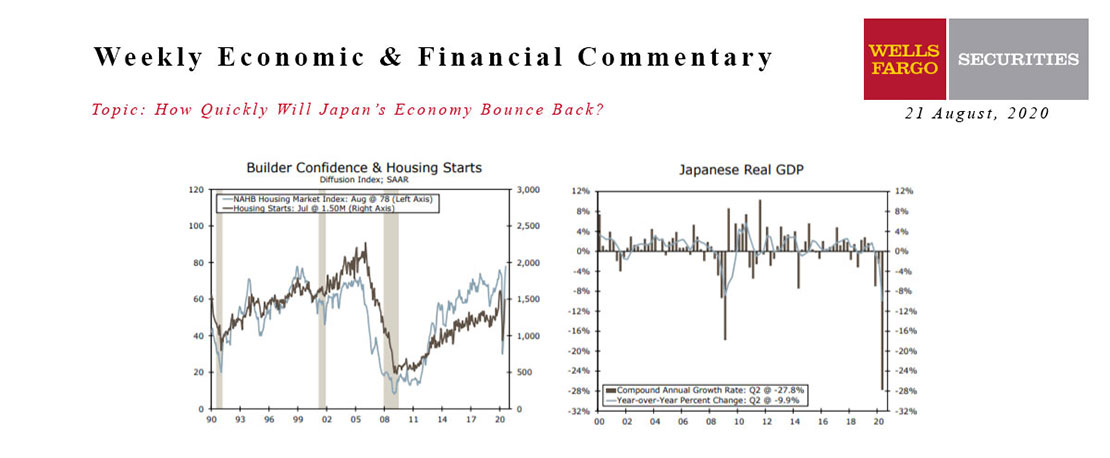

This Week's State Of The Economy - What Is Ahead? - 21 August 2020

Wells Fargo Economics & Financial Report / Aug 18, 2020

Despite indications of lost momentum elsewhere, residential construction activity is picking up steam.

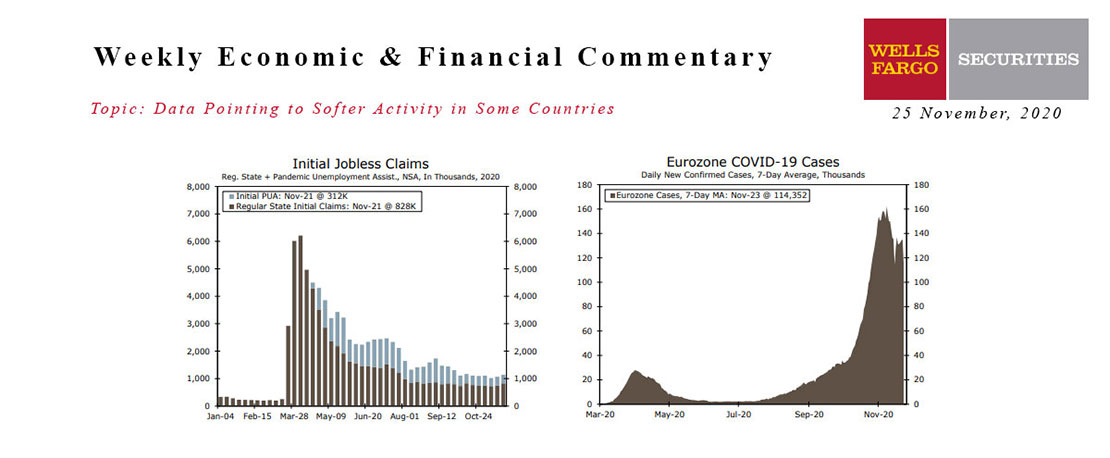

This Week's State Of The Economy - What Is Ahead? - 25 November 2020

Wells Fargo Economics & Financial Report / Nov 28, 2020

It may be a holiday-shortened week, but there have been as many developments and economic indicators packed into three days as we can recall seeing in any other week this year.

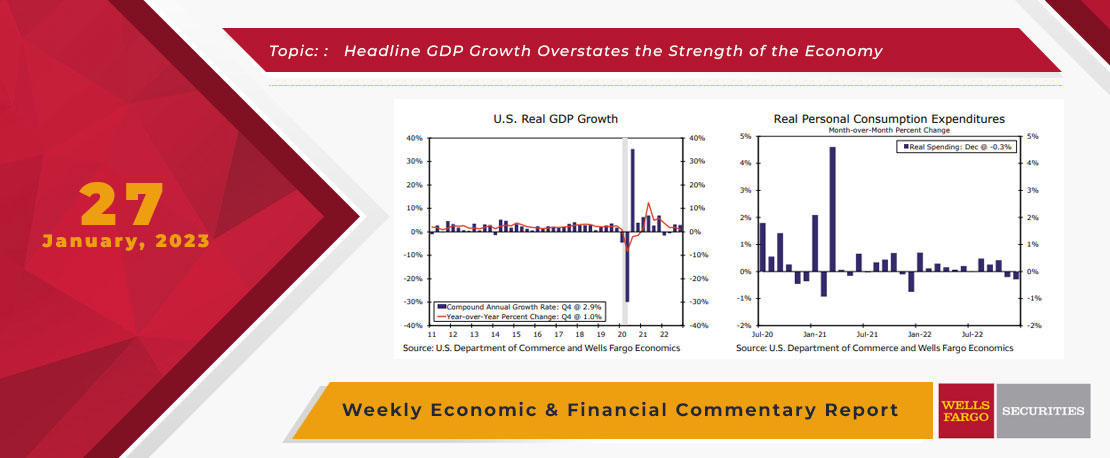

This Week's State Of The Economy - What Is Ahead? - 27 January 2023

Wells Fargo Economics & Financial Report / Jan 28, 2023

Real GDP expanded at a 2.9% annualized pace in Q4. While beating expectations, the underlying details were not as encouraging. Moreover, the weakening monthly indicator performances to end the year suggest the decelerating trend will continue in Q1.

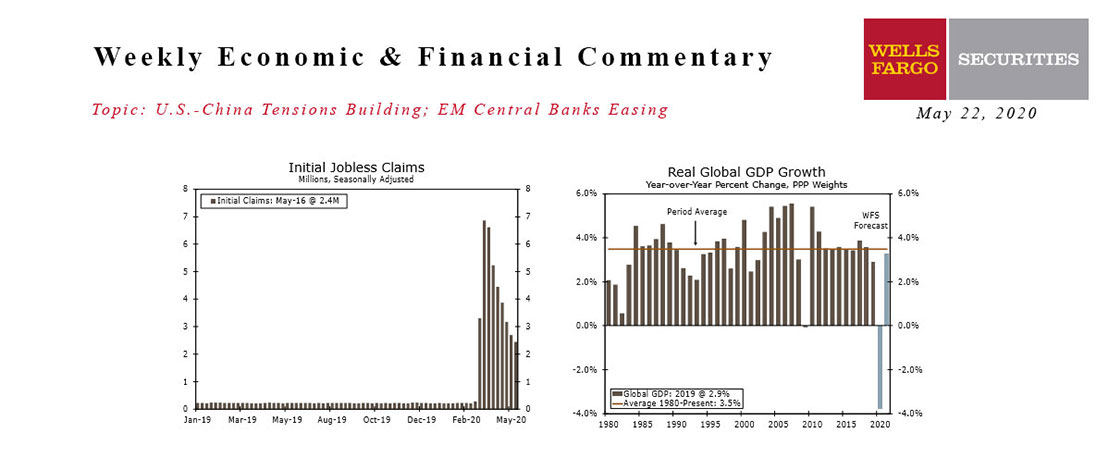

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

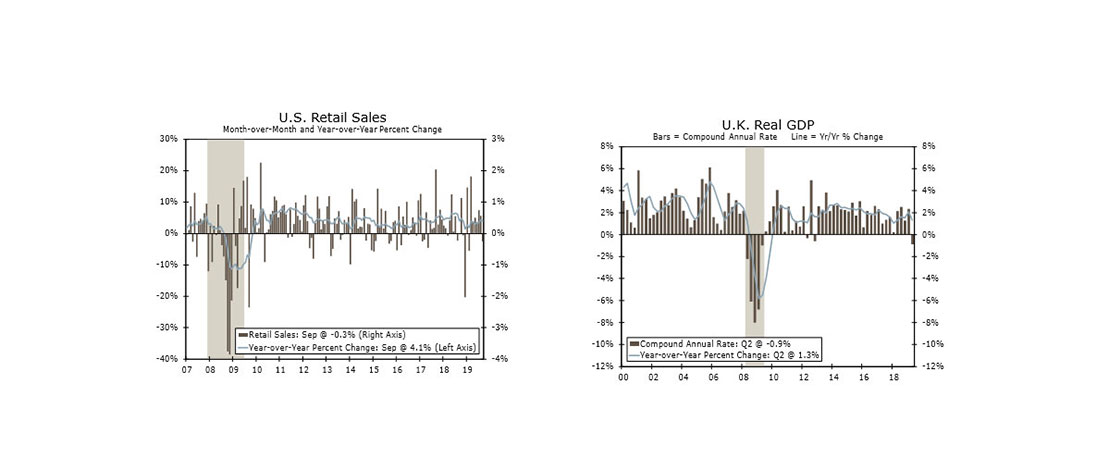

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

This Week's State Of The Economy - What Is Ahead? - 28 June 2024

Wells Fargo Economics & Financial Report / Jul 04, 2024

According to the Federal Reserve\'s preferred gauge, core inflation cooled to its softest pace in more than three years in May against a backdrop of measured consumer spending and still-strong personal income.

This Week's State Of The Economy - What Is Ahead? - 20 December 2019

Wells Fargo Economics & Financial Report / Dec 21, 2019

President Trump became the third president in U.S. history to be impeached by the House, but removal by the Senate is highly unlikely. The House also passed the USMCA, which should be signed into law in early 2020.