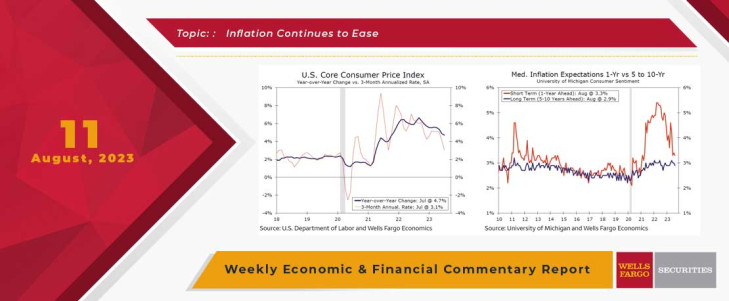

Inflation was in the spotlight this week. During July, both the headline and core measures of the Consumer Price Index (CPI) rose 0.2%. These monthly gains were largely in line with consensus expectations and provided additional evidence that price pressures are still receding. Inflation's descent, however, continues to be gradual. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging. The recent string of lower core CPI prints has pushed down the three-month annualized pace to 3.1%, the lowest since September 2021. The downshift in inflation without a material deterioration in economic growth has raised the likelihood of a soft landing, a topic we cover in more detail in our macroeconomic forecast update for August.

That said, by most measures, inflation is still above the Fed's 2% target and the path from here is anything but certain. There is a bit more clarity on the trajectory of shelter costs, which have been a substantial driver of overall inflation over the past year. The pace of shelter inflation has eased in recent months, yet it still is running at a hot rate. Primary shelter inflation, which largely reflect apartment rents, rose 0.4% during July. The CPI's measure of shelter prices tends to significantly lag private measures, which have shown a considerable downshift in rent growth. In addition, apartment demand has been more modest recently, and the pipeline of new apartment construction continues to run at a near-record pace. Together, these factors point to a further moderation in shelter costs in the near term.

Outside of the heavily weighted shelter component, services price changes were mixed in July. Airfares and vehicle rental prices both declined during the month. Medical services inflation softened during the month, while motor vehicle insurance, recreation services and tuition and childcare all rose. All told, core services inflation picked up 0.4% during the month, a more temperate rate compared to earlier in the year, but a mild acceleration relative to June.The climbdown in inflation continues to be aided by smoother functioning supply chains and normalizing demand. Core goods prices dropped 0.3% in July, the largest drop since March 2022. Prices for new and used autos fell during the month. Declines in household furnishings, recreation goods, education and communication goods also contributed to the downdraft.

Evidence that underlying inflation pressures are not intensifying was presented elsewhere this week. The core Producer Price Index (PPI), which excludes volatile food and energy costs, increased 0.3% during July, a tad higher than market expectations. However, over the past year, the core PPI was up 2.4%, similar to June's annual change. Cost pressures also appear to be diminishing for small business owners. Small business optimism bested expectations in July, notching its third consecutive improvement to reach an index reading of 91.9. Small business confidence is still low but has brightened recently alongside more moderate inflation. Consequently, fewer firms are reporting the need to implement price hikes. The net percentage of firms raising prices over the past three months fell to 25%, its lowest level since February 2021.

Inflation expectations also remain well-anchored, at least according to the preliminary results for the University of Michigan's Consumer Sentiment index for August. The top-line sentiment index came in at a reading of 71.2, down slightly from July's reading. The slip in sentiment was in line with consensus estimates and occurred against a backdrop of rising gas prices, announcement of a U.S. debt rating downgrade and ongoing financial market volatility. The inflation expectations components were more encouraging. One-year inflation expectations eased to 3.3% during the survey period, while 5-10 year inflation expectations slipped to 2.9%. Consumers continuing to not anticipate a sharp run-up in prices in the future will come as welcome news to policymakers and bolsters our view that July's 25 bps fed funds rate hike was the last of this tightening cycle. Inflation continues to ease; however, it still remains above target. Until price pressures are convincingly set on a course for 2%, rate cuts still look to be off in the distance.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

This Week's State Of The Economy - What Is Ahead? - 04 August 2023

Wells Fargo Economics & Financial Report / Aug 09, 2023

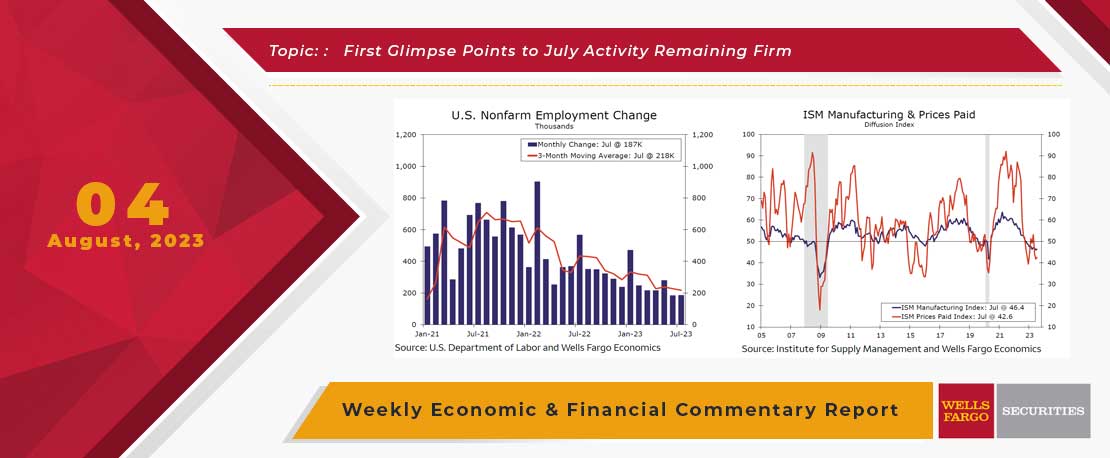

Employment growth was broad-based, though reliant on a 87K gain in health care & social assistance. Modest gains from construction, financial activities and hospitality also contributed to private sector job growth.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

September 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Sep 19, 2020

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well.

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

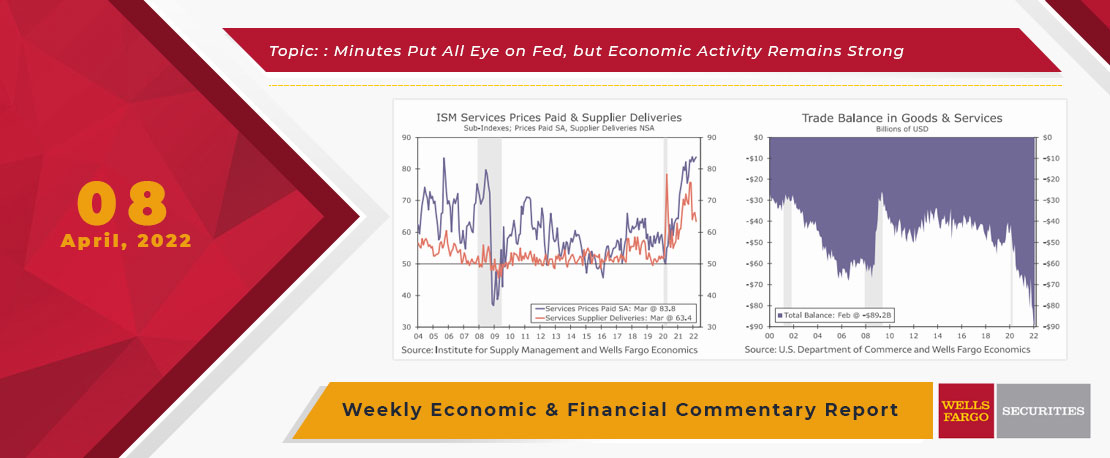

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.

2021 Annual Economic Outlook

Wells Fargo Economics & Financial Report / Dec 16, 2020

The longest U.S. economic expansion since the end of the Second World War came to an abrupt end earlier this year as the COVID pandemic essentially shut down the economy.

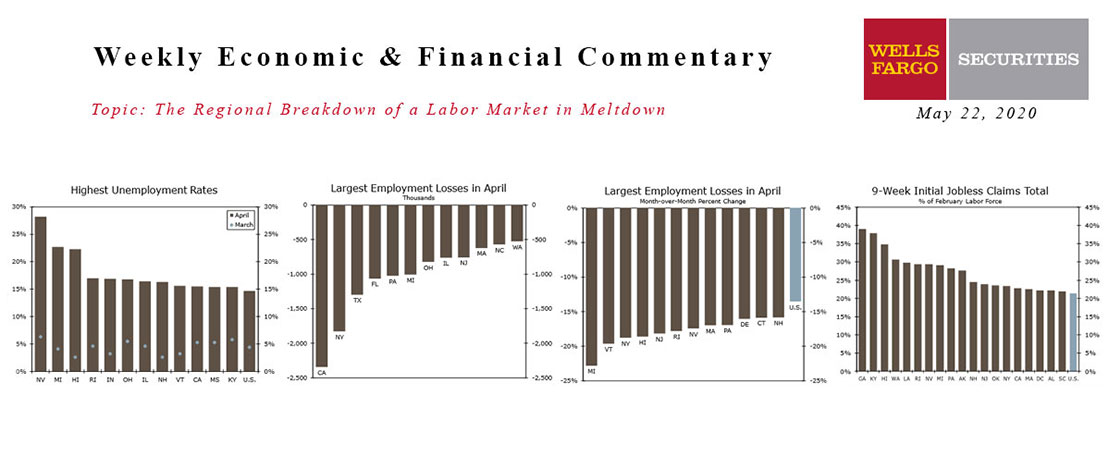

The Regional Breakdown Of A Labor Market In Meltdown

Wells Fargo Economics & Financial Report / May 26, 2020

Employment fell in all 50 states and 43 states saw their unemployment rate rise to a record in April. The damage is already hard to fathom-a 28% unemployment rate in Nevada and still another month of job losses ahead.

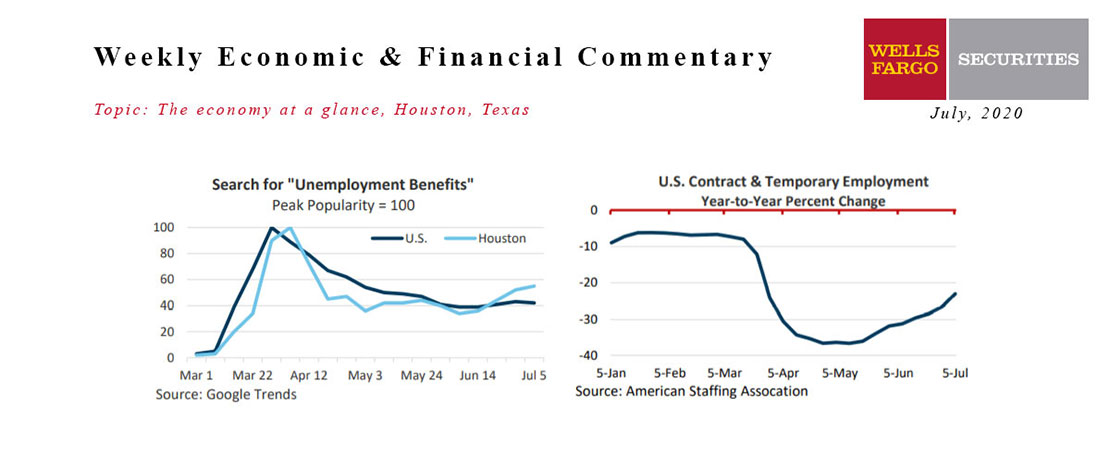

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

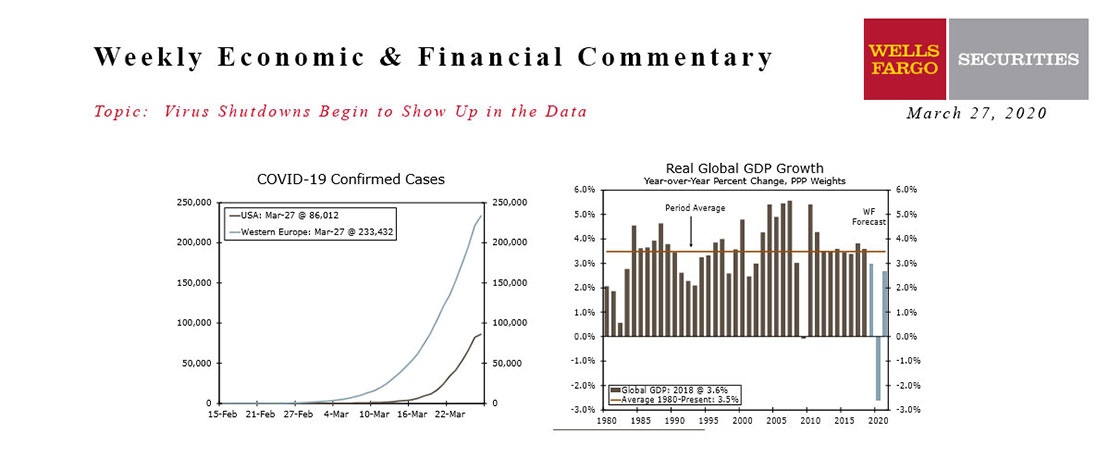

This Week's State Of The Economy - What Is Ahead? - 27 March 2020

Wells Fargo Economics & Financial Report / Mar 28, 2020

The U.S. surpassed Italy and China with the most confirmed cases of COVID-19. Europe is still the center of the storm, with the total cases in Europe’s five largest economies topping 230,000.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.