Energy

A March survey by the Federal Reserve Bank of Dallas found most exploration firms need West Texas Inter-mediate (WTI) at $49 per barrel or higher to profitably drill a well. EIA doesn’t forecast WTI to reach that level until late in ’21. And Rystad Energy doesn’t see drilling activity returning to last year’s level for at least five years.

Manufacturing

Ninety percent of the losses in manufacturing were in durable goods, i.e., items that not easily consumed or that wear out quickly. Two-thirds of those losses can be tied to the energy downturn. Fabricated metal products (i.e., pipes, valves, flanges) and oil field equipment manufacturing have cut a combined 9,600 jobs. Without an increase in drilling activity, the jobs are unlikely to return.

Transportation and Warehousing

Passenger traffic through the Houston Airport System (HAS) traffic has improved. Early in the pandemic, it was down 90 percent. Today, traffic is down only 75 percent.

Though container volume at the Port of Houston is down 4.5 percent, the total weight of those containers is up 3.9 percent. Shippers, to economize, appear to be packing more cargo into each box.

Finance, Insurance, Real Estate, & Rental

Finance has fared well, with employment at banks, broker-ages and insurance agencies now above pre-pandemic levels. Consumers rushing to buy or refinance a home, the opening of dozen or so bank offices and branches, and until recently a hot stock market has helped create finance jobs during the pandemic. This momentum should support additional growth over the coming months.

Commercial real estate has struggled, however. The market recorded negative absorption for office, industrial and retail space in the second quarter. Some tenants have adopted a wait-and-see attitude, wanting to assess the impact of the recession on their business before considering new space. Others are struggling to pay their current rent. Brokers have reported an uptick in inquiries in recent weeks, suggesting demand may improve by Q4/20 or Q1/21. Employment in commercial real estate will remain flat until that happens.

Government

Job losses in the public sector are overstated. Every June and July, the sector drops 20,000 to 25,000 jobs as school districts, community colleges and universities close for the summer. Outside of public education, the government sector appears to have shed about 4,000 jobs. The employment outlook for this sector will depend on how well tax collections hold up as the economy reopens.

A False Assumption

The energy job losses layered on top of the pandemic losses have not made Houston worse off than other metros. In fact, Houston is faring better than many of its peers.

Houston is the nation’s fifth most populous metro. One might assume Houston would rank fifth or higher in jobs lost due to COVID shutdowns and the energy crunch. Houston actually ranks tenth among its peers, with fewer layoffs than less populous metros like Boston, Detroit, Miami, Philadelphia and San Francisco.

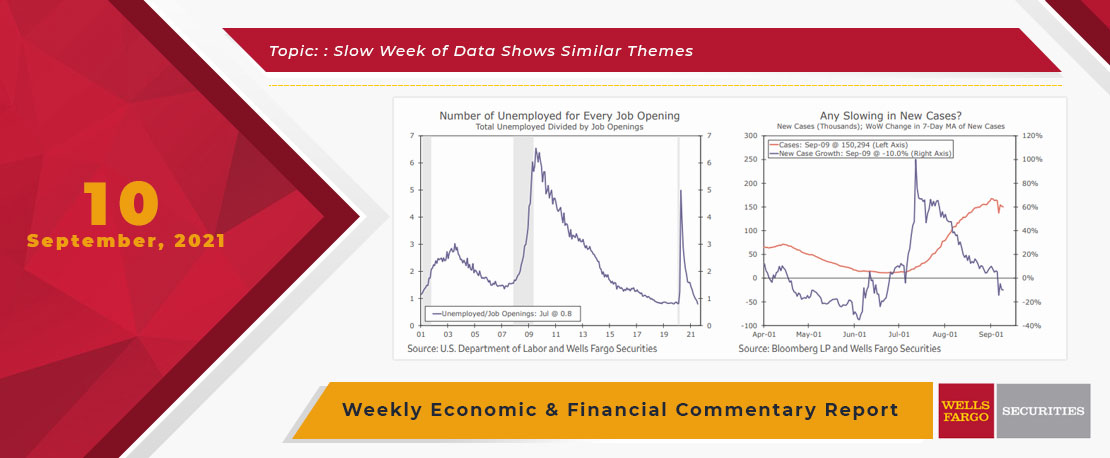

This Week's State Of The Economy - What Is Ahead? - 10 September 2021

Wells Fargo Economics & Financial Report / Sep 13, 2021

Data from the opening weekend of College Football indicates that we will have to endure another season of Nick Saban deification.

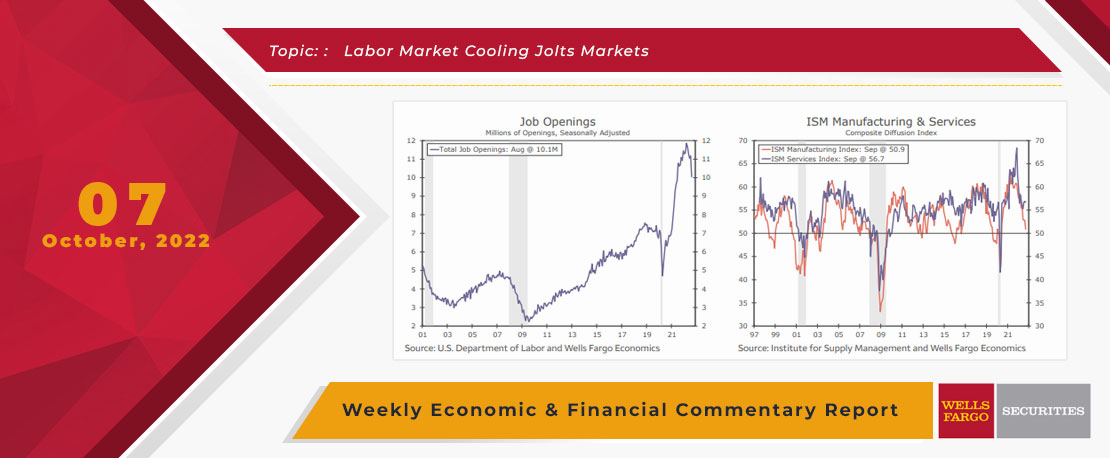

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

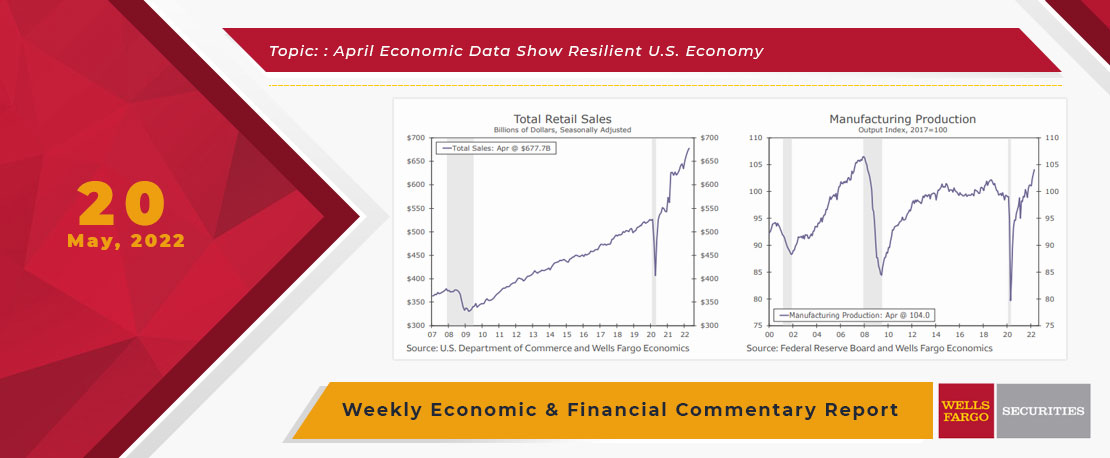

This Week's State Of The Economy - What Is Ahead? - 20 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

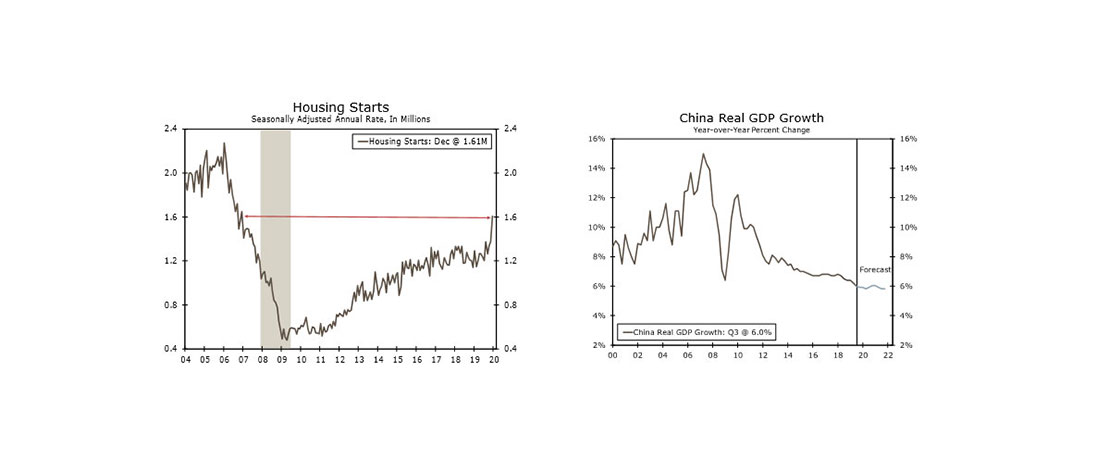

U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs of cooling.

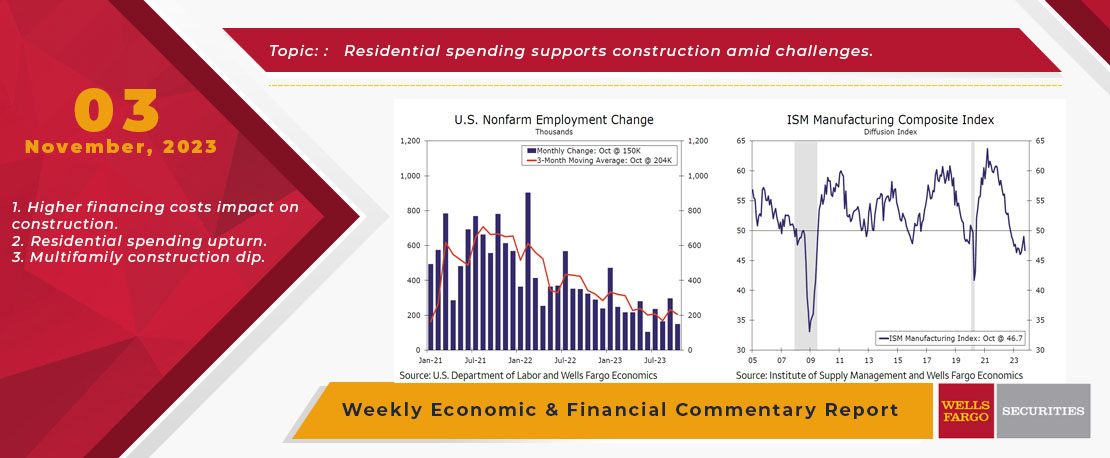

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

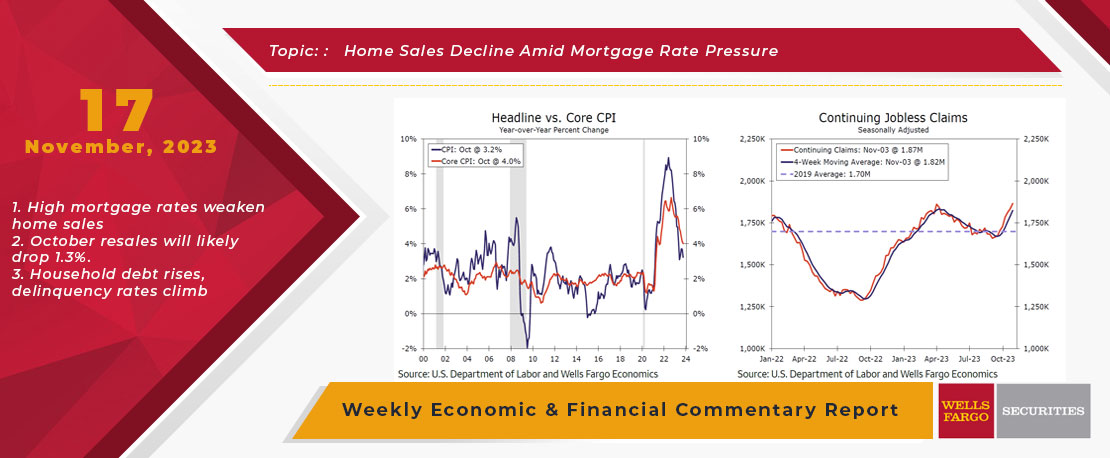

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

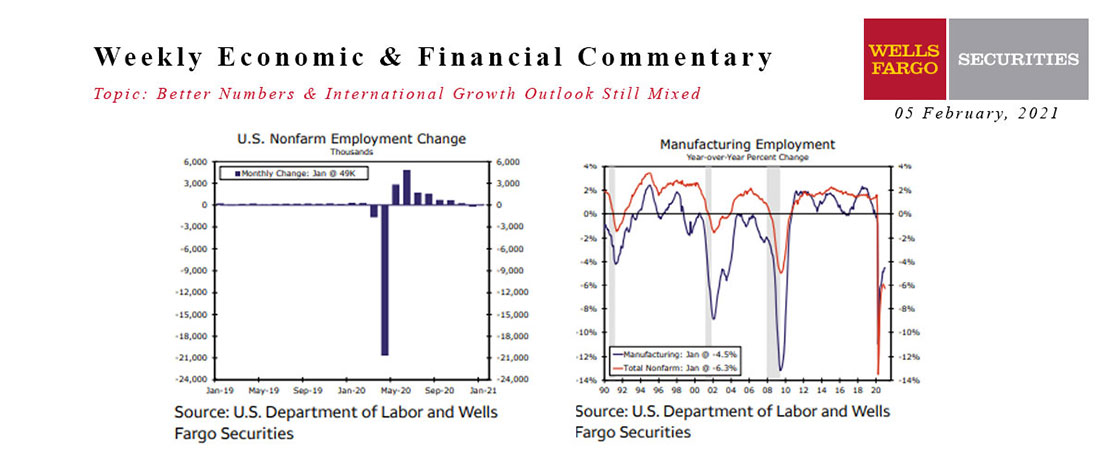

This Week's State Of The Economy - What Is Ahead? - 05 February 2021

Wells Fargo Economics & Financial Report / Feb 10, 2021

Nonfarm employment rebounded in January, with employers adding 49,000 jobs following the prior month\'s 227,000-job drop.

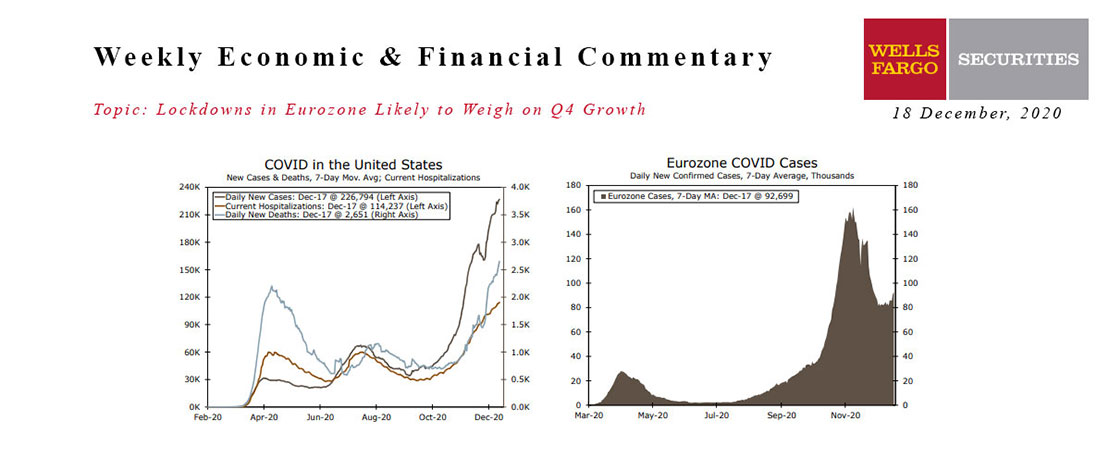

This Week's State Of The Economy - What Is Ahead? - 18 December 2020

Wells Fargo Economics & Financial Report / Dec 21, 2020

This week marked the first U.S. COVID vaccinations and the imminent rollout of a second vaccine.

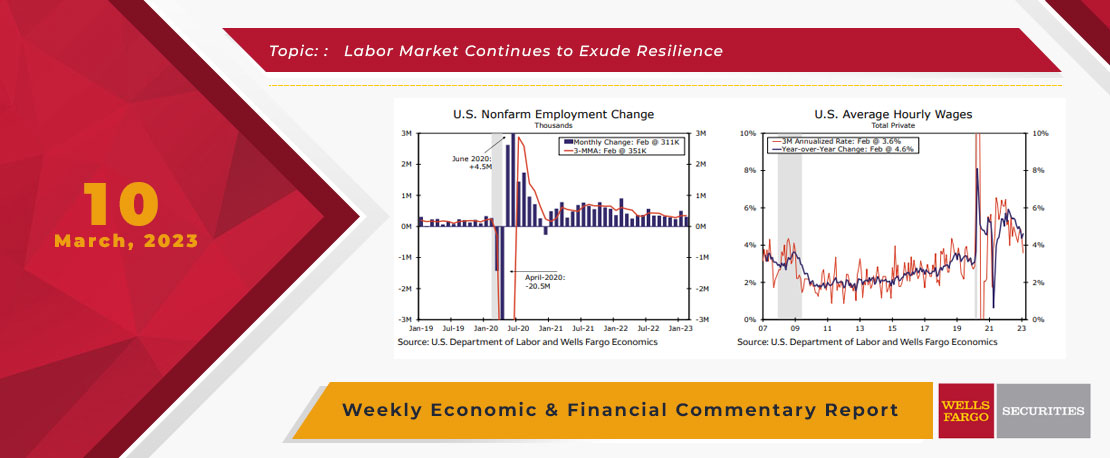

This Week's State Of The Economy - What Is Ahead? - 10 March 2023

Wells Fargo Economics & Financial Report / Mar 14, 2023

Financial markets were looking for validation that January\'s unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized.

Where Will That $2 Trillion Come From Anyway?

Wells Fargo Economics & Financial Report / Apr 01, 2020

Net Treasury issuance is set to surge in the coming weeks and months. At present, we look for the federal budget deficit to be $2.4 trillion in FY 2020 and $1.7 trillion in FY 2021.

This Week's State Of The Economy - What Is Ahead? - 17 November 2023

Wells Fargo Economics & Financial Report / Nov 23, 2023

Retail and Industrial activity were stronger than the headline data suggest, there are also some signs of weakening.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.