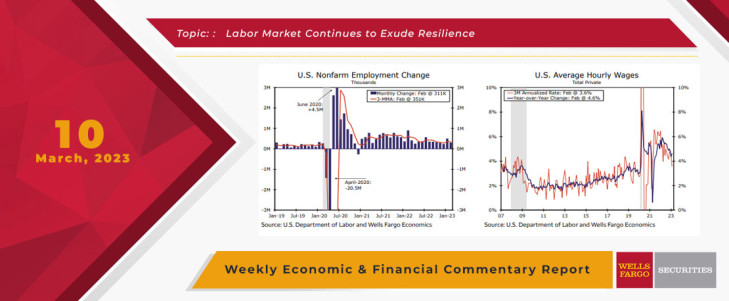

Labor Market Continues to Exude Resilience

Coming into the week, financial markets were looking for validation that January's unexpected strength was not a fluke and that the downward slide in economic momentum experienced late last year had stabilized. On balance, this week's indicators supported that notion.

Total nonfarm payrolls increased 311,000 in February, marking the 11th consecutive month payrolls have beaten consensus expectations. Leisure & hospitality led the charge, adding 105K jobs last month. Strong monthly gains were also seen in retail (50K), professional business services (45K), healthcare (44K) and government (46k). In contrast, net hiring losses were reported in information (-25K), manufacturing (-4K) and financial (-1K). The unemployment rate rose to 3.6% in February from 3.4% in January, as the strong 419K increase in the labor force offset a more muted 177K gain in household employment. The labor force participation rate now sits at a fresh cycle high of 62.5%, not too far off the pre-pandemic average of 63.3%. In another encouraging sign for Fed officials, average hourly earnings rose less than expected last month, up just 0.2%. Along with modest downward revisions to December's and January's gains, average hourly earnings growth has slowed to a 3.6% annualized rate—a pace that is getting much closer within the realm of what would be consistent with 2% inflation.

Also released this week, the Job Openings and Labor Turnover Survey (JOLTS) suggested labor demand remained reasonably firm at the start of the year. While job openings fell 3.7% in January to a level of 10.824 million from an upwardly revised December figure, the level remains high, down only 10% from its peak last March and still running about 50% above pre-pandemic levels. The job openings rate (job openings as a percent of total employment plus job openings) fell to 6.5% in January from 6.8% in December, with the ratio of job openings to the number of unemployed slipping slightly to 1.9 from 2.0 in the prior month. Following signs of greater progress last year, the January decline in job openings points to only modest progress in addressing the substantial imbalance between labor demand and supply.

Outside of the labor market, yet still supportive of resilient demand, the trade deficit widened in January as imports and exports both posted strong monthly gains. Exports rebounded 3.4%, marking the first sequential gain in five months, while imports increased 3.0%. While this has been an encouraging start to the year, questions remain over whether these positive trajectories can be maintained. The January trade report puts net exports on track to be a slight negative for GDP growth in the first quarter

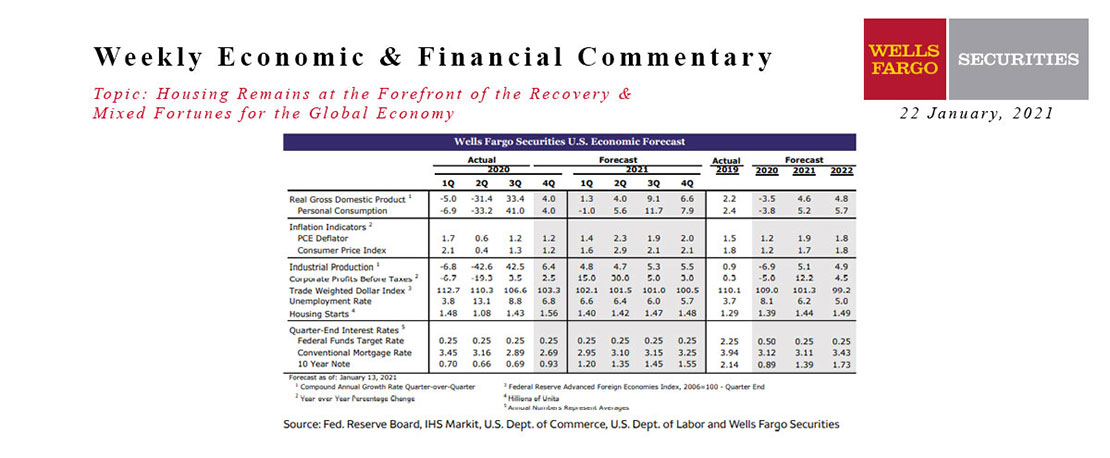

This Week's State Of The Economy - What Is Ahead? - 22 January 2021

Wells Fargo Economics & Financial Report / Jan 23, 2021

Housing starts jumped 5.8% during December. Single-family starts soared 12%, while multifamily starts dropped 13.6%.

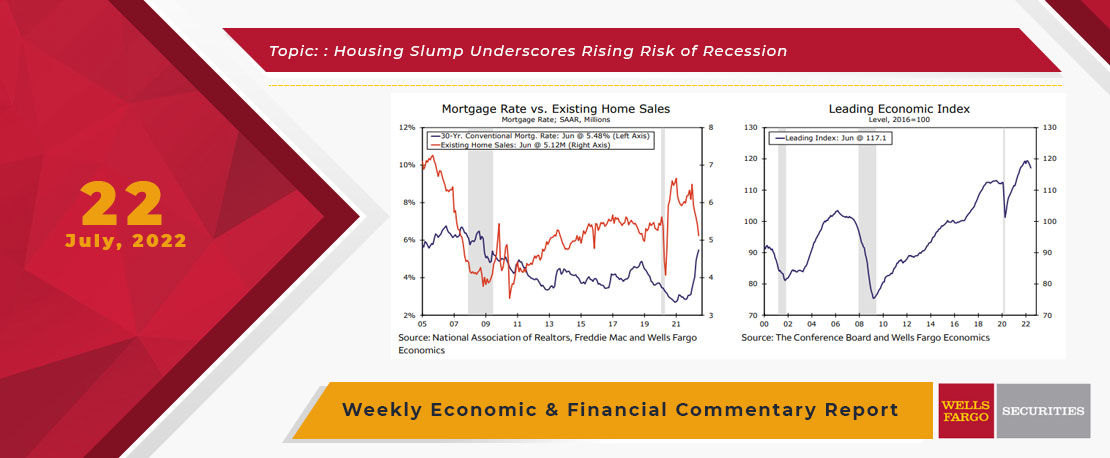

This Week's State Of The Economy - What Is Ahead? - 22 July 2022

Wells Fargo Economics & Financial Report / Jul 27, 2022

July\'s NAHB Housing Market Index dropped 12 points to 55, the second largest monthly decline on record behind April 2020\'s pandemic-induced collapse.

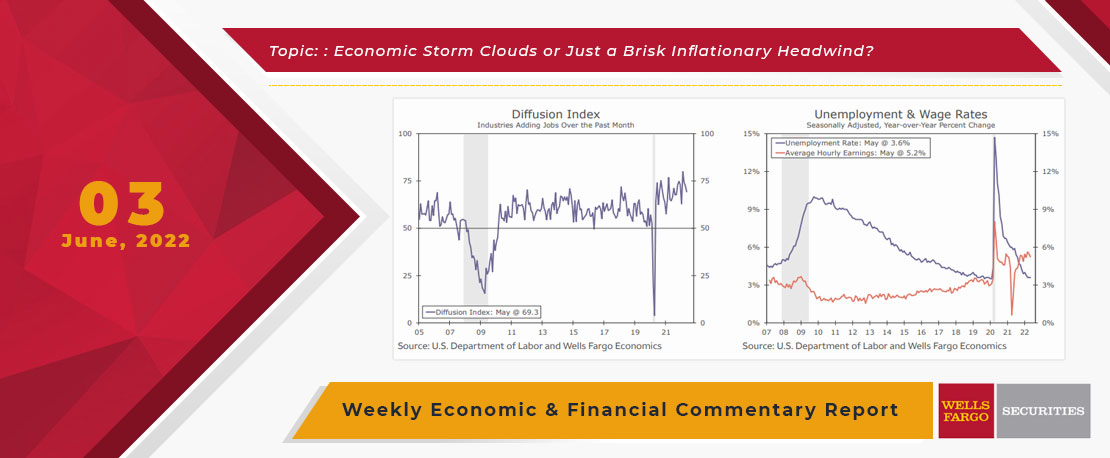

This Week's State Of The Economy - What Is Ahead? - 03 June 2022

Wells Fargo Economics & Financial Report / Jun 08, 2022

While talk of recession has kicked up in recent weeks, the majority of economic data remain consistent with modest growth.

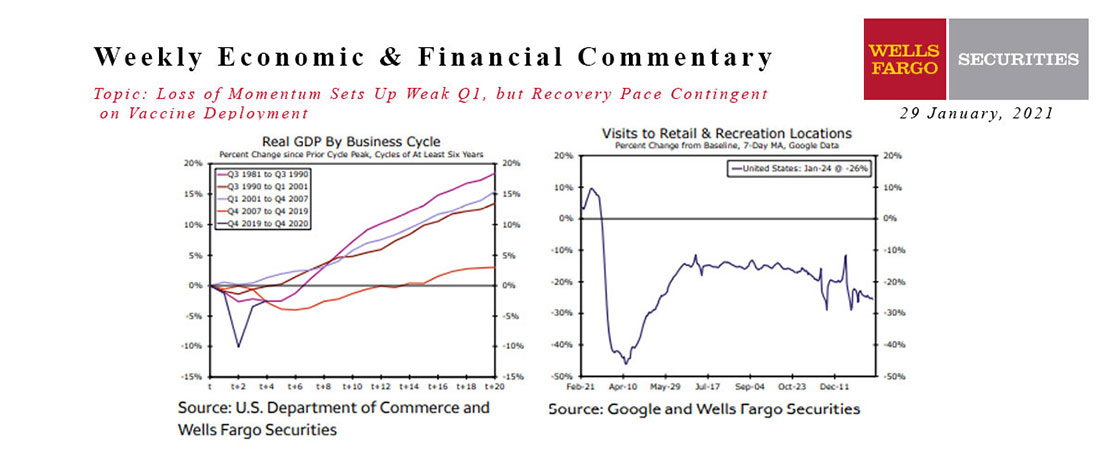

This Week's State Of The Economy - What Is Ahead? - 29 January 2021

Wells Fargo Economics & Financial Report / Feb 09, 2021

Economic data came in largely as expected this week and suggest continued economic recovery.

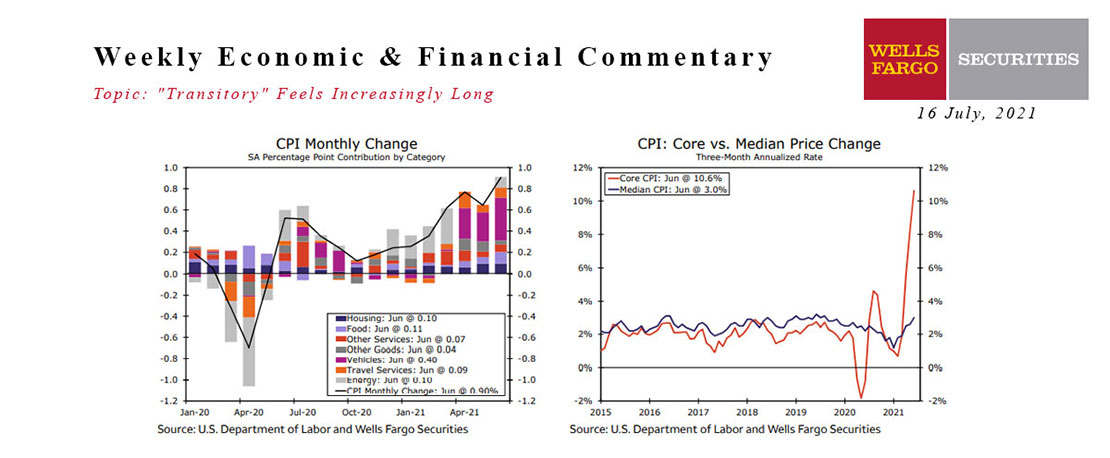

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

This Week's State Of The Economy - What Is Ahead? - 17 May 2024

Wells Fargo Economics & Financial Report / May 23, 2024

The Producer Price Index (PPI) was a bit firm in April, rising 0.5% amid higher services prices, though it did come with slight downward revisions to prior month\'s data.

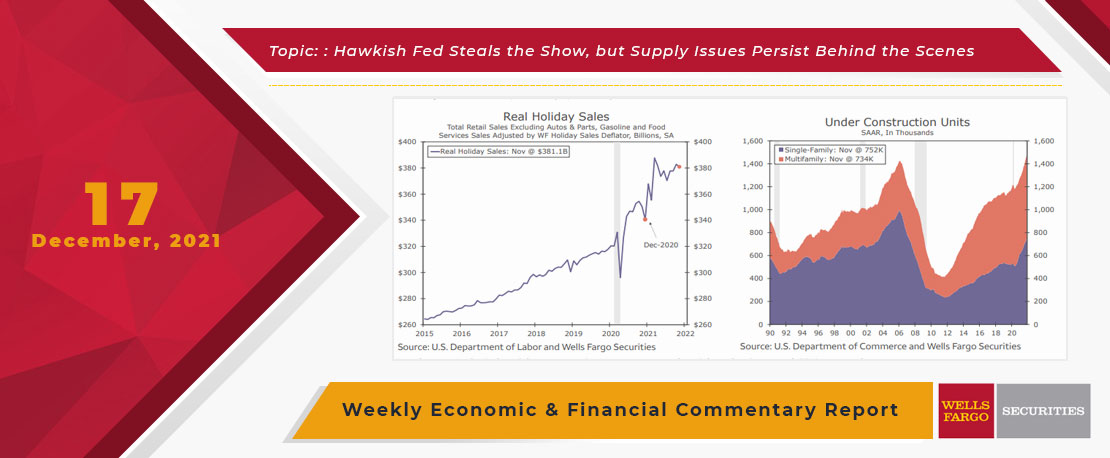

This Week's State Of The Economy - What Is Ahead? - 17 December 2021

Wells Fargo Economics & Financial Report / Dec 21, 2021

7 Interest Rate Watch for more detail. In other news, retail sales data disappointed as higher prices factor into spending and industrial activity continued to recover but remains beset by supply issues.

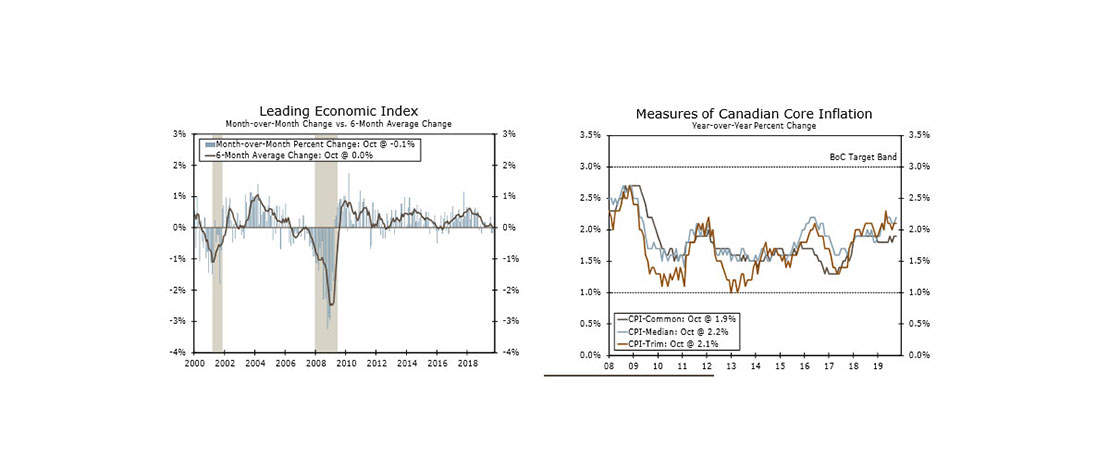

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.

This Week's State Of The Economy - What Is Ahead? - 30 September 2022

Wells Fargo Economics & Financial Report / Oct 03, 2022

Just as I know the folks in Florida are resilient and will recover in time, incoming data indicate a slowing yet resilient economy.

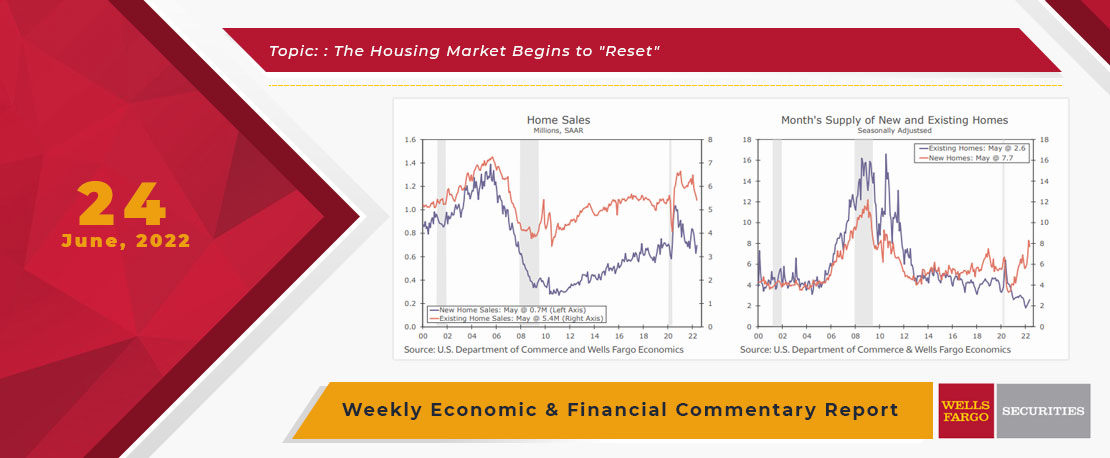

This Week's State Of The Economy - What Is Ahead? - 24 June 2022

Wells Fargo Economics & Financial Report / Jun 25, 2022

The biggest economic news was Fed Chair Powell presenting the Federal Reserve\'s semiannual Monetary Policy report to Congress this week.