While some parts of the U.S., such as the Western U.S. up to the Northwest, were enduring some truly high temperatures the last couple weeks, I was visiting family in the upper Mid West, where cooler-but-still-warm temperatures were causing the local Scandinavian-descended population to melt. Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to. For those paying attention, that’s also my excuse for not getting my weekly Economic Commentary distribution done last week.

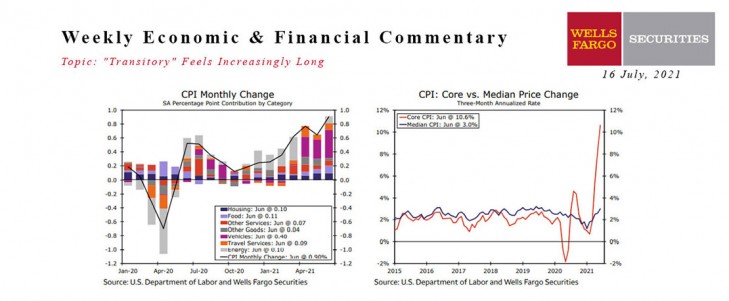

I don’t think we missed much in economic news. Inflationary pressure is still present, as both consumer and producer price inflation results for June came in higher-than-expected, and the Fed still seems of the view that current inflationary pressure is most likely temporary. See p. 2 of the Commentary for more detail. Next week we have updated data on housing starts and existing home sales to look forward to. In the meantime, have a great weekend.

This Week's State Of The Economy - What Is Ahead? - 30 April 2021

Wells Fargo Economics & Financial Report / May 18, 2021

The gain in output leaves the level of real GDP just a stone\'s throw below its pre-COVID Q4-2019 level (see chart).

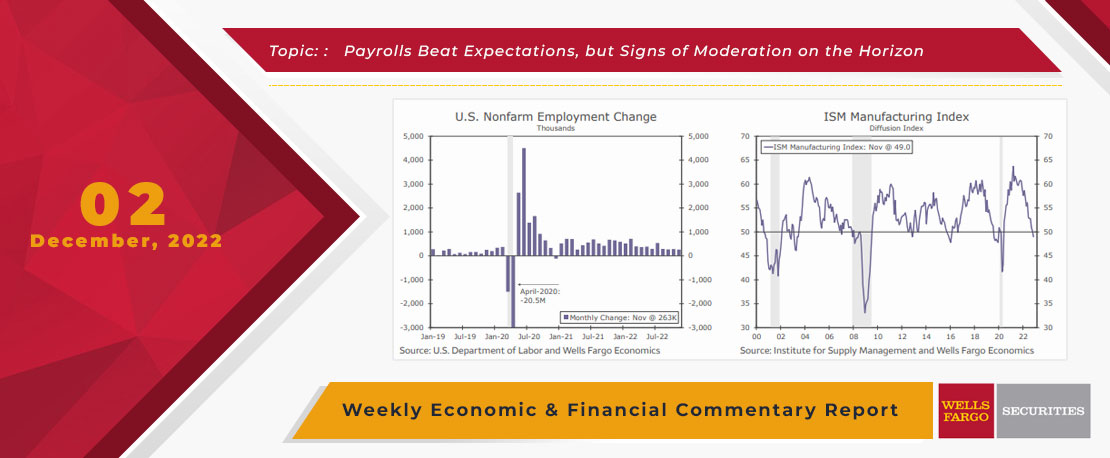

This Week's State Of The Economy - What Is Ahead? - 02 December 2022

Wells Fargo Economics & Financial Report / Dec 08, 2022

Total payrolls rose by 263K in November, with the unemployment rate holding steady at 3.7% and average hourly earning rising by 0.6%.

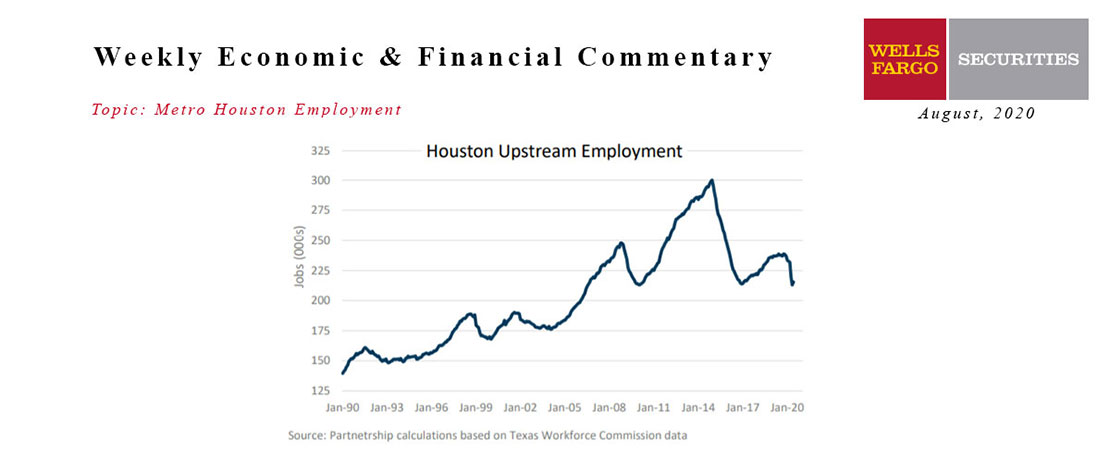

August 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Aug 22, 2020

Downstream involves the refining and processing of oil and natural gas into fuels, chemicals, and plastics. All three sectors are well-represented in Houston.

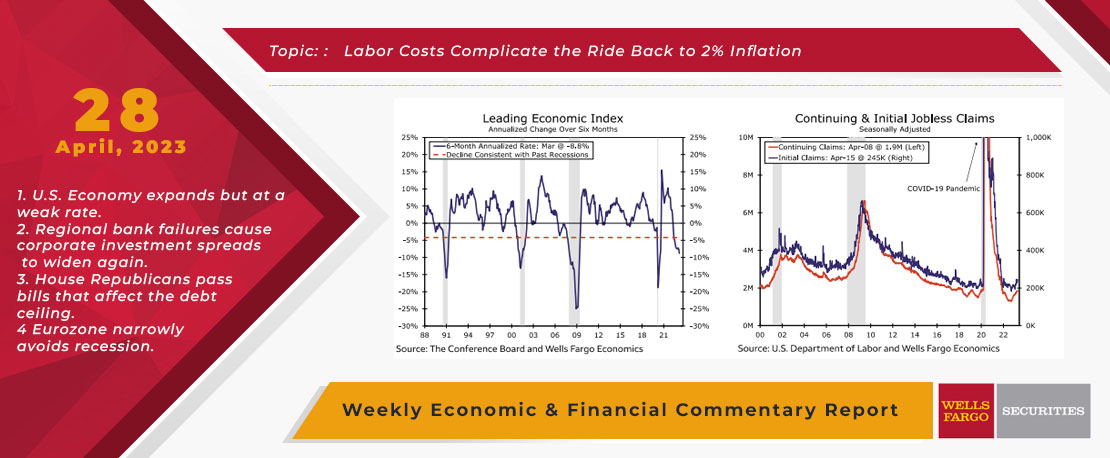

This Week's State Of The Economy - What Is Ahead? - 28 April 2023

Wells Fargo Economics & Financial Report / May 03, 2023

U.S. Economy expands but at a weak rate. Regional bank failures cause corporate investment spreads to widen again. House Republicans pass bills that affect the debt ceiling.

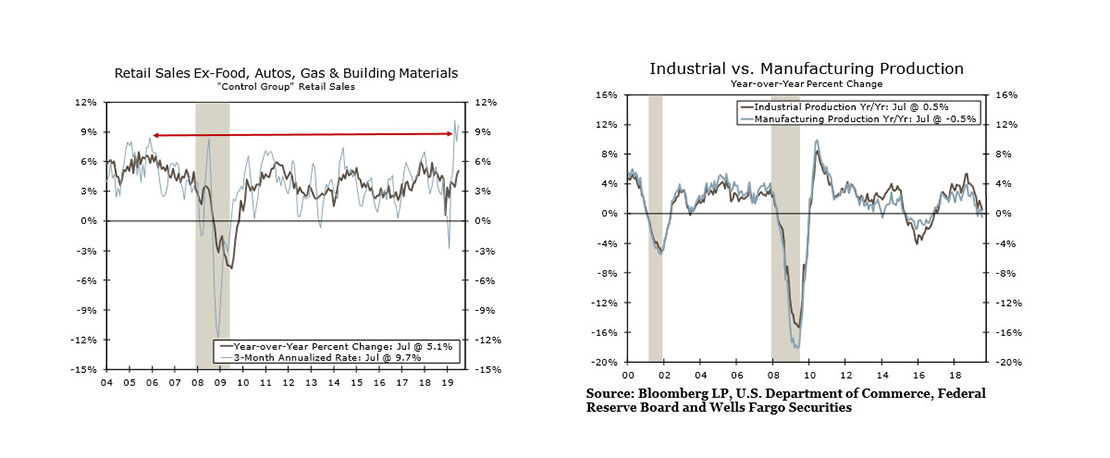

This Week's State Of The Economy - What Is Ahead? - 16 August 2019

Wells Fargo Economics & Financial Report / Aug 17, 2019

Markets gyrated this week as the spread between the ten- and two-year Treasury\'s turned negative for the first time since 2007. Financial markets seem to expect that the sharp slowdown in growth overseas will soon spread to the United States.

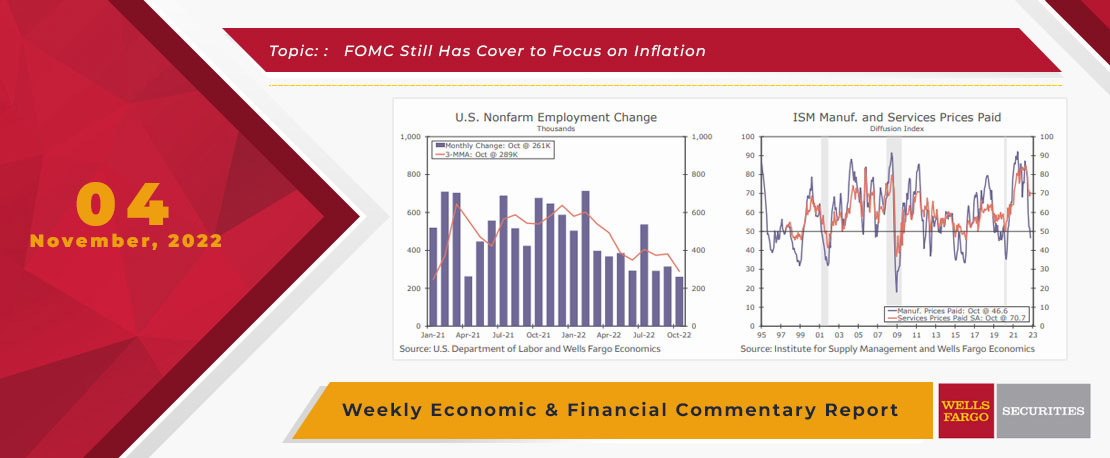

This Week's State Of The Economy - What Is Ahead? - 04 November 2022

Wells Fargo Economics & Financial Report / Nov 07, 2022

Employers continued to add jobs at a steady clip in October, demonstrating the labor market remains tight and the FOMC will continue to tighten policy.

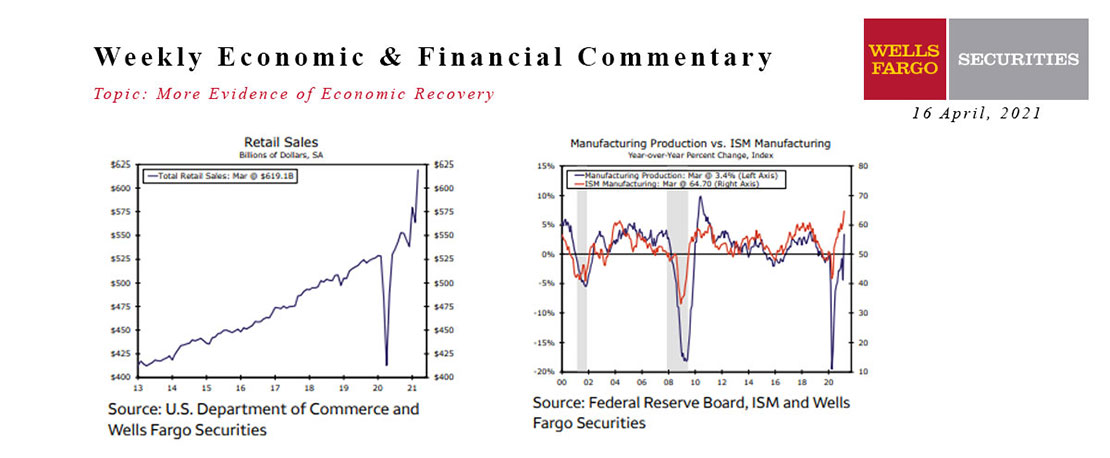

This Week's State Of The Economy - What Is Ahead? - 16 April 2021

Wells Fargo Economics & Financial Report / Apr 17, 2021

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived.

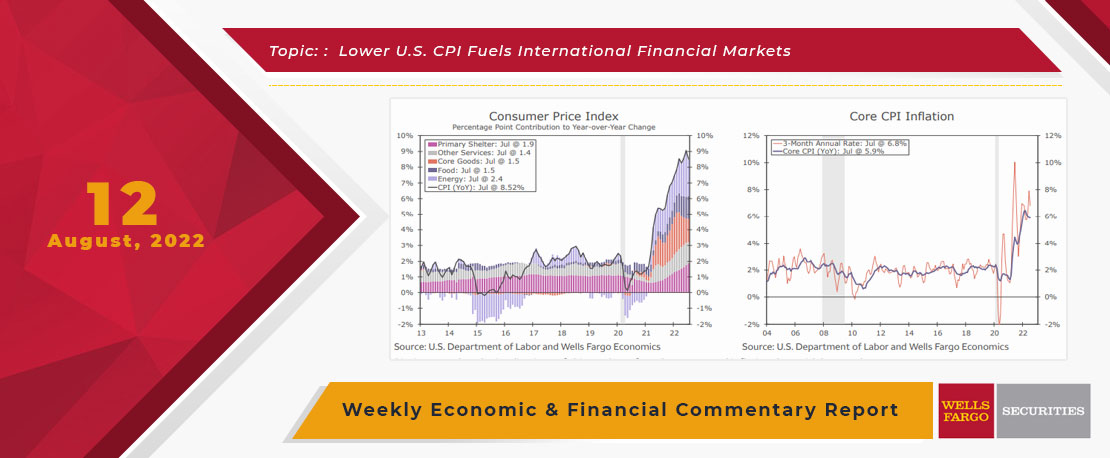

This Week's State Of The Economy - What Is Ahead? - 12 August 2022

Wells Fargo Economics & Financial Report / Aug 13, 2022

The FOMC has made it clear that it needs to see inflation slowing on a sustained basis before pivoting from its current stance. The data seems to be going in multiple directions all at once.

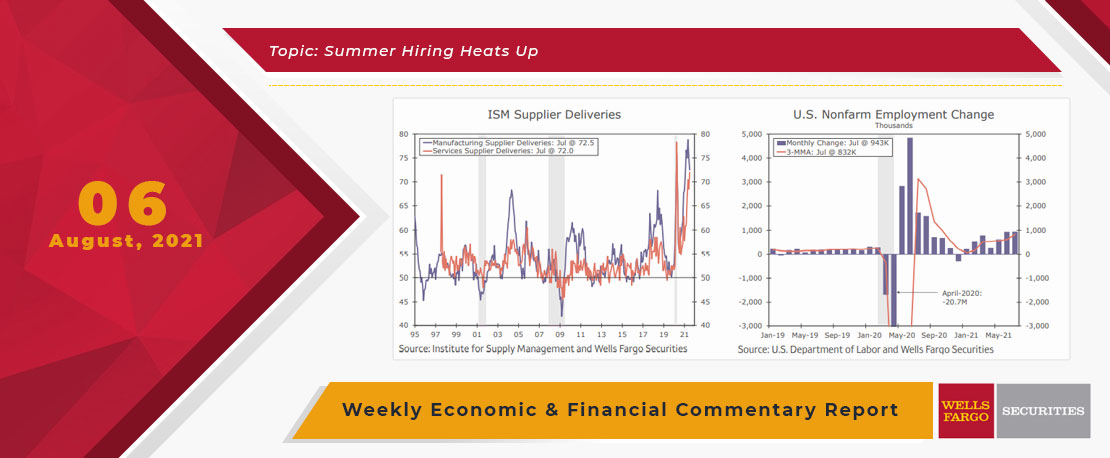

This Week's State Of The Economy - What Is Ahead? - 06 August 2021

Wells Fargo Economics & Financial Report / Aug 16, 2021

Back to the economy, issues with supply constraints remains a broken-record reference, but data this week highlighted the economy\'s resilience in spite of those continuing problems.

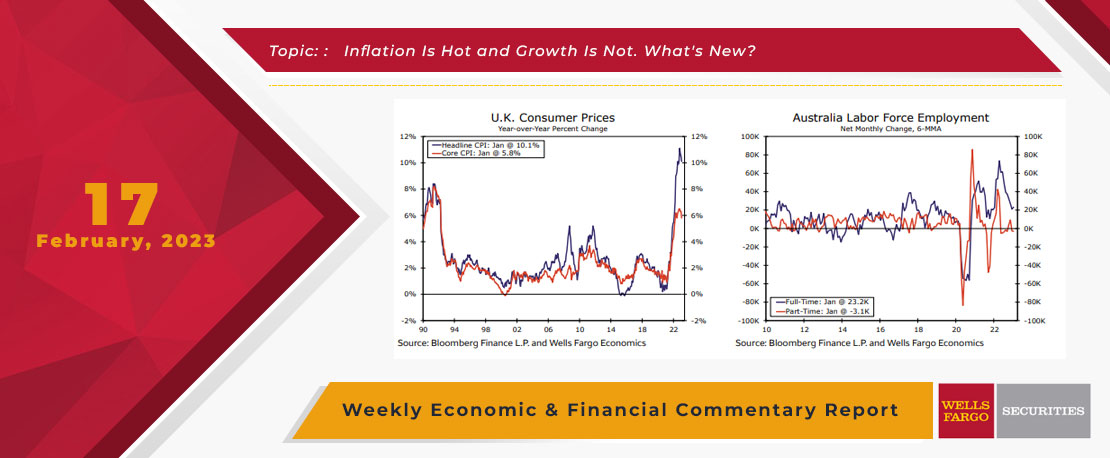

This Week's State Of The Economy - What Is Ahead? - 17 February 2023

Wells Fargo Economics & Financial Report / Feb 20, 2023

Inflation in the U.K. receded for the third straight month in January, with the headline rate coming in at 10.1% year-over-year. In bad news, this is still five times the Bank of England\'s 2% target.