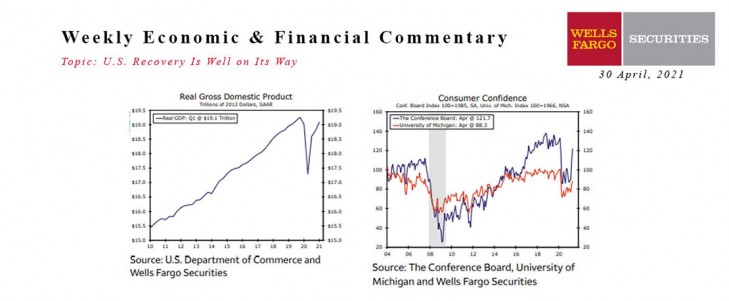

U.S. Review U.S. Recovery Is Well on Its Way

Data released this week showed the U.S. economy expanded at a rapid 6.4% annualized rate in the first quarter. The gain in output leaves the level of real GDP just a stone's throw below its pre-COVID Q4-2019 level (see chart). We project the level of output to eclipse its pre-COVID position in the second quarter and for the remaining output gap to close by the end of the year. Most major areas of the economy expanded in the first quarter, but a considerable boost came from stimulus-fueled consumers.

U.S. households are flush with cash. Many households received their third, considerably larger stimulus check in March, which caused personal income to surge a record 21.1% during the month. In fact, many households received two stimulus checks during the first quarter, and even with the double-digit annualized gain in real personal consumption expenditures (+10.7%), the large influx of stimulus boosted the personal saving rate to 21% from 13% in the fourth quarter. In total, we estimate consumers are sitting on $2.2 trillion in “excess savings” through March, which is a considerable amount of dry powder at their disposal to fuel what is shaping up to be a consumer-led recovery.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

This Week's State Of The Economy - What Is Ahead? - 21 January 2022

Wells Fargo Economics & Financial Report / Jan 24, 2022

The Texans have earned a top draft position yet again, the Cowboys are home again for the remainder of the playoffs, and inflation concerns that continue to mount, along with ongoing supply chain disruptions, are weighing on homebuilder confidence.

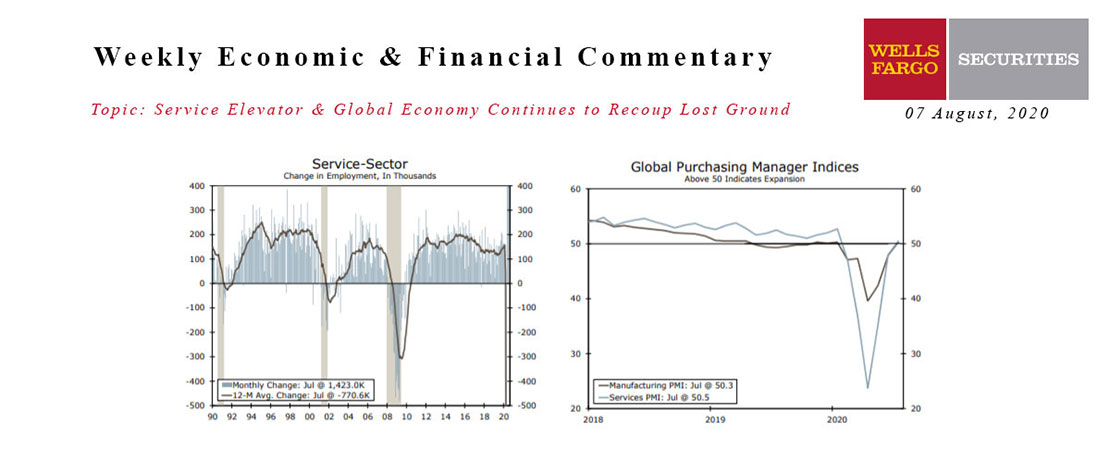

This Week's State Of The Economy - What Is Ahead? - 07 August 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

There were more signs of global recovery this week and PMI surveys improved further across the world.

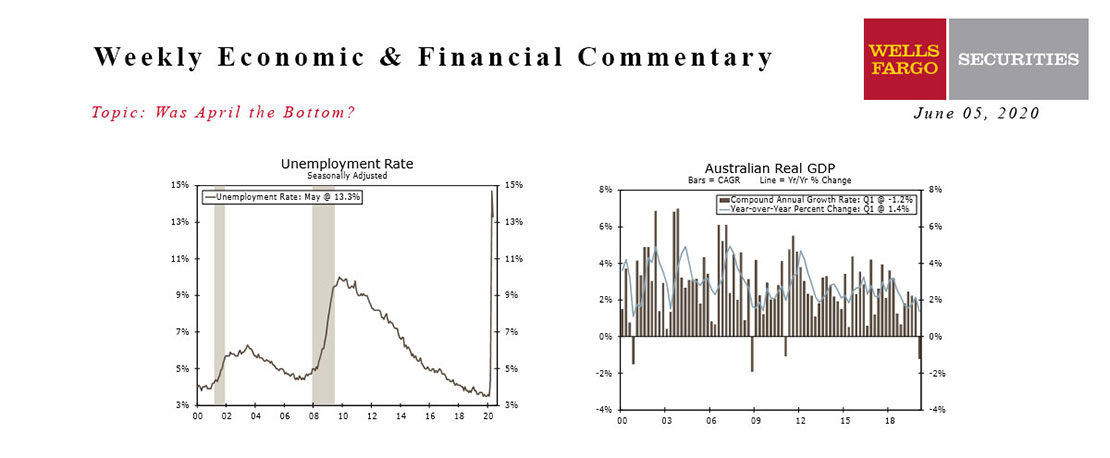

This Week's State Of The Economy - What Is Ahead? - 05 June 2020

Wells Fargo Economics & Financial Report / Jun 09, 2020

Data this week continued to suggest the U.S. economy hit rock bottom in April. Still, it is a long road to recovery and the pickup in economic activity will be gradual.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

This Week's State Of The Economy - What Is Ahead? - 11 August 2023

Wells Fargo Economics & Financial Report / Aug 15, 2023

During July, both the headline and core Consumer Price Index (CPI) rose 0.2%. On a year-over-year basis, the core CPI was up 4.7% in July. Recent signs have been more encouraging, with core CPI running at a 3.1% three-month annualized pace.

This Week's State Of The Economy - What Is Ahead? - 09 April 2020

Wells Fargo Economics & Financial Report / Apr 10, 2020

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak.

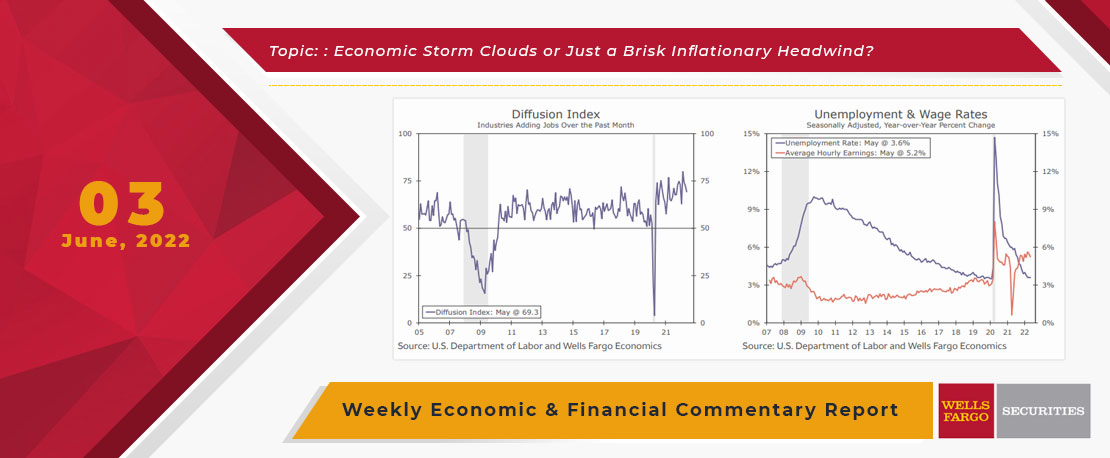

This Week's State Of The Economy - What Is Ahead? - 03 June 2022

Wells Fargo Economics & Financial Report / Jun 08, 2022

While talk of recession has kicked up in recent weeks, the majority of economic data remain consistent with modest growth.

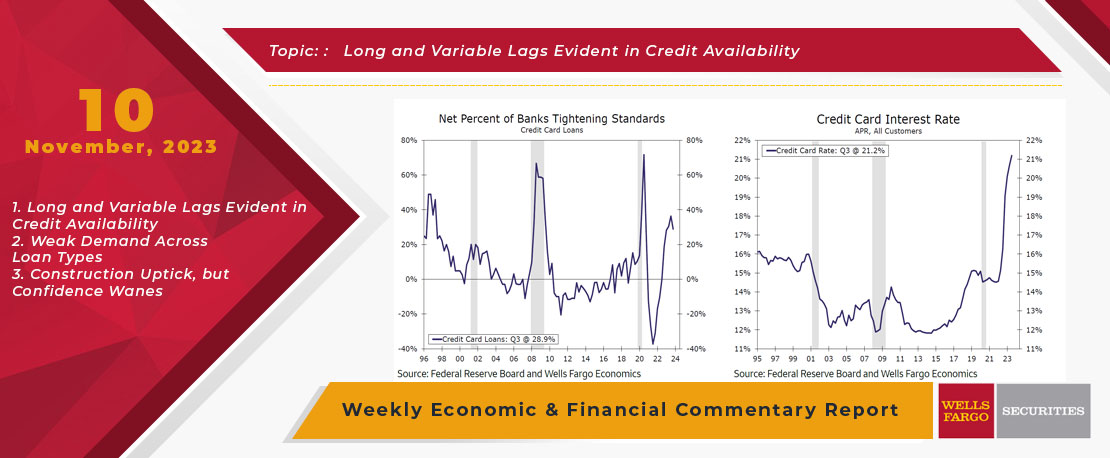

This Week's State Of The Economy - What Is Ahead? - 10 November 2023

Wells Fargo Economics & Financial Report / Nov 16, 2023

Sometimes, the impact of higher rates is quite obvious, such as the series of bank failures that occurred earlier this year.

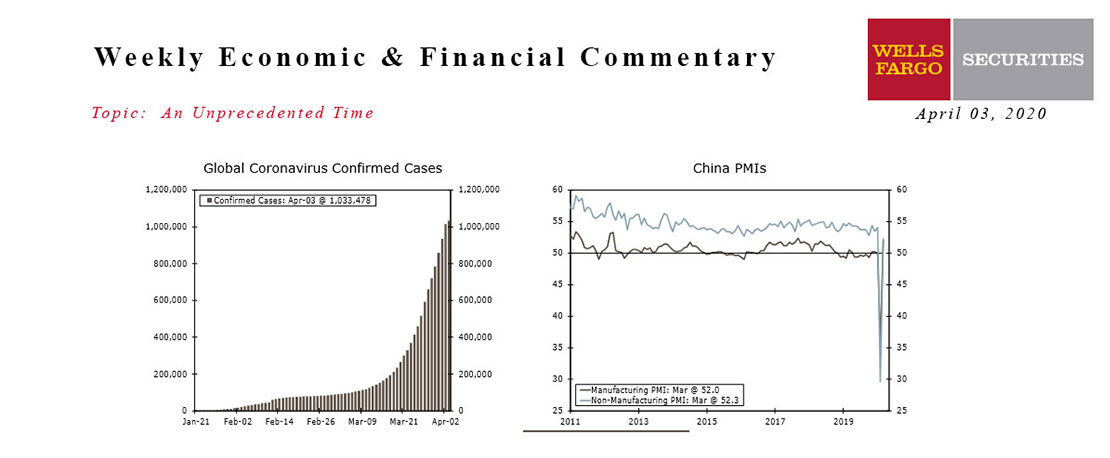

This Week's State Of The Economy - What Is Ahead? - 03 April 2020

Wells Fargo Economics & Financial Report / Apr 04, 2020

Efforts to contain the virus are leading to millions of job losses and it’s likely only a matter of time before a majority of economic data reveal unprecedented declines.