The Fed Goes Nuclear: Part II

The Federal Reserve announced a series of measures this morning that are intended to assist households, businesses and state & local governments as they cope with the economic fallout of the COVID-19 outbreak. The Fed estimates that the programs will provide an additional $2.3 trillion worth of financial support. The Federal Reserve provided details today of a new program it foreshadowed when it announced a series of measures on March 23, which we discussed in a report we wrote that day. The Fed also expanded some of the programs that it put in place on March 23. We welcome these measures because they should provide further liquidity support to capital markets and help businesses that may be struggling to stay afloat while many parts of the economy remain on lock down.

The most important new measure is the Main Street Lending Program, which the Fed noted on March 23 would be forthcoming. The program will make four-year loans to businesses that have up to 10,000 employees or revenues of less than $2.5 billion. The businesses must have been “in good financial standing” before the crisis, and they must commit to make “reasonable efforts” to maintain payrolls and retain workers. Businesses will receive loans from commercial banks, which will retain a 5% stake and sell the remaining 95% to the Main Street Lending facility, which will purchase up to $600 billion in loans. The idea behind the Fed buying 95% of the loans is so that banks can keep as much room as possible on their balance sheets for additional lending. The Fed will defer principal and interest payments for one year. The facility is being capitalized by a $75 billion equity position that is provided by the U.S. Treasury Department via funding from the CARES Act.

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

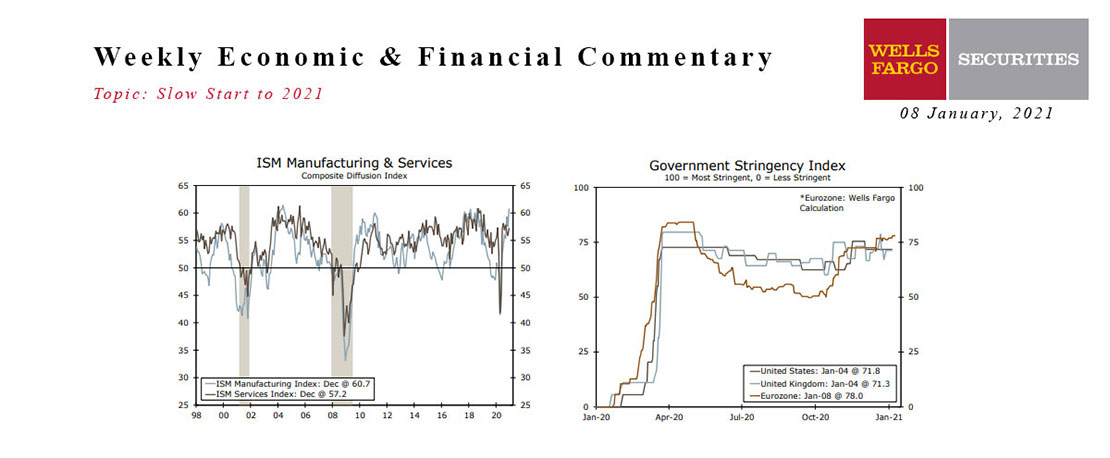

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

This Week's State Of The Economy - What Is Ahead? - 25 March 2022

Wells Fargo Economics & Financial Report / Mar 27, 2022

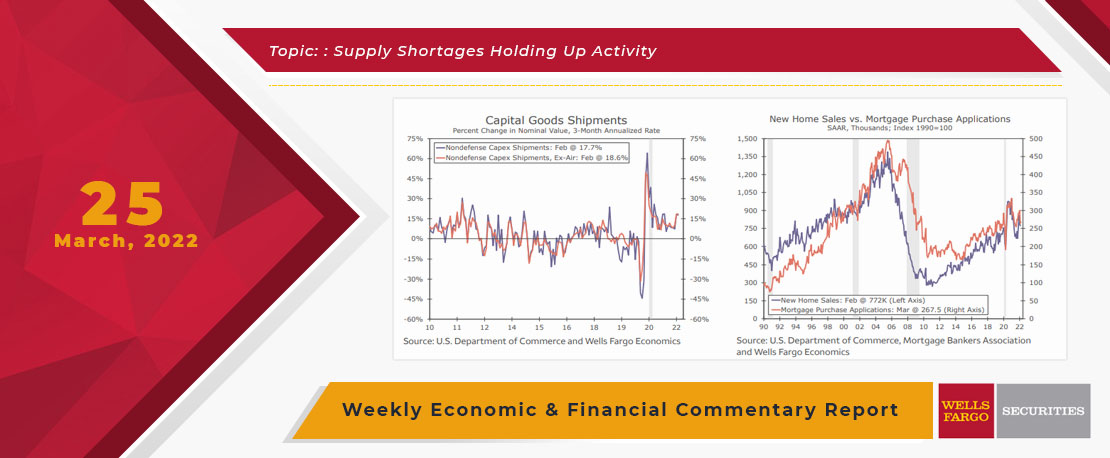

The fact that capital goods shipments surprised on the upside was one of the few things that went right in this week\'s durable goods report.

This Week's State Of The Economy - What Is Ahead? - 13 November 2020

Wells Fargo Economics & Financial Report / Nov 14, 2020

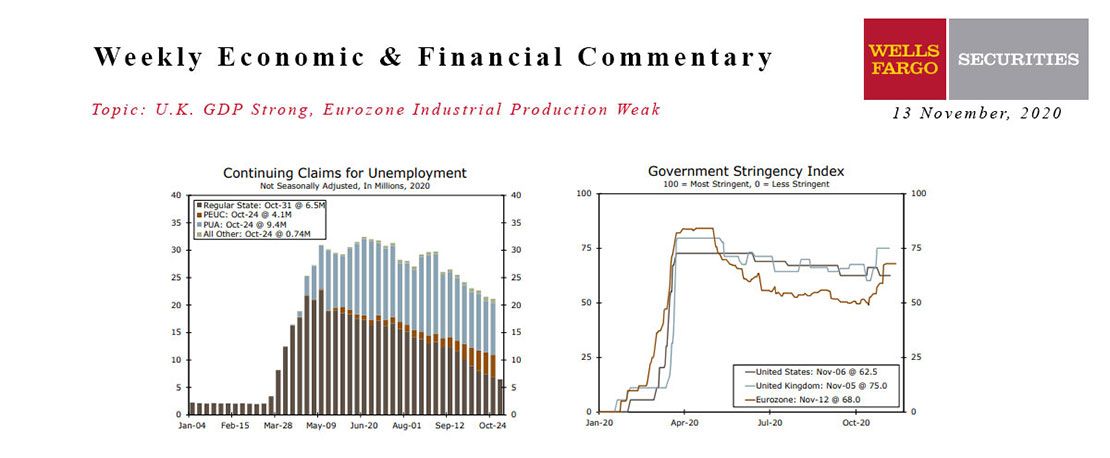

The combination of the election outcome and a workable vaccine boosted financial markets and set the background music for this week’s short list of indicators.

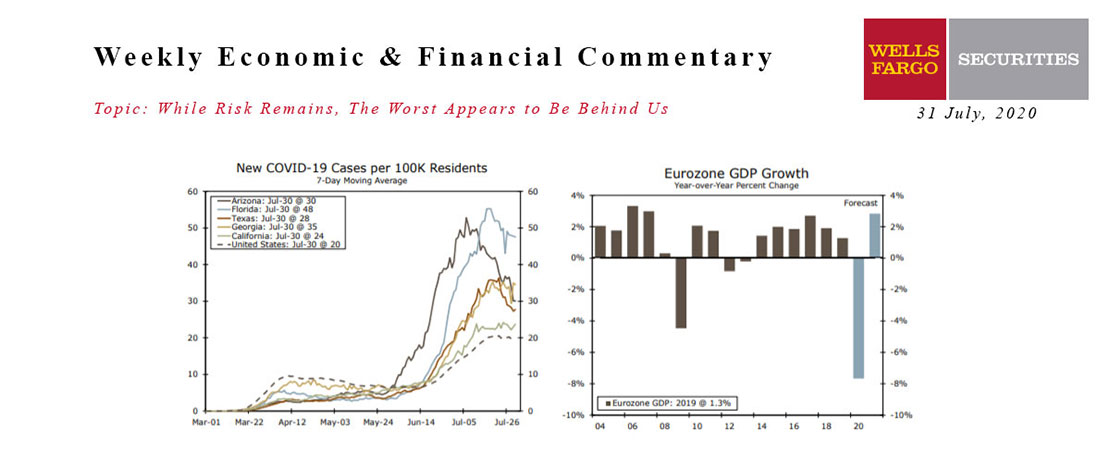

This Week's State Of The Economy - What Is Ahead? - 31 July 2020

Wells Fargo Economics & Financial Report / Aug 11, 2020

The resurgence in COVID-19 in much of the Sun Belt appears to have topped out, although cases are rising faster in some smaller mid-Atlantic states and in parts of Europe, Asia and Australia.

This Week's State Of The Economy - What Is Ahead? - 27 August 2021

Wells Fargo Economics & Financial Report / Aug 30, 2021

In other economic news, output continues to ramp up across the U.S., even as the resurgence in COVID cases is leading to some pullback in consumer engagement.

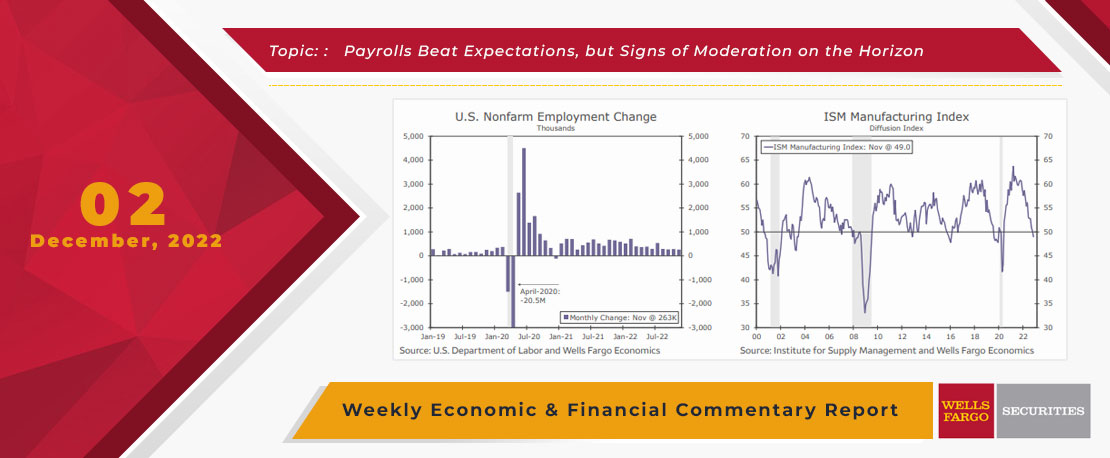

This Week's State Of The Economy - What Is Ahead? - 02 December 2022

Wells Fargo Economics & Financial Report / Dec 08, 2022

Total payrolls rose by 263K in November, with the unemployment rate holding steady at 3.7% and average hourly earning rising by 0.6%.

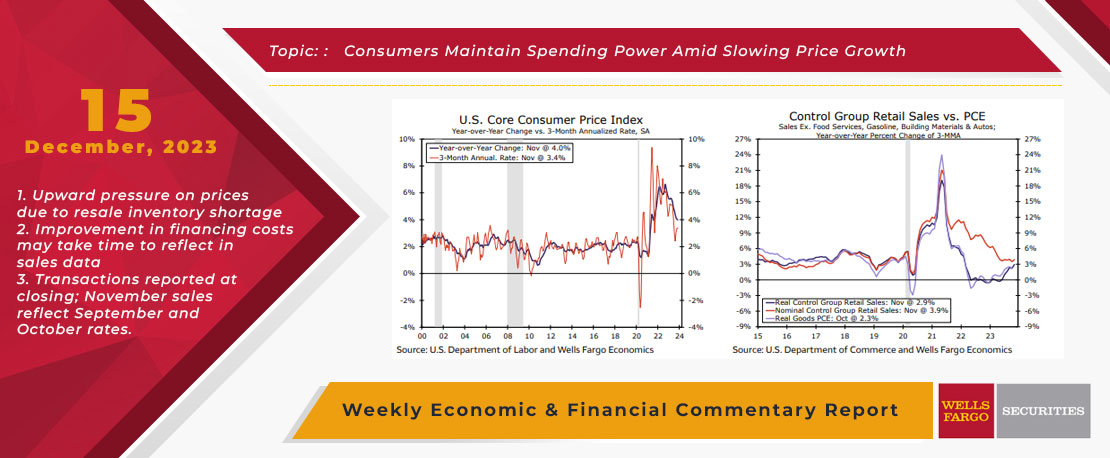

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

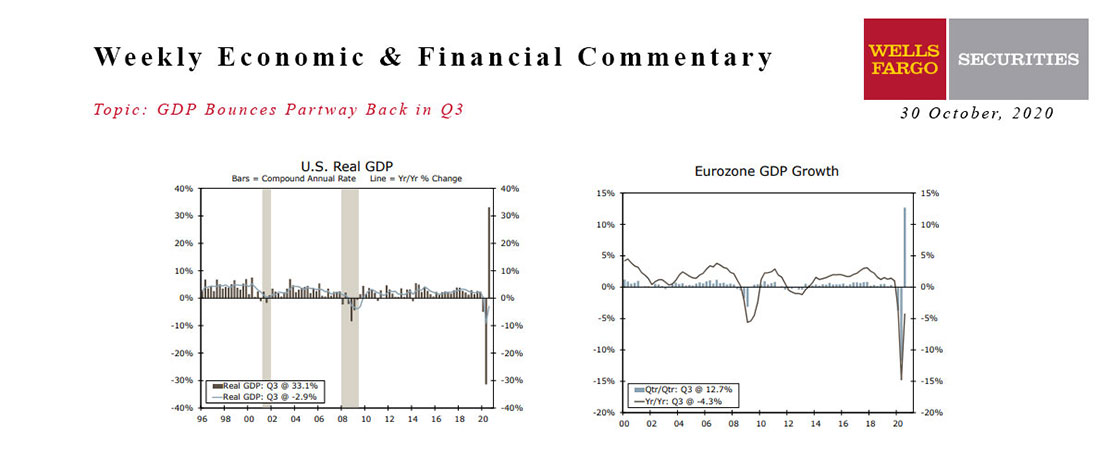

This Week's State Of The Economy - What Is Ahead? - 30 October 2020

Wells Fargo Economics & Financial Report / Oct 27, 2020

Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain.

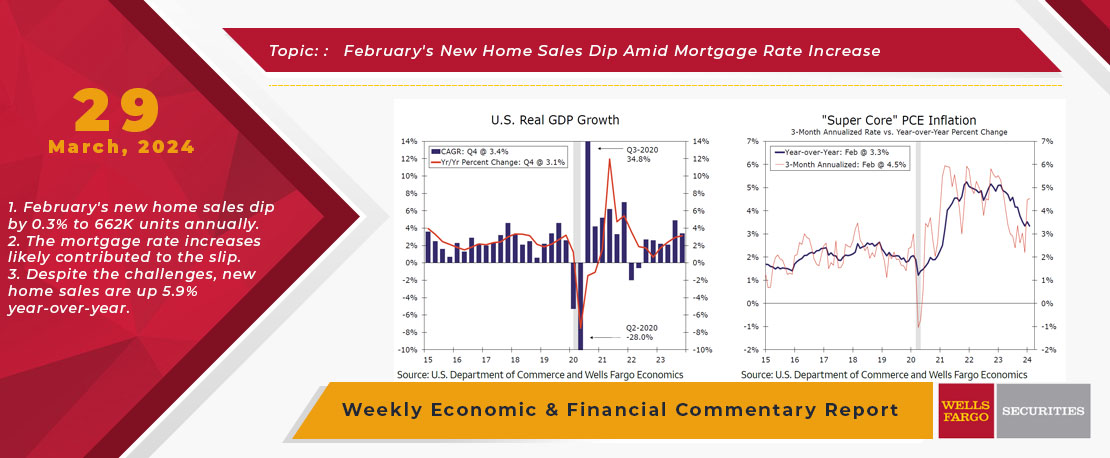

This Week's State Of The Economy - What Is Ahead? - 29 March 2024

Wells Fargo Economics & Financial Report / Apr 03, 2024

Consumer momentum remains largely intact, inflation continues to inch back down, albeit at a slower pace, and rate-sensitive sectors stayed in a holding pattern.

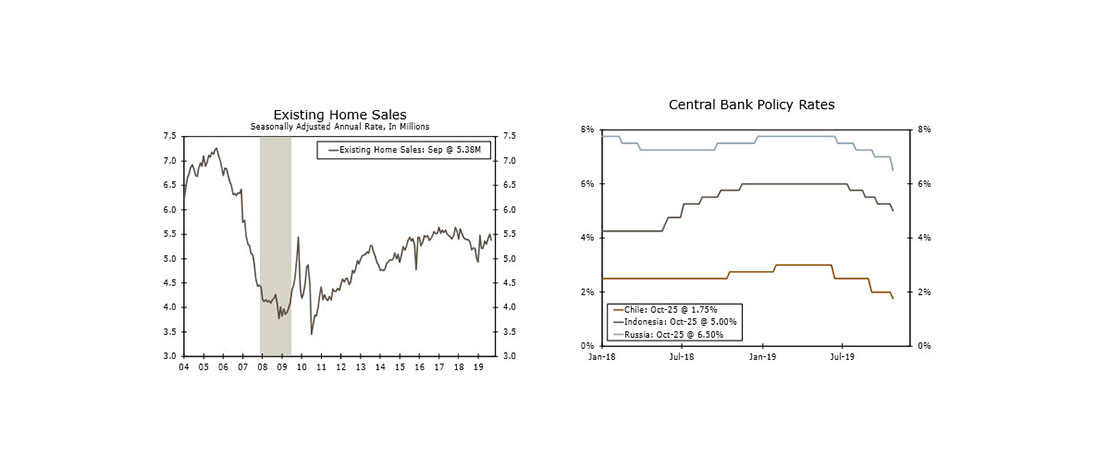

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.