Greetings. Again, I hope this finds you all healthy and safe as we continue on our path through the COVID-19 pandemic. As a follow up to what I put out last week, I wanted to touch again on what I am seeing and hearing in the marketplace.

Information is paramount these days and with the flood of media coverage in just about every respect, it can be a challenge to get an unbiased situation report. Man, I miss the days of an unbiased media. It is hard to decipher fact from opinion. This effort will be based simply on the capital markets facts as they are observed by this office.

So here it is again: The Good, The Bad, and The Reality.

CORRECTION: Last week I incorrectly stated that the investment banks had come out with standard relief packages. This obviously was supposed to read ‘commercial banks’ instead. The investment banks/CMBS servicers are taking relief requests on a deal by deal basis. More on this below.

The Good

Call me crazy for putting this in “The Good” section, but it was very good that those CMBS offerings didn’t try to force the issue and find a buyer. I got some color on the gap between the bid/ask on the AAAs and was told it was around 300-ish wide of the ask. A huge delta to be sure. There will likely be losses on these bonds when they clear, but they will be manageable losses. Think of the old saying: “sometimes some of the best deals you do are the ones you don’t do.”

As expected, many of the life companies that were on the sideline last week are now back. So, as a continuum of my take last week, the life companies, banks, and GSEs remain open for business. The supply of available debt looking for opportunities remains high, albeit more conservative than 30 days ago.

Life company debt is generally still pricing out between 3.50% and 4.25% with leverage points starting at 65% and below. The GSEs continue to deploy loans priced between the low 3’s to the low 4’s depending on leverage. Commercial banks are still quoting business in the 250 to 400 range over LIBOR, with most banks still instituting a LIBOR floor between 0.75% and 1%. Commercial banks are giving depositors priority and remain selective. Leverage points are a function of underwriting, the relationship, and the meaningfulness of available recourse. I would advise not to expect more than 65% leverage right now. Of course there can be exceptions here.

I was quiet on oil prices last week – one crisis addressed at a time. Even though Houston is an Oil and Gas town – always has been, always will be – it is not all that we are. Houston is a much more diversified economy today than ever before, but the reality is that a lot of our economy hinges on energy. The reason I am putting this in “The Good” section is because it would appear that WTI is finding its footing. Saudi Arabia and Russia are talking and appear to be nearing an end to their pointless staring contest. Maybe this should have gone in “The Reality” section…call me an optimist. Time will tell.

The Bad

CMBS is still out of the market. Ask any lender and they will tell you that CMBS plays a vital role in the commercial lending universe. The market as a whole is in a way better place with an active CMBS market and the liquidity it provides. Also, from my conversations with securitized lenders, CMBS servicing is handling the forbearance requests on a deal by deal basis – something they were never designed to do. Patience is a virtue. Pay your mortgage if you are asking for relief. Not doing so is bad for everyone, especially the borrower.

Most apartment owners are saying that April will not be “the bad” month. That will come in May. Anyone offering concessions are being encouraged to continue to do so by their lender. To compound this, apartment leasing velocity has slowed considerably. As a mitigant, I will simply say that of all the asset classes, multifamily remains the one with the most liquidity. As far as May being the “bad month,” that probably holds true across the other three primary food groups as well.

The Reality

Cap rates are somewhat in a state of flux. The investment sales brokers I have spoken with remain non-committal on specifics but all agree they are going up. Maybe this should have in in “The Bad.”

On the CMBS servicing side, as I said above, forbearance requests are being taken on a deal by deal basis. What I wanted to add is lenders are keeping score. What I have heard is basically this: Be able to clearly articulate your need, be prepared, and be honest. How you conduct yourself has consequences both good and bad. What I see when I read between the lines is that if you don’t have a need for relief, don’t ask for it. To do so would be begging for a Scarlet Letter that would not go away any time soon. If you have questions in this regard, feel free to call me.

And finally, part of the frustration for us all is that there is nobody to blame…no human action to point to and say “if we hadn’t done this…if we had only done this….” But we are all dealing with it (like it or not). The stats coming out of the WHO are encouraging, but fall short of allowing for any theory of when this will end. Until then each of us has an opportunity to help expedite our path out of this – stay home if you can. Wash your hands.

Source: Greg Young, Grandbridge

Abbott Says COVID-19 Cases Are 'leveling Off' But Stay-at-home Order Stands

Covid-19 / Apr 23, 2020

Texas Gov. Greg Abbott painted a positive picture of the state’s battle against COVID-19 on Tuesday, but said it’s not yet time to fully reopen the economy.

Not A Lot Of Good Options To Help Collapsing Oil Prices

Covid-19 / Apr 23, 2020

Governments around the globe are scrambling to figure out what, if anything, they can do to arrest the collapse of oil prices, which fell below zero on Monday.

Houston Seeks OK To Use Pandemic Aid To Close Budget Gap

Covid-19 / Apr 23, 2020

Mayor Sylvester Turner is asking the federal government to let Houston use $404 million in aid to help close its ballooning budget gap and reduce the number of expected furloughs.

Texas Activists Say They Will Bail People Out Of Jail To Protect Them

Covid-19 / Apr 23, 2020

Local community activists said they would begin bailing defendants out of some of Texas’ largest county jails to protect them from the spread of the new coronavirus.

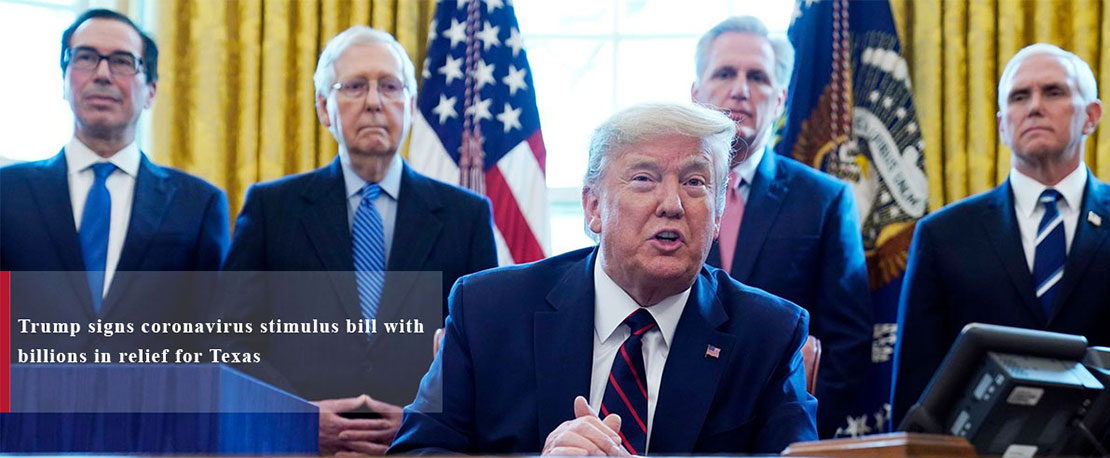

Trump Signs Coronavirus Stimulus Bill With Billions In Relief For Texas

Covid-19 / Apr 03, 2020

House Speaker Rep. Nancy Pelosi (D-Calif.) speaks with reporters at the Capitol in Washington, Friday morning, March 27, 2020.

Coronavirus (COVID-19) - Small Business Guidance & Loan Resources

Covid-19 / Apr 03, 2020

Health and government officials are working together to maintain the safety, security, and health of the American people. Small businesses are encouraged to do their part to keep their employees, customers, and themselves healthy.