U.S - Looking Back at a Soft Q3

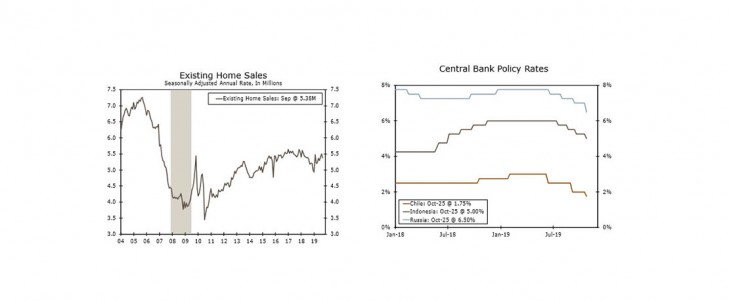

- Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

- Overall durable goods orders fell 1.1% in September, reflecting weak demand for aircraft and motor vehicles. Boeing's issues and the GM strike are becoming more apparent in the macro data and are likely to become increasingly so in coming weeks.

- Sales of new homes fell 0.7% to a 701,000-unit pace in September from a revised 706,000-unit pace the prior month. With mortgage rates down more than a percentage point from last year, housing is set to become a more positive force.

Global - The Big Ease-ing

- The global easing theme was at the forefront this week with rate cuts from several central banks. Turkey's central bank lowered its policy rate 2.50 percentage points, while central banks in Chile, Indonesia and Russia cut rates 0.25%-0.50%.

- The European Central Bank held monetary policy steady this week, but further easing seems likely at some point. Eurozone October PMIs surprised to the downside, while Q3 GDP growth is expected to slow further from an already sluggish Q2 pace.

- In Canada, PM Trudeau's Liberal Party won the most seats in this week's election, but fell short of the number needed for an outright majority.

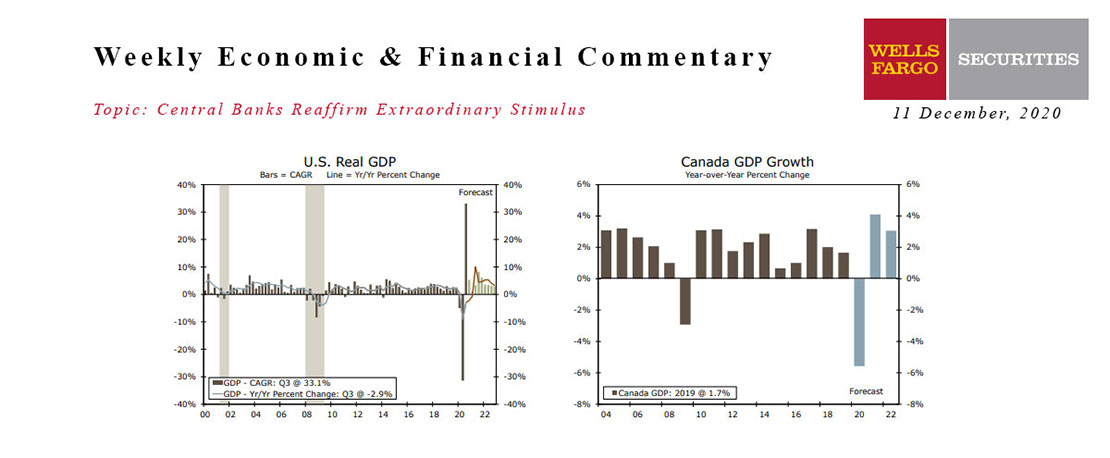

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.

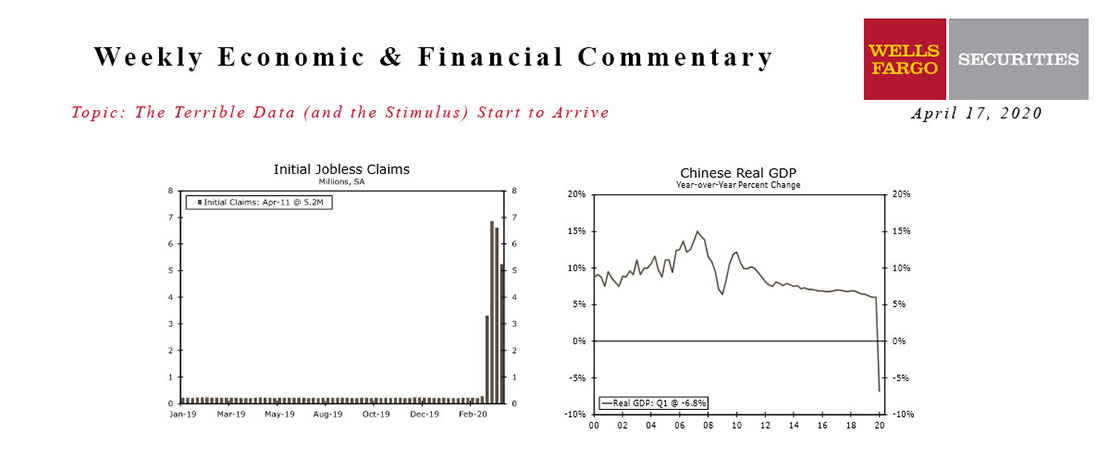

This Week's State Of The Economy - What Is Ahead? - 17 April 2020

Wells Fargo Economics & Financial Report / Apr 18, 2020

Economic data from the early stages of the Great Shutdown have finally arrived, and they are as bad as feared. ‘Worst on record’ is about to become an all too common refrain in our commentary.

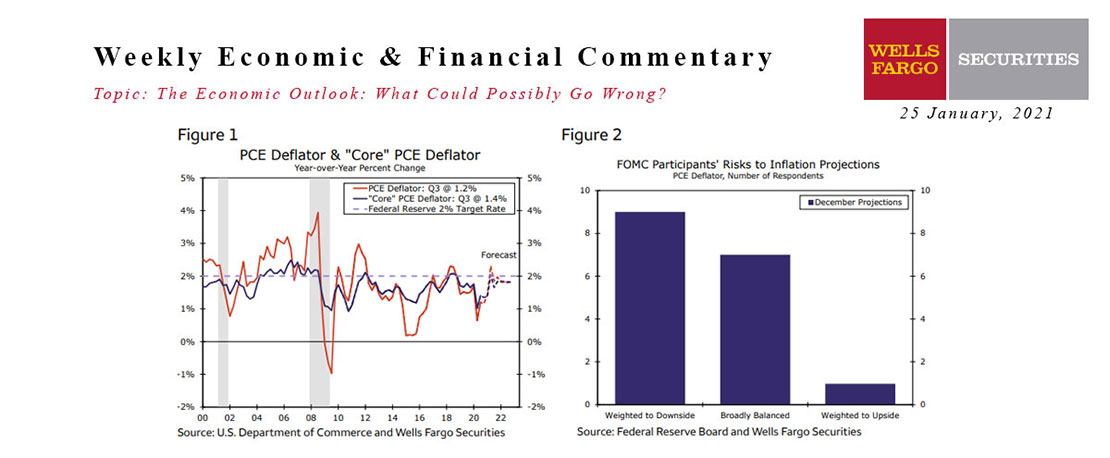

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

This Week's State Of The Economy - What Is Ahead? - 24 May 2024

Wells Fargo Economics & Financial Report / May 29, 2024

Homebuying retreated in April following a leg up in mortgage rates. Meanwhile, durable goods orders surprised to the upside, suggesting the manufacturing industry is on better footing.

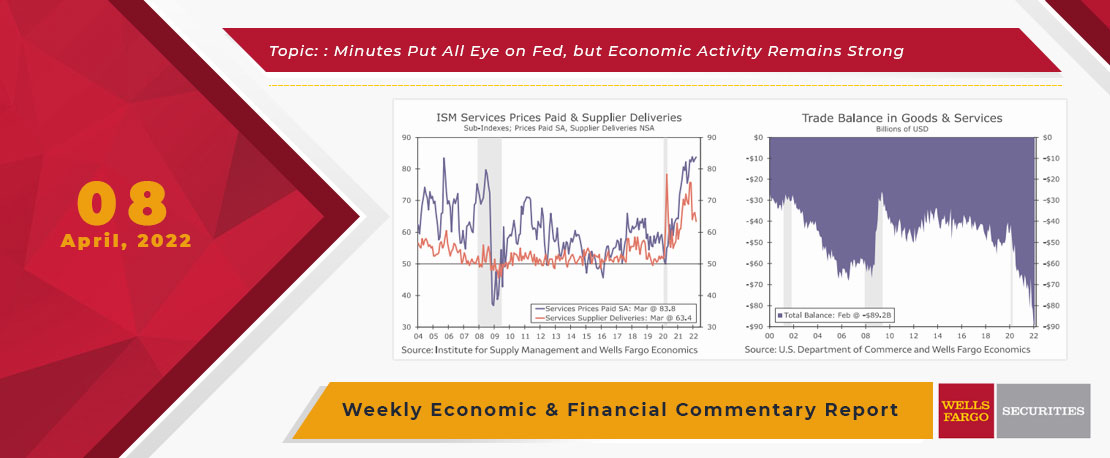

This Week's State Of The Economy - What Is Ahead? - 08 April 2022

Wells Fargo Economics & Financial Report / Apr 11, 2022

Wednesday\'s release of the FOMC minutes stirred things up as comments showed committee members agreeing that elevated inflation and the tight labor market at present warrant balance sheet reduction to begin soon.

This Week's State Of The Economy - What Is Ahead? - 26 April 2024

Wells Fargo Economics & Financial Report / Apr 29, 2024

We got our first look at Q1 GDP, which downshifted to a 1.6% annualized pace and was accompanied by a hot core PCE deflator reading.

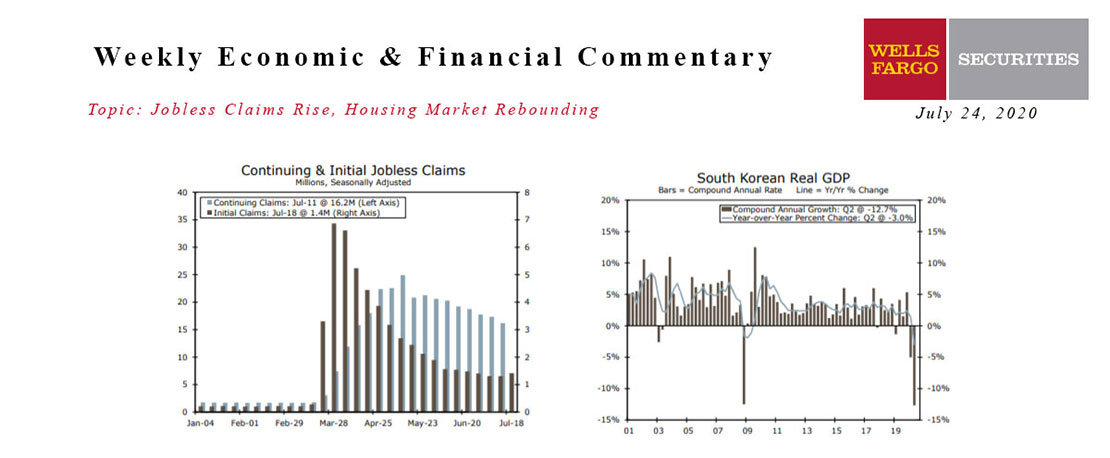

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

This Week's State Of The Economy - What Is Ahead? - 19 July 2024

Wells Fargo Economics & Financial Report / Jul 22, 2024

Retail sales, housing starts and industrial production all surprised to the upside this week.

This Week's State Of The Economy - What Is Ahead? - 31 March 2023

Wells Fargo Economics & Financial Report / Apr 08, 2023

This week brought glimpses of market stabilization after weeks of turmoil. Although consumers seem unfazed by the uproar, tighter credit conditions coming down the pipeline will likely weigh on growth.

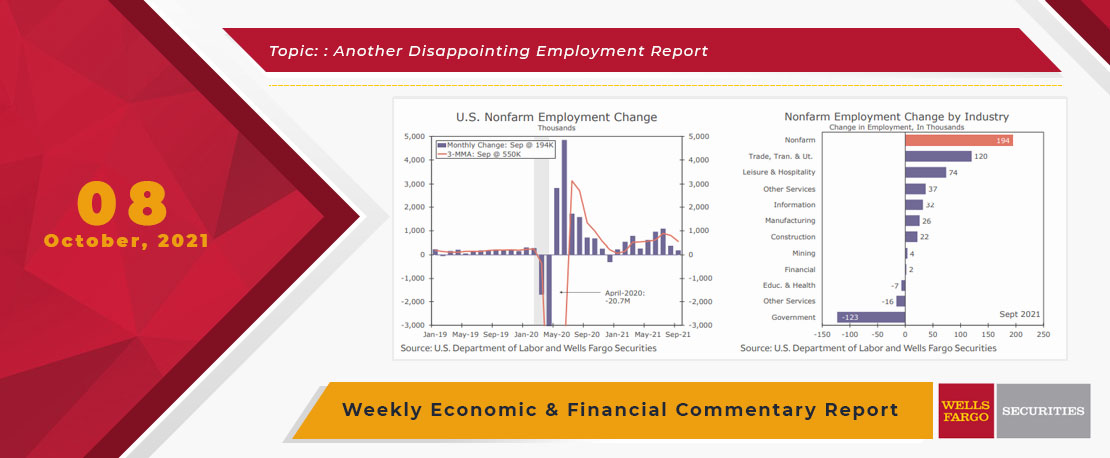

This Week's State Of The Economy - What Is Ahead? - 08 October 2021

Wells Fargo Economics & Financial Report / Oct 15, 2021

September\'s disappointing employment report clearly takes center stage over this week\'s other economic reports. Nonfarm employment rose by just 194,000 jobs, as employers continue to have trouble finding the workers they need.