U.S. - Jobless Claims Rise, Housing Market Rebounding

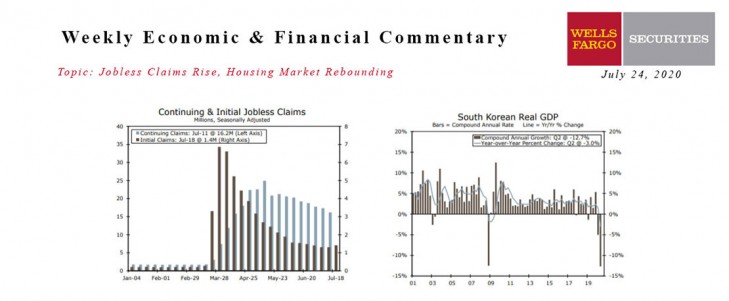

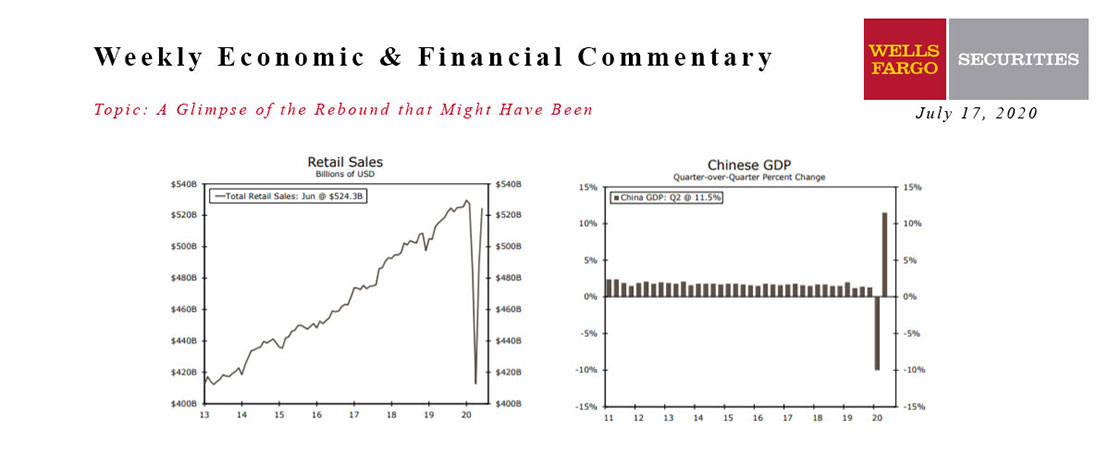

- Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

- Record low mortgage rates have spurred a rebound in the housing market. Existing home sales jumped 20.7% and new home sales rose 13.8% during June. More improvement is on the way, as purchase mortgage applications continue to climb.

- The Leading Economic Index (LEI) moderated slightly, but still increased 2.0%. Overall, the U.S. economic recovery continues, but the pace of improvement appears to be slowing.

Global - COVID-19 Outbreak Set to Disrupt Q2 Global Activity

- This week’s data releases offered more insight into the severity of the economic downturn resulting from the COVID-19 pandemic as well as subsequent lock down and social distancing measures. South Korea—one of the first countries to release its Q2 GDP data—fell into recession with Q2 growth contracting 3.3% quarter-over-quarter.

- As COVID-19 cases continue to surge in South Africa, the South African Reserve Bank (SARB) opted to cut its repo rate for the fifth time, reducing the key rate 25 bps to 3.50%. Elsewhere, Eurozone manufacturing and services PMIs recovered more than expected in July, moving back into expansionary territory.

28 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Feb 08, 2021

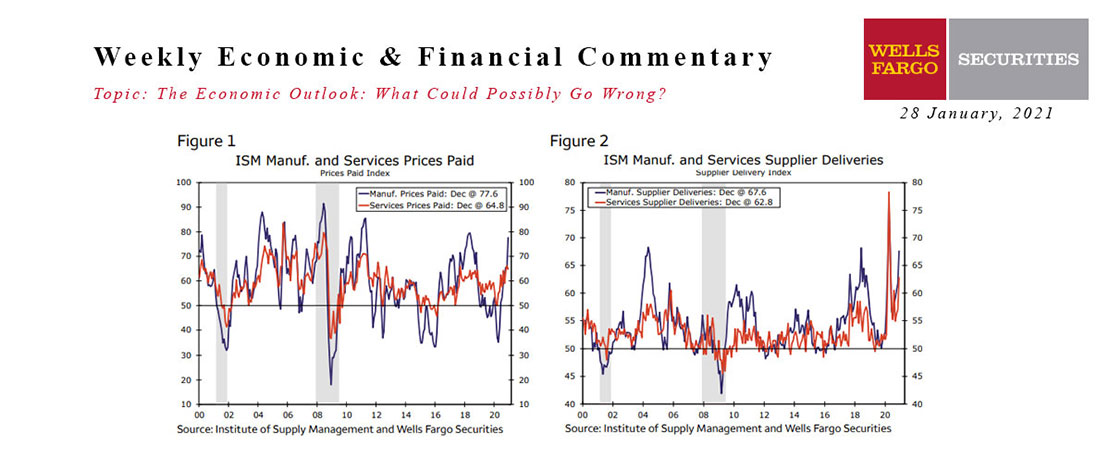

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years.

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

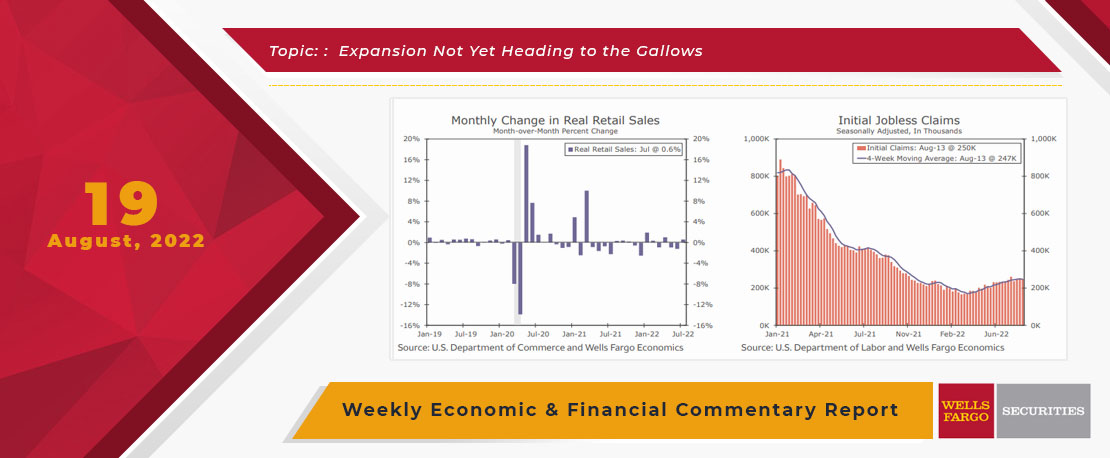

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

This Week's State Of The Economy - What Is Ahead? - 14 October 2020

Wells Fargo Economics & Financial Report / Oct 14, 2020

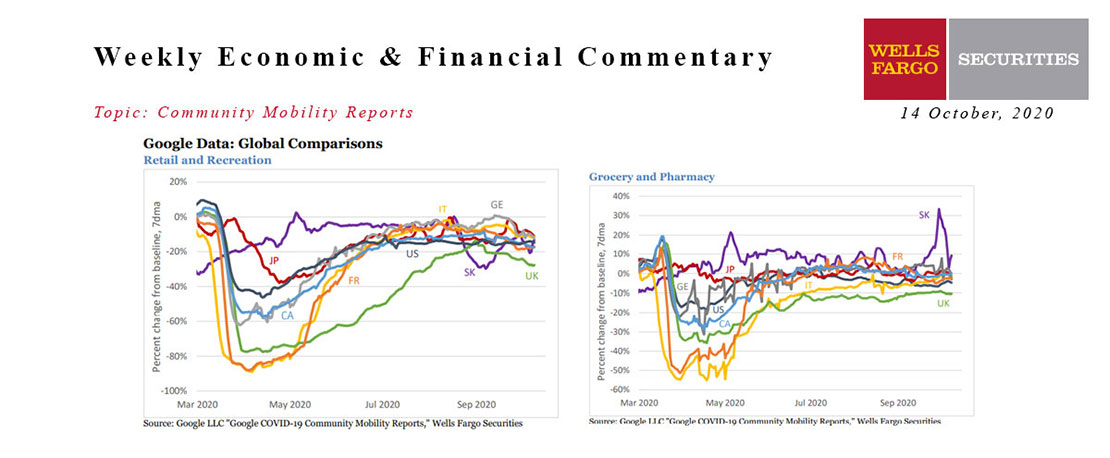

The global mobility playing field is equalizing. Major European countries such as Germany and France have seen a slowdown in recent weeks, leaving them right in line with the United States relative to the January baseline.

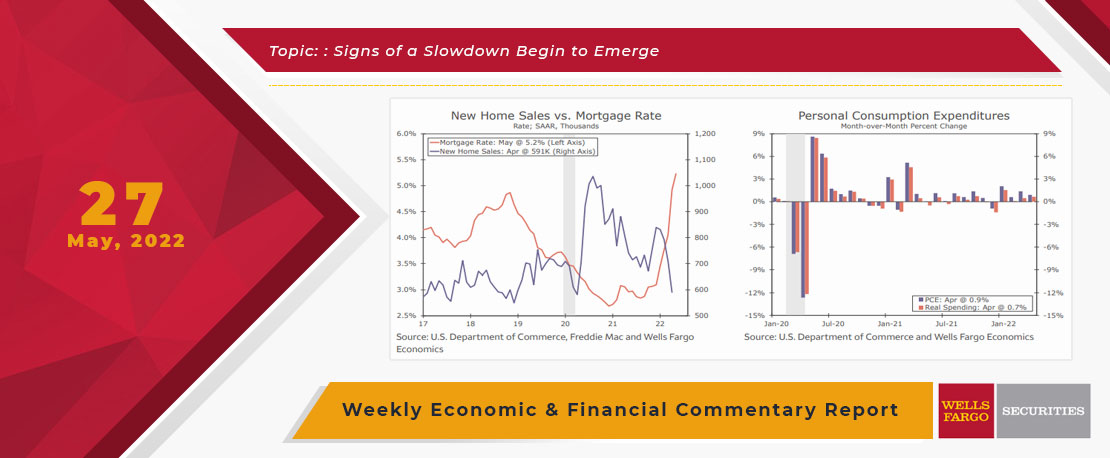

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

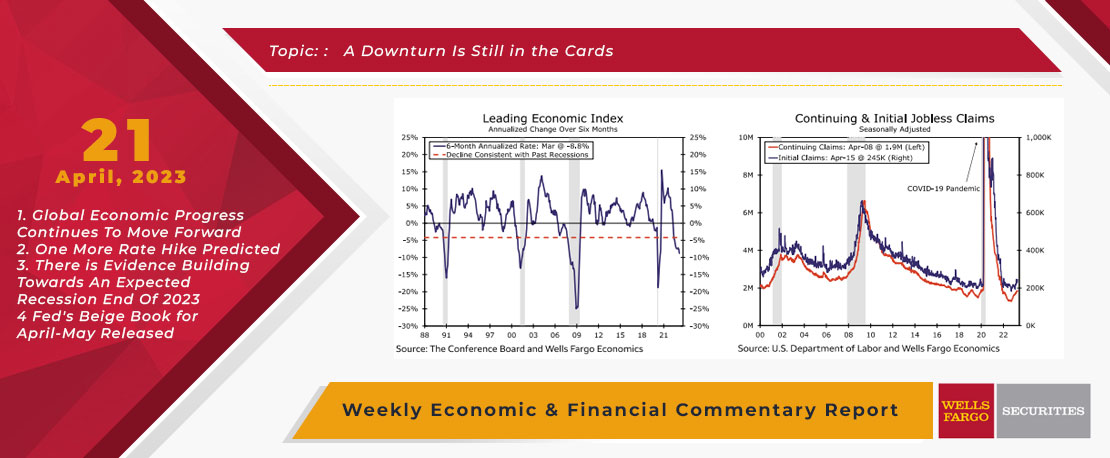

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

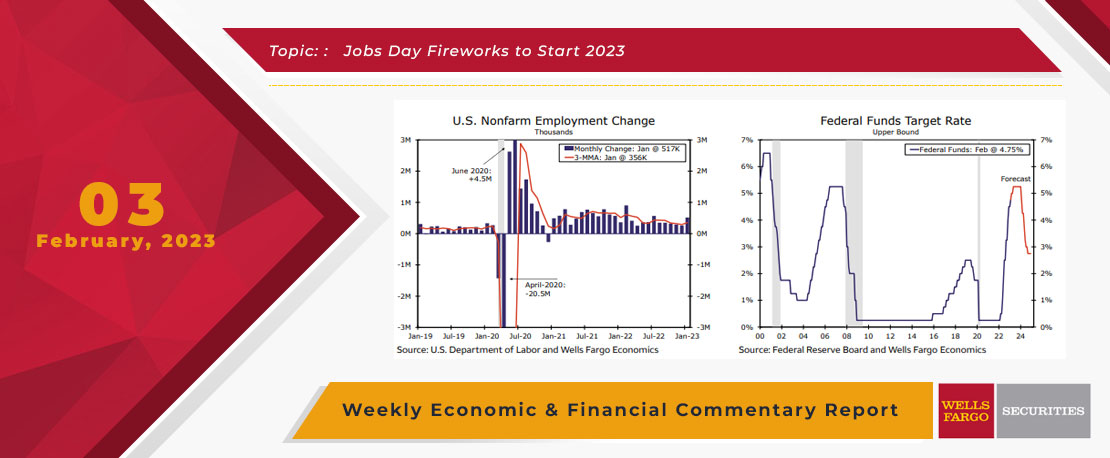

This Week's State Of The Economy - What Is Ahead? - 03 February 2023

Wells Fargo Economics & Financial Report / Feb 04, 2023

During January, payrolls jumped by 517K, the unemployment rate fell to 3.4% and average hourly earnings rose by 0.3%. The FOMC raised the fed funds target range by 25 bps to 4.5%-4.75% this week.

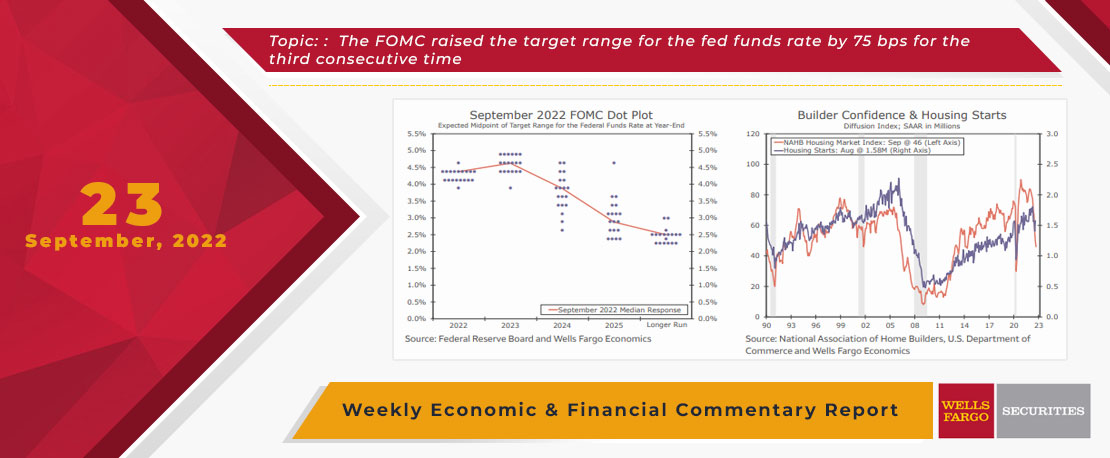

This Week's State Of The Economy - What Is Ahead? - 23 September 2022

Wells Fargo Economics & Financial Report / Sep 27, 2022

The FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage rates.

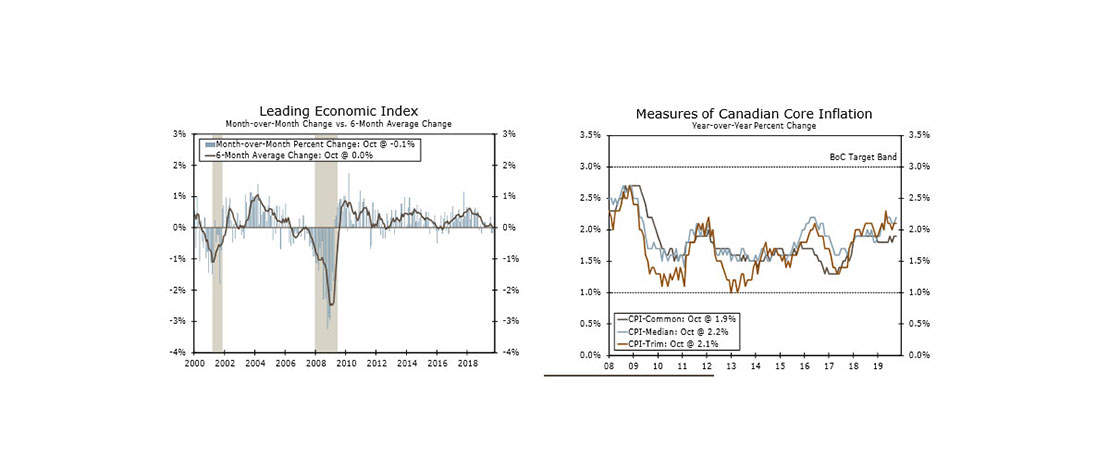

This Week's State Of The Economy - What Is Ahead? - 22 November 2019

Wells Fargo Economics & Financial Report / Nov 23, 2019

Minutes from the October FOMC meeting indicated the Fed is content to remain on the sidelines for the rest of this year as the looser financial conditions resulting from rate cuts at three consecutive meetings feed through to the economy.

This Week's State Of The Economy - What Is Ahead? - 17 July 2020

Wells Fargo Economics & Financial Report / Jul 18, 2020

Two countervailing themes competed for attention this week in financial markets. The first is that for the most part, economic data continue to surprise to the upside and do not yet rule out prospects for that elusive V-shaped recovery.

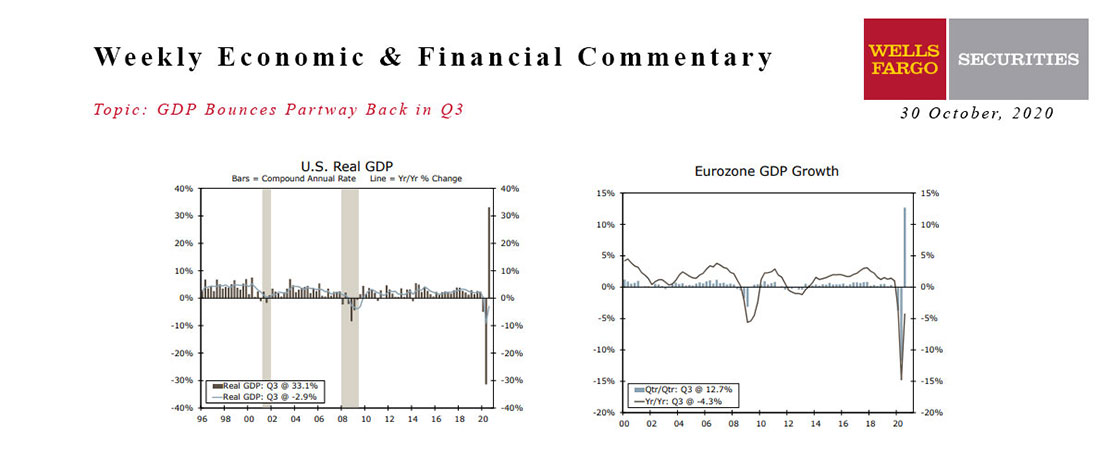

This Week's State Of The Economy - What Is Ahead? - 30 October 2020

Wells Fargo Economics & Financial Report / Oct 27, 2020

Real GDP jumped a record 33.1% during Q3, beating expectations. A 40.7% surge in consumer spending drove the gain.