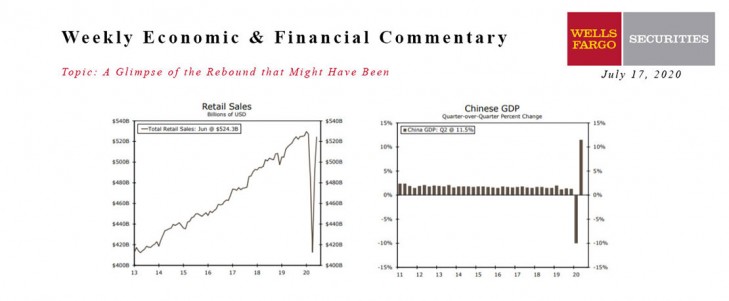

U.S. - A Glimpse of the Rebound that Might Have Been

- Two countervailing themes competed for attention this week in financial markets. The first is that for the most part, economic data continue to surprise to the upside and do not yet rule out prospects for that elusive V-shaped recovery. The chart to the right plotting the level of retail sales offers a great example: that is about as close to a V as you get.

- But the recovery is in jeopardy of being held back by the very thing that got us into this mess to begin with. Corona virus infections continue to mount and even hit a single-day record north of 78K on Thursday, as officials and businesses are increasingly requiring residents and customers to wear masks to help stop the spread.

Global - Central Banks on Hold; China Data Somewhat Mixed

- The European Central Bank and Bank of Canada both met this week. As expected, no major policy changes were made and both central banks remain committed to keep interest rates low and asset purchases in place for the time being.

- China GDP data beat expectations, signaling the recovery in the world’s second-largest economy is gathering momentum. While the Q2 headline GDP print was stellar, June retail sales missed consensus expectations and may be calling into question the strength of the recovery as we head into the second half of the year.

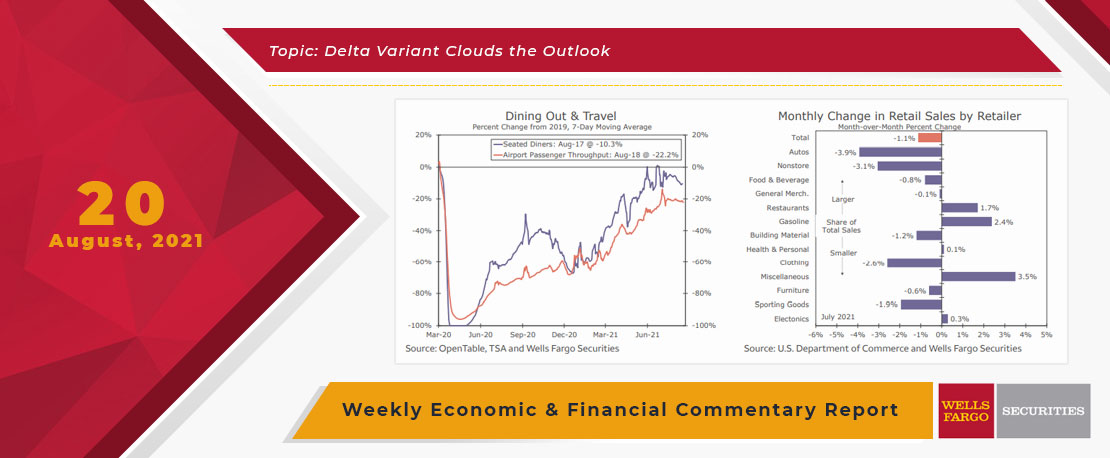

This Week's State Of The Economy - What Is Ahead? - 20 August 2021

Wells Fargo Economics & Financial Report / Aug 24, 2021

The Wells Fargo Economics team notes in the Commentary that new COVID cases in New Zealand disrupted the Reserve Bank of New Zealand\'s plan to tighten monetary policy this week.

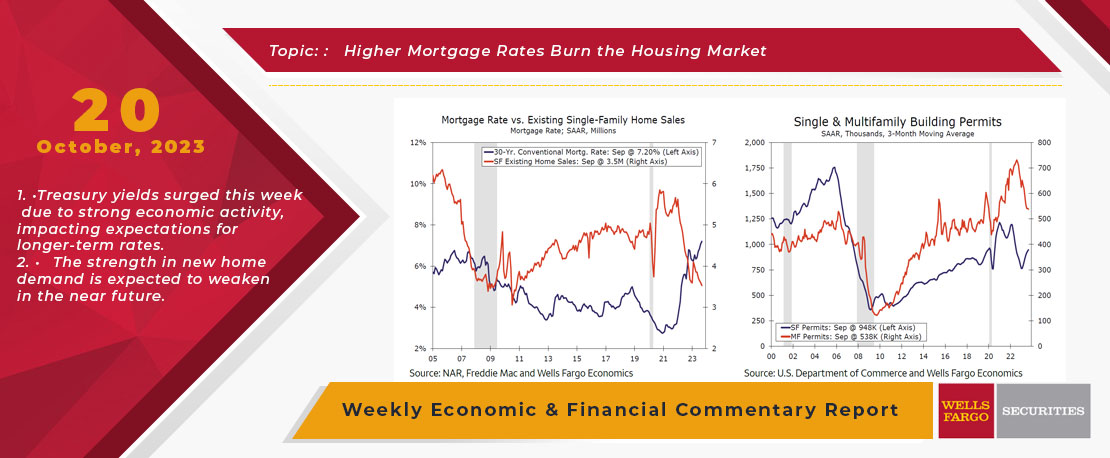

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

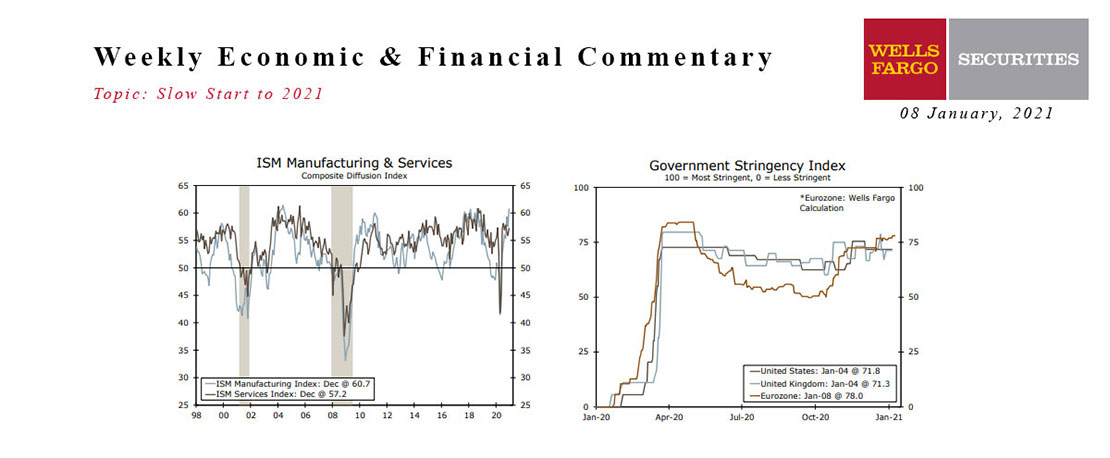

This Week's State Of The Economy - What Is Ahead? - 08 January 2021

Wells Fargo Economics & Financial Report / Jan 12, 2021

The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

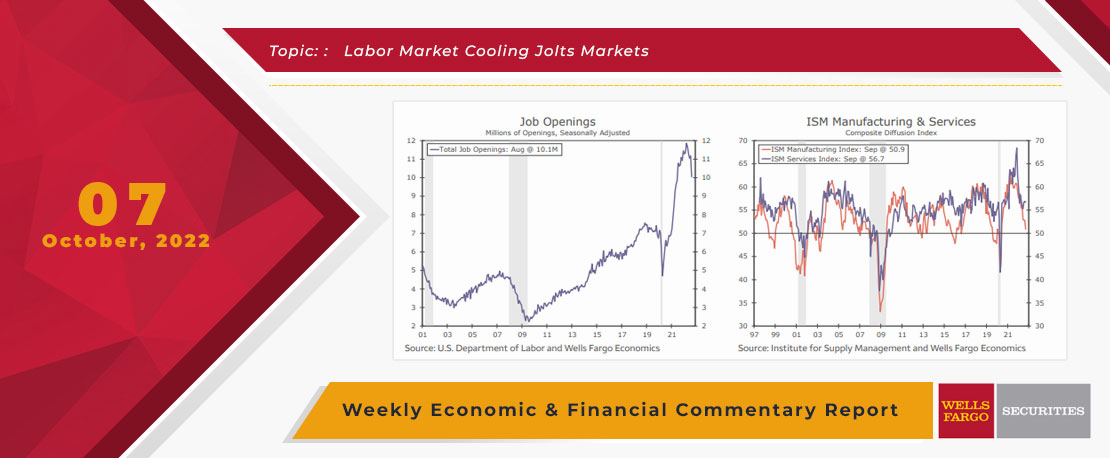

This Week's State Of The Economy - What Is Ahead? - 07 October 2022

Wells Fargo Economics & Financial Report / Oct 10, 2022

higher interest rates and inflation appear to be weighing on manufacturing and construction, yet service sector activity remains fairly resilient.

This Week's State Of The Economy - What Is Ahead? - 21 February 2020

Wells Fargo Economics & Financial Report / Feb 22, 2020

Minutes from the January 28-29 FOMC meeting indicate the coronavirus will not push the Fed to cut interest rates, and for the most part housing and manufacturing survey data this week supported that view.

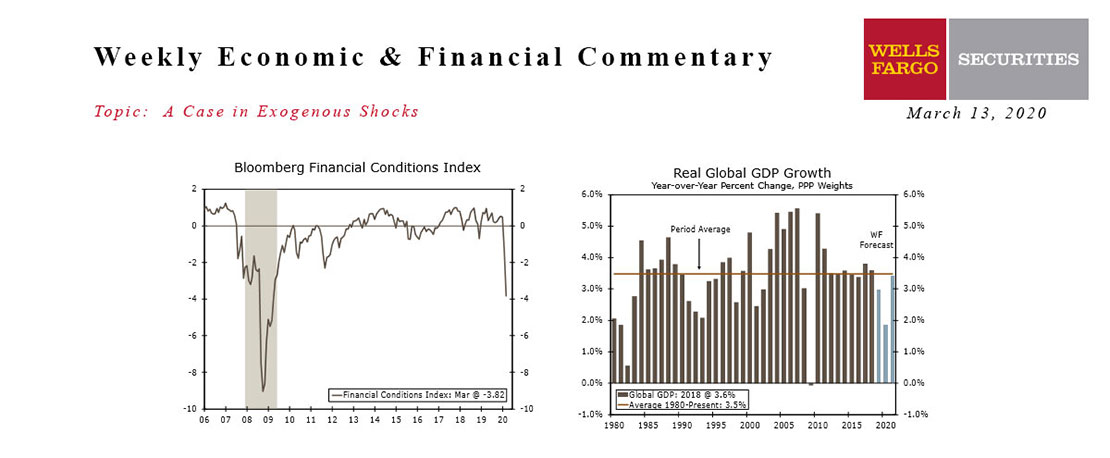

This Week's State Of The Economy - What Is Ahead? - 13 March 2020

Wells Fargo Economics & Financial Report / Mar 14, 2020

Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

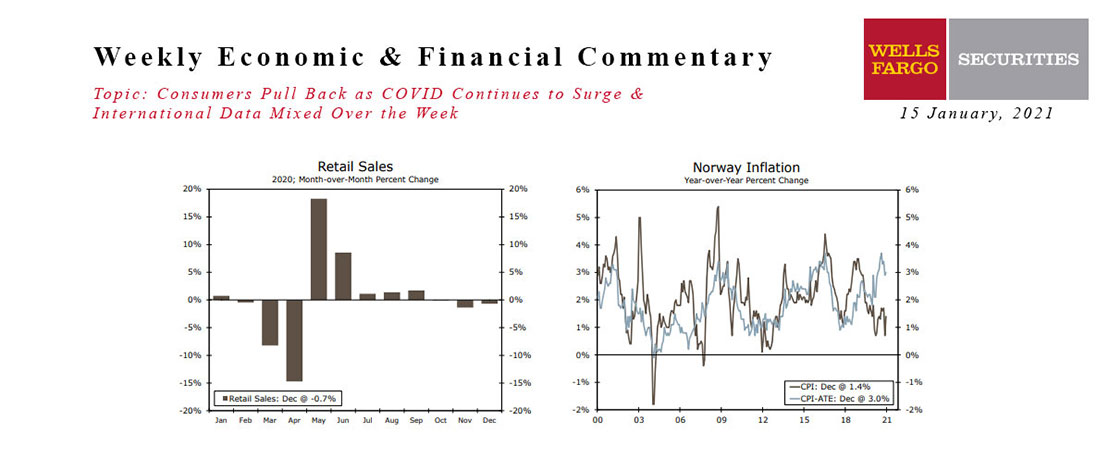

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

This Week's State Of The Economy - What Is Ahead? - 25 October 2019

Wells Fargo Economics & Financial Report / Oct 26, 2019

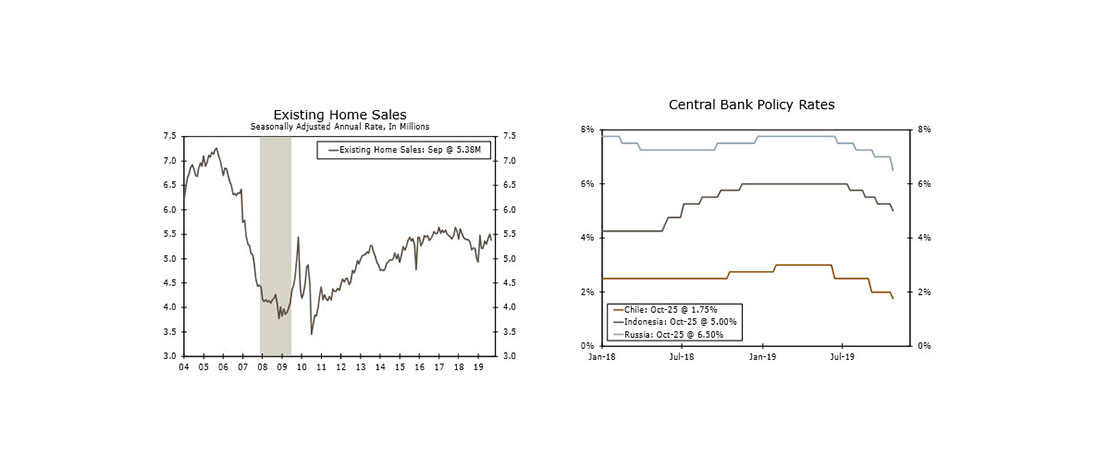

Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

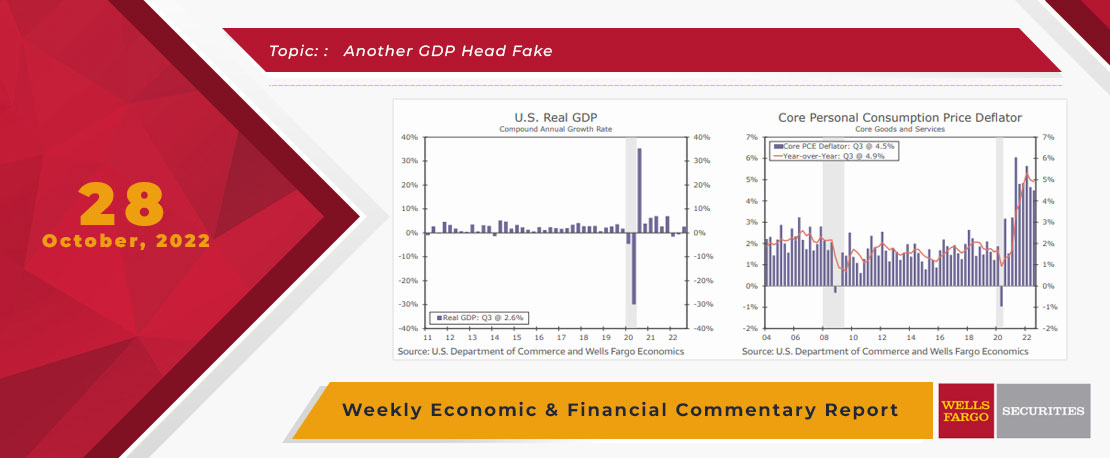

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.