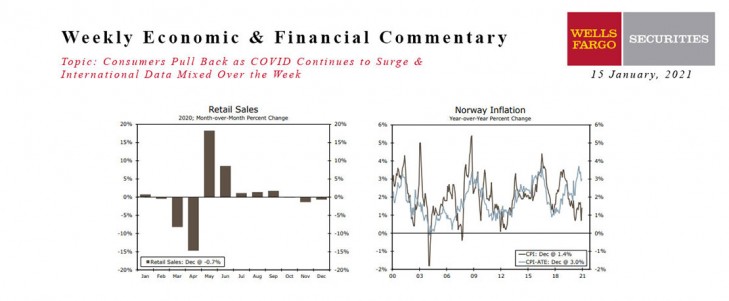

U.S. - Consumers Pull Back as COVID Continues to Surge

- Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

- The CPI advanced 0.4% in December (1.4% over the year). Inflation remains tepid, with core prices up 0.1% in the month.

- Initial jobless claims jumped to 965K (week end Jan. 9).

- Several Fed officials pushed back on the idea of a shift in monetary policy anytime soon.

- Industrial production rose 1.6% in December.

- Small business optimism (NFIB) dropped to 95.9 in December. Consumer sentiment (U. Michigan) slipped to 79.2 in January.

Global - International Data Mixed Over the Week

- Brazilian inflation surprised to the upside in December, rising 4.5% year-over-year. Brazil’s inflation has been steadily increasing since May amid lower interest rates, additional fiscal spending and a weaker exchange rate.

- Norwegian mainland output fell less than expected in November, suggesting risks to our Q4 GDP growth forecast are tilted toward the upside. Meanwhile, Norway’s inflation recovered in line with consensus estimates in December.

- Elsewhere, Peru’s central bank opted to continue its expansionary policy stance, holding its reference rate at 0.25% and indicated it is ready to increase stimulus if needed.

This Week's State Of The Economy - What Is Ahead? - 12 August 2020

Wells Fargo Economics & Financial Report / Aug 15, 2020

The consumer has been a bright spot in the recovery so far, but with jobless benefits in flux and no clear path for the long-awaited stimulus bill, the support here could fade.

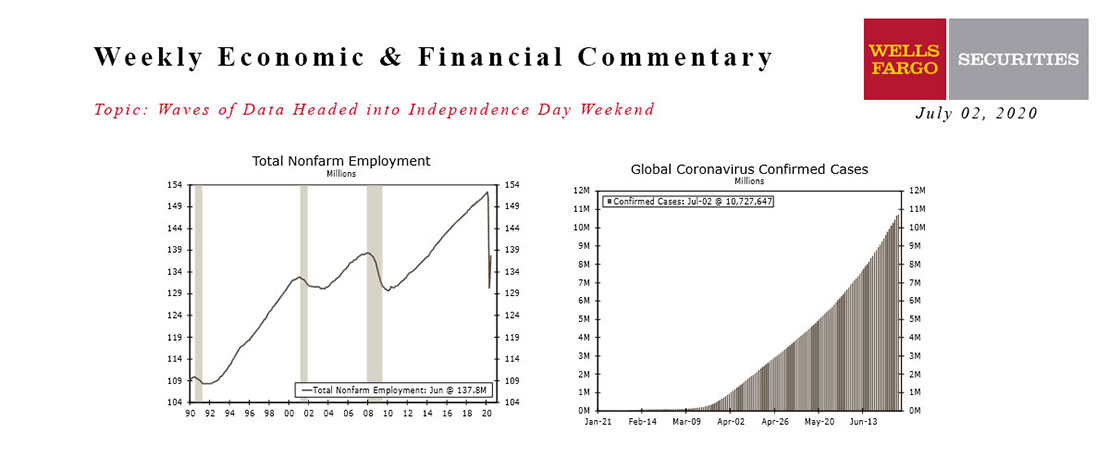

This Week's State Of The Economy - What Is Ahead? - 02 July 2020

Wells Fargo Economics & Financial Report / Jul 04, 2020

It was a mildly busy week for foreign economic data and events, while global COVID-19 cases continued to rise.

This Week's State Of The Economy - What Is Ahead? - 14 June 2024

Wells Fargo Economics & Financial Report / Jun 20, 2024

On Wednesday, the May CPI data showed that consumer prices were unchanged in the month, the first flat reading for the CPI since July 2022.

This Week's State Of The Economy - What Is Ahead? - 30 September 2022

Wells Fargo Economics & Financial Report / Oct 03, 2022

Just as I know the folks in Florida are resilient and will recover in time, incoming data indicate a slowing yet resilient economy.

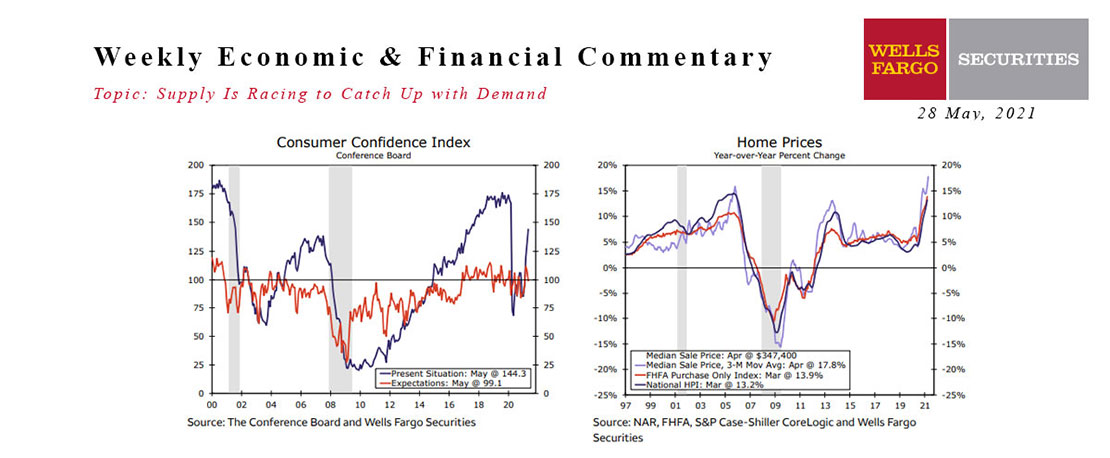

This Week's State Of The Economy - What Is Ahead? - 28 May 2021

Wells Fargo Economics & Financial Report / Jun 08, 2021

This week\'s light calendar of economic reports showed supply chain disruptions tugging a little at economic growth.

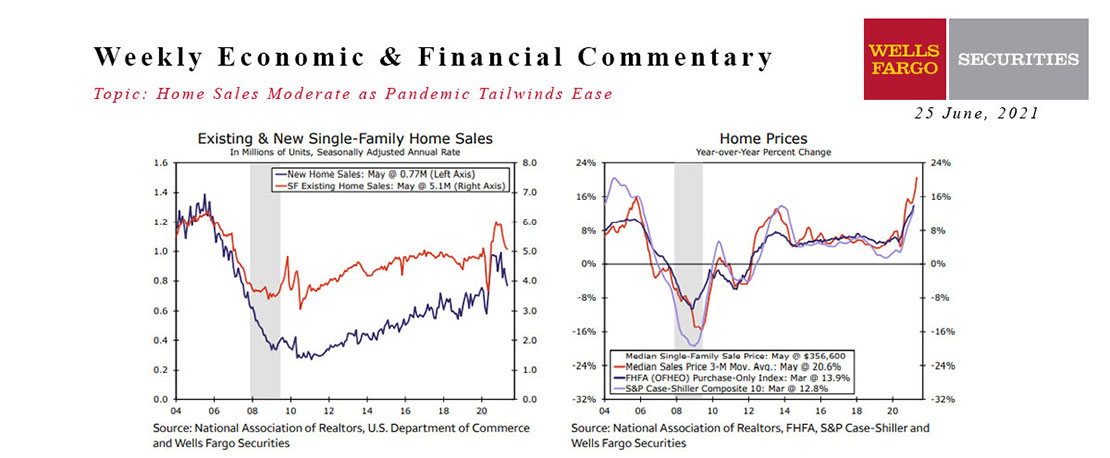

This Week's State Of The Economy - What Is Ahead? - 25 June 2021

Wells Fargo Economics & Financial Report / Jun 26, 2021

Supply chain bottlenecks continue to cause pain-in-the-necks. In spite of all the difficulties, the Economic whizzes in the WF Economics team have upgraded their forecast for full-year 2021 U.S.

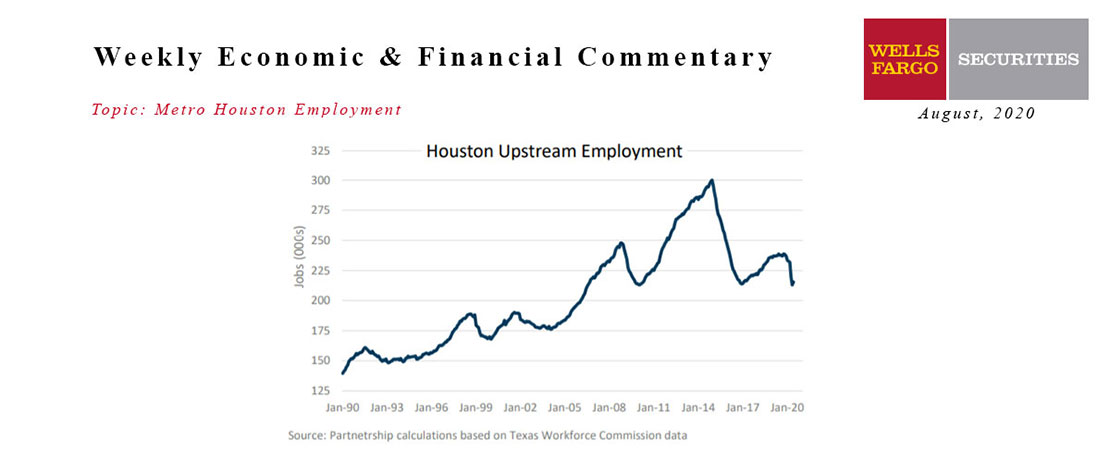

August 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Aug 22, 2020

Downstream involves the refining and processing of oil and natural gas into fuels, chemicals, and plastics. All three sectors are well-represented in Houston.

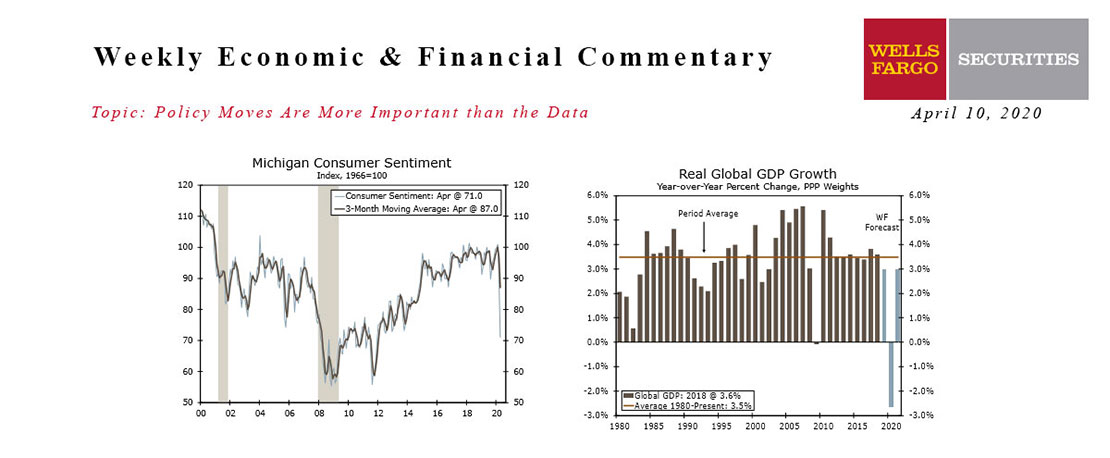

This Week's State Of The Economy - What Is Ahead? - 10 April 2020

Wells Fargo Economics & Financial Report / Apr 11, 2020

The Federal Reserve greatly expanded the collateral that it is willing to buy, further easing pressures in financial markets.

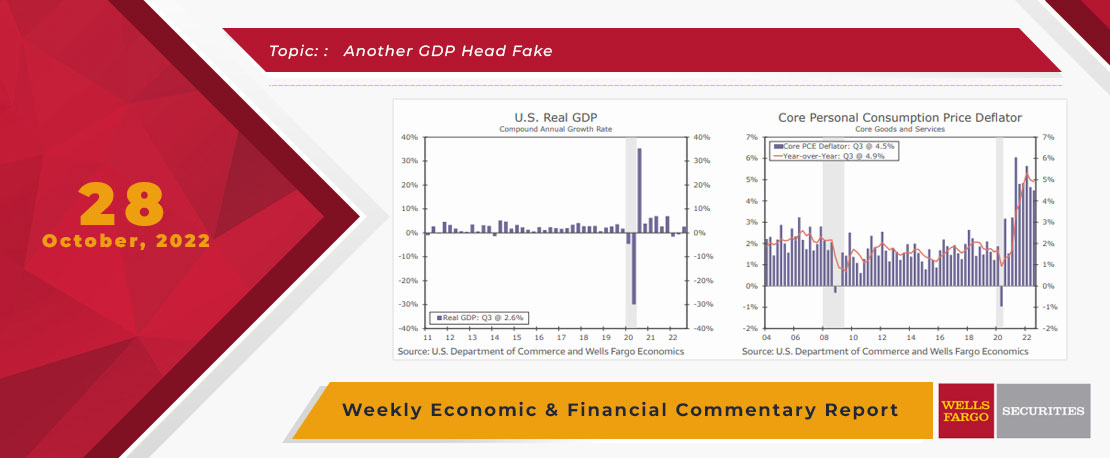

This Week's State Of The Economy - What Is Ahead? - 28 October 2022

Wells Fargo Economics & Financial Report / Oct 31, 2022

Headline GDP continues to send mixed signals on the direction of the U.S. economy. During Q3, real GDP rose at a 2.6% annualized rate, ending the recent string of quarterly declines in growth registered in the first half of 2022.

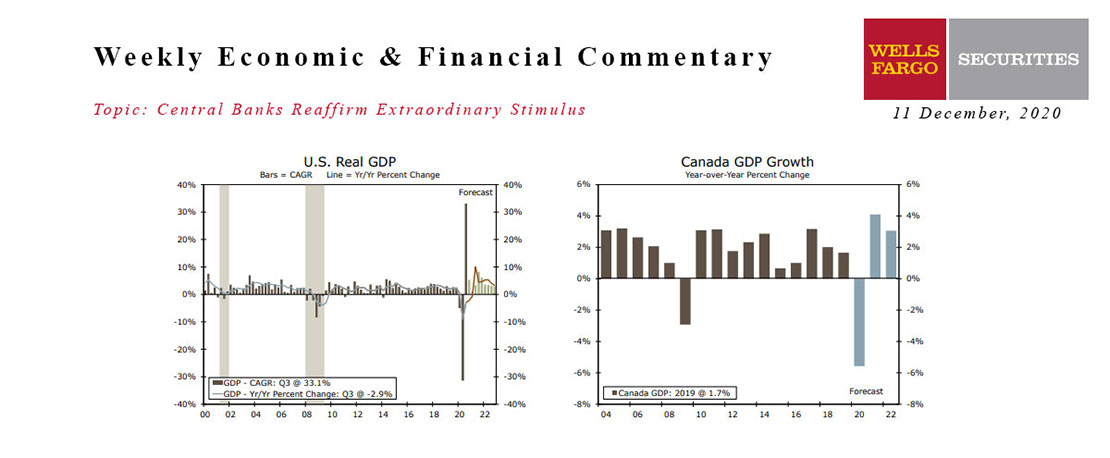

This Week's State Of The Economy - What Is Ahead? - 11 December 2020

Wells Fargo Economics & Financial Report / Dec 14, 2020

Emergency authorization of the Pfizer-BioNTech COVID vaccine appears imminent, but the virus is running rampant across the United States today, pointing to a grim winter.