U.S. - Slow Start to 2021

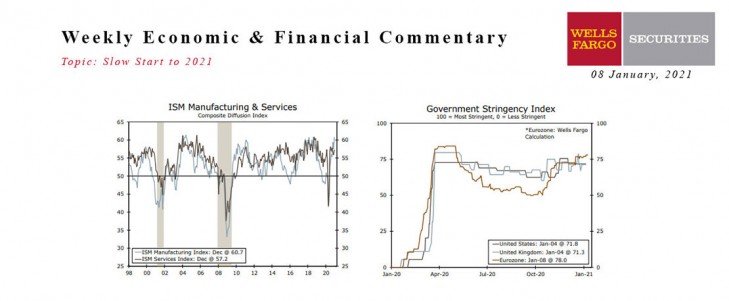

- The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong.

- The service sector is also showing a great deal of strength, although activity has clearly slowed in high-contact parts of the economy due to renewed operating restrictions.

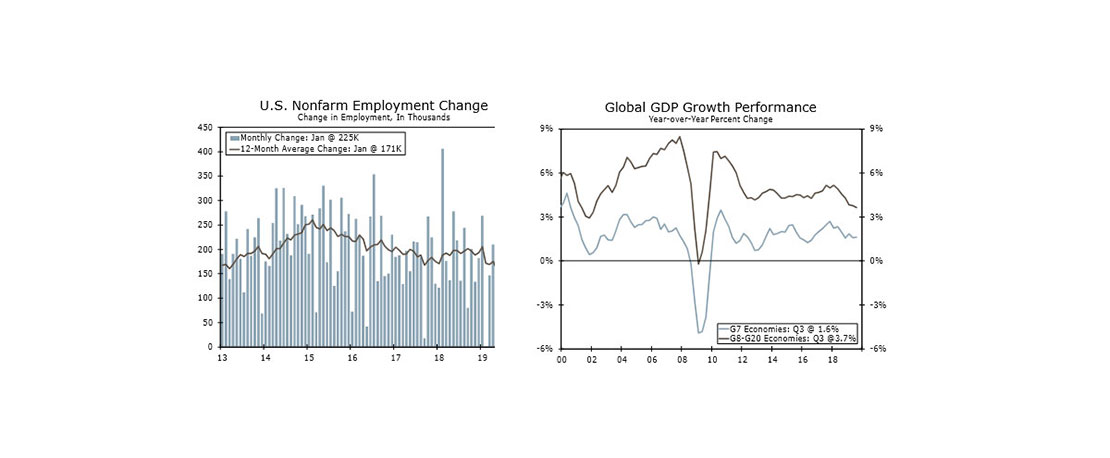

- Nonfarm employment declined by 140,000 jobs in December. Private payrolls fell less, dropping by 95,000. Most of the drop was in the leisure & hospitality sector. The unemployment rate was unchanged at 6.7%.

Global - U.K. Enters New Lockdown

- On Monday morning, U.K. Prime Minister Boris Johnson announced a new nationwide lockdown in an effort to contain the spread of COVID. With the U.K. economy already struggling to gather momentum amid already imposed restrictions and Brexit uncertainties, a nationwide lockdown introduces more downside risk to the local economic recovery.

Inflation Eases in Mexico

- CPI inflation has been stubbornly high in Mexico; however, data released this week indicate price pressure may be starting to ease. With inflation now in the central bank’s target range, additional policy rate cuts could be imminent.

This Week's State Of The Economy - What Is Ahead? - 07 February 2020

Wells Fargo Economics & Financial Report / Feb 08, 2020

U.S. employers added 225K new workers to their payrolls in January, which handily beat expectations. But the factory sector shed jobs for the third time in four months, and net layoffs were reported for finance and retail as well.

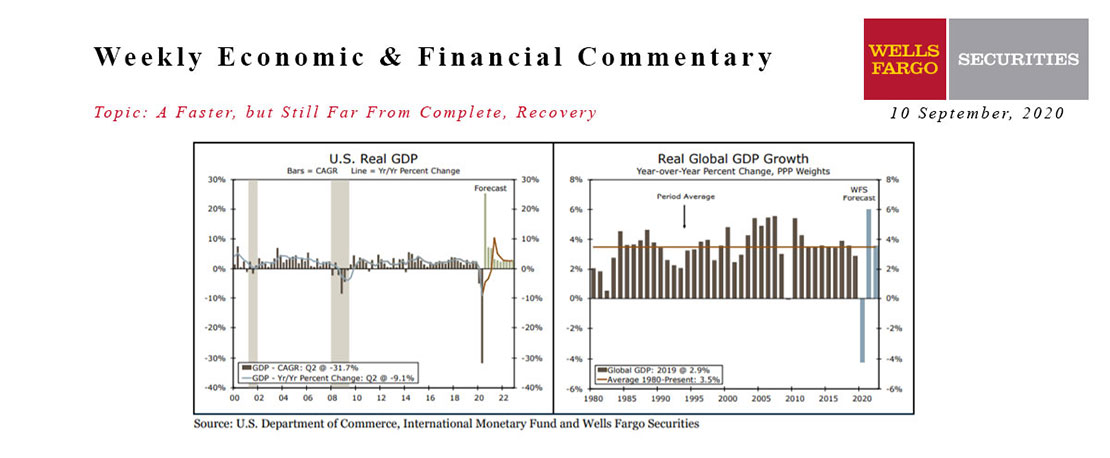

This Week's State Of The Economy - What Is Ahead? - 10 September 2020

Wells Fargo Economics & Financial Report / Sep 12, 2020

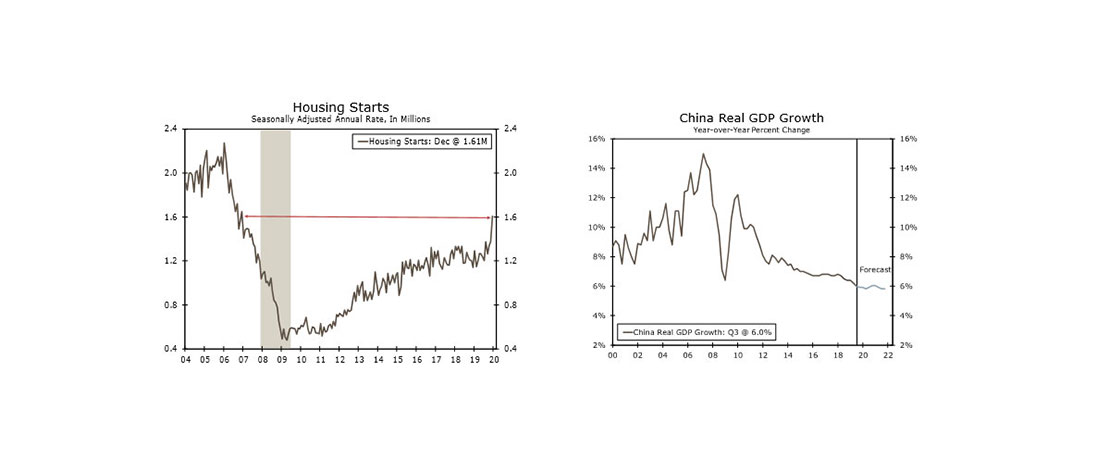

Although the recovery from the COVID recession is still far from over, the U.S. economy is bouncing back faster than many expected.

This Week's State Of The Economy - What Is Ahead? - 10 January 2020

Wells Fargo Economics & Financial Report / Jan 11, 2020

The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday.

This Week's State Of The Economy - What Is Ahead? - 16 September 2022

Wells Fargo Economics & Financial Report / Sep 20, 2022

Financial markets reacted in a zig-zag pattern to this week\'s economic data ahead of the next FOMC meeting. Price pressure is still not showing the sustained slowdown the Fed needs before it takes its foot off the throttle of tighter policy.

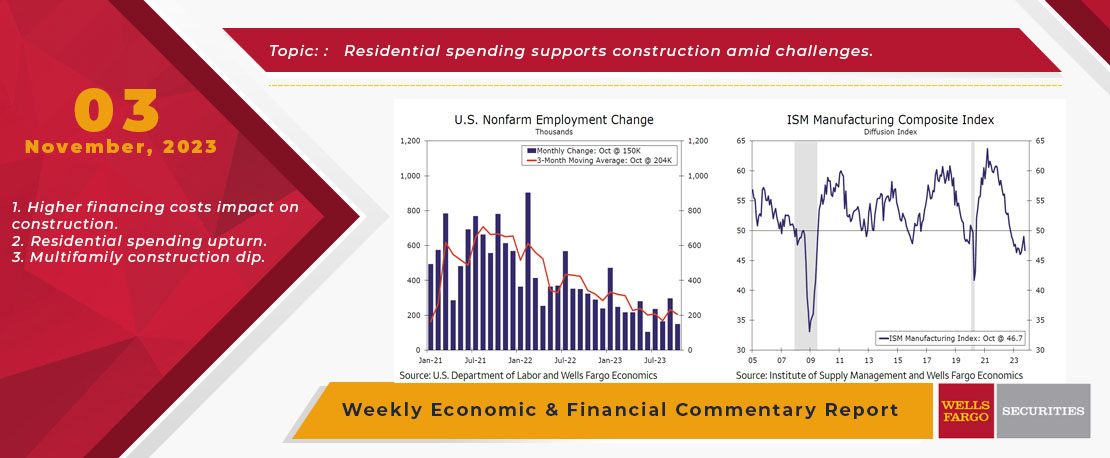

This Week's State Of The Economy - What Is Ahead? - 03 November 2023

Wells Fargo Economics & Financial Report / Nov 08, 2023

Although payroll growth is easing, the labor market remains relatively tight. The unemployment rate inched up to 3.9% in October, slightly higher than the cycle low of 3.4% first hit in January 2023, but still low compared to historical averages.

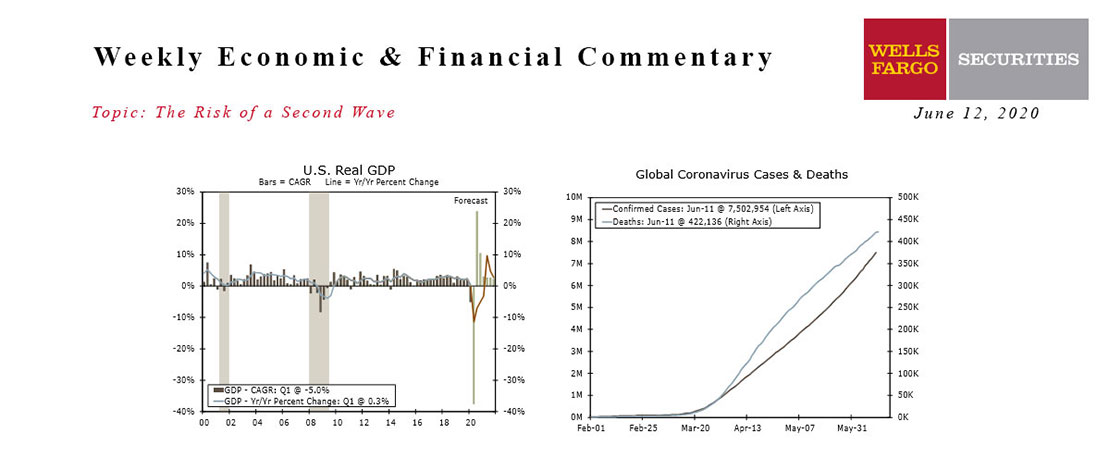

This Week's State Of The Economy - What Is Ahead? - 12 June 2020

Wells Fargo Economics & Financial Report / Jun 13, 2020

Lock downs began to be lifted across most of the country by the end of May and the total amount of daily new coronavirus cases has been trending lower. But the flattening case count has not been consistent across the country.

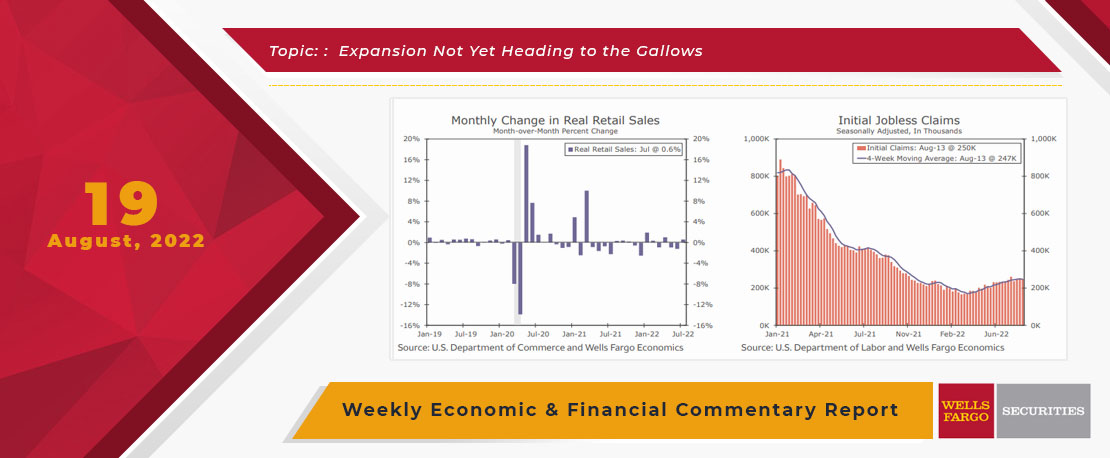

This Week's State Of The Economy - What Is Ahead? - 19August 2022

Wells Fargo Economics & Financial Report / Aug 23, 2022

July data indicates that we celebrated a decline in gas prices by going shopping, boosting retail sales figures. I’m not sure I get the connection...

This Week's State Of The Economy - What Is Ahead? - 03 September 2021

Wells Fargo Economics & Financial Report / Sep 10, 2021

e move into the Labor Day weekend celebrating the 235K jobs added in August, while simultaneously lamenting that it was about half a million jobs short of expectations.

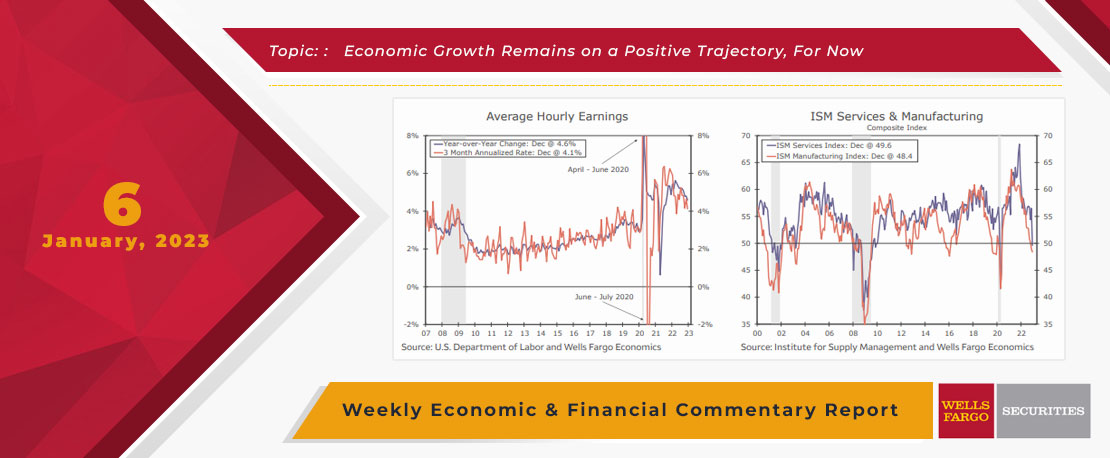

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

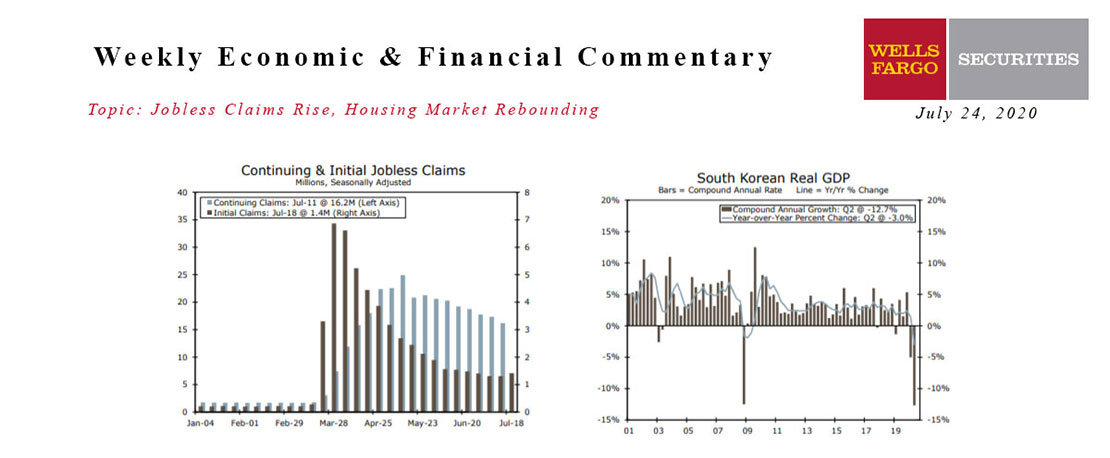

This Week's State Of The Economy - What Is Ahead? - 24 July 2020

Wells Fargo Economics & Financial Report / Jul 25, 2020

Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.