U.S. - Well, That De-Escalated Quickly

- The week began amid rising tensions carrying over from the U.S. killing of Iranian General Qasem Soleimani last Friday. Iran responded with non-lethal airstrikes on U.S. facilities, but President Trump has said the U.S. has no plans to escalate further, and the Iranians appear to have concluded their response for now.

- Compared to just prior to the drone strike, U.S. stocks are higher as is the dollar and the price for a barrel of oil (after spiking briefly) is now about $2.00 lower.

- The job market continued to expand adding another 145K jobs although wages rose the least since mid-2018.

Global - A (Mostly) Happy New Year

- It was a relatively busy week for international data and events. In the Eurozone, inflation increased in December at the fastest pace since April, an encouraging sign for the ECB, while European industrial data were sturdy.

- Canadian employment rebounded in December after two straight months of declines, lessening concerns about a slowdown in job growth.

- In Mexico, the data was not as promising, however. Mexico’s consumer prices eased further in December and industrial production disappointed in November, supporting the case for additional monetary policy easing from the central bank.

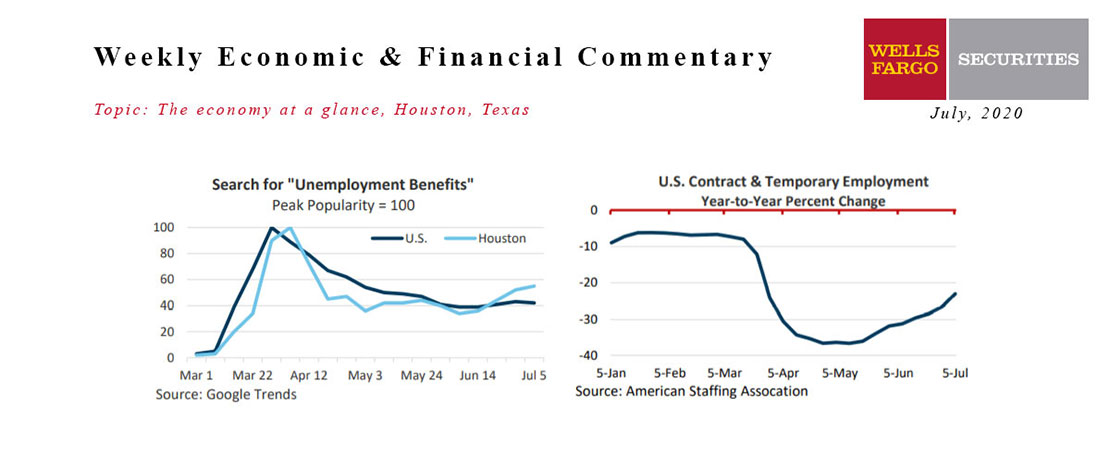

July 2020 Economy At A Glance

Wells Fargo Economics & Financial Report / Jul 30, 2020

The recent surge in COVID-19 cases indicates that elected officials re-opened the economy too soon, that too many Americans are flaunting social distancing guidelines, and that the virus is likely to be around longer than we’d hoped.

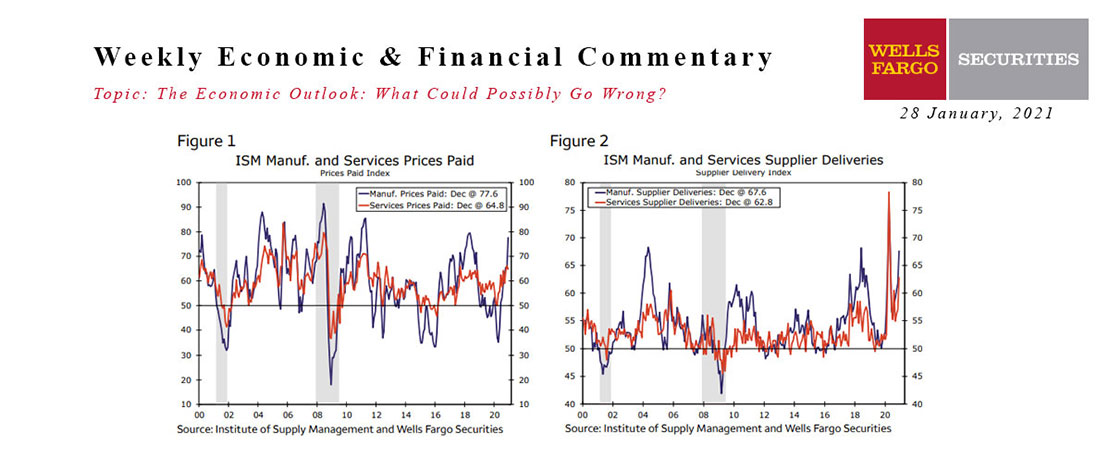

28 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Feb 08, 2021

In our recently released second report in this series of economic risks, we focused on the potential of demand-side factors to lead to significantly higher U.S. inflation in the next few years.

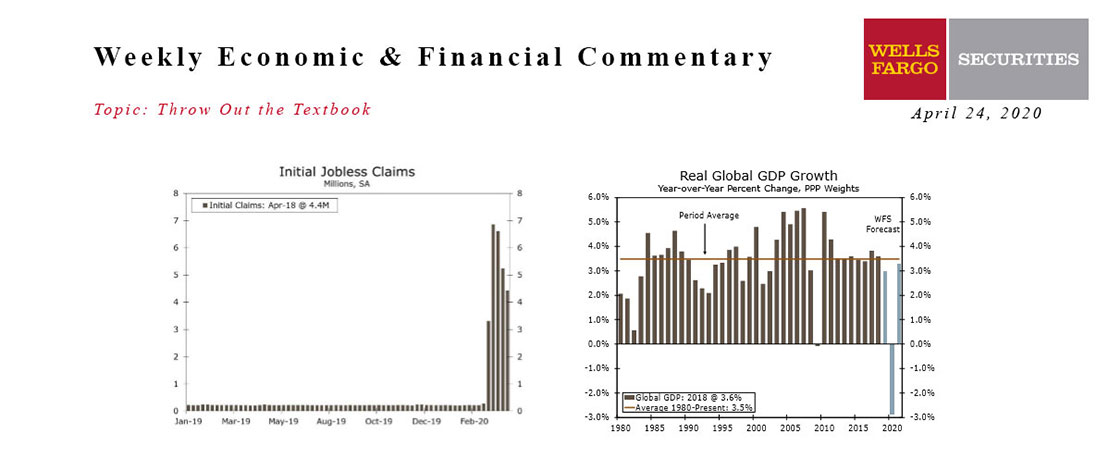

This Week's State Of The Economy - What Is Ahead? - 24 April 2020

Wells Fargo Economics & Financial Report / Apr 27, 2020

Oil prices went negative for the first time in history on Monday as the evaporation of demand collided with a supply glut. In the past five weeks, 26.5 million people have filed for unemployment insurance, or more than one out of every seven workers.

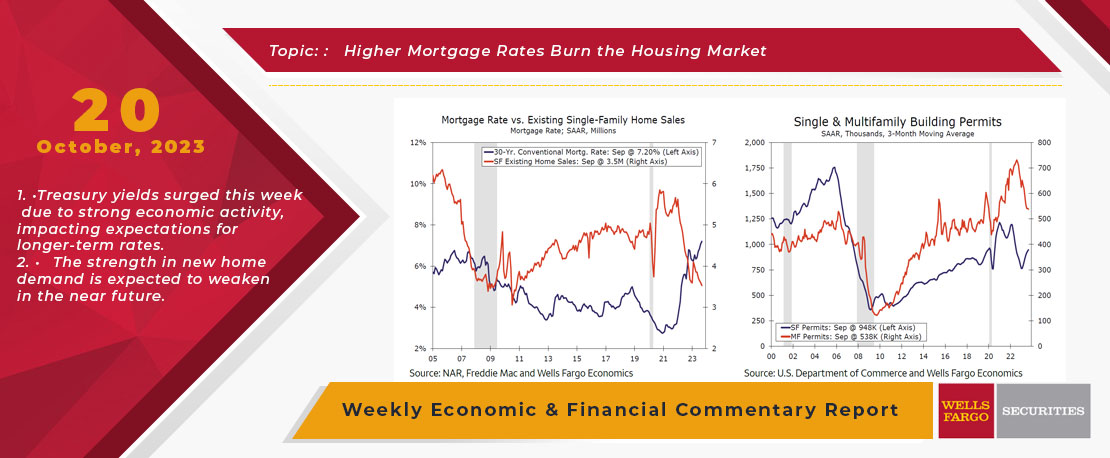

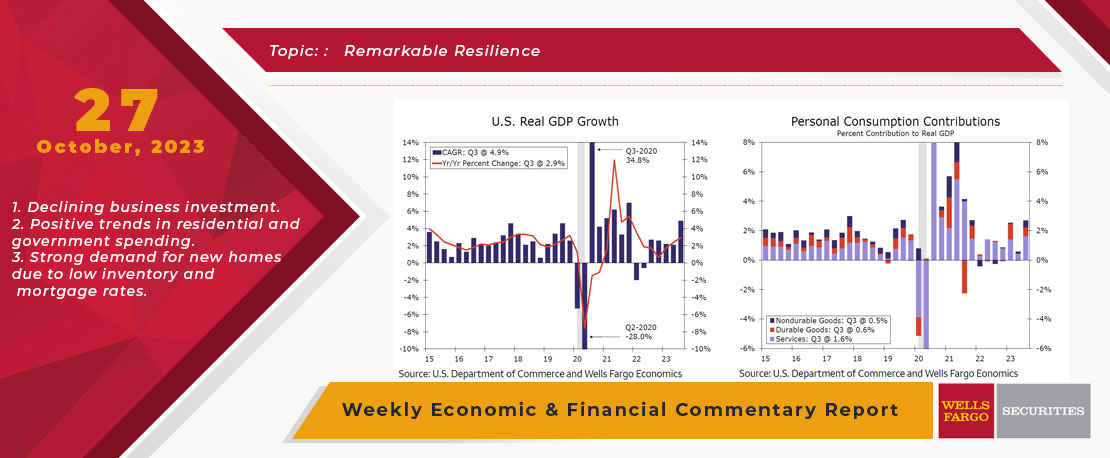

This Week's State Of The Economy - What Is Ahead? - 20 October 2023

Wells Fargo Economics & Financial Report / Oct 27, 2023

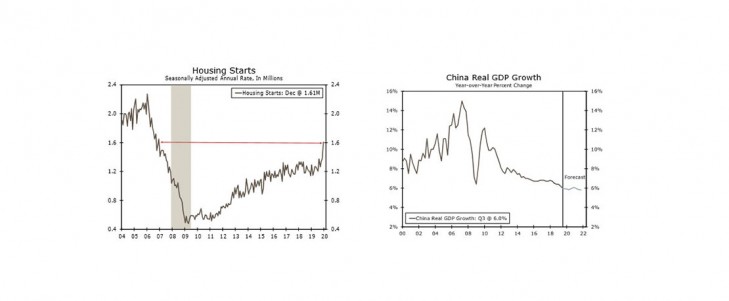

Treasury yields surged this week due to strong economic activity, impacting expectations for longer-term rates. New home sales led to a rise in single-family permits, but spiking mortgage rates are testing builder affordability strategies.

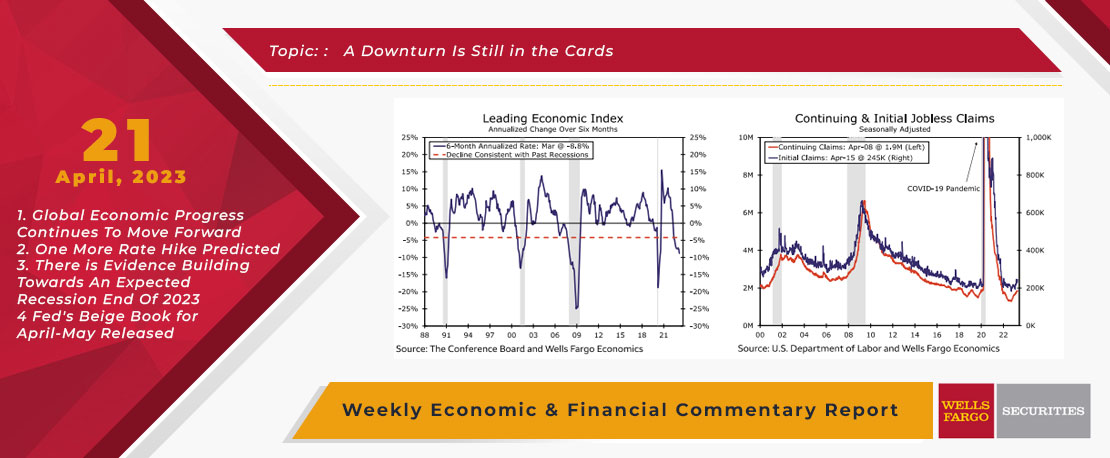

This Week's State Of The Economy - What Is Ahead? - 21 April 2023

Wells Fargo Economics & Financial Report / Apr 26, 2023

The Leading Economic Index (“LEI”) continued to flash contraction as early signs of labor market weakening are starting to emerge. Meanwhile, a batch of housing data confirmed that a full-fledged housing market recovery is still far off.

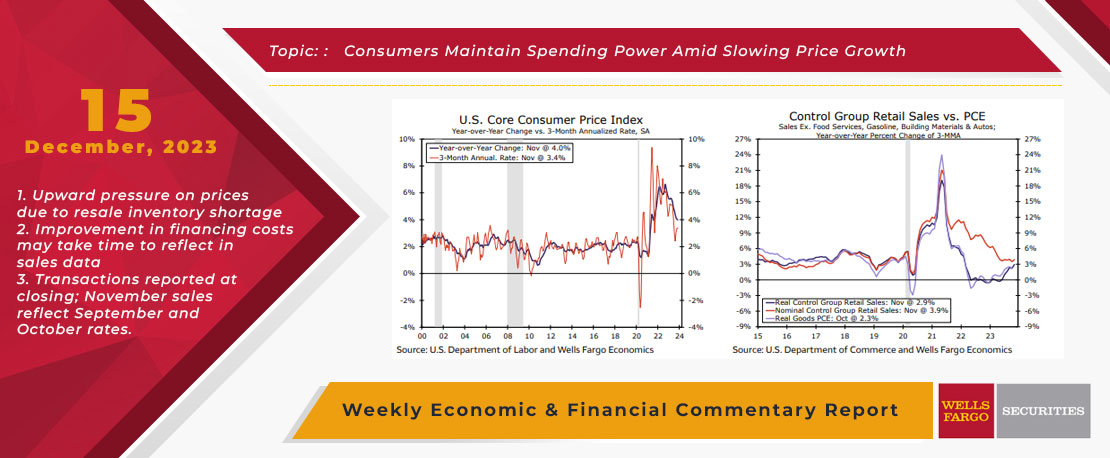

This Week's State Of The Economy - What Is Ahead? - 15 December 2023

Wells Fargo Economics & Financial Report / Dec 21, 2023

core CPI remained elevated in November at a 4.0% annual rate, a string of slower monthly prints suggests that disinflation has more room to run.

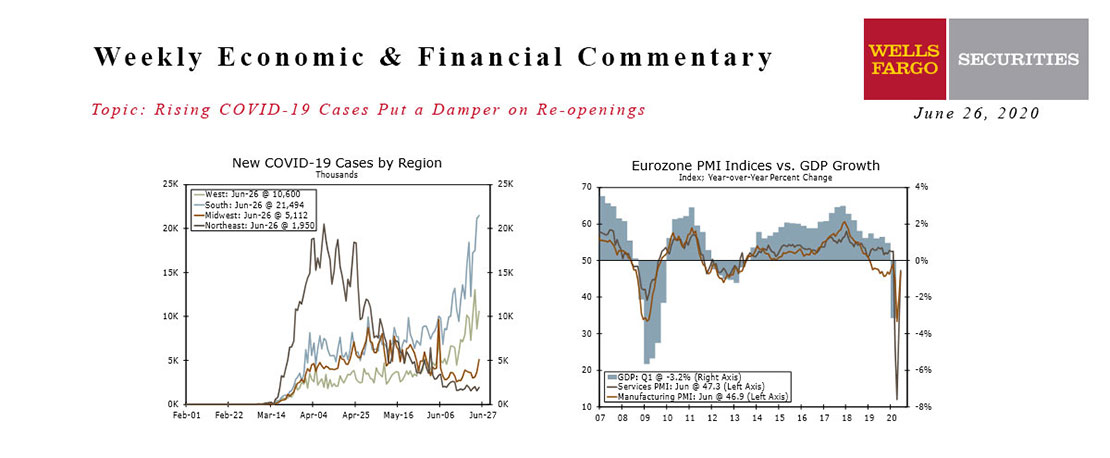

Rising COVID-19 Cases Put A Damper On Re-openings

Wells Fargo Economics & Financial Report / Jun 27, 2020

The rising number of COVID-19 infections gained momentum this week, with most of the rise occurring in the South and West. The rise in infections is larger than can be explained by increased testing alone and is slowing re-openings.

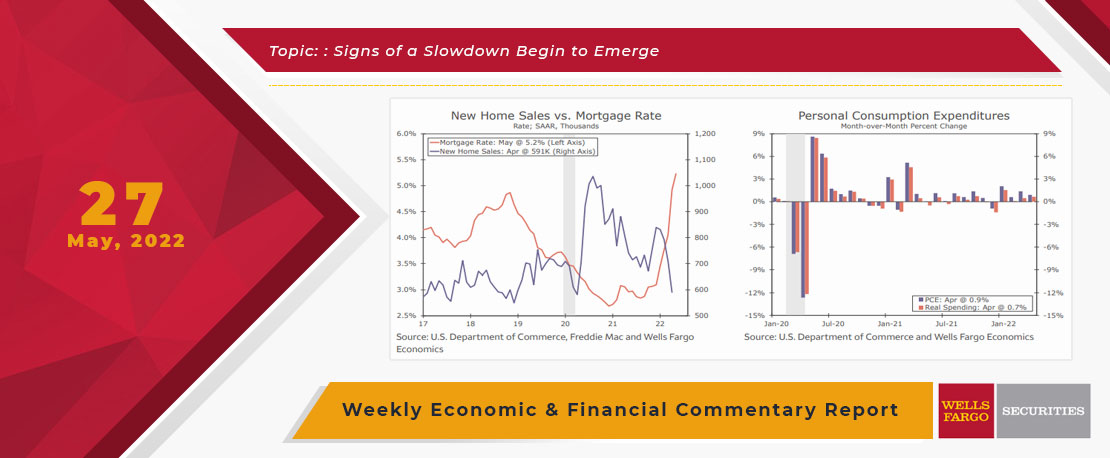

This Week's State Of The Economy - What Is Ahead? - 27 May 2022

Wells Fargo Economics & Financial Report / May 29, 2022

it looks like higher mortgage rates are starting to have some effect on the housing market as April...

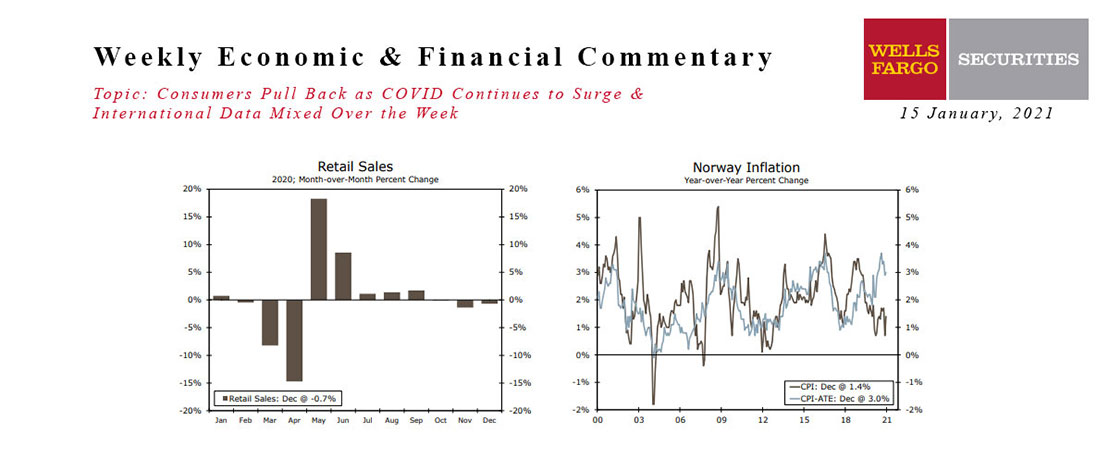

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

This Week's State Of The Economy - What Is Ahead? - 27 October 2023

Wells Fargo Economics & Financial Report / Nov 02, 2023

The U.S. economy expanded at a stronger-than-expected pace in Q3, with real GDP increasing at a robust 4.9% annualized rate.