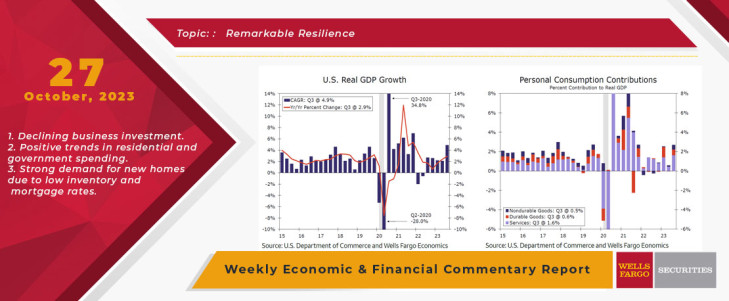

The U.S. economy continues to show remarkable resilience in the face of higher interest rates and tightening credit conditions. The Bureau of Economic Analysis' first pass revealed U.S. real GDP increased 4.9% in the third quarter, marking the strongest annualized pace since Q4-2021 when stimulus payments were in full force. The increase was widely expected in light of incredibly strong consumer spending seen over the summer. Contributing nearly 2.7 percentage points to overall growth, consumer spending increased at a 4.0% annualized pace, driven by services rising at the strongest rate since the 2021 pandemic recovery. Spending for goods also rose solidly, with spending for durable goods jumping 7.6% and spending on nondurable goods increasing 3.3%. However, last quarter's spending largely came from savings, as real disposable income declined at a1.0% annualized pace in Q3 with the saving rate falling to 3.8% from 5.2% in Q2.

Following modest accumulation in the first half of the year, inventory investment accelerated notably in Q3, returning to levels last seen during the post-pandemic inventory restocking in mid-2022. The$80.6 billion build in inventories contributed 1.3 percentage points to overall GDP growth, compared to a neutral contribution in Q2. This inventory accumulation reflects, in part, the restocking efforts amid last quarter's resilient performance for consumer goods spending. While a strong contributor in Q3, the outsized inventory investment gain is not likely to be repeated in Q4.

Business fixed investment slowed sharply during the third quarter. Reflecting the broader slowdown in goods production as well as the impact of rising interest rates and tightening credit conditions, spending on new equipment fell at a 3.8% annualized rate last quarter. Nonresidential structures spending continued to increase, climbing at a 1.6% pace, though well below the double-digit gains seen in the prior two quarters. Spending on nonresidential structures has benefited from recent legislation, including the CHIPS & Science Act and Inflation Reduction Act, which has boosted construction of electronic vehicle and semiconductor plants.

Marking the first positive performance in ten quarters, residential investment rose at a 3.9% annualized rate and likely reflects efforts from builders to speed up deliveries of homes under construction to take advantage of historically low existing home inventory. Government spending increased at a 4.6% annual rate last quarter, reflecting healthy gains in both defense and nondefense outlays. Net exports subtracted 0.1 percentage points from overall GDP growth, with exports and imports rebounding at roughly the same pace from declines in Q2.

Outside of GDP, new home sales surged 12.3% in September to a 759,000-unit annualized pace. The stronger-than-expected print highlights resilient demand despite elevated mortgage rates throughout the month. New home sales, which are measured at the time of the contract signing, reflect a timelier picture of mortgage rates than existing home sales, which are measured at the time of the closing. With current homeowners unwilling to give up their historically low mortgage rates to move, the diminished supply of existing homes has pushed more homebuyers into the new home sales market, supporting more resilient demand as evidenced by the highest level of sales since February 2022.

Looking ahead, we still believe the anticipated rise in the real fed funds rate—as the FOMC holds rates steady and inflation recedes—will likely lead to a slower pace of growth in coming quarters and a modest contraction in economic activity in Q2- and Q3-2024. That said, the degree of conviction about an outright recession is not as strong today as it was about a year ago when the FOMC was aggressively tightening monetary policy. Given the U.S. economy's surprising resilience, the Fed might be inclined to raise interest rates a touch more. However, with continued progress on inflation moving to target, alongside heightened geopolitical uncertainty and the potential for a government shutdown, we doubt the Fed will hike interest rates anymore this year.

This Week's State Of The Economy - What Is Ahead? - 07 October 2020

Wells Fargo Economics & Financial Report / Oct 10, 2020

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery.

This Week's State Of The Economy - What Is Ahead? - 29 September 2023

Wells Fargo Economics & Financial Report / Oct 02, 2023

On the housing front, new home sales dropped more than expected in August, though an upward revision to July results left us about where everyone expected us to be year-to-date.

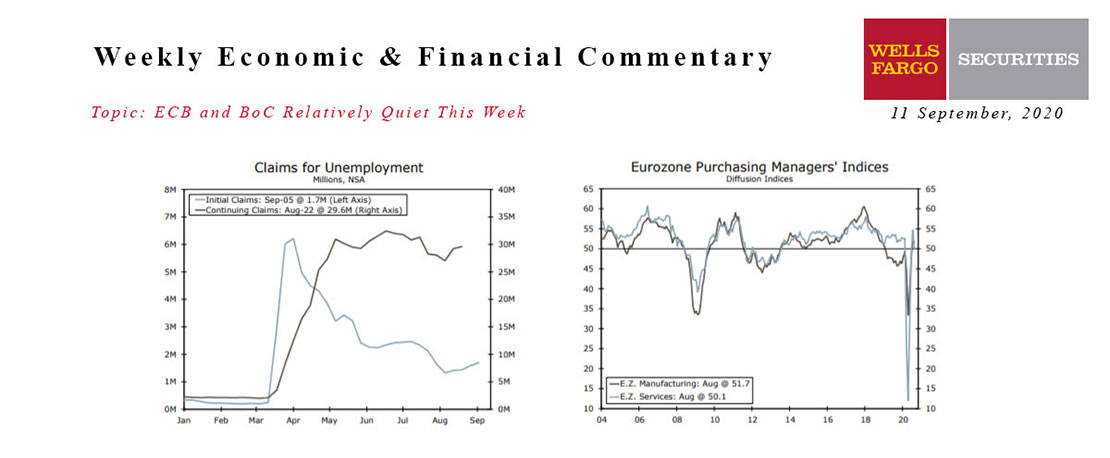

This Week's State Of The Economy - What Is Ahead? - 11 September 2020

Wells Fargo Economics & Financial Report / Sep 14, 2020

In the holiday-shortened week, analysts’ attention remained on the progress of the labor market. Recent jobless claims data remain stubbornly high and point to a slowing jobs rebound.

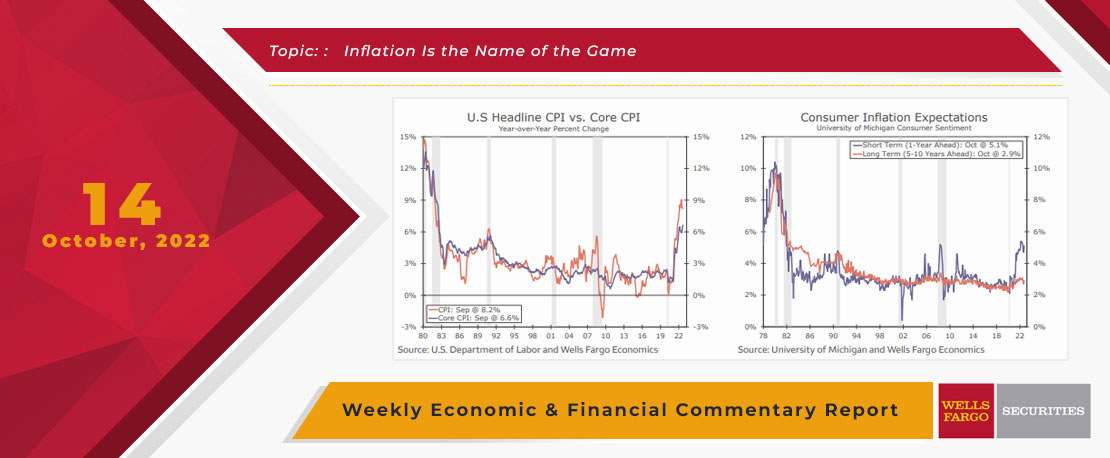

This Week's State Of The Economy - What Is Ahead? - 14 October 2022

Wells Fargo Economics & Financial Report / Oct 18, 2022

Highly anticipated Consumer Price Index report surprised to the upside. Headline CPI rose 0.4% in September, and core CPI increased 0.6%.

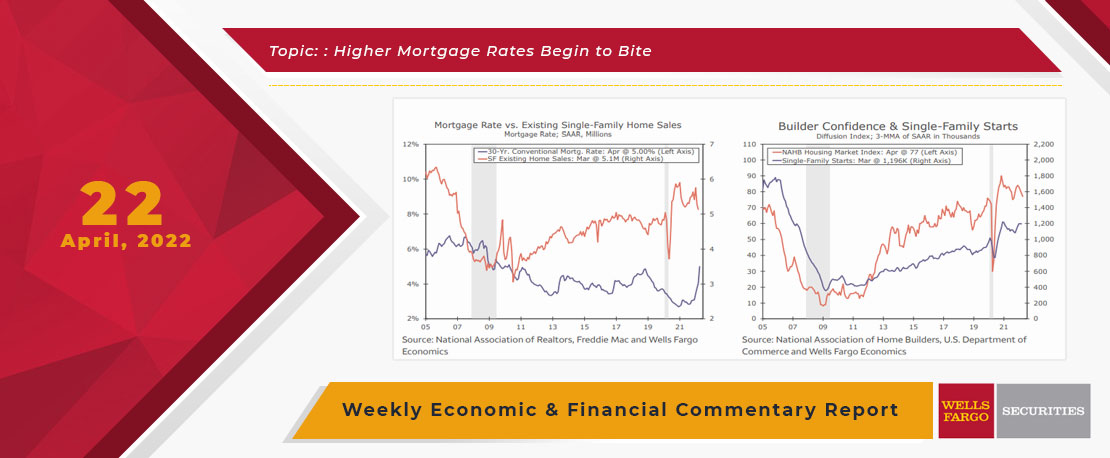

This Week's State Of The Economy - What Is Ahead? - 22 April 2022

Wells Fargo Economics & Financial Report / Apr 27, 2022

I’ll wish you a Happy Earth Day anyway. Don’t expect a card this year. While the Earth continues to thankfully revolve at a steady rate, rising mortgage rates appear to be slowing residential activity

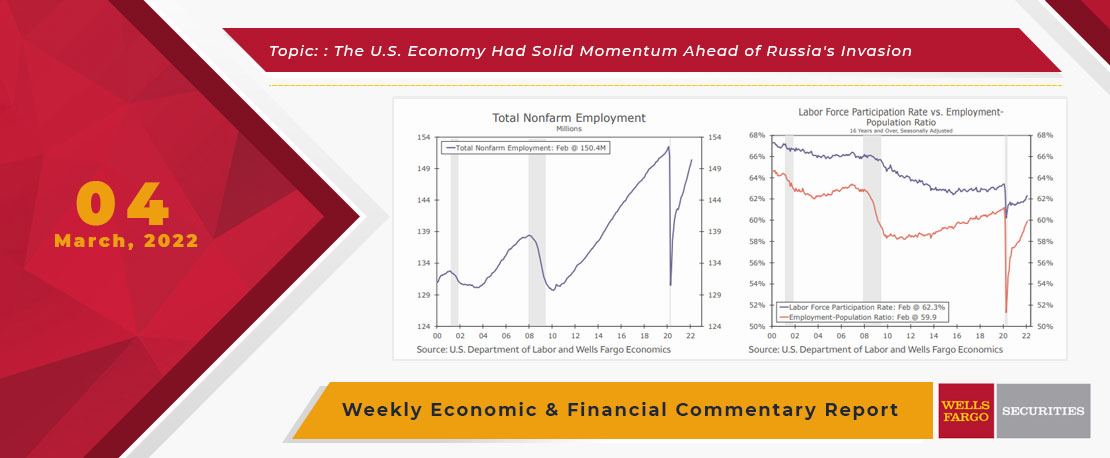

This Week's State Of The Economy - What Is Ahead? - 04 March 2022

Wells Fargo Economics & Financial Report / Mar 08, 2022

February\'s employment data showed the economy had strong momentum, but that seems pretty dated now with Russia\'s invasion of Ukraine and the Fed\'s shift to a more hawkish tone on monetary policy.

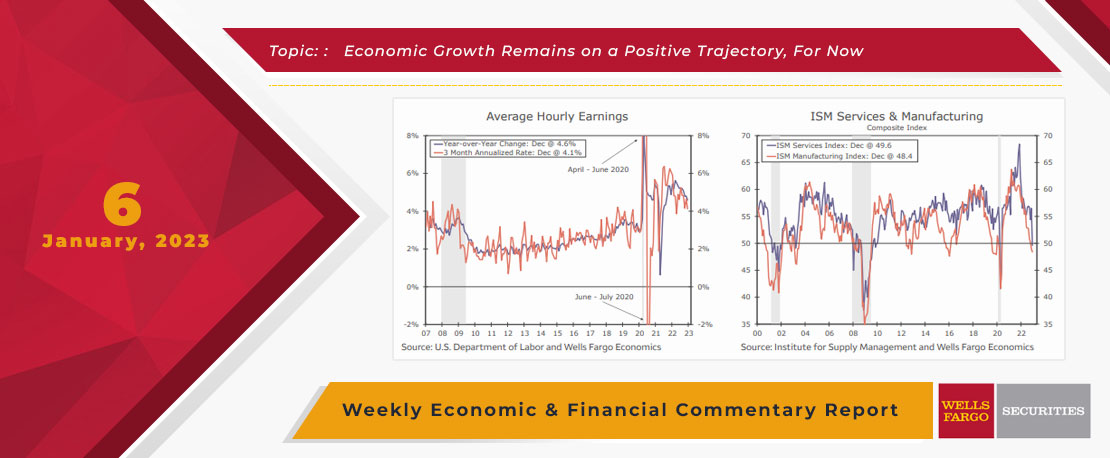

This Week's State Of The Economy - What Is Ahead? - 06 January 2023

Wells Fargo Economics & Financial Report / Jan 12, 2023

During December, payrolls rose by 223K while the unemployment rate fell to 3.5% and average hourly earnings eased 0.3%. Job openings (JOLTS) edged down to 10.46 million in November.

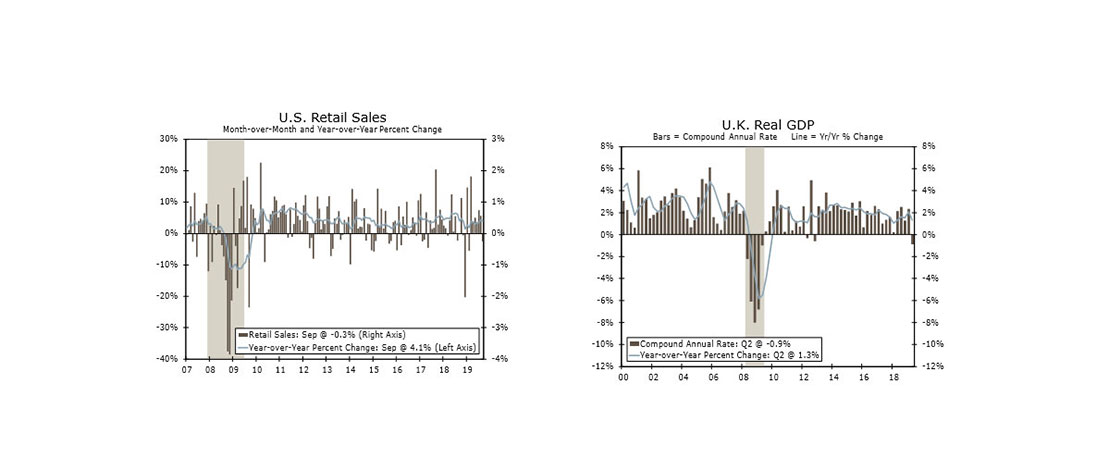

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

This Week's State Of The Economy - What Is Ahead? - 09 June 2023

Wells Fargo Economics & Financial Report / Jun 14, 2023

An unexpected spike in jobless claims is a sign that cracks are forming in the labor market. Higher mortgage rates look to be hindering a housing market rebound.

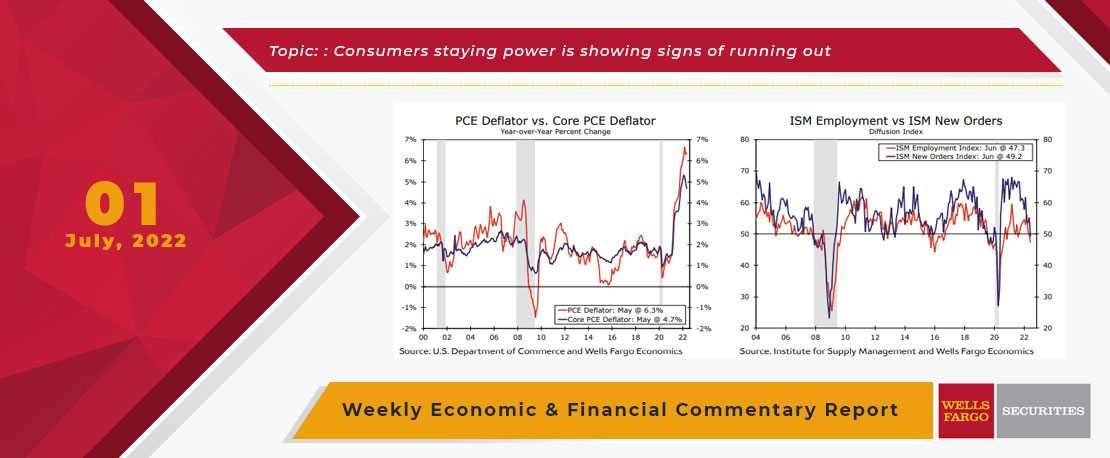

This Week's State Of The Economy - What Is Ahead? - 01 July 2022

Wells Fargo Economics & Financial Report / Jul 14, 2022

As with the Mets and Yankees when they ran into the Astros over the last couple days, consumers staying power is showing signs of running out as inflation persists and confidence moves sharply lower.