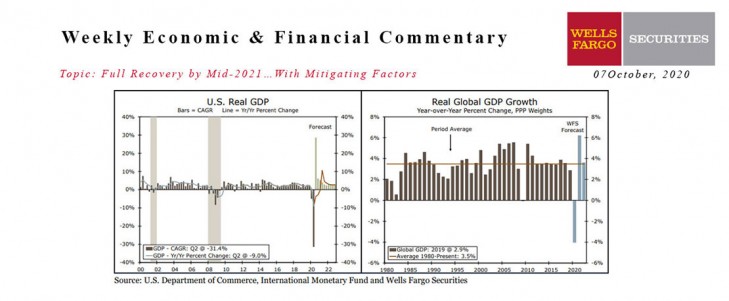

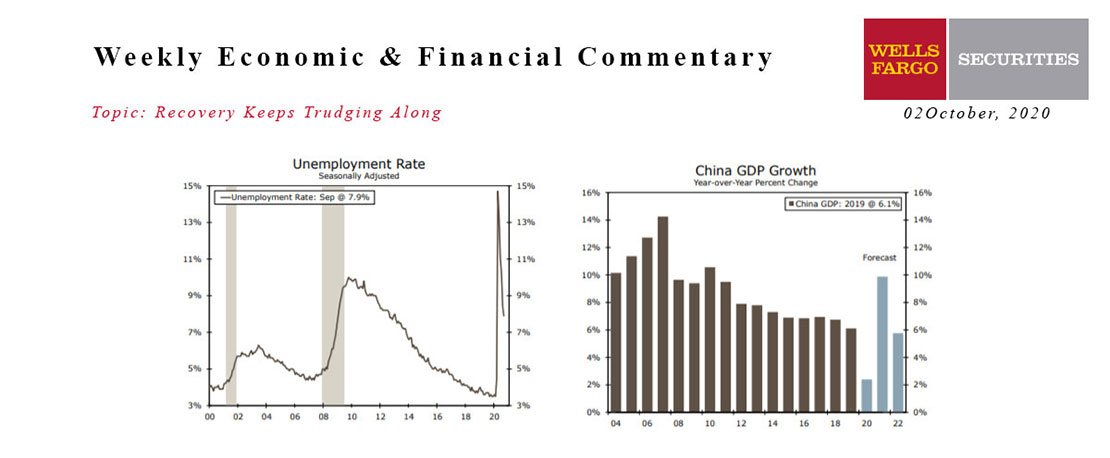

U.S Overview - Full Recovery by Mid-2021…With Mitigating Factors

In the immediate fallout after the lockdowns in the early stages of this pandemic, there was a lot of discussion about the shape of the recovery. From the outset, we have taken the position that consumer spending would snap back fairly quickly due to the unprecedented amount of stimulus that policymakers implemented earlier this year. But, we also argued that it would take some time to fully dig out of the deep hole that the economy fell into earlier this year.

International Overview - Global Growth Outlook Improves Modestly

Our forecast for the global economy has improved, although the upward revision is relatively modest. This month, we revised our global GDP forecast higher and now forecast a contraction of 4.0%, a modest improvement from 4.3% last month. While most of the upward revision comes from an improved outlook in the United States, the outlook for some international economies has also improved. In particular, we see slightly stronger GDP prospects in Canada, Japan and New Zealand, while in Europe, we expect smaller economic declines in Sweden and Norway.

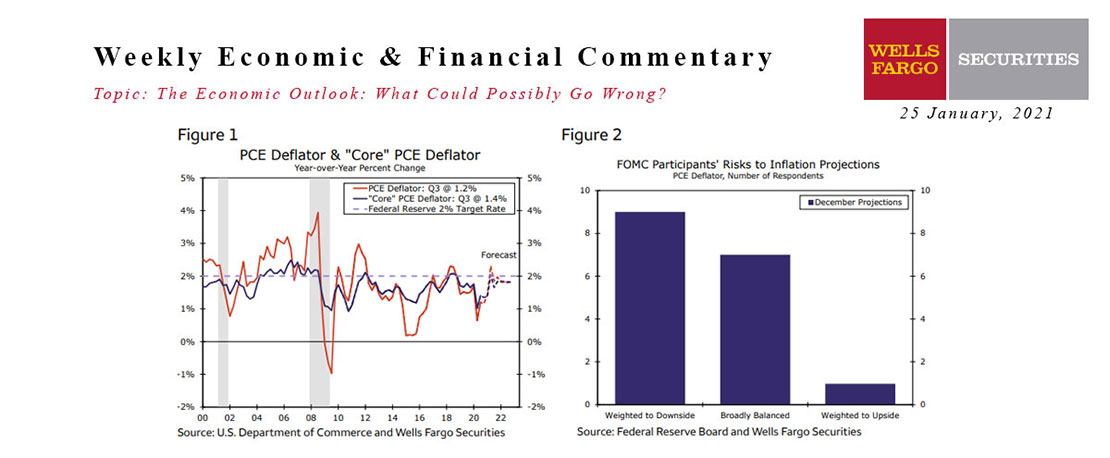

25 January 2021 Economic Outlook Report

Wells Fargo Economics & Financial Report / Jan 30, 2021

In the second installment of our series on economic risks in the foreseeable future, we analyze the potential for higher inflation in coming years stemming from excess demand.

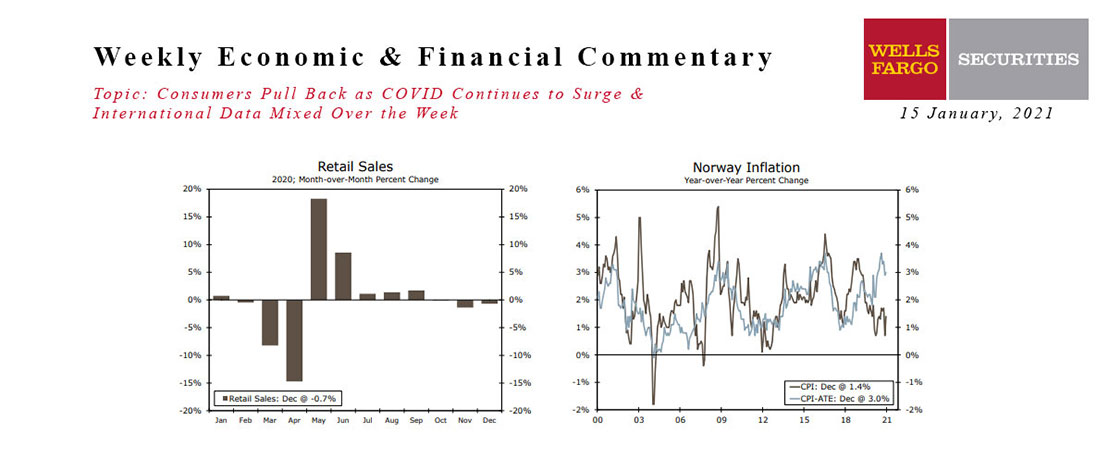

This Week's State Of The Economy - What Is Ahead? - 15 January 2021

Wells Fargo Economics & Financial Report / Jan 18, 2021

Retail sales fell 0.7% in December, the third straight monthly decline. Sales are still up 2.9% over the year, however.

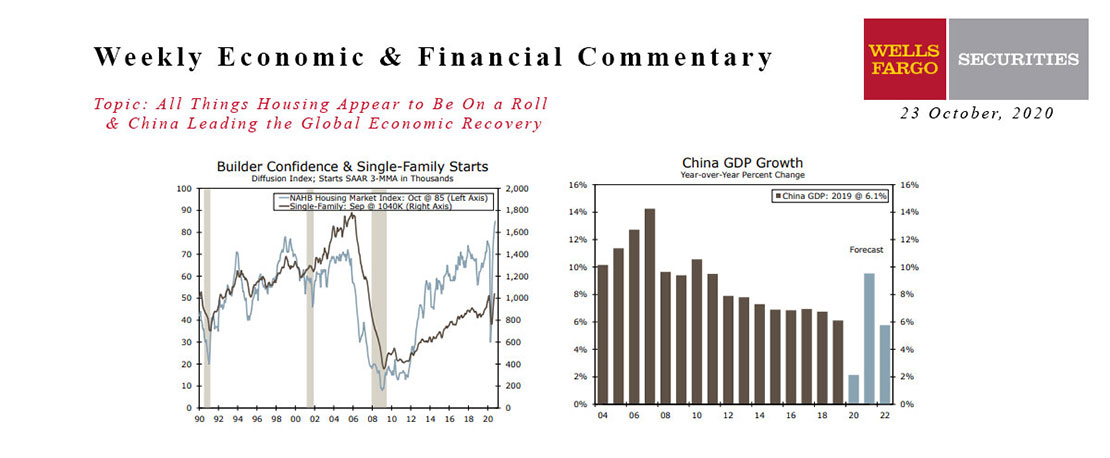

This Week's State Of The Economy - What Is Ahead? - 23 October 2020

Wells Fargo Economics & Financial Report / Oct 24, 2020

A recent strong report from the National Association of Homebuilders set the tone for another round of strong housing data. The NAHB index rose two points to a record high 85.

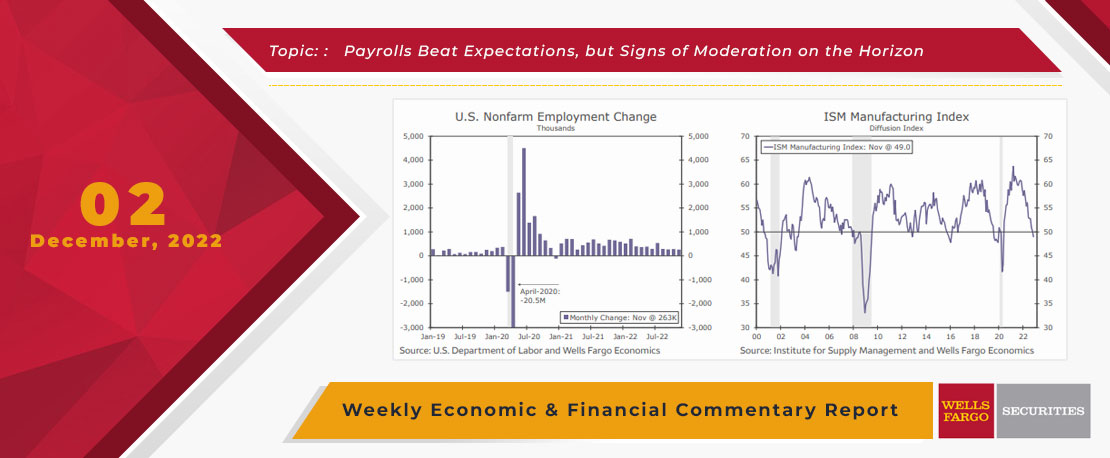

This Week's State Of The Economy - What Is Ahead? - 02 December 2022

Wells Fargo Economics & Financial Report / Dec 08, 2022

Total payrolls rose by 263K in November, with the unemployment rate holding steady at 3.7% and average hourly earning rising by 0.6%.

This Week's State Of The Economy - What Is Ahead? - 25 February 2022

Wells Fargo Economics & Financial Report / Feb 27, 2022

What a crazy week. It’s hard to worry about something as relatively unimportant as economic trends when one thinks about what folks in Ukraine are enduring, but economies are nonetheless impacted.

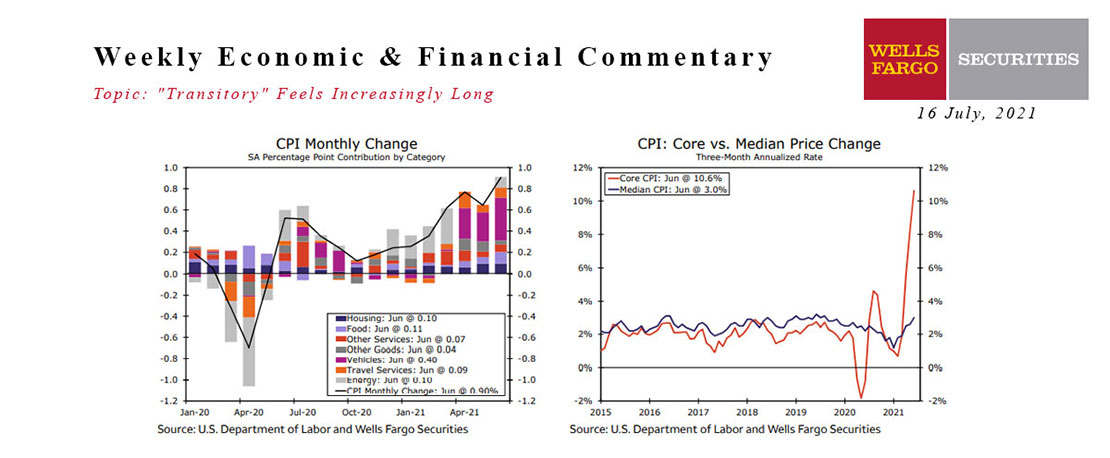

This Week's State Of The Economy - What Is Ahead? - 16 July 2021

Wells Fargo Economics & Financial Report / Jul 30, 2021

Visiting from Texas, it felt more like fall, which like the Texas cold-snap last February just goes to show that it’s a case of what you’re used to.

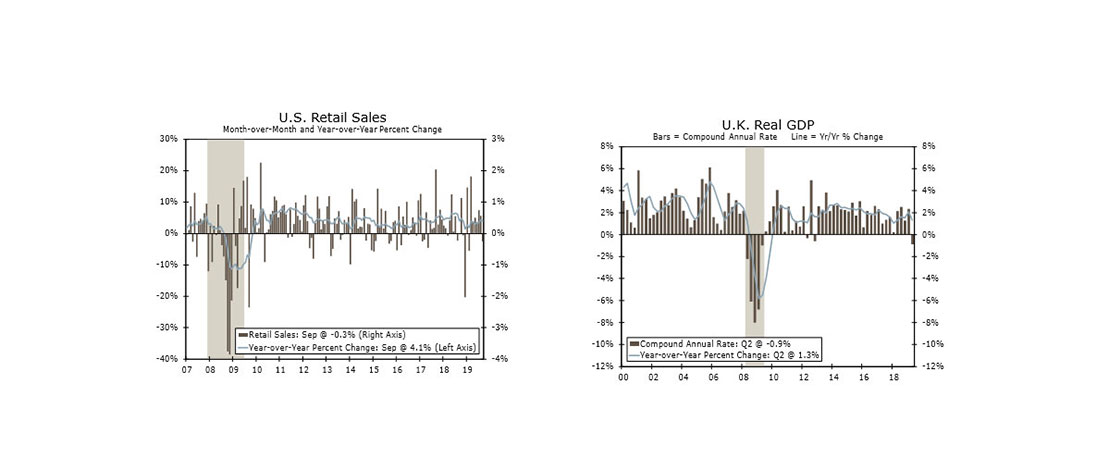

This Week's State Of The Economy - What Is Ahead? - 18 October 2019

Wells Fargo Economics & Financial Report / Oct 19, 2019

Personal consumption is still on track for a solid Q3, but retail sales declined in September for the first time in seven months.

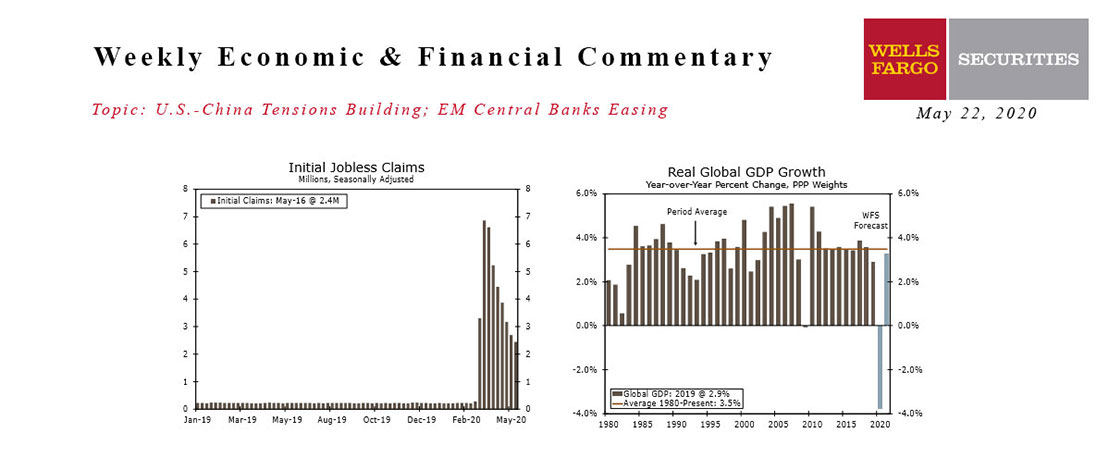

This Week's State Of The Economy - What Is Ahead? - 22 May 2020

Wells Fargo Economics & Financial Report / May 25, 2020

The re-opening of the country is getting underway, with all 50 states starting to roll back restrictions.

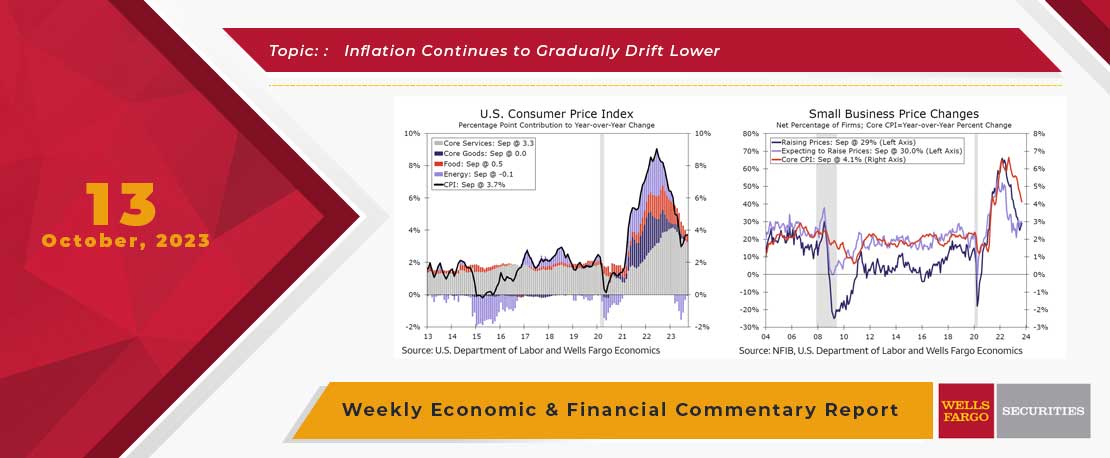

This Week's State Of The Economy - What Is Ahead? - 13 October 2023

Wells Fargo Economics & Financial Report / Oct 13, 2023

The Consumer Price Index (CPI) rose 0.4% in September, a monthly change that was a bit softer than the 0.6% increase registered in August. The core CPI rose 0.3% during the month, a pace unchanged from the month prior.

This Week's State Of The Economy - What Is Ahead? - 02 October 2020

Wells Fargo Economics & Financial Report / Sep 29, 2020

In what was a jam-packed week of economic data, the jobs report, prospects of additional fiscal stimulus and the president’s positive COVID-19 test result commanded markets’ attention.